Global Poultry Feed Pigments Market

Market Size in USD Billion

CAGR :

%

USD

1.62 Billion

USD

2.23 Billion

2024

2032

USD

1.62 Billion

USD

2.23 Billion

2024

2032

| 2025 –2032 | |

| USD 1.62 Billion | |

| USD 2.23 Billion | |

|

|

|

|

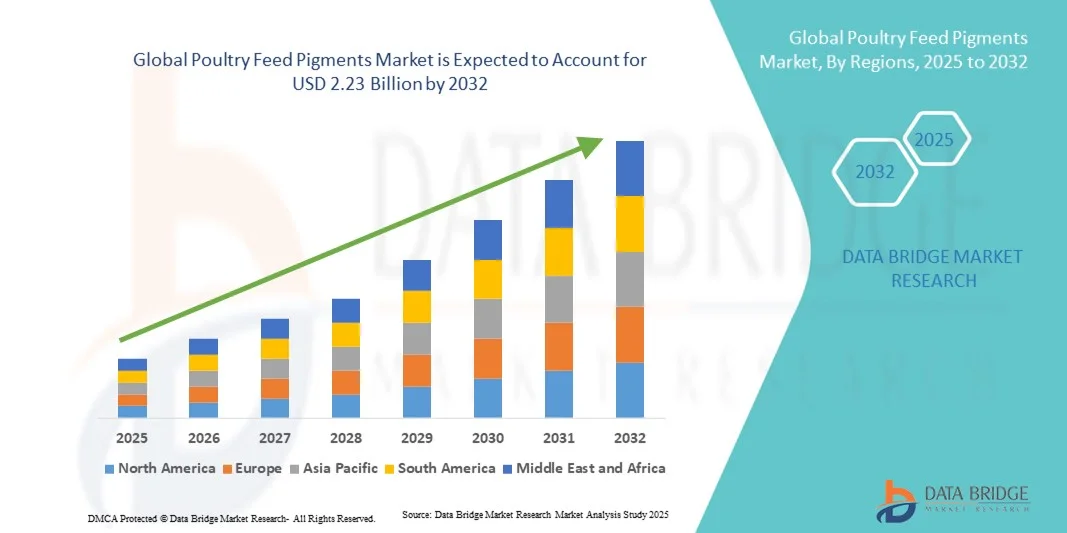

What is the Global Poultry Feed Pigments Market Size and Growth Rate?

- The global poultry feed pigments market size was valued at USD 1.62 billion in 2024 and is expected to reach USD 2.23 billion by 2032, at a CAGR of 4.10% during the forecast period

- The growing consumption of meat across the globe, rising preferences towards the consumption of pellet feed, rapid industrialization for poultry, pork, and aquaculture business, rising demand of the feed pigment to enhance the appearance as well as quality of meat along with high-quality feed pigments help in refining the commercial value of animal products are some of the major as well as impactful factors which will likely to augment the growth of the poultry feed pigments market

What are the Major Takeaways of Poultry Feed Pigments Market?

- Rising applications from developing economies along with growth of the aquaculture and feed pigments market which will further contribute by generating immense opportunities that will led to the growth of the poultry feed pigments market in the above mentioned projected timeframe

- Increasing number of regulatory aspects along with volatility in the prices of raw material which will such asly to act as market restraints factor for the growth of the poultry feed pigments in the above mentioned projected timeframe

- North America dominated the poultry feed pigments market with the largest revenue share of 39.7% in 2024, driven by the strong presence of organized poultry industries, increasing meat consumption, and rising awareness regarding the use of natural pigments for enhanced product quality

- The Asia-Pacific poultry feed pigments market is projected to grow at the fastest CAGR of 10.8% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and growing demand for quality poultry products in China, India, and Japan

- The natural feed pigments segment dominated the market with the largest revenue share of 61.3% in 2024, owing to the increasing consumer demand for clean-label and chemical-free poultry products

Report Scope and Poultry Feed Pigments Market Segmentation

|

Attributes |

Poultry Feed Pigments Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Poultry Feed Pigments Market?

