What is the Global Poultry Feed Vitamins and Minerals Market Size and Growth Rate?

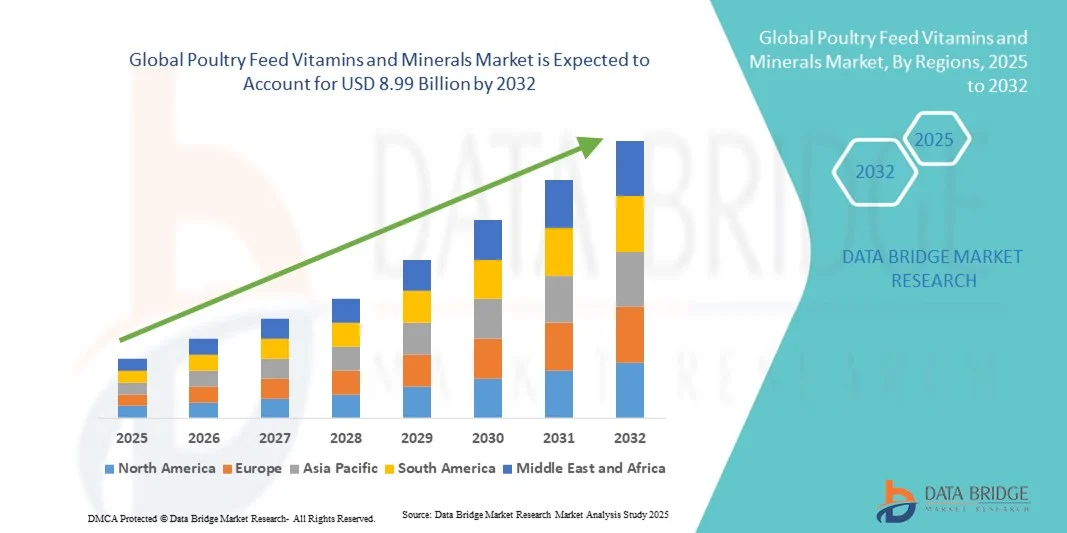

- The global poultry feed vitamins and minerals market size was valued at USD 5.6O billion in 2024 and is expected to reach USD 8.99 billion by 2032, at a CAGR of 6.10% during the forecast period

- Favourable policies and rising initiatives of the government to promote and support feed supplements, the growing awareness among the people regarding the availability of various type of feed supplement, rising purchasing power of the people and rising growth of the economy are some of the major as well as vital factors which will likely to enhance the growth of the poultry feed vitamins and minerals market

What are the Major Takeaways of Poultry Feed Vitamins and Minerals Market?

- Rising adoption of nutrition supplements for sheep, cows and goats which will further bring various opportunities for the growth of the poultry feed vitamins and minerals in the above mentioned projected timeframe

- Lack of awareness regarding storage and preparation of feed supplements will act as a restraint factor for the growth of the poultry feed vitamins and minerals

- Asia-Pacific dominated the poultry feed vitamins and minerals market with the largest revenue share of 42.5% in 2024, driven by the region's rapidly growing poultry industry, rising demand for fortified feed, and increasing awareness of poultry health and productivity

- North America is expected to grow at the fastest CAGR of 9.21% between 2025 and 2032. The growth is supported by advanced feed formulation technologies, high-quality poultry production, and rising consumer demand for nutrient-rich animal products

- The vitamins segment dominated the poultry feed vitamins and minerals market with the largest revenue share of 55% in 2024, driven by the increasing awareness of the critical role vitamins play in poultry growth, immunity, and overall flock health

Report Scope and Poultry Feed Vitamins and Minerals Market Segmentation

|

Attributes |

Poultry Feed Vitamins and Minerals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Poultry Feed Vitamins and Minerals Market?

Focus on Enhanced Feed Efficiency and Precision Nutrition

- A significant and accelerating trend in the global poultry feed vitamins and minerals market is the shift toward precision nutrition and feed optimization. Poultry producers are increasingly adopting data-driven feeding strategies to enhance growth performance, feed conversion ratios, and overall flock health

- For instance, advanced premixes enriched with targeted vitamins and minerals, such as vitamin D3, zinc, and selenium, allow producers to meet the exact nutritional requirements of different poultry breeds and growth stages, improving overall productivity

- Precision nutrition in poultry feed facilitates controlled supplementation, reducing nutrient wastage, optimizing feed costs, and minimizing environmental impact from over-supplementation. Companies such as DSM and Kemin are developing fortified feed premixes with scientifically validated bioavailability and absorption rates for improved flock performance

- The integration of advanced feed analytics and automated dosing systems enables farmers to adjust vitamin and mineral supplementation in real time based on flock health and growth monitoring. This technological integration promotes more uniform growth, reduces disease susceptibility, and enhances egg and meat quality

- This trend toward precision supplementation and feed efficiency is redefining poultry farming practices globally. Producers increasingly demand customized vitamin and mineral solutions to achieve optimal performance while reducing costs and improving sustainability

What are the Key Drivers of Poultry Feed Vitamins and Minerals Market?

