Global Poultry Feed Processing Market

Market Size in USD Billion

CAGR :

%

USD

208.24 Billion

USD

296.14 Billion

2025

2033

USD

208.24 Billion

USD

296.14 Billion

2025

2033

| 2026 –2033 | |

| USD 208.24 Billion | |

| USD 296.14 Billion | |

|

|

|

|

Global Poultry Feed Processing Market Size

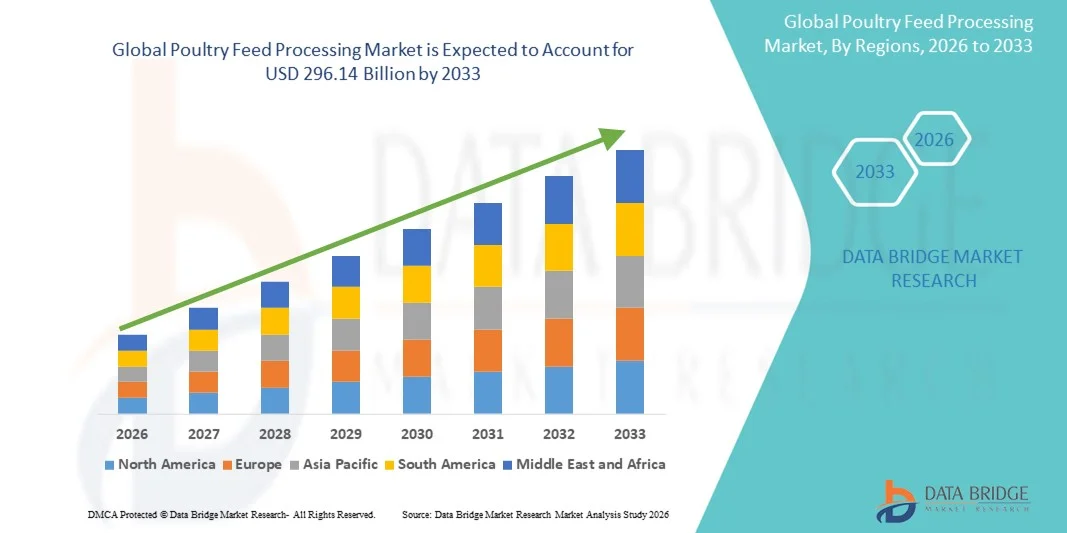

- The global Poultry Feed Processing Market size was valued at USD 208.24 billion in 2025 and is expected to reach USD 296.14 billion by 2033, at a CAGR of 4.50% during the forecast period.

- The market growth is primarily driven by the rising global demand for poultry products, coupled with increasing investments in modern feed processing technologies to enhance productivity and feed efficiency.

- Additionally, advancements in automation, precision feed formulation, and nutritional optimization are encouraging poultry producers to adopt innovative feed processing solutions. These factors collectively are accelerating the adoption of advanced poultry feed processing systems, thereby significantly fueling the market’s growth.

Global Poultry Feed Processing Market Analysis

- Poultry feed processing, involving the production of nutritionally balanced and high-quality feed for poultry, is increasingly essential for modern poultry farming operations in both commercial and small-scale settings due to its efficiency, consistency, and ability to optimize bird growth and health.

- The rising demand for poultry feed is primarily fueled by the growing global consumption of poultry products, increasing focus on livestock nutrition, and the need for cost-effective and high-efficiency feed solutions.

- Asia-Pacific dominated the Global Poultry Feed Processing Market with the largest revenue share of 34.6% in 2025, supported by advanced farming infrastructure, high technological adoption in feed processing, and the presence of leading market players, with the U.S. witnessing significant investments in automated and precision feed processing equipment for commercial poultry farms.

- Europe is expected to be the fastest-growing region in the Global Poultry Feed Processing Market during the forecast period due to rapid urbanization, rising disposable incomes, and increasing adoption of modern poultry farming techniques.

