Global Pouch Packaging Machine Market

Market Size in USD Billion

CAGR :

%

USD

1.15 Billion

USD

1.60 Billion

2024

2032

USD

1.15 Billion

USD

1.60 Billion

2024

2032

| 2025 –2032 | |

| USD 1.15 Billion | |

| USD 1.60 Billion | |

|

|

|

|

Pouch Packaging Market Size

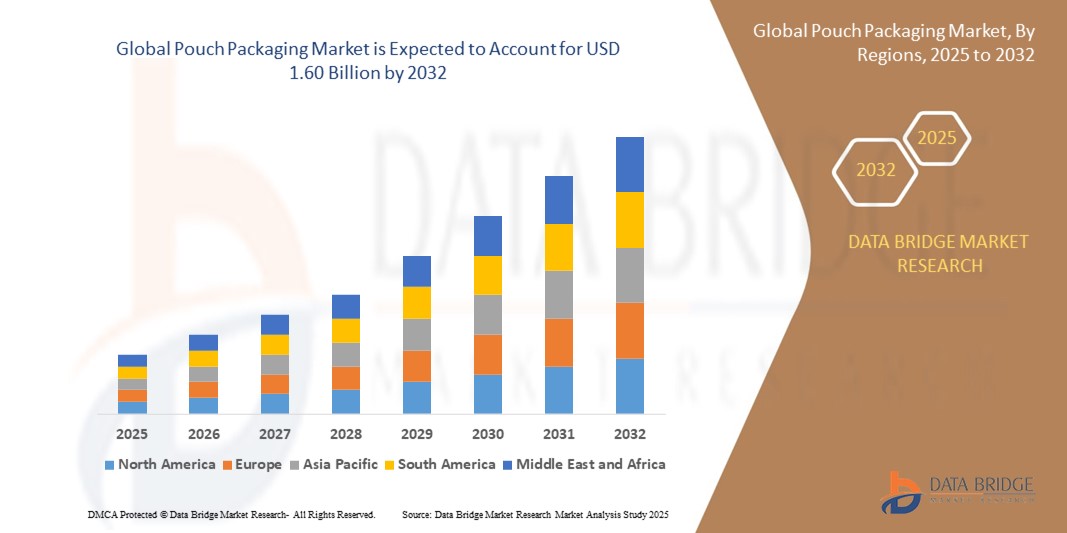

- The global pouch packaging market size was valued at USD 1.15 billion in 2024 and is expected to reach USD 1.60 billion by 2032, at a CAGR of 4.20% during the forecast period

- The market growth is largely fueled by increasing demand for automated and high-speed packaging solutions across food & beverage, pharmaceutical, and personal care industries, driving manufacturers to adopt advanced pouch packaging machines for efficiency and consistency

- Furthermore, rising consumer preference for packaged products with extended shelf life, improved hygiene, and tamper-evident features is encouraging companies to invest in versatile, high-precision packaging machinery. These converging factors are accelerating the adoption of automated pouch packaging solutions, thereby significantly boosting the market's growth

Pouch Packaging Market Analysis

- Pouch packaging machines are industrial systems designed to form, fill, and seal pouches in a wide range of formats, including premade pouches, stand-up bags, and vacuum packs. These machines enhance production efficiency, reduce material wastage, and maintain consistent product quality across food, pharmaceutical, and personal care sectors

- The escalating demand for pouch packaging machines is primarily fueled by the growth of packaged food and beverage consumption, increasing industrial automation, and the need for precise, hygienic, and sustainable packaging solutions that comply with global quality and safety standards

- North America dominated the pouch packaging market in 2024, due to increasing demand for automated packaging solutions across food & beverage, pharmaceutical, and personal care sectors

- Asia-Pacific is expected to be the fastest growing region in the pouch packaging market during the forecast period due to rapid urbanization, rising disposable incomes, and industrial expansion in countries such as China, Japan, and India

- Steel segment dominated the market with a market share of 56.1% in 2024, due to its durability, resistance to corrosion, and suitability for high-speed and continuous operations. Steel machines are preferred in sectors such as food & beverage and pharmaceuticals, where hygiene standards and longevity are critical considerations. The segment also benefits from advancements in stainless steel and coated alloys that minimize maintenance requirements and extend the operational lifespan of machines

Report Scope and Pouch Packaging Market Segmentation

|

Attributes |

Pouch Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pouch Packaging Market Trends

Sustainability and Digital Printing

- The market is being reshaped by growing environmental demands as brands adopt recyclable films and compostable laminations. Digital printing technology is making small‐batch, personalized pouch packaging more affordable and visually distinctive for brands and private labels

