Global Poultry Feed Phosphates Market

Market Size in USD Million

CAGR :

%

USD

860.00 Million

USD

2,059.67 Million

2025

2033

USD

860.00 Million

USD

2,059.67 Million

2025

2033

| 2026 –2033 | |

| USD 860.00 Million | |

| USD 2,059.67 Million | |

|

|

|

|

Poultry Feed Phosphates Market Size

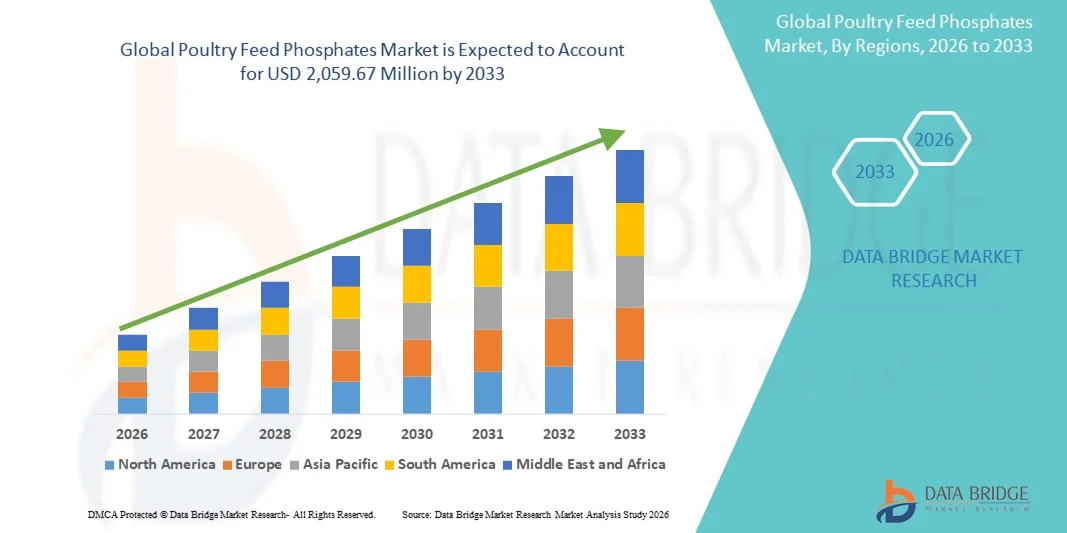

- The global poultry feed phosphates market size was valued at USD 860.00 million in 2025 and is expected to reach USD 2,059.67 million by 2033, at a CAGR of 4.10% during the forecast period

- The market growth is largely fuelled by the rising demand for high-quality poultry nutrition that supports optimal bone development, digestion, and productivity

- Increasing industrial poultry production and the growing focus on improving feed efficiency and flock health are further accelerating the adoption of feed phosphates

Poultry Feed Phosphates Market Analysis

- The market is witnessing steady growth driven by the expansion of commercial poultry farms and the rising adoption of scientifically formulated feed solutions

- Advancements in feed processing technologies and the introduction of highly bioavailable phosphate variants are enhancing nutrient absorption and improving poultry performance

- North America dominated the poultry feed phosphates market with the largest revenue share in 2025, driven by strong poultry production volumes and the growing adoption of high-quality mineral supplements in commercial feed formulations

- Asia-Pacific region is expected to witness the highest growth rate in the global poultry feed phosphates market, driven by rising poultry meat consumption and growing investments in feed production capacity

- The Dicalcium Phosphate segment held the largest market revenue share in 2025 driven by its widespread use in poultry feed formulations due to its high digestibility, balanced calcium-phosphorus ratio, and cost-effectiveness. It remains the preferred option for improving skeletal strength, growth rates, and overall nutrient absorption across broilers, layers, and breeders

Report Scope and Poultry Feed Phosphates Market Segmentation

|

Attributes |

Poultry Feed Phosphates Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Mosaic (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Poultry Feed Phosphates Market Trends

Growing Adoption Of High-Purity And Bioavailable Feed Phosphates

- The increasing emphasis on poultry productivity and gut health is driving a strong shift toward high-purity, highly bioavailable feed phosphates that support optimal bone development and metabolic functions. These formulations improve overall nutrient uptake efficiency in both broilers and layers. Their consistent quality ensures better flock performance even under intensive production environments

- The rising demand for rapid growth cycles in broilers and enhanced egg production in layers is accelerating the adoption of specialized phosphate blends. These products help optimize energy utilization and support higher feed conversion efficiency across various production systems. Their adaptability to different feed formulations makes them suitable for commercial and integrated farms

- Cost-effective and performance-driven phosphate variants are gaining popularity among small and mid-scale poultry producers, supporting consistent flock nutrition. Their stable composition ensures uniform nutrient delivery, reducing performance variations across batches. They are increasingly preferred by large-volume feed manufacturers aiming to standardize product quality

- For instance, in 2023, several poultry producers across Southeast Asia reported improved feed conversion ratios after switching to high-bioavailability monocalcium phosphate blends supplied by regional feed additive companies. These improvements were mainly driven by enhanced mineral absorption and optimized skeletal development. Such shifts demonstrate rising confidence in advanced phosphate solutions

