Global Poultry Compound Feed Market

Market Size in USD Billion

CAGR :

%

USD

243.56 Billion

USD

341.62 Billion

2025

2033

USD

243.56 Billion

USD

341.62 Billion

2025

2033

| 2026 –2033 | |

| USD 243.56 Billion | |

| USD 341.62 Billion | |

|

|

|

|

Poultry Compound Feed Market Size

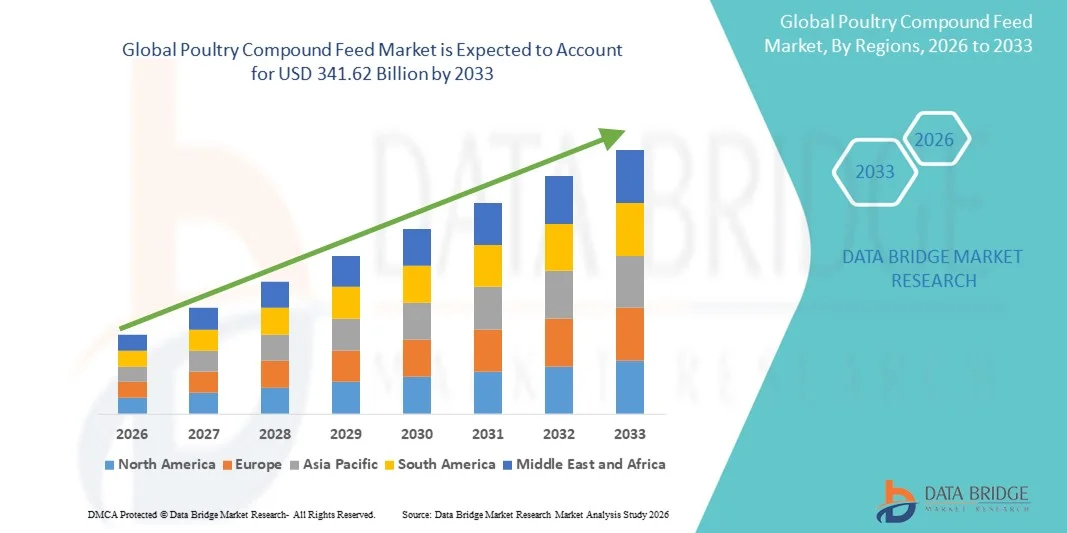

- The global poultry compound feed market size was valued at USD 243.56 billion in 2025 and is expected to reach USD 341.62 billion by 2033, at a CAGR of 4.32% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-quality animal protein, driven by the rising global population and growing meat consumption

- The shift toward nutritionally balanced feed formulations that enhance poultry health, productivity, and growth performance is further supporting market expansion

Poultry Compound Feed Market Analysis

- The poultry compound feed market is witnessing steady growth, supported by the intensifying commercialization of the poultry industry and the rising need for efficient feeding solutions

- Increasing demand for broilers and layers has led to the adoption of compound feeds that ensure balanced nutrient intake and improved feed conversion ratios

- North America dominated the poultry compound feed market with the largest revenue share in 2025, driven by the region’s well-established poultry industry, high consumption of meat and eggs, and increasing adoption of advanced feed formulations. Feed producers in the region are emphasizing sustainable and nutrient-balanced products that improve poultry health, productivity, and feed efficiency

- Asia-Pacific region is expected to witness the highest growth rate in the global poultry compound feed market, driven by expanding poultry production, increasing disposable incomes, and supportive government initiatives promoting the livestock sector

- The cereals segment held the largest market revenue share in 2025, driven by the extensive use of corn, wheat, and barley as primary energy sources in poultry diets. These ingredients are rich in carbohydrates and provide high digestibility, supporting optimal growth and feed efficiency in birds

Report Scope and Poultry Compound Feed Market Segmentation

|

Attributes |

Poultry Compound Feed Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Cargill, Incorporated. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Poultry Compound Feed Market Trends

Rising Focus On High-Performance And Nutrient-Optimized Feed Formulations

- The poultry industry is witnessing a strong shift toward high-performance and nutrient-optimized compound feed formulations designed to enhance growth rate, immunity, and feed efficiency in birds. Manufacturers are investing heavily in R&D to develop balanced diets that meet species-specific requirements and support sustainable production. This shift is also improving feed conversion ratios, reducing environmental impact, and enabling consistent flock performance across different climatic conditions