Rising Demand for Natural and Sustainable Pigment Sources

- A major and accelerating trend in the global poultry feed pigments market is the growing shift toward natural, plant-based, and sustainable pigment alternatives. Consumers and feed manufacturers are increasingly focusing on natural carotenoids, such as lutein, zeaxanthin, and beta-carotene, derived from marigold, paprika, and algae, to meet the demand for chemical-free poultry products

- For instance, Kemin Industries, Inc. and DSM have developed high-quality natural carotenoids to enhance yolk color and poultry skin pigmentation while addressing the consumer preference for clean-label feed additives

- The move toward sustainable and environment-friendly pigment production is driven by growing awareness of synthetic pigment residues in animal products and their potential health impact. Companies are adopting biotechnological extraction methods to improve pigment yield from natural sources

- In addition, the increasing adoption of circular economy practices, where natural pigment residues are repurposed, is strengthening sustainability in feed manufacturing. Producers are focusing on eco-efficient processes that reduce environmental footprint while maintaining pigment stability and bioavailability

- This trend toward natural and sustainable pigment innovation is redefining the industry landscape, compelling manufacturers to invest in R&D and explore renewable feed pigment sources that align with consumer expectations for ethical and environmentally responsible poultry production

What are the Key Drivers of Poultry Feed Pigments Market?

- The rising consumer preference for visually appealing poultry products with enhanced yolk and skin coloration is a major growth driver. The pigmentation level is directly associated with perceived product quality and freshness, driving higher adoption of pigment additives in poultry feed

- For instance, in April 2024, Adisseo expanded its feed additives portfolio by introducing Rhodimet and Carophyll Red natural pigment blends to improve coloration consistency in poultry products across Asia-Pacific markets

- Furthermore, the increasing global demand for natural carotenoids in poultry feed due to the ban on synthetic additives in several regions is fueling market expansion. Regulatory bodies in the U.S., U.K., and European Union are encouraging the use of safer, bio-based pigment alternatives

- The rapidly growing poultry meat and egg consumption, coupled with the need to maintain uniform product appearance, is also boosting pigment usage. Manufacturers are leveraging microencapsulation technologies to improve pigment stability and absorption efficiency

- Lastly, the growing emphasis on animal nutrition, product differentiation, and health-conscious consumer behavior continues to propel market demand for premium, sustainable poultry feed pigments worldwide

Which Factor is Challenging the Growth of the Poultry Feed Pigments Market?

- The high cost of natural pigment extraction and processing remains a primary challenge for market growth. The production of stable, natural carotenoids from botanical sources is capital-intensive and requires advanced purification technologies

- For instance, fluctuations in raw material supply—such as marigold flowers and paprika—often lead to price volatility, affecting the profit margins of feed manufacturers

- Moreover, synthetic pigments, despite their declining popularity, continue to offer cost efficiency and stability advantages, especially in developing markets with price-sensitive consumers

- Another significant challenge is the limited shelf life and lower stability of natural pigments under heat and light exposure, which affects their effectiveness during feed processing and storage

- To overcome these issues, leading companies such as BASF SE and Cargill, Incorporated. are investing in advanced microencapsulation and fermentation technologies to enhance pigment stability and reduce overall production costs. However, balancing cost-efficiency with sustainability remains critical for broader market adoption and long-term growth

How is the Poultry Feed Pigments Market Segmented?

The market is segmented on the basis of source, type, and application.

- By Source

On the basis of source, the poultry feed pigments market is segmented into natural feed pigments and synthetic feed pigments. The natural feed pigments segment dominated the market with the largest revenue share of 61.3% in 2024, owing to the increasing consumer demand for clean-label and chemical-free poultry products. These pigments, derived from marigold, paprika, algae, and turmeric, enhance the aesthetic and nutritional quality of poultry products while addressing regulatory restrictions on synthetic additives.

The synthetic feed pigments segment is projected to witness the fastest CAGR from 2025 to 2032, driven by their cost efficiency, stability, and consistency in pigmentation. Although natural pigments are preferred, synthetic variants remain popular in developing markets due to their affordability and easy formulation in feed production.