- For instance, Amcor has launched recyclable pouch packaging formats with digital print capabilities, appealing to major food and beverage brands eager to meet eco‐label criteria and respond quickly to consumer design trends

- Brands are speeding product launches with just‐in‐time packaging enabled by digital printing. This agility supports seasonal campaigns while reducing inventory and waste through shorter production runs and rapid design modifications

- Clear pouches and windowed formats are gaining popularity for visually appealing product presentation. Advances in film transparency and print quality help manufacturers highlight textures, colors, and freshness in food and personal care categories

- The rise of e-commerce is driving demand for durable, shippable pouches. Flexible packaging solutions provide protection against punctures and leaks, with lightweight formats supporting lower transportation costs and improved logistics efficiency

- Smart pouch technology is expanding with QR codes and RFID tags for tracking, authentication, and consumer engagement. Digital tools are helping brands strengthen traceability, interaction, and anti-counterfeiting features in food, pharma, and plant care categories

Pouch Packaging Market Dynamics

Driver

Growing Need for Flexible and Integrated Packaging Machinery

- Manufacturers are investing in versatile machines capable of handling multiple pouch formats and film types. The need for rapid changeovers, automation, and in-line inspection systems is reshaping procurement requirements with efficiency and compliance top priorities

- For instance, Bosch Packaging Technology has introduced integrated pouch systems supporting multi-material, multi-size bag production for CPG and pharma sectors. Their emphasis on flexibility and high-speed automation is driving adoption among global manufacturers

- On-demand packaging is growing as brands seek to launch SKUs faster for diverse retail channels. Multipurpose machinery enables companies to adapt more quickly to shifting consumer and market trends without major capital outlays

- The increasing complexity of regulatory requirements calls for advanced inspection and serialization within machinery. Integrated solutions reduce labor while ensuring product quality and traceability in highly regulated food, beverage, and medical applications

- Expanding international export activities are fueling need for packaging machinery that accommodates different pouch specifications. Multinational brands benefit from equipment that rapidly adapts to diverse regional and product safety standards

Restraint/Challenge

Ensuring Sterility in Final Product Manufacturing Processes

- Maintaining sterility in pouch packaging is a challenge for food, pharmaceuticals, and medical applications. Any contamination or seal failure can compromise safety and result in costly recalls or regulatory compliance exposure

- For instance, Fresenius Medical Care has implemented advanced sterilization and seal integrity testing for medical device packaging. Their approach emphasizes precise process control to meet stringent hygiene requirements for critical healthcare products

- Stringent regulatory standards increase production complexity for manufacturers. Continuous oversight and testing protocols are needed through every production step to avoid microbial contamination or breaches in sterile barriers

- Machinery calibration and maintenance are essential for sterile pouch packaging. Inconsistent seal pressure, temperature drift, or operator error can lead to failures, demanding robust preventive maintenance programs within busy manufacturing operations

- New biobased and recycled films sometimes introduce unanticipated sterility risks. Ongoing R&D and collaboration with material suppliers are crucial to ensure devices and medicines remain safely protected throughout distribution and use

Pouch Packaging Market Scope

The market is segmented on the basis of type, application, sales channel, and material.

- By Type

On the basis of type, the pouch packaging machine market is segmented into premade pouch packaging machines, horizontal form fill & seal machines, vacuum packaging machines, and vertical form fill & seal machines. The horizontal form fill & seal machine segment dominated the largest market revenue share in 2024, driven by its versatility in handling a wide variety of pouch shapes and sizes, including flat, stand-up, and gusseted pouches. Manufacturers prefer these machines for their high-speed operation and consistent sealing quality, which reduces material wastage and enhances packaging efficiency. The segment also benefits from increasing adoption in the food & beverage and pharmaceutical industries, where packaging precision and hygiene standards are critical. Furthermore, horizontal machines integrate well with automated production lines, further boosting their demand across large-scale operations.

The vacuum packaging machine segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for extended shelf-life packaging across food, pet care, and pharmaceutical sectors. Vacuum machines help in preserving product freshness and quality by removing air and reducing oxidation, which is critical for perishable goods. Small and medium enterprises are increasingly adopting vacuum packaging machines due to their compact footprint and ease of integration into existing production lines. Growing consumer awareness of food safety and hygiene standards is further accelerating the uptake of vacuum packaging solutions globally.

- By Application

On the basis of application, the pouch packaging machine market is segmented into food & beverage, beauty & personal care, pharmaceutical, automotive, homecare, and pet care. The food & beverage segment dominated the largest market revenue share in 2024, owing to the high consumption of packaged snacks, beverages, ready-to-eat meals, and liquid products that require efficient and safe packaging solutions. Rising consumer demand for convenience foods, coupled with the need for extended shelf life and tamper-evident packaging, has made food & beverage the key driver for pouch packaging machine adoption. The market also sees strong demand due to innovations in multi-layered pouches that protect product quality and enhance brand appeal.

