Global Poultry Feed Acidulants Market

Market Size in USD Billion

CAGR :

%

USD

4.42 Billion

USD

6.53 Billion

2025

2033

USD

4.42 Billion

USD

6.53 Billion

2025

2033

| 2026 –2033 | |

| USD 4.42 Billion | |

| USD 6.53 Billion | |

|

|

|

|

What is the Global Poultry Feed Acidulants Market Size and Growth Rate?

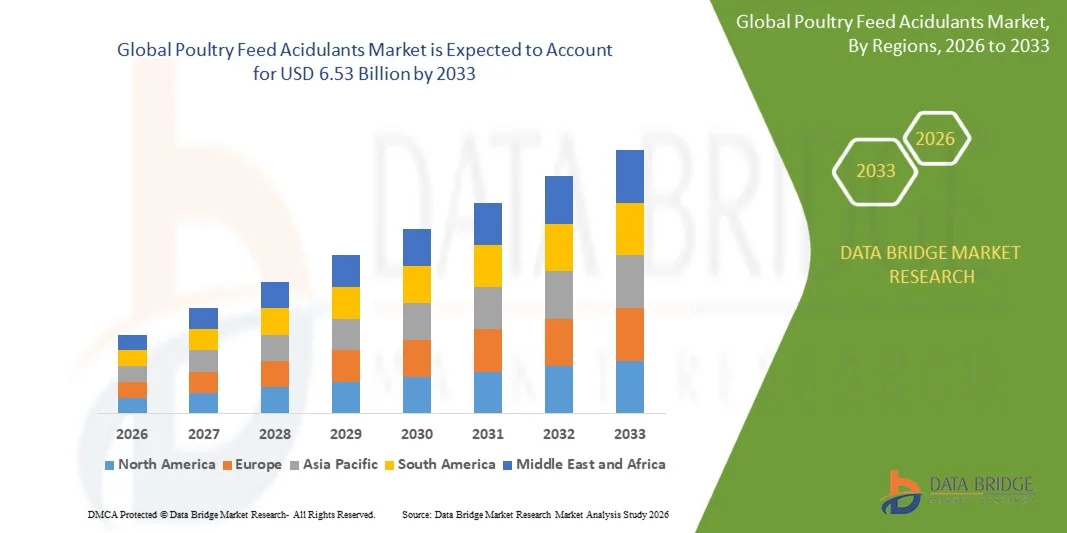

- The global poultry feed acidulants market size was valued at USD 4.42 billion in 2025 and is expected to reach USD 6.53 billion by 2033, at a CAGR of 5.80% during the forecast period

- The expansion of animal husbandry and rise in demand for feed and feed additives are the major factors driving the poultry feed acidulants market. The growing awareness among livestock rearers for animal nutrition value and the surging government funding in the feed industry accelerate the poultry feed acidulants market growth

- The increasing prevalence of diseases in livestock and the restriction on the usage of antibiotics boosts the poultry feed acidulants market. The increasing emphasis on the poultry plays an important role in the food security, their supply of protein and nutrition in the form of eggs and meat and the increasing need to produce food with the purpose of managing the large requirement of food among population globally influence the poultry feed acidulants market

What are the Major Takeaways of Poultry Feed Acidulants Market?

- The growing mergers of key players increase in research and development activities and high demand for meat and eggs among costumers propel the poultry feed acidulants market

- In addition, the rising importance of animal nutrition, enhancement of animal feed products and consumer preference towards healthy lifestyle positively affects the poultry feed acidulants market. Furthermore, the process of encapsulation utilized for feed acidulants extend profitable opportunities to the poultry feed acidulants market players

- Asia-Pacific dominated the poultry feed acidulants market with the largest revenue share of 42.6% in 2025, driven by rapid growth in poultry meat and egg production, increasing industrial livestock farming, and rising demand for antibiotic-free feed additives

- The North America poultry feed acidulants market is expected to grow at the fastest CAGR of 11.8% from 2025 to 2033, fueled by rising awareness regarding antibiotic alternatives and sustainable poultry production practices

- The propionic acid segment dominated the market with the largest revenue share of 32.8% in 2025, primarily due to its superior antimicrobial properties and effectiveness in preventing mold and bacterial growth in poultry feed

Report Scope and Poultry Feed Acidulants Market Segmentation

|

Attributes |

Poultry Feed Acidulants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Poultry Feed Acidulants Market?