- Rising global demand for poultry meat and eggs, driven by population growth and increasing protein consumption, is a key driver for the Poultry Feed Vitamins and Minerals market. Producers are investing in nutrient-enriched feed to improve flock productivity and product quality

- For instance, in 2024, DSM launched novel vitamin premixes that improve feed efficiency and support immune health in broilers, directly driving market growth through advanced supplementation strategies

- Increased awareness of poultry health management and disease prevention is fueling demand for vitamin- and mineral-enriched feeds. These additives help maintain gut health, enhance immunity, and reduce reliance on antibiotics, aligning with sustainable farming trends

- Government regulations and industry standards promoting animal welfare and feed safety are also driving the adoption of fortified feed supplements. Producers are leveraging high-quality vitamin and mineral formulations to comply with safety norms and improve market competitiveness

- Moreover, the need to optimize feed cost and reduce environmental impact from nutrient runoff is motivating poultry producers to adopt precision vitamin and mineral supplementation. The convenience of ready-to-use premixes and scientifically formulated supplements accelerates adoption across commercial poultry farms

Which Factor is Challenging the Growth of the Poultry Feed Vitamins and Minerals Market?

- High production costs of premium vitamin and mineral feed additives pose a challenge for price-sensitive poultry producers, particularly in developing regions. The initial investment for advanced formulations may limit adoption despite long-term benefits

- For instance, premium microencapsulated vitamins or chelated minerals are more expensive than standard feed supplements, making them less accessible to small-scale poultry farmers

- Variability in raw material quality, including vitamins and mineral sources, can affect consistency in feed performance, leading to reluctance among producers to fully adopt fortified formulations. Companies such as ADM and Adisseo emphasize strict quality control and standardized premix formulations to mitigate this challenge

- Supply chain disruptions, such as fluctuations in raw material availability or logistics delays, can impact timely delivery of feed additives, creating barriers to widespread adoption.

- Overcoming these challenges through cost-optimized formulations, bulk supply agreements, and farmer education on the long-term benefits of vitamin and mineral supplementation will be crucial to sustaining market growth

How is the Poultry Feed Vitamins and Minerals Market Segmented?

The market is segmented on the basis of product type, poultry type, and form.

- By Product Type

On the basis of product type, the market is segmented into vitamins type and minerals type. The vitamins segment dominated the Poultry Feed Vitamins and Minerals market with the largest revenue share of 55% in 2024, driven by the increasing awareness of the critical role vitamins play in poultry growth, immunity, and overall flock health. Producers are prioritizing vitamin-enriched premixes to optimize feed conversion ratios and enhance productivity in broilers and layers. Vitamins such as vitamin A, D3, E, and B-complex are in high demand due to their benefits in bone development, egg production, and disease resistance.

The minerals segment is anticipated to witness the fastest growth at a CAGR of 22.5% from 2025 to 2032, fueled by the rising need for trace minerals such as zinc, selenium, and manganese to support poultry performance and prevent deficiencies, particularly in large-scale commercial farms.

- By Poultry Type

On the basis of poultry type, the market is segmented into broilers, layers, turkey, and others. The broilers segment accounted for the largest market revenue share of 48% in 2024, driven by the high global demand for poultry meat and the increasing adoption of fortified feed to ensure rapid growth and optimum health. Broiler producers focus on both vitamins and minerals to improve feed efficiency, weight gain, and immunity against common diseases.

The turkey segment is projected to witness the fastest CAGR of 20.8% from 2025 to 2032, driven by growing demand for turkey meat in North America and Europe, along with increasing investments in specialized feed formulations designed to enhance growth performance, feathering quality, and reproductive health.

- By Form

On the basis of form, the market is segmented into dry and liquid. The dry feed form dominated the market with the largest revenue share of 60% in 2024, attributed to its ease of handling, longer shelf life, and compatibility with standard poultry feed production processes. Dry vitamin and mineral premixes allow uniform distribution in feed and reduce nutrient loss during storage.

The liquid form is expected to witness the fastest growth at a CAGR of 21% from 2025 to 2032, fueled by its higher bioavailability, easier absorption, and suitability for precise supplementation through water or feed lines. Liquid formulations are gaining traction in commercial poultry farms looking for enhanced nutrient delivery, flexibility, and optimized flock performance.

Which Region Holds the Largest Share of the Poultry Feed Vitamins and Minerals Market?