- The growing demand for antibiotic-free and organic feed is driving innovation in natural additives such as enzymes, probiotics, and amino acids. These functional ingredients are increasingly being used to replace synthetic growth promoters, improving gut health and disease resistance in poultry while aligning with consumer preference for clean-label products. Feed companies are focusing on developing customized blends that improve nutrient absorption, reduce waste output, and support overall animal welfare

- Precision nutrition technologies and data-driven feeding systems are also transforming poultry farming practices. Feed producers are adopting digital tools for ration optimization, which helps minimize waste, reduce costs, and improve performance consistency across flocks. The integration of artificial intelligence (AI) and Internet of Things (IoT) in feed management enables real-time monitoring of feed consumption and bird health, ensuring optimal productivity levels

- For instance, in 2023, several poultry producers in the U.S. and Europe integrated smart feed monitoring systems to track nutrient intake and feed conversion ratios, enhancing productivity and ensuring efficient feed utilization. Such advancements are setting new standards for performance management in poultry farming. These systems also help farmers identify early nutritional deficiencies, manage feed schedules effectively, and achieve better consistency in output quality

- While innovation in feed formulation is driving productivity, ensuring ingredient quality, cost efficiency, and consistent nutrient supply remains a priority. Feed manufacturers must balance sustainability and profitability to maintain market competitiveness. Strategic collaborations with ingredient suppliers and the adoption of circular economy principles are expected to strengthen supply chain resilience and long-term sustainability in feed production

Poultry Compound Feed Market Dynamics

Driver

Increasing Global Demand For Poultry Meat And Eggs

- The rising global consumption of poultry products is a major driver of the compound feed market. Poultry serves as one of the most affordable and efficient sources of animal protein, leading to increased production across both developed and emerging economies. The steady rise in quick-service restaurants, fast-food chains, and ready-to-eat products has further accelerated poultry meat consumption worldwide

- Growing urbanization, population expansion, and dietary shifts toward protein-rich foods have further bolstered demand for poultry products, prompting large-scale adoption of high-quality compound feed. This trend is particularly evident in Asia-Pacific, where expanding middle-class populations are driving consumption growth. Feed producers are responding by increasing production capacity and enhancing nutrient formulations to meet growing demand sustainably

- Government initiatives supporting livestock productivity and biosecurity are also contributing to the development of standardized feed formulations. Investments in feed infrastructure and technology are fostering better nutritional management and higher yield performance. Public-private partnerships and farmer training programs are helping to modernize poultry farming operations and ensure quality feed usage

- For instance, in 2023, India’s National Livestock Mission introduced incentives for commercial poultry farmers adopting fortified feed, improving overall bird health and growth rate. Such policies are accelerating market adoption of compound feed solutions. Similar efforts across Africa and Southeast Asia are encouraging local production and reducing dependency on imported feed ingredients

- While the growing demand for poultry products continues to support feed market expansion, maintaining ingredient affordability amid fluctuating grain prices remains a significant challenge. Feed manufacturers must also address sustainability concerns by adopting environmentally friendly ingredients and optimizing feed utilization to reduce waste and carbon footprint

Restraint/Challenge

Volatility In Raw Material Prices And Supply Chain Disruptions

- The poultry compound feed industry is highly dependent on raw materials such as corn, soybean meal, and wheat, making it vulnerable to price fluctuations caused by climate variability, trade restrictions, and global supply chain disruptions. Sudden cost spikes in these inputs directly affect feed production costs and profit margins for producers. As a result, feed producers are increasingly diversifying ingredient sourcing to mitigate risks and maintain price stability

- Limited availability of high-quality feed grains and increasing competition from biofuel industries have intensified pricing pressure on feed manufacturers. These factors often lead to inconsistent feed quality, which can impact bird performance and farm productivity. Producers are exploring alternative ingredients such as insect meal, algae, and fermented protein sources to ensure cost-effective and sustainable feed formulations

- Global logistics challenges, including shipping delays and rising transportation costs, have further compounded supply chain instability, particularly for countries that rely heavily on imports of feed ingredients. Disruptions caused by geopolitical tensions and fluctuating fuel costs continue to create uncertainties in raw material availability and delivery timelines. This has prompted feed producers to develop regional supply networks and local ingredient processing facilities

- For instance, in 2023, drought conditions in major grain-producing regions of North America and Europe led to a significant surge in feed grain prices, affecting poultry producers worldwide. The incident underscored the sector’s sensitivity to agricultural disruptions. In response, several producers began investing in vertical integration models to gain greater control over their ingredient supply chains

- While supply chain challenges persist, long-term solutions such as diversification of raw material sources, development of alternative protein ingredients, and strategic inventory management are becoming crucial for ensuring market stability and cost control. The adoption of digital supply chain analytics and predictive modeling is also helping feed manufacturers optimize procurement and reduce dependency on volatile markets

Poultry Compound Feed Market Scope

The market is segmented on the basis of ingredient, supplement, source, form, and mode of livestock.

