Global Potash Sulphate Fertilizers Market

Market Size in USD Million

CAGR :

%

USD

356.62 Million

USD

484.32 Million

2025

2033

USD

356.62 Million

USD

484.32 Million

2025

2033

| 2026 –2033 | |

| USD 356.62 Million | |

| USD 484.32 Million | |

|

|

|

|

What is the Global Potash Sulphate Fertilizers Market Size and Growth Rate?

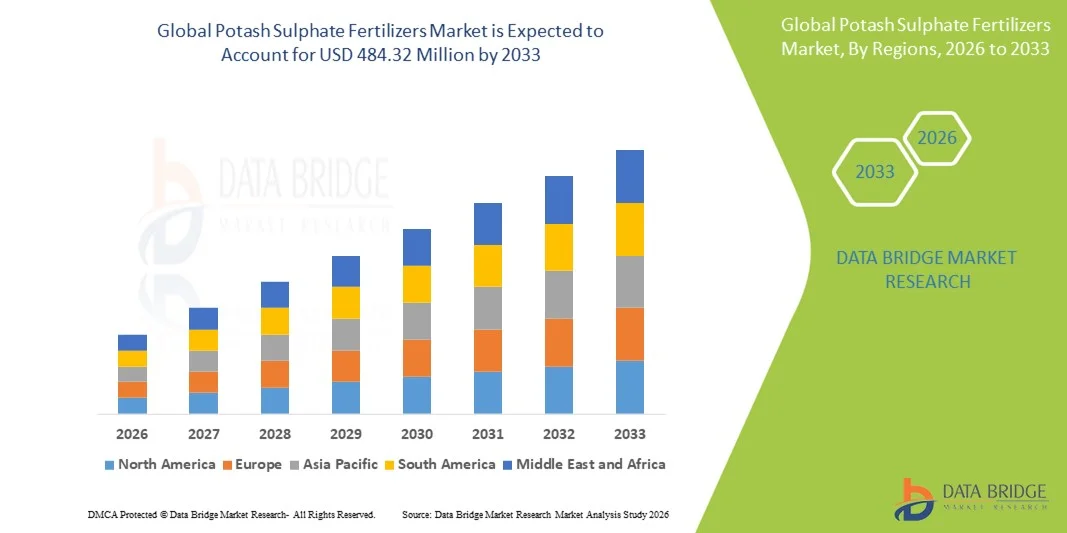

- The global potash sulphate fertilizers market size was valued at USD 356.62 million in 2025 and is expected to reach USD 484.32 million by 2033, at a CAGR of3.90% during the forecast period

- The increase in demand for the product owning to its significant potassium content, low chloride and slat index, acts as one of the major factors driving the growth of potash sulphate fertilizers market

- The high utilization of the product for the growth of fruits, vegetables, treenuts, tobacco, among others and initiatives by government to grow awareness among farmers regarding the use of novel value-added fertilizers accelerate the market growth

What are the Major Takeaways of Potash Sulphate Fertilizers Market?

- The increase in the adoption of potassium sulphate or sulphate of potash (SOP)-based fertilizers with the purpose of increasing their crop yields in their limited lands and reduction in the amount of arable land further influence the market

- In addition, the high investment in agrochemicals, food scarcity due to increasing population, and increase in demand for high quality food positively affect the potash sulphate fertilizers market. Furthermore, product innovations and research and development activities extend profitable opportunities to the market players

- Asia-Pacific dominated the potash sulphate fertilizers market with an estimated 34.45% revenue share in 2025, driven by large agricultural landholdings, rising cultivation of chloride-sensitive crops, and increasing adoption of balanced fertilization practices across China, India, and Southeast Asia

- North America is projected to register the fastest CAGR of 9.32% from 2026 to 2033, supported by large-scale commercial farming, advanced irrigation infrastructure, and rising adoption of specialty fertilizers

- The Standard SOP segment dominated the market with an estimated 44.6% share in 2025, owing to its widespread use in conventional farming practices, cost-effectiveness, and suitability for soil application across a wide range of crops

Report Scope and Potash Sulphate Fertilizers Market Segmentation

|

Attributes |

Potash Sulphate Fertilizers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Potash Sulphate Fertilizers Market?

Increasing Shift Toward Chloride-Free, High-Purity, and Specialty Potash Sulphate Fertilizers

- The potash sulphate fertilizers market is witnessing rising adoption of chloride-free, high-purity SOP fertilizers designed to improve crop yield, quality, and soil health, particularly for high-value and chloride-sensitive crops

- Manufacturers are introducing granular, water-soluble, and specialty-grade SOP fertilizers with improved nutrient availability, uniform particle size, and enhanced application efficiency

- Growing emphasis on sustainable agriculture, balanced fertilization, and soil salinity management is accelerating the shift toward sulphate-based potash fertilizers

- For instance, companies such as K+S, SQM, Nutrien, ICL Fertilizers, and EuroChem are expanding SOP production capacity and improving product quality for fruits, vegetables, nuts, and plantation crops

- Increasing cultivation of high-value crops, including fruits, vegetables, coffee, tea, and tobacco, is driving strong demand across Asia-Pacific, Europe, and Latin America

- As precision farming and sustainable nutrient management gain traction, Potash Sulphate Fertilizers will remain critical for improving crop productivity and long-term soil fertility

What are the Key Drivers of Potash Sulphate Fertilizers Market?