- Asia-Pacific dominated the poultry feed vitamins and minerals market with the largest revenue share of 42.5% in 2024, driven by the region's rapidly growing poultry industry, rising demand for fortified feed, and increasing awareness of poultry health and productivity

- Consumers and commercial poultry producers in the region highly value nutrient-rich vitamins and mineral premixes to enhance growth, egg production, and immunity across broilers, layers, and turkeys

- This widespread adoption is further supported by increasing urbanization, government initiatives promoting food security, and strong investments in commercial poultry farming, establishing Asia-Pacific as a key hub for Poultry Feed Vitamins and Minerals production and consumption

China Poultry Feed Vitamins and Minerals Market Insight

China captured the largest revenue share of 38% in Asia-Pacific in 2024. The market growth is fueled by the country’s booming poultry industry, high adoption of technological innovations in feed production, and increasing exports of poultry products. Fortified feed enhances productivity, animal health, and product quality. Rising consumer preference for safe, nutrient-enriched poultry products also drives demand. Continuous investments in modern feed manufacturing facilities support the expansion of vitamins and minerals usage across commercial poultry farms.

Japan Poultry Feed Vitamins and Minerals Market Insight

The Japan market is witnessing steady growth, primarily driven by stringent quality standards and a focus on animal health optimization. Poultry producers are increasingly adopting fortified feed with essential vitamins and minerals to enhance egg and meat production, improve immunity, and manage disease risks. The demand for processed poultry products and ready-to-eat options further promotes the use of enriched feed. Japan’s well-established poultry industry and technologically advanced feed formulations make it a key contributor to the Asia-Pacific market.

India Poultry Feed Vitamins and Minerals Market Insight

India is projected to grow at a substantial CAGR, driven by the rising poultry population and government initiatives supporting feed fortification programs. Both small- and large-scale poultry farmers are incorporating vitamins and minerals to boost productivity, improve flock health, and meet the growing domestic demand for high-quality protein. Increasing awareness about safe, enriched poultry products among consumers further supports market growth. Expanding poultry infrastructure and investments in modern feed mills are expected to accelerate the adoption of fortified feed solutions.

Which Region is the Fastest Growing Region in the Poultry Feed Vitamins and Minerals Market?

North America is expected to grow at the fastest CAGR of 9.21% between 2025 and 2032. The growth is supported by advanced feed formulation technologies, high-quality poultry production, and rising consumer demand for nutrient-rich animal products. Fortified feed enhances poultry health, productivity, and food safety. Strong investments in research and development, coupled with increasing adoption of vitamins and minerals in commercial poultry operations, continue to drive market growth in the U.S. and Canada.

U.S. Poultry Feed Vitamins and Minerals Market Insight

The U.S. market held the largest share in North America in 2024, driven by advanced feed manufacturing, high poultry production, and a growing focus on fortified feed for better animal health. Vitamins and minerals improve growth rates, egg quality, and immunity, meeting both consumer and regulatory standards. The growing demand for sustainable and safe poultry products, combined with technological adoption in feed formulation, positions the U.S. as a key market for fortified feed solutions.

Canada Poultry Feed Vitamins and Minerals Market Insight

Canada is witnessing steady market growth due to stringent feed quality regulations and increased awareness of the benefits of fortified feed. Poultry farms, both large and small, are incorporating vitamins and minerals to enhance productivity, improve flock health, and ensure higher-quality meat and eggs. Adoption of innovative feed solutions, including custom formulations and sustainable options, is increasing. Continuous investments in feed technology and modern poultry infrastructure are expected to further boost the market in the coming years.

Which are the Top Companies in Poultry Feed Vitamins and Minerals Market?

The poultry feed vitamins and minerals industry is primarily led by well-established companies, including:

- DSM (Netherlands)

- Cargill, Incorporated (U.S.)

- Kemin Industries, Inc. (U.S.)

- Adisseo (France)

- BASF SE (Germany)

- Alltech (U.S.)

- Nutreco N.V. (Netherlands)

- DLG (Denmark)

- ADM (U.S.)

- LEO BIO‑CARE Pvt. LTD. (India)

- Grain Corp Ltd (Australia)

- Land O’Lakes, Inc. (U.S.)

- Animix LLC (U.S.)

- Burkmann Industries, Inc. (U.S.)

- ARASCO (Saudi Arabia)

- BEC Feed Solutions (New Zealand)

- Lantmännen (Sweden)

- Masterfeeds (Canada)

- Nutrius LLC (U.S.)

- Zagro (Singapore)

What are the Recent Developments in Global Poultry Feed Vitamins and Minerals Market?

- In July 2022, Adisseo and Calysta announced a joint venture to produce 20,000 tons of FeedKind® Aqua protein annually at their facility in Chongqing, China, strengthening the sustainable protein supply for aquaculture and supporting global feed innovation

- In July 2022, ADM Animal Nutrition introduced its product AminoGain, a protein and vitamin supplement designed for growing and breeding cattle, based on over 20 years of research into amino acid requirements to optimize genetic potential, marking a shift from traditional crude protein feeding methods

- In May 2022, Lonza and the Israel Biotech Fund announced a collaboration framework agreement to support portfolio companies in developing and manufacturing biologics and small molecules, while facilitating access to the Israeli market, enhancing opportunities for biotech innovation and commercialization

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.