Rising Adoption of Natural and Organic Acidulants in Poultry Nutrition

- A prominent and accelerating trend in the global poultry feed acidulants market is the increasing shift toward natural and organic acidulant formulations to meet consumer demand for antibiotic-free and sustainable poultry production. Feed manufacturers are moving away from synthetic acids, focusing instead on plant-based and fermentation-derived acidulants to enhance gut health and performance naturally

- For instance, Corbion Purac introduced lactic acid-based feed acidulants derived from renewable sources, which support antimicrobial activity while improving nutrient digestibility. Similarly, Perstorp Holding AB launched ProPhorce™ SR series, featuring butyric acid products that promote intestinal integrity and feed conversion efficiency in poultry

- This growing preference for eco-friendly formulations aligns with global trends in clean-label animal nutrition. Poultry producers are emphasizing transparency and sustainability, aiming to reduce antibiotic usage while maintaining optimal flock health and productivity. In addition, organic acidulants contribute to reducing environmental impact due to their biodegradable and low-residue nature

- The adoption of natural feed acidulants reflects the poultry industry’s transition toward more sustainable and health-focused production models. As consumer awareness of food safety and antibiotic alternatives continues to grow, this trend is expected to dominate future innovation and product development in the market

What are the Key Drivers of Poultry Feed Acidulants Market?

- The increasing demand for high-quality poultry products and the global shift toward antibiotic-free animal nutrition are primary drivers propelling the growth of the Poultry Feed Acidulants market. Feed acidulants are gaining traction as effective alternatives to antibiotics, improving gut health, nutrient absorption, and disease resistance in poultry

- For instance, in January 2024, Novus International, Inc. (U.S.) launched its enhanced line of organic acid-based feed additives, designed to optimize gut health and performance without relying on antibiotic growth promoters. Similarly, BASF SE (Germany) continues to expand its feed additives portfolio with formic and propionic acid solutions to improve feed preservation and microbial control

- The growing focus on food safety, livestock productivity, and sustainable farming practices is encouraging producers to adopt feed acidulants that ensure efficient feed utilization while maintaining animal welfare. Government regulations across the European Union and North America restricting antibiotic use in animal feed further support this demand surge

- In addition, the expansion of the poultry industry in emerging markets such as India, China, and Brazil is boosting feed acidulant consumption, driven by rising meat consumption and the need to enhance flock performance cost-effectively

Which Factor is Challenging the Growth of the Poultry Feed Acidulants Market?

- One of the primary challenges facing the market is the high cost of natural and specialty acidulants compared to conventional chemical options. Producers often face narrow profit margins, which can make the adoption of advanced acidulant formulations less feasible, particularly in price-sensitive regions

- For instance, fluctuations in raw material costs—especially for organic acids such as citric and butyric acid—have impacted the production expenses of leading manufacturers such as Yara International ASA (Norway) and Kemira OYJ (Finland). These cost pressures limit accessibility for small-scale poultry farmers and hinder market expansion in developing economies

- Another challenge is the limited awareness among poultry producers about the optimal use and dosage of acidulants. Inadequate knowledge can lead to underperformance or feed inefficiency, reducing overall productivity benefits. Moreover, variations in poultry gut microbiota and feed composition often require tailored acidulant formulations, adding complexity to product development

- Addressing these issues through cost optimization, producer education, and improved formulation technologies will be essential for sustained growth. Companies are focusing on innovation in encapsulation techniques and synergistic acid blends to enhance efficacy, reduce volatility, and maximize return on investment for poultry farmers

How is the Poultry Feed Acidulants Market Segmented?

The market is segmented on the basis of type, animal type, form, compound, and function.

- By Type

On the basis of type, the poultry feed acidulants market is segmented into propionic acid, formic acid, citric acid, lactic acid, sorbic acid, malic acid, acetic acid, and others. The propionic acid segment dominated the market with the largest revenue share of 32.8% in 2025, primarily due to its superior antimicrobial properties and effectiveness in preventing mold and bacterial growth in poultry feed. It is widely used as a preservative to extend feed shelf life and ensure nutrient stability.

The formic acid segment is anticipated to witness the fastest CAGR from 2026 to 2033, driven by its growing use in improving gut health and digestion efficiency in poultry. Increasing demand for natural acidulants that enhance feed conversion ratios without antibiotics is propelling the adoption of formic acid-based solutions across both developed and emerging poultry-producing regions.

- By Animal Type

Based on animal type, the market is segmented into poultry, ruminants, swine, aquaculture, pets, and equine. The poultry segment held the largest market share of 45.5% in 2025, supported by the rapid expansion of global poultry meat and egg production. Rising demand for antibiotic-free poultry feed and the adoption of acidulants to promote gut health, reduce pathogens, and improve nutrient absorption are fueling segment growth.

The swine segment is projected to grow at the fastest CAGR during the forecast period, driven by the rising need to enhance feed efficiency and disease resistance in pig farming. The increasing awareness of biosecurity and gut performance optimization in swine nutrition is encouraging feed manufacturers to incorporate acidulant blends that maintain microbial balance and improve production outcomes.

