Global Potting And Encapsulating Compounds Market

Market Size in USD Billion

CAGR :

%

USD

3.64 Billion

USD

5.38 Billion

2024

2032

USD

3.64 Billion

USD

5.38 Billion

2024

2032

| 2025 –2032 | |

| USD 3.64 Billion | |

| USD 5.38 Billion | |

|

|

|

|

Potting and Encapsulating Compounds Market Size

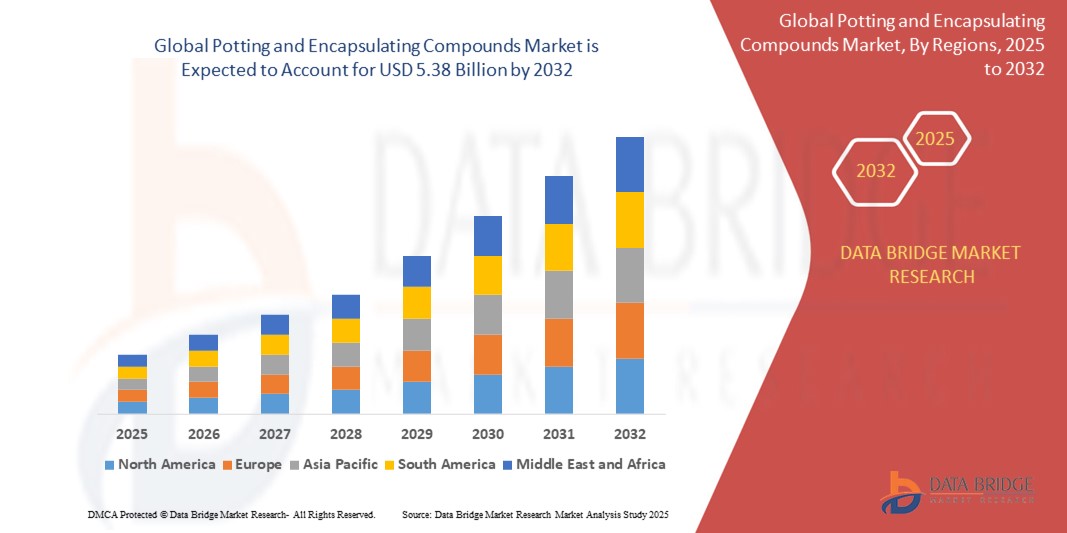

- The global potting and encapsulating compounds market size was valued at USD 3.64 billion in 2024 and is expected to reach USD 5.38 billion by 2032, at a CAGR of 5.00% during the forecast period

- The market growth is largely fuelled by the increasing demand for reliable and durable electronic components in consumer electronics, automotive, and industrial applications. These compounds offer superior protection against moisture, dust, chemicals, and thermal shock, which extends the operational life of electronic assemblies

- In addition, the rising trend of miniaturization and the growing adoption of electric vehicles (EVs) are driving the need for advanced potting and encapsulation solutions to ensure component safety and performance under harsh conditions

Potting and Encapsulating Compounds Market Analysis

- The market for potting and encapsulating compounds is expanding steadily as more industries adopt these materials to protect sensitive electronic components from environmental damage and mechanical stress, ensuring longer product lifespans and reliability

- Manufacturers are focusing on developing advanced compounds with improved thermal stability and electrical insulation properties to meet the growing requirements of complex electronic devices, enhancing overall performance and safety

- North America leads the potting and encapsulating compounds market with the largest revenue share of 38.5% in 2024, primarily driven by its strong presence in the electronics, automotive, and aerospace industries

- Asia-Pacific region is expected to witness the highest growth rate in the global potting and encapsulating compounds market, driven by rapid industrialization, growing electronics manufacturing hubs in China, India, and Southeast Asia, and rising demand for electric vehicles and renewable energy systems across developing economies

- The epoxy segment dominates with the largest market revenue share of 38.5% in 2024, due to its excellent adhesion, mechanical strength, and thermal stability, making it widely preferred for electronic component protection

Report Scope and Potting and Encapsulating Compounds Market Segmentation

|

Attributes |

Potting and Encapsulating Compounds Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Potting and Encapsulating Compounds Market Trends

“Rise of Eco-Friendly and Sustainable Potting Compounds”

- There is a growing trend towards developing eco-friendly potting and encapsulating compounds that minimize environmental impact while maintaining performance standards

- Manufacturers are investing in bio-based and recyclable materials to address increasing regulatory pressures and consumer demand for sustainable electronics

- For instance, Henkel introduced a new line of bio-based encapsulants aimed at reducing carbon footprints in electronic manufacturing

- These sustainable compounds offer comparable thermal and electrical protection, helping industries such as automotive and consumer electronics align with green initiatives

- For instance, companies such as 3M are enhancing their product portfolios with low-VOC (volatile organic compound) options, improving workplace safety and reducing environmental hazards