- While advanced phosphates are improving poultry nutrition, continued innovation, sustainability in phosphate sourcing, and cost management remain essential for expanding adoption across developing markets. Producers are also focusing on integrating eco-friendly manufacturing practices to align with global sustainability goals. These efforts are expected to strengthen long-term usage across the industry

Poultry Feed Phosphates Market Dynamics

Driver

Rising Demand For Poultry Meat And Eggs Globally

- The rapid growth in global poultry consumption is driving the need for nutrient-rich feed formulations that ensure optimal growth, high yield, and improved immunity. This increasing consumption is pushing producers to focus on mineral-balanced diets for better skeletal and metabolic health. As a result, phosphates remain a vital component for ensuring consistent flock performance

- Producers are becoming more aware of the economic benefits associated with balanced mineral nutrition, such as reduced mortality, improved feed conversion, and better productivity. This awareness is leading to increased adoption of high-quality feed phosphates that enhance long-term production efficiency. Both commercial farms and integrators are prioritizing fortified feed solutions to maximize output

- Government initiatives supporting livestock nutrition, global protein demand, and expansion of commercial poultry production systems are boosting phosphate usage. Countries are updating feed quality standards to align with modern poultry genetics and high-yield production models. These regulatory changes encourage manufacturers to integrate advanced phosphate formulations

- For instance, in 2022, several European countries updated mineral requirement guidelines for broiler feed, prompting increased adoption of advanced phosphate formulations among feed mills. Such regulatory shifts are increasingly influencing global feed manufacturing practices. They also drive innovation in producing more efficient and sustainable phosphate blends

- While rising production and nutrition standards are fueling growth, ensuring consistent supply and optimizing phosphate formulations remain critical for sustaining market progress. Producers must manage fluctuating raw material costs and balance formulation economics. Strategic sourcing and technological improvements are becoming essential for long-term market stability

Restraint/Challenge

Volatile Raw Material Prices And Environmental Concerns

- The cost of phosphate rock and other raw materials used in feed phosphate production often fluctuates due to mining limitations, geopolitical instability, and supply chain constraints. These fluctuations affect pricing stability and reduce predictability for feed manufacturers. Such conditions make it challenging to maintain consistent feed formulations across batches

- Growing environmental concerns regarding phosphate mining and waste accumulation are pressuring producers to adopt cleaner extraction and production methods. Sustainability-related regulations are prompting companies to invest in eco-friendly technologies. These requirements can increase production costs and complicate market expansion strategies

- Supply chain disruptions, especially in developing regions, limit the consistent availability of high-quality phosphates. Smaller poultry farms often face challenges in accessing premium phosphate blends, affecting feed quality and flock performance. Limited infrastructure further slows the adoption of advanced nutritional solutions

- For instance, in 2023, phosphate price fluctuations in global markets led several feed producers in Latin America to reformulate diets, resulting in inconsistent mineral intake across poultry flocks. Such volatility impacts growth rates, skeletal health, and overall production efficiency. It also forces producers to adopt temporary nutritional adjustments that may not meet optimal standards

- While the industry is shifting toward eco-efficient production and alternative sources, addressing cost pressures and environmental impacts remains crucial for ensuring reliable phosphate supply and stable market growth. Increased focus on sustainable mining practices and recycling technologies is expected to influence future production strategies. Industry collaboration will be essential for long-term resource security

Poultry Feed Phosphates Market Scope

The market is segmented on the basis of type and form

- By Type

On the basis of type, the poultry feed phosphates market is segmented into Dicalcium Phosphate, Monocalcium Phosphate, Mono-Dicalcium Phosphate, Defluorinated Phosphate, Tricalcium Phosphate, and Others. The Dicalcium Phosphate segment held the largest market revenue share in 2025 driven by its widespread use in poultry feed formulations due to its high digestibility, balanced calcium-phosphorus ratio, and cost-effectiveness. It remains the preferred option for improving skeletal strength, growth rates, and overall nutrient absorption across broilers, layers, and breeders.

The Monocalcium Phosphate segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its superior bioavailability and higher phosphorus content that support enhanced metabolic efficiency. This type is increasingly adopted for high-performance poultry production systems requiring optimized feed conversion and consistent mineral balance, making it a favored choice among advanced feed mills and integrators.

- By Form

On the basis of form, the poultry feed phosphates market is segmented into Powder and Granule. The Powder segment held the largest market revenue share in 2025 driven by its easy incorporation into feed mixtures, uniform distribution of minerals, and suitability for large-scale commercial feed production. Its versatility and cost-efficiency make it the dominant form used by most poultry feed manufacturers.

The Granule segment is expected to witness the fastest growth rate from 2026 to 2033, supported by its reduced dust generation, improved handling properties, and consistent nutrient release during digestion. Granular phosphates are gaining adoption among feed producers seeking cleaner processing, enhanced flowability, and better pellet quality in high-capacity feed mills.