- By Ingredient

On the basis of ingredient, the poultry compound feed market is segmented into cereals, cereal by-products, oilseed meal, oils, molasses, supplements, and others. The cereals segment held the largest market revenue share in 2025, driven by the extensive use of corn, wheat, and barley as primary energy sources in poultry diets. These ingredients are rich in carbohydrates and provide high digestibility, supporting optimal growth and feed efficiency in birds.

The oilseed meal segment is expected to witness the fastest growth rate from 2026 to 2033, attributed to its high protein content and essential amino acid profile that promotes muscle development and weight gain in poultry. Soybean meal continues to dominate this category due to its superior nutritional value, wide availability, and cost-effectiveness in feed formulation.

- By Supplement

On the basis of supplement, the market is segmented into vitamins, antibiotics, antioxidants, amino acids, enzymes, acidifiers, and others. The amino acids segment accounted for the largest revenue share in 2025, driven by their vital role in enhancing protein synthesis, feed efficiency, and overall bird health. Formulations rich in methionine, lysine, and threonine are increasingly being adopted to improve meat quality and growth performance.

The enzymes segment is expected to witness the fastest growth rate from 2026 to 2033, fuelled by their ability to improve nutrient absorption and reduce feed wastage. Enzyme-based additives help break down complex feed components, enhancing digestibility and promoting sustainable feed utilization across poultry production systems.

- By Source

On the basis of source, the poultry compound feed market is segmented into plant-based and animal-based. The plant-based segment dominated the market in 2025, driven by the high inclusion of grains, oilseeds, and legumes in poultry diets due to their nutritional richness and affordability. The shift toward plant-derived proteins also aligns with sustainability goals and consumer demand for naturally sourced ingredients.

The animal-based segment is expected to grow at the fastest rate from 2026 to 2033, supported by increasing demand for nutrient-dense feed components such as fish meal and meat bone meal. These ingredients are particularly valued for their high digestibility, superior amino acid profile, and role in boosting feed palatability and productivity.

- By Form

On the basis of form, the poultry compound feed market is segmented into mash, pellets, crumbles, and other forms. The pellets segment held the largest revenue share in 2025, driven by their uniform composition, ease of handling, and ability to reduce feed wastage. Pelleted feed enhances nutrient intake efficiency, supports better weight gain, and improves overall flock uniformity.

The crumbles segment is expected to witness the fastest growth rate from 2026 to 2033, owing to its suitability for young birds and its ability to promote faster growth and easier digestion. Crumbled feed provides a balanced nutrient structure that ensures efficient feed conversion and higher productivity during early growth stages.

- By Mode of Livestock

On the basis of mode of livestock, the poultry compound feed market is segmented into broilers, layers, breeders, and others. The broilers segment dominated the market in 2025, driven by the high global demand for poultry meat and the increasing focus on achieving faster growth rates and improved feed conversion ratios. Broiler feed formulations are specifically designed to enhance muscle development and meat quality.

The layers segment is expected to grow at the fastest rate from 2026 to 2033, propelled by rising egg consumption and the growing emphasis on improving egg production, shell strength, and nutrient enrichment. Producers are increasingly investing in feed formulations that enhance laying performance, egg size uniformity, and overall bird health.

Poultry Compound Feed Market Regional Analysis

- North America dominated the poultry compound feed market with the largest revenue share in 2025, driven by the region’s well-established poultry industry, high consumption of meat and eggs, and increasing adoption of advanced feed formulations. Feed producers in the region are emphasizing sustainable and nutrient-balanced products that improve poultry health, productivity, and feed efficiency

- The region’s strong infrastructure, integration of precision feeding technologies, and growing consumer demand for antibiotic-free poultry products are further contributing to market growth

- Moreover, strategic investments by major feed manufacturers and supportive government policies for livestock productivity have positioned North America as a global leader in compound feed innovation and adoption

U.S. Poultry Compound Feed Market Insight

The U.S. poultry compound feed market captured the largest revenue share in 2025 within North America, driven by high domestic poultry production and growing consumer preference for protein-rich diets. The increasing focus on feed optimization and nutrient enrichment is supporting producers in maximizing yield and efficiency. Moreover, rising demand for organic and non-GMO poultry feed has encouraged innovation in natural ingredient sourcing. The presence of key market players and continued investment in R&D further solidify the U.S. position as a key hub for poultry feed innovation and sustainability.