- By Type

On the basis of type, the poultry feed pigments market is segmented into carotenoids, curcumin, caramel, spirulina, and other feed pigments. The carotenoids segment dominated the market with a share of 48.6% in 2024, attributed to their widespread use in enhancing egg yolk and skin coloration. Carotenoids such as lutein, zeaxanthin, and beta-carotene are known for their superior coloring properties and antioxidant benefits, making them highly sought after in premium poultry feed formulations.

The spirulina segment is expected to register the fastest growth rate from 2025 to 2032, supported by its natural origin, high pigment concentration, and nutritional benefits. Spirulina’s rich phycocyanin and carotenoid content make it an emerging choice for sustainable and health-oriented poultry farming practices.

- By Application

On the basis of application, the poultry feed pigments market is segmented into food and beverages, pharmaceutical, nutraceuticals, and others. The food and beverages segment held the largest share of 54.9% in 2024, driven by the high demand for uniform poultry product coloration and improved aesthetic appeal. Feed pigments play a vital role in maintaining product quality and consumer acceptance across meat and egg categories.

The nutraceuticals segment is anticipated to record the fastest CAGR from 2025 to 2032, driven by the rising use of bioactive pigments for antioxidant and immune-boosting properties in poultry diets. This growth reflects the industry’s move toward functional feed solutions that support animal health and product differentiation in global markets.

Which Region Holds the Largest Share of the Poultry Feed Pigments Market?

- North America dominated the poultry feed pigments market with the largest revenue share of 39.7% in 2024, driven by the strong presence of organized poultry industries, increasing meat consumption, and rising awareness regarding the use of natural pigments for enhanced product quality. The region’s advanced feed manufacturing infrastructure and stringent food safety regulations further contribute to the adoption of high-quality feed pigments

- Poultry producers in North America are prioritizing the use of carotenoids, curcumin, and spirulina-based pigments to enhance the visual appeal and nutritional value of eggs and meat

- This dominance is further supported by increasing demand for clean-label and organic poultry products, as well as innovation in natural pigment extraction technologies, ensuring consistent coloration and improved animal health outcomes

U.S. Poultry Feed Pigments Market Insight

The U.S. poultry feed pigments market accounted for over 80% of North America’s revenue share in 2024, supported by a robust poultry sector and the rapid adoption of natural and sustainable feed ingredients. Rising consumer preference for naturally pigmented eggs and poultry products has prompted feed manufacturers to replace synthetic additives with botanical sources such as marigold and paprika extracts. Moreover, the increasing focus on animal welfare and feed traceability is boosting the adoption of eco-friendly pigment formulations. The presence of leading pigment suppliers and research institutions continues to strengthen innovation and market expansion across the country.

Europe Poultry Feed Pigments Market Insight

The Europe poultry feed pigments market is projected to grow at a steady rate during the forecast period, driven by strict regulations on synthetic additives and a growing shift toward sustainable poultry farming. European producers emphasize natural coloring agents derived from plants, algae, and yeast, ensuring compliance with the European Food Safety Authority (EFSA) standards. Countries such as Germany, Spain, and the Netherlands are major consumers, focusing on premium poultry products with uniform color and improved nutritional profiles. In addition, continuous R&D in microencapsulated pigment technologies is enhancing pigment stability and bioavailability in poultry feed formulations.

U.K. Poultry Feed Pigments Market Insight

The U.K. poultry feed pigments market is expected to expand at a notable CAGR through 2032, supported by rising demand for free-range and organic poultry products. The market growth is driven by the increasing use of natural carotenoids and spirulina extracts, which enhance egg yolk color and improve bird immunity. Moreover, the strong distribution network of feed producers and government support for sustainable livestock farming contribute to the growing adoption of eco-friendly pigments. British consumers’ preference for visually appealing and nutritionally enriched eggs further boosts market growth.