Potting and Encapsulating Compounds Market Dynamics

Driver

“Increasing Demand for Protection of Electronic Components”

- The demand for potting and encapsulating compounds is driven by the need to protect sensitive electronic components from moisture, dust, chemicals, and mechanical shock in harsh environments

- Increasing miniaturization and sophistication of electronic devices across industries such as automotive, consumer electronics, aerospace, and renewable energy make durability and reliability crucial

- These compounds provide insulation, thermal management, and protection against vibration and corrosion, enhancing device performance and lifespan

- For instance, electric vehicle manufacturers use potting compounds extensively to protect batteries and power modules from temperature changes and moisture ingress

- The rise of IoT devices and smart electronics fuels the adoption of potting materials to ensure secure, long-lasting performance in both industrial and outdoor settings

Restraint/Challenge

“High Production and Raw Material Costs”

- One major challenge to adopting potting and encapsulating compounds is the high production cost due to expensive raw materials such as high-purity resins and fillers

- Price fluctuations caused by supply chain issues and geopolitical tensions add uncertainty to raw material costs, impacting overall manufacturing expenses

- The need for precision and strict quality control in production further increases operational costs, making these compounds less accessible for price-sensitive applications

- Small and medium-sized enterprises often struggle to afford these costs, limiting their ability to use advanced potting materials in their products

- For instance, the push for sustainable and eco-friendly components raises expenses due to research, development, and sourcing of greener alternatives, which can result in higher prices and slower adoption in cost-conscious markets

Potting and Encapsulating Compounds Market Scope

The global potting and encapsulating compounds market is segmented based on type, substrate type, function, curing technique, distribution channel, application, and end-user.

- By Type

On the basis of type, the potting and encapsulating compounds market is segmented into epoxy, polyurethane, silicone, polyester system, polyamide, polyolefin, and others. The epoxy segment dominates with the largest market revenue share of 38.5% in 2024, due to its excellent adhesion, mechanical strength, and thermal stability, making it widely preferred for electronic component protection.

The silicone segment is expected to witness the fastest growth rate from 2025 to 2032 due to its high flexibility and resistance to extreme temperatures. These qualities make it ideal for critical use in automotive and aerospace electronics.

- By Substrate Type

On the basis of substrate type, the potting and encapsulating compounds is segmented into glass, metal, ceramic, and others. The metal substrate segment holds the largest market revenue share of 42.3% in 2024, as metals are commonly used in electrical and electronic components requiring enhanced protection.

The glass segment is expected to witness the fastest growth rate from 2025 to 2032, supported by its increasing use in optical sensors and high-performance electronics. Its insulating properties are crucial for next-generation devices.

- By Function

On the basis of function, the potting and encapsulating compounds market is segmented into electrical insulation, heat dissipation, corrosion protection, shock resistance, chemical protection, and others. Electrical insulation dominates with a market share of 44.1% in 2024, owing to its critical role in safeguarding sensitive electronic parts.

The heat dissipation segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising adoption in electric vehicles and power electronics. Efficient thermal management is vital to ensure component longevity.

- By Curing Technique

On the basis of curing technique, the potting and encapsulating compounds market is segmented into room temperature cured, high temperature or thermally cured, and ultraviolet cured compounds. Room temperature cured compounds lead the market with a 46.0% revenue share in 2024 due to their ease of application and energy efficiency.

The UV cured compounds segment is expected to witness the fastest growth rate from 2025 to 2032, thanks to fast processing times and eco-friendly features. It is increasingly preferred in applications requiring high throughput and sustainability.

- By Distribution Channel

On the basis of distribution channel, the potting and encapsulating compounds market is divided into offline and online. The offline segment accounts for 71.5% of the market revenue in 2024, supported by established procurement methods in industrial sectors.

The online distribution segment is anticipated to witness the highest growth from 2025 to 2032, boosted by the digitalization of procurement and growing preference for direct online sourcing by end users.

- By Application

On the basis of application, the potting and encapsulating compounds market is segmented into electronics and electrical applications. The electronics application dominates the market with a 63.8% revenue share in 2024, fuelled by growing demand for consumer electronics, automotive electronics, and IoT devices.

The electrical application segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by expanding global power infrastructure. Demand is rising for protective compounds in switchgear and transformers.

- By End-User

On the basis of end-user, the potting and encapsulating compounds market is categorized into transportation, consumer electronics, energy and power, telecommunication, healthcare, and others. The consumer electronics segment holds the largest revenue share of 35.7% in 2024, owing to the proliferation of smart devices and connected technologies.

The transportation end-user segment is expected to witness the fastest growth rate from 2025 to 2032 due to increasing electric vehicle production. These vehicles require high-performance materials for battery and motor protection.