Europe Poultry Compound Feed Market Insight

The Europe poultry compound feed market is expected to witness significant growth from 2026 to 2033, driven by stringent regulations on feed quality, traceability, and sustainable sourcing. European feed manufacturers are focusing on developing eco-friendly and antibiotic-free formulations to comply with evolving consumer preferences and animal welfare standards. Rising poultry consumption, coupled with growing investments in feed automation and efficiency technologies, is further accelerating market expansion across major countries such as Germany, France, and the U.K.

U.K. Poultry Compound Feed Market Insight

The U.K. poultry compound feed market is expected to experience strong growth from 2026 to 2033, fuelled by increasing poultry meat and egg consumption, along with a growing preference for premium, sustainable feed options. Producers in the U.K. are adopting innovative ingredients such as plant-based proteins and probiotics to improve poultry nutrition and health. Furthermore, ongoing efforts to reduce environmental impact through circular feed production and waste utilization are shaping the future of the poultry feed industry in the country.

Germany Poultry Compound Feed Market Insight

The Germany poultry compound feed market is projected to grow rapidly from 2026 to 2033, supported by advancements in feed processing technologies and growing emphasis on high-quality, animal-safe feed ingredients. German producers are focusing on traceable supply chains and precision feeding practices that enhance productivity while minimizing environmental footprint. Moreover, government-backed sustainability programs and a strong focus on reducing antibiotic use are further driving innovation in the country’s feed sector.

Asia-Pacific Poultry Compound Feed Market Insight

The Asia-Pacific poultry compound feed market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, population growth, and rising disposable incomes in countries such as China, India, and Indonesia. The region’s expanding poultry industry and growing demand for affordable protein sources are propelling feed production capacity. Furthermore, government initiatives promoting livestock development and private sector investments in feed mills are contributing to the region’s dominant position in global poultry production.

China Poultry Compound Feed Market Insight

The China poultry compound feed market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s strong poultry production base, rising demand for high-quality meat products, and adoption of modern feeding technologies. Feed manufacturers in China are increasingly focusing on enhancing feed conversion efficiency and developing sustainable feed alternatives to reduce dependency on imported raw materials. In addition, supportive agricultural policies and growing exports of poultry products are bolstering market growth.

Japan Poultry Compound Feed Market Insight

The Japan poultry compound feed market is expected to witness steady growth from 2026 to 2033, driven by the rising demand for premium-quality poultry products and the country’s emphasis on food safety and nutritional excellence. Japanese feed producers are focusing on high-performance formulations enriched with amino acids, enzymes, and probiotics to enhance poultry health and productivity. Moreover, technological advancements in feed processing, automation, and precision nutrition are supporting efficiency improvements in the country’s well-regulated poultry sector. The growing adoption of sustainable and eco-friendly feed solutions aligns with Japan’s commitment to reducing its environmental footprint and improving livestock welfare standards.

Poultry Compound Feed Market Share

The Poultry Compound Feed industry is primarily led by well-established companies, including:

• Cargill, Incorporated. (U.S.)

• ADM (U.S.)

• New Hope Group (China)

• Charoen Pokphand Foods PCL (Thailand)

• Land O'Lakes, Inc. (U.S.)

• Nutreco N.V. (Netherlands)

• Guangdong HAID Group Co., Ltd. (China)

• ForFarmers (Netherlands)

• Alltech (U.S.)

• Feedone Co., Ltd. (Japan)

• J. D. Heiskell & Co. (U.S.)

• Kent Nutrition Group (U.S.)

• PT Japfa Comfeed Indonesia Tbk. (Indonesia)

• COFCO (China)

• United Animal Health (U.S.)

• Institut de Sélection Animale BV (Netherlands)

• Miratorg Holding (Russia)

• De Heus Animal Nutrition (Netherlands)

• BASF SE (Germany)

• Associated British Foods plc (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.