Germany Poultry Feed Pigments Market Insight

The Germany poultry feed pigments market is projected to witness stable growth owing to the country’s advanced feed formulation technologies and stringent quality standards. Poultry producers are increasingly integrating antioxidant-rich pigments such as astaxanthin and lutein to enhance product shelf life and nutritional appeal. Germany’s emphasis on green and sustainable livestock practices, along with innovations in algae-based pigments, supports the transition toward natural alternatives. The demand for high-quality, vividly colored poultry products is expected to sustain the market’s upward trend.

Which Region is the Fastest Growing Region in the Poultry Feed Pigments Market?

The Asia-Pacific poultry feed pigments market is projected to grow at the fastest CAGR of 10.8% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and growing demand for quality poultry products in China, India, and Japan. The expansion of the poultry industry, combined with government initiatives promoting feed quality improvement, is boosting pigment adoption. The growing preference for natural carotenoids and herbal extracts is reshaping the feed industry across the region. Increasing awareness of poultry health and coloration consistency among farmers is further stimulating market growth. As Asia-Pacific emerges as a global poultry production hub, cost-effective and locally sourced pigment ingredients are making natural feed pigments more accessible, strengthening the region’s market leadership potential.

China Poultry Feed Pigments Market Insight

The China poultry feed pigments market held the largest share within Asia-Pacific in 2024, driven by an expanding poultry population and strong domestic production of natural carotenoids. Rapid industrialization in feed manufacturing, coupled with a shift toward antibiotic-free poultry production, is driving pigment usage. Moreover, the availability of low-cost natural pigment sources and large-scale local producers supports sustained market growth.

Japan Poultry Feed Pigments Market Insight

The Japan poultry feed pigments market is gaining momentum due to the country’s emphasis on premium poultry products and nutritional enhancement. High consumer standards for egg color uniformity and feed transparency are driving the use of microalgae-derived pigments such as spirulina. The Japanese market also benefits from advanced R&D in pigment bioavailability and sustainable production technologies, ensuring consistent growth through the forecast period.

Which are the Top Companies in Poultry Feed Pigments Market?

The poultry feed pigments industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- DSM (Netherlands)

- Kemin Industries, Inc. (U.S.)

- Cargill, Incorporated. (U.S.)

- Adisseo (France)

- NOVUS INTERNATIONAL (U.S.)

- DDW The Color House (U.S.)

- Nutrex (U.S.)

- BEHN MEYER (Germany)

- Vitafor (Brazil)

- Innov Ad NV/SA (Belgium)

- LOHMANN & Co. AKTIENGESELLSCHAFT (Germany)

- Synthite Industries Ltd. (India)

- Kalsec Inc. (U.S.)

- Roha Dyechem Pvt. Ltd. (India)

- Welding GmbH & Co. KG. (Germany)

- Engormix (Argentina)

- Nutreco N.V. (Netherlands)

- Vepinsa Industries, S.A. de C.V. (Mexico)

- Bioergex Salatas Bros S.A. (Greece)

What are the Recent Developments in Global Poultry Feed Pigments Market?

- In January 2025, DSM-Firmenich completed a USD 45 million expansion of its astaxanthin production capacity in Norway, incorporating advanced bio-encapsulation lines to enhance pigment retention. This strategic move strengthens DSM-Firmenich’s leadership in natural carotenoid solutions for the feed industry

- In December 2024, BASF received European Food Safety Authority (EFSA) approval for its algae-based beta-carotene feed additive designed for poultry. The approval reinforces BASF’s commitment to sustainable and innovative feed ingredient development across Europe

- In November 2024, Kemin Industries acquired Brazilian pigment producer Nutron for USD 85 million, establishing localized carotenoid production capacity in South America. This acquisition expands Kemin’s regional footprint and enhances its supply chain resilience in the Latin American market

- In February 2021, EW Nutrition, a global provider of feed and pigment solutions, acquired the Feed Quality and Pigments business from Novus International, Inc., including a production facility in Constantí, Spain. The acquisition broadened EW Nutrition’s pigment portfolio and strengthened its European manufacturing base

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.