- The pellet segment dominated the market with the largest revenue share of 45.6% in 2025, driven by its ability to improve feed conversion efficiency, reduce wastage, and ensure uniform nutrient intake.

Report Scope and Global Poultry Feed Processing Market Segmentation

|

Attributes |

Poultry Feed Processing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Poultry Feed Processing Market Trends

Enhanced Efficiency Through Automation and AI Integration

- A significant and accelerating trend in the global Poultry Feed Processing Market is the increasing integration of advanced automation and artificial intelligence (AI) technologies. This combination is significantly enhancing operational efficiency, feed quality, and resource management in poultry production.

- For instance, modern feed processing systems from companies such as Bühler and Cargill employ AI-driven automation to optimize grinding, mixing, and pelleting processes, ensuring consistent feed quality while reducing waste. Similarly, De Heus and ForFarmers use AI-based predictive models to adjust feed formulations based on flock growth patterns and environmental conditions.

- AI integration in feed processing enables features such as real-time monitoring of nutritional content, automated adjustments for different poultry stages, and predictive maintenance for equipment. For example, some Evonik systems utilize AI to optimize feed formulations dynamically, improving feed conversion ratios and reducing costs. Furthermore, automation allows for precise control over production parameters, minimizing human error and increasing overall productivity.

- The seamless integration of AI and automation in feed processing facilities allows centralized monitoring and management of production lines, ensuring consistent quality across multiple production sites. Through a single interface, operators can control feed grinding, mixing, pelleting, and packaging operations, streamlining the entire production workflow.

- This trend towards more intelligent, automated, and interconnected feed processing systems is fundamentally reshaping industry standards for efficiency and feed quality. Consequently, companies such as Cargill, ADM, and Purina are developing AI-enabled feed processing solutions with real-time monitoring, predictive adjustments, and integration with farm management software.

- The demand for advanced feed processing systems with AI and automation integration is growing rapidly across both large-scale commercial and emerging poultry operations, as producers increasingly prioritize efficiency, sustainability, and optimized flock performance.

Global Poultry Feed Processing Market Dynamics

Driver

Growing Need Due to Rising Demand for Efficient Poultry Production

-

The increasing global demand for poultry products, coupled with the need for efficient and cost-effective feed management, is a significant driver for the heightened adoption of advanced poultry feed processing systems.

- For instance, in 2025, Cargill introduced a next-generation automated feed mill system designed to optimize feed formulation and reduce wastage. Such innovations by key companies are expected to drive the poultry feed processing market growth during the forecast period.

- As poultry producers seek to improve flock productivity and feed conversion ratios, modern feed processing systems offer advanced features such as precise nutrient balancing, automated mixing, and real-time monitoring, providing a significant upgrade over traditional feed methods.

- Furthermore, the growing adoption of modern farming practices and integrated poultry operations is making advanced feed processing equipment an essential component of efficient poultry production, ensuring consistent feed quality and optimized flock performance.

- The ability to produce feed with higher nutritional value, automate labor-intensive processes, and manage feed production through intelligent control systems are key factors propelling the adoption of advanced poultry feed processing systems in both commercial and emerging poultry farms.

Restraint/Challenge

Concerns Regarding High Initial Investment and Operational Complexity

-

The relatively high initial investment required for modern poultry feed processing systems poses a significant challenge to broader market penetration, particularly for small-scale or emerging poultry farms. Advanced machinery and automated systems can be costly compared to traditional feed preparation methods.

- For instance, high upfront costs for fully automated feed mills or pelletizing machines may discourage adoption among price-sensitive producers, especially in developing regions.

- Addressing these challenges through financing options, modular system designs, and training for farm operators is crucial for wider adoption. Companies such as Bühler and ForFarmers offer scalable solutions and operator support to help farms transition to advanced feed processing technologies.

- Additionally, operational complexity and the need for technical expertise to manage automated systems can limit adoption, particularly in regions with lower technical know-how.