- Rising global demand for high-quality agricultural produce and premium crops is significantly boosting adoption of chloride-free SOP fertilizers

- For instance, in 2024–2025, companies such as SQM, K+S, and ICL Fertilizers expanded SOP supply and distribution to support specialty crop cultivation across Europe, Asia-Pacific, and South America

- Growing awareness of soil degradation, salinity control, and nutrient efficiency is encouraging farmers to shift from MOP to SOP fertilizers

- Increasing adoption of fertigation, drip irrigation, and precision agriculture practices supports higher usage of water-soluble and granular SOP products

- Expansion of commercial horticulture, greenhouse farming, and export-oriented agriculture is strengthening long-term market demand

- Supported by government initiatives for sustainable farming and rising investment in advanced fertilizer solutions, the Potash Sulphate Fertilizers market is projected to experience steady long-term growth

Which Factor is Challenging the Growth of the Potash Sulphate Fertilizers Market?

- Higher production and pricing of SOP fertilizers compared to muriate of potash (MOP) limit adoption among cost-sensitive farmers

- During 2024–2025, volatility in raw material prices, energy costs, and mining operations increased production costs for several global SOP manufacturers

- Limited availability of SOP and supply constraints in certain regions restrict widespread market penetration

- Lower awareness among smallholder farmers regarding the long-term agronomic benefits of SOP slows adoption in developing markets

- Competition from cheaper potassium fertilizers and blended nutrient products creates pricing pressure for SOP producers

- To address these challenges, manufacturers are focusing on capacity expansion, cost optimization, farmer education programs, and improved distribution networks to accelerate global adoption of Potash Sulphate Fertilizers

How is the Potash Sulphate Fertilizers Market Segmented?

The market is segmented on the basis of grade type, form, application, and crop type.

- By Grade Type

On the basis of grade type, the potash sulphate fertilizers market is segmented into Standard SOP, Granular SOP, and Soluble SOP. The Standard SOP segment dominated the market with an estimated 44.6% share in 2025, owing to its widespread use in conventional farming practices, cost-effectiveness, and suitability for soil application across a wide range of crops. Standard SOP provides balanced potassium and sulfur nutrition, making it a preferred choice for cereals, oilseeds, and plantation crops.

The Soluble SOP segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising adoption of fertigation systems, precision agriculture, and greenhouse cultivation. Soluble SOP offers rapid nutrient uptake, uniform distribution, and compatibility with drip irrigation, supporting higher yields in fruits, vegetables, and high-value crops.

- By Form

Based on form, the market is segmented into Solid and Liquid Potash Sulphate Fertilizers. The Solid segment dominated the market with a 71.3% share in 2025, supported by ease of handling, longer shelf life, established distribution networks, and extensive use in large-scale agriculture. Solid SOP fertilizers are widely applied through broadcasting and soil incorporation methods, making them suitable for both smallholder and commercial farms.

The Liquid segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing use in fertigation and foliar feeding systems. Liquid SOP allows precise nutrient dosing, quick absorption, and reduced nutrient losses, aligning with modern farming practices focused on efficiency, water conservation, and improved crop productivity.

- By Application

On the basis of application, the potash sulphate fertilizers market is segmented into Broadcasting, Foliar, and Fertigation. The Broadcasting segment dominated the market with an estimated 48.9% share in 2025, driven by its simplicity, low labor requirement, and widespread adoption in traditional agriculture. Broadcasting remains the preferred method for staple crops and large landholdings, particularly in developing regions.

The Fertigation segment is expected to register the fastest growth from 2026 to 2033, supported by the rapid expansion of drip irrigation, precision farming, and controlled-environment agriculture. Fertigation enables efficient nutrient delivery directly to the root zone, improving nutrient use efficiency and reducing fertilizer wastage, particularly in high-value horticultural crops.

- By Crop Type

By crop type, the market is segmented into Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, and Others. The Cereals and Grains segment dominated the market with a 40.7% share in 2025, due to large cultivation areas and consistent demand for potassium and sulfur nutrients to enhance yield and stress resistance. SOP is increasingly used to improve grain quality and soil health in cereal farming.

The Fruits and Vegetables segment is anticipated to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for high-quality produce, export-oriented horticulture, and chloride-sensitive crops. SOP’s role in improving fruit size, color, sugar content, and shelf life strongly supports its growing adoption in this segment.

Which Region Holds the Largest Share of the Potash Sulphate Fertilizers Market?