The pharmaceutical segment is expected to witness the fastest CAGR from 2025 to 2032, driven by stringent regulatory requirements for hygiene, safety, and precise dosage packaging. The rise in generic drugs, nutraceuticals, and personalized medicine has increased the demand for specialized pouch packaging machines capable of handling blister packs, liquid pouches, and sachets. Growing awareness about counterfeit prevention and compliance with global pharmaceutical standards further supports the adoption of automated pouch packaging solutions in this sector.

- By Sales Channel

On the basis of sales channel, the pouch packaging machine market is segmented into offline and online. The offline segment dominated the largest market revenue share in 2024, as buyers prefer direct interactions with manufacturers and distributors to evaluate machinery performance, after-sales service, and installation support. Trade shows, industrial exhibitions, and in-person consultations have historically been key drivers of offline sales, allowing companies to establish long-term partnerships with suppliers. Moreover, offline channels facilitate demonstration of machine capabilities for large-scale production units, building trust and reliability among industrial buyers.

The online segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing adoption of digital platforms and e-commerce portals for industrial machinery procurement. Online channels allow small and medium enterprises to access multiple vendors, compare features and pricing, and place orders with ease. The rise of virtual demos, AI-powered customer support, and secure online payment gateways further enhance buyer confidence, accelerating the growth of online sales in the pouch packaging machine market.

- By Material

On the basis of material, the pouch packaging machine market is segmented into steel, iron, and other materials. The steel segment dominated the largest market revenue share of 56.1% in 2024, owing to its durability, resistance to corrosion, and suitability for high-speed and continuous operations. Steel machines are preferred in sectors such as food & beverage and pharmaceuticals, where hygiene standards and longevity are critical considerations. The segment also benefits from advancements in stainless steel and coated alloys that minimize maintenance requirements and extend the operational lifespan of machines.

The iron segment is expected to witness the fastest CAGR from 2025 to 2032, driven by cost-effectiveness and adoption in small-scale and emerging market manufacturing units. Iron-based machines offer adequate performance for moderate production capacities while keeping upfront investment low. Their adaptability for custom modifications and compatibility with locally available parts also supports rapid adoption in developing regions. As production automation increases in smaller enterprises, demand for iron-based pouch packaging machines is anticipated to grow steadily over the forecast period.

Pouch Packaging Market Regional Analysis

- North America dominated the pouch packaging market with the largest revenue share in 2024, driven by increasing demand for automated packaging solutions across food & beverage, pharmaceutical, and personal care sectors

- Manufacturers in the region are focusing on high-speed, versatile machinery to meet stringent quality and hygiene standards

- The widespread adoption is further supported by advanced manufacturing infrastructure, high disposable incomes, and a strong preference for energy-efficient and precise packaging systems, establishing automated pouch packaging machines as a favored solution for both large and small-scale enterprises

U.S. Pouch Packaging Machine Market Insight

The U.S. pouch packaging machine market captured the largest revenue share in 2024 within North America, fueled by the increasing adoption of automation in food processing and pharmaceutical industries. Companies are prioritizing machines that enhance production efficiency, reduce material wastage, and ensure consistent packaging quality. The growing trend of ready-to-eat meals, packaged beverages, and pharmaceutical products, combined with robust demand for hygienic and customizable packaging, further propels the market. Moreover, integration with smart production lines and digital monitoring systems is significantly contributing to market expansion.

Europe Pouch Packaging Machine Market Insight

The Europe pouch packaging machine market is projected to expand at a substantial CAGR during the forecast period, driven by stringent regulatory standards for food safety and pharmaceutical packaging. The rising focus on sustainability, energy efficiency, and automation is encouraging manufacturers to adopt modern pouch packaging machines. European enterprises are increasingly investing in machines that support multi-layered pouches, stand-up bags, and vacuum packaging solutions. The market is witnessing growth across food processing, personal care, and healthcare industries, supported by high consumer demand for convenience and product quality.

U.K. Pouch Packaging Machine Market Insight

The U.K. pouch packaging machine market is expected to grow at a notable CAGR during the forecast period, driven by the adoption of automated packaging solutions in food & beverage, pharmaceutical, and beauty sectors. Concerns regarding product safety, hygiene, and efficiency are encouraging companies to shift from manual to automated packaging. The U.K.’s strong industrial infrastructure, coupled with advanced e-commerce and retail channels, is facilitating faster adoption of machinery that supports versatile pouch formats and high-speed production.