- Overcoming these challenges through user-friendly designs, operator training programs, and cost-effective equipment models will be vital for sustained growth in the global poultry feed processing market.

Global Poultry Feed Processing Market Scope

Poultry feed processing market is segmented on the basis of form of feed, mode of operation, livestock, type, ingredients and supplements.

- By Form of Feed

On the basis of form of feed, the Global Poultry Feed Processing Market is segmented into pellets, mash, and others. The pellet segment dominated the market with the largest revenue share of 45.6% in 2025, driven by its ability to improve feed conversion efficiency, reduce wastage, and ensure uniform nutrient intake. Pellets are widely preferred by commercial poultry farms due to ease of handling, storage, and feeding, and their consistent size and shape enhance consumption by birds.

The mash segment is expected to witness the fastest CAGR of 19.2% from 2026 to 2033, fueled by increasing demand from small-scale and backyard poultry operations where mash feed allows for flexible mixing of ingredients, cost-effectiveness, and suitability for varied poultry species. The growing focus on tailored nutrition and feed formulations in emerging markets further supports the adoption of mash feed.

- By Mode of Operation

On the basis of mode of operation, the market is segmented into manual, semi-automatic, and automatic feed processing systems. The automatic segment dominated the market with a revenue share of 52.3% in 2025, attributed to its ability to optimize production efficiency, reduce labor dependency, and ensure consistent feed quality. Automatic systems offer precise control over grinding, mixing, and pelleting processes, which is critical for large-scale poultry operations.

The semi-automatic segment is expected to witness the fastest CAGR of 18.7% during 2026–2033, driven by small- and medium-scale poultry farms seeking cost-effective solutions with partial automation. Semi-automatic systems offer a balance between affordability and operational efficiency, allowing farmers to gradually transition to fully automated feed production while maintaining quality control.

- By Livestock

On the basis of livestock, the market is segmented into poultry, swine, and others. The poultry segment dominated the market with a revenue share of 61.5% in 2025, owing to the global increase in poultry consumption, high feed requirements, and the adoption of modern poultry farming practices. Poultry operations require specialized feed with precise nutrient composition, driving demand for advanced processing systems.

The swine segment is expected to witness the fastest CAGR of 20.1% from 2026 to 2033, supported by expanding pig farming in Asia-Pacific and Latin America, and increasing awareness about the role of optimized feed in growth performance, disease prevention, and cost efficiency. Emerging markets are increasingly investing in feed systems tailored for swine production.

- By Type of Processing Equipment

On the basis of type, the market is segmented into conditioning & expanding, cleaning & sorting, grinding, mixing, and others. The grinding segment dominated the market with a revenue share of 38.4% in 2025, driven by its critical role in reducing raw material particle size for efficient digestion and uniform feed consistency. Grinding equipment is widely adopted due to its importance in improving feed efficiency and nutrient absorption.

The mixing segment is expected to witness the fastest CAGR of 21.5% from 2026 to 2033, fueled by the increasing demand for customized feed formulations and uniform nutrient distribution in both poultry and swine feed. The adoption of automated mixers ensures consistent feed quality at scale.

- By Ingredients

On the basis of ingredients, the market is segmented into cereal, oilseed meal, oil, molasses, and other ingredients. The cereal segment dominated the market with a revenue share of 47.2% in 2025, due to its role as a primary energy source in poultry and swine feed. Cereals such as maize and wheat are extensively used in commercial feed formulations for their high digestibility and energy content.

The oilseed meal segment is expected to witness the fastest CAGR of 19.8% from 2026 to 2033, driven by the rising demand for protein-rich feed components and the increasing use of soybean, sunflower, and rapeseed meals in feed to enhance growth performance and overall health of livestock.

- By Supplement

On the basis of supplement, the market is segmented into vitamins, amino acids, antibiotics, enzymes, anti-oxidants, acidifiers, probiotics and prebiotics, and other supplements. The amino acids segment dominated the market with a revenue share of 34.5% in 2025, attributed to their critical role in supporting growth, feed efficiency, and overall livestock health. Amino acids such as lysine and methionine are widely used to complement protein levels in feed formulations.