- By Form

On the basis of form, the poultry feed acidulants market is divided into dry and liquid. The dry form segment dominated the market with a revenue share of 57.6% in 2025, attributed to its superior handling convenience, stability during storage, and compatibility with pelleted feed formulations. Dry acidulants are easier to blend, offer uniform distribution in feed, and have a longer shelf life compared to their liquid counterparts.

The liquid form segment is expected to witness the fastest growth rate through 2033, owing to its enhanced solubility and quick absorption in animal diets. Liquid acidulants are increasingly preferred for applications in drinking water systems and liquid feed formulations, allowing precise dosing and faster gut pH regulation. This growing shift toward liquid formulations aligns with modern precision feeding techniques and automated poultry management systems.

- By Compound

Based on compound, the market is segmented into blended and single. The blended segment dominated the market with the highest share of 64.2% in 2025, driven by the synergistic benefits offered by combinations of organic acids such as formic, propionic, and citric acids. These blends provide comprehensive antimicrobial effects, improved feed preservation, and enhanced nutrient digestibility in poultry diets.

The single compound segment is projected to register the fastest CAGR from 2026 to 2033, as feed producers increasingly prefer customized formulations that target specific performance objectives. The ability to fine-tune acid concentration and response based on animal type, age, and feed composition is encouraging the adoption of single-acid solutions, particularly in high-value poultry production systems emphasizing efficiency and precision.

- By Function

On the basis of function, the market is segmented into pH control, feed efficiency, and flavor. The pH control segment dominated the market with a revenue share of 49.3% in 2025, owing to the crucial role of acidulants in maintaining optimal intestinal pH and inhibiting pathogenic bacterial growth. Efficient pH regulation enhances nutrient absorption and gut health, leading to improved overall poultry performance.

The feed efficiency segment is expected to record the fastest CAGR through 2033, supported by increasing demand for performance-enhancing additives that reduce feed costs and maximize weight gain. As global poultry producers focus on profitability and sustainable production, acidulants designed to optimize feed conversion ratios are becoming a critical component of feed formulations, driving this segment’s robust growth trajectory.

Which Region Holds the Largest Share of the Poultry Feed Acidulants Market?

- Asia-Pacific dominated the poultry feed acidulants market with the largest revenue share of 42.6% in 2025, driven by rapid growth in poultry meat and egg production, increasing industrial livestock farming, and rising demand for antibiotic-free feed additives. Countries such as China, India, Japan, and Indonesia are major contributors, supported by strong government initiatives promoting sustainable and safe poultry production

- Feed manufacturers across the region are increasingly incorporating organic and blended acidulants to enhance gut health, improve feed efficiency, and reduce pathogenic bacteria. The region’s rising population, coupled with changing dietary preferences toward high-protein foods, continues to propel poultry sector expansion

- Furthermore, the presence of major feed producers and raw material suppliers, coupled with affordable labor and large-scale poultry operations, strengthens the region’s market dominance. These factors position Asia-Pacific as the global hub for poultry feed acidulant innovation and production

China Poultry Feed Acidulants Market Insight

The China poultry feed acidulants market accounted for the largest revenue share of 48% in 2025 within the Asia-Pacific region, supported by strong government initiatives to phase out antibiotic growth promoters and promote sustainable poultry farming. The country’s rapidly growing poultry industry, coupled with rising awareness of feed quality and safety, has accelerated the adoption of acidulants in broiler and layer feed. Chinese feed producers are increasingly investing in propionic and formic acid-based blends for improved preservation and gut performance. The expansion of domestic feed mills, along with collaborations between local and international additive manufacturers, further drives the market. As the nation’s poultry production capacity continues to grow, the demand for advanced acidulant solutions is expected to remain robust throughout the forecast period.

India Poultry Feed Acidulants Market Insight

The India poultry feed acidulants market is projected to expand at a substantial CAGR from 2025 to 2033, driven by the country’s rising poultry consumption, growing exports, and increasing adoption of quality feed solutions. The market is witnessing higher usage of citric and lactic acids to enhance nutrient digestibility and flock health, aligning with the government’s initiatives to reduce antibiotic dependence in livestock production. Local feed manufacturers are collaborating with global companies to develop cost-effective, blended acidulants tailored for regional climatic and nutritional needs. The rapid urbanization and expansion of organized poultry farming are creating strong growth opportunities, particularly for natural and encapsulated acidulant formulations that support feed hygiene and long-term storage stability.