- Asia-Pacific dominated the potash sulphate fertilizers market with an estimated 34.45% revenue share in 2025, driven by large agricultural landholdings, rising cultivation of chloride-sensitive crops, and increasing adoption of balanced fertilization practices across China, India, and Southeast Asia

- Growing demand for high-value fruits, vegetables, plantation crops, and export-oriented horticulture, coupled with rising awareness of soil salinity management, is boosting SOP fertilizer consumption across the region

- Strong domestic production capacity, expanding fertilizer distribution networks, and government-supported sustainable agriculture programs continue to reinforce Asia-Pacific’s leadership in the global potash sulphate fertilizers market

China Potash Sulphate Fertilizers Market Insight

China is the largest contributor within Asia-Pacific, supported by extensive cultivation of fruits, vegetables, and cash crops requiring chloride-free potassium nutrition. Increasing focus on soil quality improvement, yield optimization, and export-grade produce drives SOP fertilizer adoption. Government initiatives promoting efficient fertilizer use, along with strong domestic manufacturing capacity and cost-competitive supply, further strengthen market growth. Expansion of greenhouse farming and precision agriculture practices also supports rising SOP demand.

India Potash Sulphate Fertilizers Market Insight

India holds a significant market share, fueled by growing horticulture production, expanding drip irrigation and fertigation systems, and increasing awareness of SOP benefits for chloride-sensitive crops. Rising cultivation of fruits, vegetables, oilseeds, and plantation crops, along with government subsidies for balanced nutrient application, continues to accelerate market penetration. Growth in export-oriented agriculture further supports long-term demand.

Japan Potash Sulphate Fertilizers Market Insight

Japan shows steady growth, driven by intensive farming practices, high-value crop cultivation, and strong focus on crop quality rather than volume. SOP fertilizers are widely used in fruits, vegetables, and greenhouse farming to enhance produce quality, shelf life, and nutrient efficiency. Advanced farming techniques, limited arable land, and emphasis on sustainable agriculture support consistent SOP demand.

North America Potash Sulphate Fertilizers Market

North America is projected to register the fastest CAGR of 9.32% from 2026 to 2033, supported by large-scale commercial farming, advanced irrigation infrastructure, and rising adoption of specialty fertilizers. Increasing use of SOP in fruits, vegetables, nuts, and potatoes, particularly in chloride-sensitive soils, drives demand across the U.S. and Canada. Strong awareness of soil health and precision farming sustains stable regional growth.

U.S. Potash Sulphate Fertilizers Market Insight

The U.S. is the largest contributor in North America, driven by extensive horticulture farming, high adoption of fertigation systems, and demand for premium crop quality. SOP fertilizers are increasingly used to improve yield, nutrient uptake, and soil balance in specialty crops, supporting continued market expansion.

Canada Potash Sulphate Fertilizers Market Insight

Canada contributes steadily, supported by strong agricultural infrastructure, growing specialty crop production, and increasing awareness of sulphur deficiency in soils. Expansion of sustainable farming practices and balanced fertilization strategies continues to support SOP adoption.

Which are the Top Companies in Potash Sulphate Fertilizers Market?

The potash sulphate fertilizers industry is primarily led by well-established companies, including:

- SESODA CORPORATION (China)

- K+S Minerals and Agriculture GmbH (Germany)

- SQM S.A. (Chile)

- Migao Corporation (Canada)

- Kemira (Finland)

- The Mosaic Company (U.S.)

- Intrepid Potash (U.S.)

- SOPerior Fertilizer Corp. (U.S.)

- Shijiazhuang Hehe Chemical Fertilizer Co., Ltd (China)

- EuroChem Group (Switzerland)

- HELM AG (Germany)

- ICL Fertilizers (Israel)

- Tessenderlo Group (Belgium)

- Compass Minerals (U.S.)

- UNITED Co. (Japan)

- Yara International (Norway)

- Shandong Lianmeng Chemical Group Co., Ltd (China)

- Nutrien Ltd. (Canada)

What are the Recent Developments in Global Potash Sulphate Fertilizers Market?

- In July 2024, ICL Group signed a long-term supply agreement with China to deliver 840,000 metric tonnes of potash at USD 273 per ton, strengthening potash availability for Chinese customers and reinforcing ICL’s position in global potash trade and long-term supply security

- In June 2024, IHC Mining secured a contract to build a new fully electric floating pontoon machine for the Arab Potash Company in Jordan to harvest carnallite from the Dead Sea, supporting lower-emission operations and advancing sustainable potash extraction practices

- In April 2024, Brazil Potash received the mine Installation License from the Amazon State Environmental Protection Institute (IPAAM) for the Autazes Potash Project, enabling domestic potassium mining and reducing Brazil’s reliance on costly and risk-prone potash imports

- In October 2022, Encanto Potash Corp reaffirmed its commitment to truth and reconciliation with Canada’s First Nations by partnering with Muskowekan First Nation to develop the country’s first potash mine on a reserve, promoting environmentally sustainable mining through selective solution mining technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.