The probiotics and prebiotics segment is expected to witness the fastest CAGR of 22.3% from 2026 to 2033, driven by increasing awareness about gut health, immunity improvement, and antibiotic-free feed trends. The rising focus on sustainable and natural feed additives in poultry and swine production is fueling this growth.

Global Poultry Feed Processing Market Regional Analysis

- Asia-Pacific dominated the Global Poultry Feed Processing Market with the largest revenue share of 34.6% in 2025, driven by the presence of well-established poultry farms, advanced feed processing infrastructure, and high adoption of modern poultry farming practices.

- Producers in the region prioritize high-efficiency feed processing systems that improve feed conversion ratios, ensure consistent nutritional quality, and reduce operational costs. The adoption of automated and AI-enabled feed mills further enhances production efficiency and flock performance.

- This widespread adoption is supported by strong agricultural investments, high disposable incomes among commercial poultry operators, and the availability of skilled labor and advanced technology. These factors make North America a leading market for poultry feed processing equipment and solutions, establishing it as a benchmark for feed quality and operational efficiency in both large-scale commercial and specialized poultry operations.

U.S. Poultry Feed Processing Market Insight

The U.S. poultry feed processing market captured the largest revenue share of 81% in North America in 2025, driven by the presence of large-scale commercial poultry farms and advanced feed production technologies. Producers are increasingly prioritizing automated, high-efficiency feed processing systems to optimize feed conversion ratios, reduce wastage, and maintain consistent nutritional quality. The growing demand for specialized feed formulations for broilers, layers, and organic poultry production further boosts the market. Moreover, government support for modernized poultry farming and the adoption of AI-enabled feed mills are contributing to the expansion of the U.S. feed processing sector.

Europe Poultry Feed Processing Market Insight

The Europe poultry feed processing market is projected to grow at a substantial CAGR during the forecast period, fueled by strict regulatory standards for feed quality, safety, and sustainability. Increasing urbanization, the expansion of commercial poultry operations, and the rising demand for high-nutrition feed are driving market adoption. Countries across Europe are investing in advanced feed processing equipment that ensures consistent nutrient composition, energy efficiency, and reduced environmental impact, supporting both residential and commercial poultry production.

U.K. Poultry Feed Processing Market Insight

The U.K. poultry feed processing market is expected to grow at a notable CAGR, driven by rising consumer demand for high-quality poultry products and advanced feed formulations. Producers are increasingly adopting automated and semi-automated feed processing systems to enhance efficiency, maintain uniformity in feed quality, and meet regulatory requirements. The focus on biosecurity, sustainability, and cost-effective production practices further stimulates the adoption of modern feed processing technologies across commercial poultry farms.

Germany Poultry Feed Processing Market Insight

The Germany poultry feed processing market is anticipated to expand at a significant CAGR, supported by increasing awareness of sustainable and technologically advanced feed solutions. Germany’s robust infrastructure, strong agricultural sector, and emphasis on innovation promote the adoption of automated and energy-efficient feed processing systems. Poultry producers are increasingly integrating advanced grinding, mixing, and pelleting equipment to improve feed efficiency, support livestock health, and comply with stringent quality standards.

Asia-Pacific Poultry Feed Processing Market Insight

The Asia-Pacific poultry feed processing market is poised to grow at the fastest CAGR of 24% during 2026–2033, driven by rapid urbanization, rising disposable incomes, and the expansion of commercial poultry farms in countries such as China, India, and Japan. The increasing demand for high-quality, cost-effective feed, supported by government initiatives promoting modern agriculture and digitalized feed production, is accelerating market growth. The region’s emergence as a manufacturing hub for feed processing machinery further increases affordability and accessibility.