Japan Poultry Feed Acidulants Market Insight

The Japan poultry feed acidulants market is anticipated to grow at a notable CAGR through 2033, supported by the country’s emphasis on animal welfare, feed quality, and food safety. Japanese poultry producers are increasingly adopting high-purity organic acids and innovative feed formulations to ensure disease prevention and optimized digestion. Furthermore, Japan’s advanced agricultural technology and preference for premium poultry products are fostering greater adoption of precision feeding systems incorporating acidulant-based nutritional management. Partnerships between local research institutes and global additive manufacturers are contributing to the development of eco-friendly acidulant blends designed to meet Japan’s strict quality and safety standards.

Which Region is the Fastest Growing in the Poultry Feed Acidulants Market?

The North America poultry feed acidulants market is expected to grow at the fastest CAGR of 11.8% from 2025 to 2033, fueled by rising awareness regarding antibiotic alternatives and sustainable poultry production practices. The region’s highly developed poultry industry, coupled with strong demand for organic meat and eggs, is driving the use of feed acidulants that enhance feed preservation and improve gut health naturally. Producers are focusing on encapsulated and blended acidulant formulations to optimize nutrient utilization and ensure consistent bird performance across large-scale operations. Stringent food safety regulations set by authorities such as the U.S. Food and Drug Administration (FDA) and Canadian Food Inspection Agency (CFIA) are further accelerating market adoption.

U.S. Poultry Feed Acidulants Market Insight

The U.S. poultry feed acidulants market captured the largest share of 78% in 2025 within North America, driven by the expanding poultry production base and the ongoing transition toward antibiotic-free feeding systems. Increasing demand for high-efficiency acidulants, such as formic and propionic acid blends, is supporting enhanced gut function and pathogen control. In addition, strong R&D investments by companies such as Novus International and Kemin Industries are leading to the development of performance-driven products tailored to poultry health management. The emphasis on sustainable animal production and consumer preference for clean-label food products is expected to sustain market growth across the U.S. in the coming years.

Canada Poultry Feed Acidulants Market Insight

The Canada poultry feed acidulants market is projected to grow steadily during the forecast period, driven by government support for sustainable livestock production and strong consumer awareness of food safety. Feed producers are increasingly incorporating lactic and citric acids to enhance digestion and reduce harmful microbial load in poultry diets. Moreover, growing collaborations between Canadian feed manufacturers and European acidulant suppliers are promoting innovation and the introduction of bio-based feed acidulant solutions. The country’s focus on precision nutrition and animal welfare continues to foster opportunities for market expansion, positioning Canada as a key player in the North American feed acidulant landscape.

Which are the Top Companies in Poultry Feed Acidulants Market?

The poultry feed acidulants industry is primarily led by well-established companies, including:

- Perstorp Holding AB (Sweden)

- Novus International, Inc. (U.S.)

- Jefo Nutrition Inc. (Canada)

- Anpario plc (U.K.)

- Corbion Purac (Netherlands)

- ADDCON Group (Germany)

- Peterlabs (Malaysia)

- BASF SE (Germany)

- Yara International ASA (Norway)

- Kemin Industries Inc. (U.S.)

- Kemira OYJ (Finland)

- Biomin Holding GmbH (Austria)

- Impextraco NV (Belgium)

- Pancosma (Switzerland)

- Nutrex NV (Belgium)

What are the Recent Developments in Global Poultry Feed Acidulants Market?

- In March 2025, Kemin Industries Inc. (U.S.) introduced PROSIDIUM, a peroxy acid-based feed pathogen control acidulant formulated to combat Salmonella and viral threats in raw feed, thereby improving feed safety and animal health. This launch highlights Kemin’s commitment to enhancing biosecurity and promoting sustainable livestock production

- In October 2024, DSM-Firmenich (Switzerland) inaugurated a new facility in Sete Lagoas, Brazil, with an annual production capacity of 100,000 metric tons of cattle supplements. This expansion strengthens its feed additive portfolio in South America and supports the rising demand for functional ingredients such as feed acidulants that enhance ruminant health and productivity. The initiative reinforces DSM-Firmenich’s strategic focus on regional growth and innovation in animal nutrition

- In June 2024, Kemin Industries Inc. (U.S.) launched FORMYL, a next-generation feed acidulant designed for swine in the U.S. market. Formulated with encapsulated calcium formate and citric acid, FORMYL delivers dual benefits of acidification and pathogen control, supporting intestinal health, improving feed efficiency, and managing E. coli challenges without antibiotics. This launch underscores Kemin’s continued investment in antibiotic-free feed solutions

- In May 2024, Innovad Group (Belgium) completed the acquisition of Oligo Basics, a major player in Brazil’s nutritional feed additives market. This acquisition enhances Innovad’s regional presence and broadens its product portfolio, including feed acidulants aimed at boosting animal health and performance. The move marks a strategic step toward expanding Innovad’s footprint in the South American feed additives sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.