Potting and Encapsulating Compounds Market Regional Analysis

- North America Potting and Encapsulating Compounds Market Insight

- North America leads the potting and encapsulating compounds market with the largest revenue share of 38.5% in 2024, primarily driven by its strong presence in the electronics, automotive, and aerospace industries

- The growing demand for robust electronic protection solutions across harsh operating environments has accelerated the adoption of high-performance compounds

- The presence of major manufacturers and high R&D investments further reinforce the region’s leadership in material innovation and application development

U.S. Potting and Encapsulating Compounds Market Insight

The U.S. accounted for the dominant share of 79.2% within North America in 2024, fuelled by technological advancements and widespread integration of electronic systems across transportation and consumer products. The country’s emphasis on safety, thermal management, and product reliability in sectors such as defense and automotive strengthens market demand. Moreover, the growing deployment of renewable energy systems and EV infrastructure continues to support steady market expansion.

Asia-Pacific Potting and Encapsulating Compounds Market Insight

The Asia-Pacific is expected to witness the fastest growth rate from 2025 to 2032, supported by rising industrialization, electronic manufacturing, and automotive production in economies such as China, Japan, and India. Rapid adoption of consumer electronics and smart devices, along with favourable government initiatives for electric mobility and 5G infrastructure, significantly boosts demand for advanced encapsulating compounds. Increasing local production capacity and export-oriented growth strategies also play key roles.

China Potting and Encapsulating Compounds Market Insight

The China held the largest revenue share in the Asia-Pacific region in 2024, owing to its massive electronics manufacturing base and growing investments in EV and telecommunication sectors. Government-backed policies supporting clean energy, smart manufacturing, and technological self-reliance are driving demand for high-performance potting materials. The presence of domestic compound manufacturers offering cost-effective solutions further enhances the country’s competitive position.

Japan Potting and Encapsulating Compounds Market Insight

The Japan’s market is expected to witness the fastest growth rate from 2025 to 2032, due to the country's emphasis on product miniaturization and high-precision electronics. Its well-established automotive and industrial electronics sectors rely heavily on thermally conductive and vibration-resistant compounds. The adoption of encapsulating materials in robotics, wearable technology, and renewable energy products is also rising, reinforcing Japan’s position as a key consumer of advanced protective materials.

Europe Potting and Encapsulating Compounds Market Insight

The Europe holds a substantial market share, driven by stringent regulatory standards for electronic safety and environmental compliance. The region’s strong presence in automotive, aerospace, and industrial automation sectors contributes to steady demand. Increasing adoption of eco-friendly and low-VOC compounds, especially in countries such as Germany and the U.K., aligns with the EU’s sustainability goals, accelerating market uptake.

Germany Potting and Encapsulating Compounds Market Insight

The Germany is a leading contributor to the Europe market, supported by its advanced automotive engineering, automation, and electronics manufacturing landscape. Emphasis on reliability, safety, and environmental responsibility has led to a high uptake of silicone- and epoxy-based compounds. The integration of these materials in next-generation vehicle electronics and power systems continues to drive market growth.

U.K. Potting and Encapsulating Compounds Market Insight

The U.K. market is expected to witness the fastest growth rate from 2025 to 2032, backed by an expanding renewable energy sector and growing electronics R&D investments. The country’s focus on innovation in aerospace and electric vehicle technologies fuels demand for lightweight, durable encapsulating solutions. In addition, rising demand for energy-efficient housing and IoT devices further supports the adoption of high-performance potting materials in commercial and residential applications.

Potting and Encapsulating Compounds Market Share

The Potting and Encapsulating Compounds industry is primarily led by well-established companies, including:

- 3M (U.S.)

- DuPont (U.S.)

- PARKER HANNIFIN CORP (U.S.)

- Momentive (U.S.)

- Henkel AG and Co. KgaA (Germany)

- Solvay (Belgium)

- Avantor, Inc. (U.S.)

- ELANTAS (Germany)

- Electrolube (U.K.)

- Epoxies, Etc. (U.S.)

- Dymax (U.S.)

- Master Bond Inc. (U.S.)

- Owens Corning (U.S.)

- DELO (U.S.)

- RBC Industries, Inc. (U.S.)

- Hernon Manufacturing (U.S.)

- ITW Performance Polymers (U.S.)

- Creative Materials (U.S.)

- United Resin, Inc. (U.S.)

- Epic Resins (U.S.)

Latest Developments in Global Potting and Encapsulating Compounds Market

- In April 2021, Master Bond Inc. launched a new addition to its product portfolio with the introduction of MasterSil 153AO, a two-part addition-cured silicone featuring self-priming properties. This innovative compound offers both electrical insulation and thermal conductivity, making it ideal for protecting sensitive electronic components while efficiently managing heat. The product’s unique structure enhances device reliability and performance in demanding applications. By expanding their range, Master Bond aims to meet growing market demands for advanced protective materials, strengthening their position in the potting and encapsulating compounds sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Potting And Encapsulating Compounds Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Potting And Encapsulating Compounds Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Potting And Encapsulating Compounds Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.