Poultry Feed Phosphates Market Regional Analysis

- North America dominated the poultry feed phosphates market with the largest revenue share in 2025, driven by strong poultry production volumes and the growing adoption of high-quality mineral supplements in commercial feed formulations

- Producers in the region prioritize enhanced feed efficiency, balanced nutrition, and optimal flock performance, which increases reliance on premium phosphate ingredients in broiler and layer diets

- This strong market position is further supported by advanced poultry farming systems, high awareness of feed quality standards, and continuous innovation in feed formulations across large-scale operations

North America Poultry Feed Phosphates Market Insight

The U.S. poultry feed phosphates market captured the largest revenue share in 2025 within North America, supported by extensive commercial poultry operations and a rising focus on improving flock health through nutritionally balanced feeds. Producers are increasingly emphasizing mineral-rich formulations that enhance growth, bone strength, and feed conversion efficiency. The widespread use of advanced feed processing technologies and strict compliance with nutrition guidelines further fuel the adoption of high-purity phosphate variants. Growing consumer demand for high-quality poultry meat and eggs continues to strengthen the market landscape.

Europe Poultry Feed Phosphates Market Insight

The Europe poultry feed phosphates market is expected to witness significant growth from 2026 to 2033, driven by stringent feed safety regulations and the rising need for nutrient-optimized diets across poultry farms. The region’s increasing shift toward sustainable and performance-enhancing feed ingredients supports greater uptake of premium phosphate blends. European producers also prioritize flock welfare and efficiency, creating strong demand for bioavailable mineral sources. The adoption of advanced feed technologies across commercial poultry systems reinforces market expansion in the region.

U.K. Poultry Feed Phosphates Market Insight

The U.K. poultry feed phosphates market is expected to witness strong growth from 2026 to 2033, driven by rising poultry consumption, enhanced focus on feed quality, and the widespread adoption of precision nutrition practices. Growing concerns regarding animal health and productivity are pushing producers toward reliable phosphate sources that improve skeletal development and metabolic performance. The country’s modern poultry farming infrastructure and strong demand for nutrient-dense feed solutions continue to accelerate market growth.

Germany Poultry Feed Phosphates Market Insight

The Germany poultry feed phosphates market is expected to grow rapidly from 2026 to 2033, fueled by advanced livestock management systems and increasing emphasis on high-quality nutrition. German producers prioritize sustainable and scientifically formulated feed ingredients, driving demand for efficient and eco-conscious phosphate variants. The integration of mineral-rich formulations into modern poultry feed programs is becoming more prominent, supported by the country’s strong regulatory framework and focus on productivity enhancement.

Asia-Pacific Poultry Feed Phosphates Market Insight

The Asia-Pacific poultry feed phosphates market is expected to witness the fastest growth from 2026 to 2033, driven by rapid expansion of poultry production, rising disposable incomes, and increased adoption of nutritionally balanced feed across countries such as China, India, and Indonesia. Growing demand for high-yield poultry farming practices is pushing the use of bioavailable phosphate ingredients. Government-backed initiatives supporting livestock development and feed quality improvements further strengthen market growth across the region.

Japan Poultry Feed Phosphates Market Insight

The Japan poultry feed phosphates market is expected to witness notable growth from 2026 to 2033 due to the country's emphasis on high-quality feed formulations and its advanced approach to poultry farming. The market benefits from a strong focus on flock health, precise nutrition, and technologically driven production systems. Increasing integration of phosphate-rich feed solutions to support bone development and metabolism is boosting adoption. In addition, rising demand for premium poultry products reinforces the need for efficient mineral supplementation.

China Poultry Feed Phosphates Market Insight

The China poultry feed phosphates market accounted for the largest revenue share in Asia Pacific in 2025, supported by rapid urbanization, expanding poultry farms, and strong technological adoption in feed manufacturing. As one of the world’s largest poultry producers, China heavily relies on phosphate-rich formulations to improve feed conversion, growth performance, and overall flock health. The growing emphasis on high-quality animal protein, along with the presence of major domestic feed manufacturers, continues to propel the market forward.

Poultry Feed Phosphates Market Share

The Poultry Feed Phosphates industry is primarily led by well-established companies, including:

• Mosaic (U.S.)

• Nutrien Ltd. (Canada)

• OCP (Morocco)

• Yara (Norway)

• EuroChem Group (Switzerland)

• PhosAgro Group of Companies (Russia)

• Phosphea (France)

• FOSFITALIA GROUP (Italy)

• J.R. Simplot Company (U.S.)

• Quimpac S.A. (Peru)

• Sinochem Yunlong Co., Ltd. (China)

• AG CHEMI GROUP s.r.o. (Czech Republic)

• De Heus Animal Nutrition (Netherlands)

• Ma’aden (Saudi Arabia)

• Reanjoy (India)

• JSC „LIFOSA“ (Lithuania)

• Malaysian Phosphate Additives Sdn. Bhd. (Malaysia)

• Elixir Feed Additives Doo (Serbia)

• EuroChem (Russia)

• Guizhou Chanhen Chemical Corporation (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.