Japan Poultry Feed Processing Market Insight

The Japan poultry feed processing market is gaining momentum due to high-tech farming practices, increasing automation, and a growing focus on precision nutrition for poultry. Producers are adopting automated grinding, mixing, and pelleting systems to enhance feed efficiency, reduce labor costs, and maintain consistent quality. The integration of advanced feed technologies with farm management systems supports productivity improvements in both commercial and small-scale poultry operations, driving market growth.

China Poultry Feed Processing Market Insight

The China poultry feed processing market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid urbanization, a rising middle class, and strong technological adoption in commercial poultry farming. High demand for processed feed, specialized formulations, and cost-efficient production systems is fueling market growth. Government initiatives promoting modern feed mills, smart poultry farms, and sustainable feed production practices, along with the presence of major domestic equipment manufacturers, are key factors supporting market expansion in China.

Global Poultry Feed Processing Market Share

The Poultry Feed Processing industry is primarily led by well-established companies, including:

• Clextral S.A. (France)

• Bühler Group (Switzerland)

• ANDRITZ Feed & Biofuel (Austria)

• CPM Roskamp Champion (U.S.)

• AGI SureTrack (U.S.)

• Zhengchang Group (China)

• Van Aarsen International (Netherlands)

• Satake Corporation (Japan)

• Famsun Group (China)

• Zhengzhou Tianci Heavy Industry (China)

• Zhengzhou Leader Machinery Co., Ltd. (China)

• Jinan Grain Machinery Co., Ltd. (China)

• Zhengzhou Smile Machinery Equipment Co., Ltd. (China)

• New Hope Liuhe Co., Ltd. (China)

• Jiangsu Yangnong Feed Group Co., Ltd. (China)

• Shandong Leader Machinery Co., Ltd. (China)

• Henan Doing Mechanical Equipment Co., Ltd. (China)

• Zhengzhou Tianshui Grain & Oil Machinery Co., Ltd. (China)

• Bühler India Pvt. Ltd. (India)

• Agro Industrial Equipment Pvt. Ltd. (India)

What are the Recent Developments in Global Poultry Feed Processing Market?

- In April 2024, Clextral S.A., a global leader in feed processing solutions, launched a strategic initiative in South Africa aimed at modernizing poultry feed production through its advanced extrusion and pelleting technologies. This initiative underscores the company’s commitment to delivering high-efficiency, reliable feed processing systems tailored to the unique needs of local poultry operations. By leveraging its global expertise and innovative machinery, Clextral is addressing regional challenges while strengthening its position in the rapidly growing Global Poultry Feed Processing Market.

- In March 2024, AGI SureTrack, a U.S.-based feed equipment manufacturer, introduced its new high-capacity feed grinding and mixing system specifically engineered for large commercial poultry farms. The system is designed to enhance feed uniformity, reduce wastage, and improve flock performance. This development highlights AGI SureTrack’s dedication to providing cutting-edge solutions that boost operational efficiency and feed quality in commercial poultry production.

- In March 2024, Bühler Group successfully deployed a modern feed mill project in Bengaluru, India, aimed at improving feed production efficiency and nutritional quality for poultry farms. This project leverages advanced automation, conditioning, and pelletizing technologies to create high-quality feed with consistent nutrient content, underscoring Bühler’s commitment to innovation and sustainable poultry feed production.

- In February 2024, Andritz Feed & Biofuel announced a strategic partnership with local poultry cooperatives in the Chesapeake region to implement modular feed processing systems. This collaboration is designed to optimize feed production, reduce operational costs, and ensure consistent product quality for member farms. The initiative highlights Andritz’s commitment to innovation, operational efficiency, and supporting the growth of regional poultry industries.

- In January 2024, CPM Roskamp Champion, a leading provider of feed processing machinery, unveiled its new automated conditioning and expanding system at the International Poultry Expo 2024. The system enhances feed pellet quality, improves energy efficiency, and supports large-scale production. This launch reflects CPM Roskamp Champion’s focus on integrating advanced technologies into feed processing solutions, offering poultry producers enhanced productivity, operational reliability, and superior feed quality.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.