Germany Pouch Packaging Machine Market Insight

The Germany pouch packaging machine market is anticipated to expand at a considerable CAGR during the forecast period, fueled by the country’s emphasis on precision engineering, digitalization, and sustainable manufacturing practices. Manufacturers are increasingly adopting machines that optimize production efficiency while minimizing material usage and energy consumption. The integration of advanced technologies, such as automated dosing and sealing, along with stringent regulatory standards for food and pharmaceutical packaging, is supporting market growth across residential, commercial, and industrial applications.

Asia-Pacific Pouch Packaging Machine Market Insight

The Asia-Pacific pouch packaging machine market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and industrial expansion in countries such as China, Japan, and India. The region is witnessing increased demand for packaged food, beverages, and pharmaceutical products, promoting the adoption of high-speed, versatile packaging machinery. Government initiatives supporting manufacturing automation and digitalization are further accelerating market growth.

Japan Pouch Packaging Machine Market Insight

The Japan pouch packaging machine market is gaining momentum due to the country’s focus on advanced manufacturing, automation, and quality control. Demand is driven by the need for efficient, precise, and hygienic packaging solutions across food, pharmaceutical, and personal care sectors. The adoption of compact and technologically advanced machinery that integrates with smart production lines is supporting growth, particularly in high-density urban areas and industrial zones.

China Pouch Packaging Machine Market Insight

The China pouch packaging machine market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s expanding manufacturing base, increasing urbanization, and growing demand for packaged food, beverages, and pharmaceutical products. The region’s large consumer base, coupled with cost-effective machinery solutions and strong domestic manufacturing capabilities, is fueling market growth. In addition, government initiatives promoting industrial automation and smart factories are further accelerating the adoption of advanced pouch packaging machines.

Pouch Packaging Market Share

The pouch packaging industry is primarily led by well-established companies, including:

- GENERAL PACKER CO.,LTD. (Japan)

- SN Maschinenbau (Germany)

- TOPACK Expo (India)

- UnionPack International Co.,Ltd (China)

- Viking Masek (U.S.)

- KHS Group (Germany)

- Tetra laval Group (Switzerland)

- Sacmi (Italy)

- Douglas Machine Inc (U.S.)

- Mailis Group (Luxemberg)

- Duravant (U.S.)

- Syntegon Technology GmbH (Germany)

Latest Developments in Global Pouch Packaging Market

- In June 2025, Hassia-Redatron announced a strategic partnership with Alratech Group to expand its footprint in the Asian market. With Alratech Group serving as the official sales representative in India, this collaboration is expected to strengthen Hassia-Redatron’s presence in a rapidly growing market, enhancing accessibility to advanced packaging machinery. The partnership is likely to accelerate the adoption of innovative pouch packaging solutions in India, enabling manufacturers to improve production efficiency, meet stringent quality standards, and cater to rising consumer demand for packaged products

- In March 2025, Matrix Packaging Machinery entered into a partnership with Cetec Industries to offer a more comprehensive range of solutions for diverse packaging applications. This collaboration enables both companies to leverage each other’s technological expertise, expanding their service offerings in automated pouch packaging. By providing integrated solutions, the partnership is anticipated to boost operational efficiency for clients, reduce downtime, and support manufacturers in scaling up production while maintaining packaging quality and consistency

- In February 2025, IMA Group unveiled its new Combi Pouch Packaging Line designed for high-speed, multi-format pouch production. The system integrates advanced form-fill-seal technology with automated quality inspection, targeting food, pharmaceutical, and personal care sectors. This development is expected to drive market growth by enabling manufacturers to increase throughput, reduce packaging waste, and meet evolving regulatory and consumer requirements, reinforcing IMA Group’s leadership in the pouch packaging machinery segment

- In January 2022, KHS Group launched the Innopal PLR High-Performance Palletizer, designed to combine the low-feed advantages of traditional machines with the high throughput of advanced palletizers. The introduction of this system addresses industry challenges related to operational efficiency and productivity. By enabling faster and more precise palletizing, the Innopal PLR helps manufacturers reduce labor dependency, optimize floor space, and improve overall packaging line efficiency, thereby strengthening KHS Group’s competitive position in the automated packaging equipment market

- In January 2021, Syntegon Technology GmbH launched the Sigpack TTMD 300, a secondary packaging solution featuring Delta robot cells for precise top-load cartoning of unordered items. This innovation enhances packaging accuracy and speed, supporting manufacturers in handling diverse product formats efficiently. Its introduction has had a significant impact on the market by improving line flexibility, reducing product damage, and enabling faster turnaround for high-mix production environments, positioning Syntegon as a key provider of advanced secondary packaging solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pouch Packaging Machine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pouch Packaging Machine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pouch Packaging Machine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.