Global Poultry Growth Promoters And Performance Enhancers Market

Market Size in USD Billion

CAGR :

%

USD

10.47 Billion

USD

16.07 Billion

2025

2033

USD

10.47 Billion

USD

16.07 Billion

2025

2033

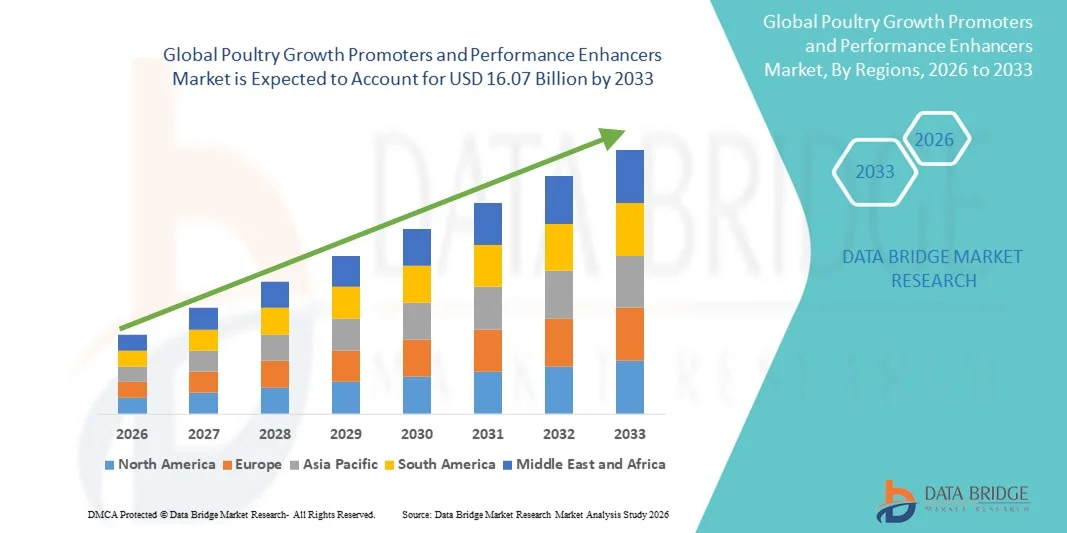

| 2026 –2033 | |

| USD 10.47 Billion | |

| USD 16.07 Billion | |

|

|

|

|

Poultry Growth Promoters and Performance Enhancers Market Size

- The global poultry growth promoters and performance enhancers market size was valued at USD 10.47 billion in 2025 and is expected to reach USD 16.07 billion by 2033, at a CAGR of 5.50% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-quality poultry products, rising consumer preference for protein-rich diets, and the need to enhance poultry production efficiency

- Growing adoption of feed additives such as probiotics, enzymes, and amino acids to improve poultry health, growth rate, and feed conversion ratio is further supporting market expansion

Poultry Growth Promoters and Performance Enhancers Market Analysis

- Increasing awareness among poultry farmers about the benefits of performance enhancers in improving flock health, productivity, and overall profitability is positively impacting market demand

- Technological advancements in feed additives, combined with regulatory support for safe and sustainable poultry production practices, are encouraging adoption across commercial poultry farms

- North America dominated the poultry growth promoters and performance enhancers market with the largest revenue share of 32.5% in 2025, driven by rising demand for antibiotic-free poultry products, advanced poultry farming practices, and growing adoption of natural and synthetic growth enhancers.

- Asia-Pacific region is expected to witness the highest growth rate in the global poultry growth promoters and performance enhancers market, driven by expanding poultry production, government support for sustainable livestock practices, and increasing awareness regarding antibiotic-free and natural growth-promoting solutions

- The Probiotic Growth Promoters segment held the largest market revenue share in 2025, driven by the increasing demand for antibiotic-free poultry products and the efficacy of probiotics in improving gut health, feed conversion, and overall flock performance. Probiotic-based solutions are widely preferred by commercial poultry farms due to their safety, regulatory compliance, and ability to enhance productivity

Report Scope and Poultry Growth Promoters and Performance Enhancers Market Segmentation

|

Attributes |

Poultry Growth Promoters and Performance Enhancers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Poultry Growth Promoters and Performance Enhancers Market Trends

Rise of Advanced Feed Additives and Natural Growth Promoters

- The growing adoption of advanced feed additives and natural growth promoters is transforming the poultry sector by enhancing flock productivity, improving feed conversion ratios, and supporting overall bird health. These products enable faster growth and higher yield, resulting in increased profitability for poultry producers, while also promoting sustainable farming practices and minimizing environmental impact

- The high demand for antibiotic-free and safe poultry products is accelerating the use of natural and alternative growth enhancers, such as probiotics, prebiotics, and plant extracts. These solutions help maintain gut health, reduce disease incidence, and support sustainable production practices, ensuring compliance with food safety standards and consumer expectations

- The affordability and ease of integration of modern performance enhancers are making them attractive for both small-scale and commercial poultry operations. Producers benefit from improved growth performance and reduced mortality without significant increases in feed costs, while minimizing reliance on conventional antibiotics and synthetic additives

- For instance, in 2023, several poultry farms in Brazil reported higher weight gain and improved egg production after incorporating enzyme-based feed additives into the diet, enhancing both farm productivity and product quality, boosting market competitiveness, and reinforcing consumer confidence in poultry products

- While advanced feed additives are driving growth, their impact depends on continued innovation, formulation optimization, and regulatory compliance. Manufacturers must focus on product efficacy, safety, and regional adaptation to fully capitalize on market demand, while ensuring cost-effectiveness and long-term sustainability

Poultry Growth Promoters and Performance Enhancers Market Dynamics

Driver

Rising Demand for Antibiotic-Free and Safe Poultry Products

- The increasing consumer preference for safe, antibiotic-free poultry products is pushing producers to adopt natural growth promoters and performance enhancers. These products help maintain animal health and improve production efficiency while complying with food safety standards, enhancing product quality and market acceptance

- Government regulations and guidelines on antibiotic usage in animal feed are accelerating the shift toward alternative growth promoters, including probiotics, prebiotics, organic acids, and enzymes. This regulatory support is creating new growth opportunities across major poultry-producing regions, encouraging investment in innovative feed solutions

- Technological advancements in feed formulation, delivery systems, and nutrient optimization are enhancing the efficacy of growth promoters, facilitating wider adoption across commercial poultry operations, ensuring better flock performance, and improving overall farm profitability

- For instance, in 2022, major poultry integrators in the U.S. implemented enzyme-based feed supplements across large-scale broiler operations, improving weight gain, feed efficiency, and product quality while complying with regulatory mandates, thereby strengthening competitive positioning in the market

- While consumer demand and regulatory frameworks are driving market growth, manufacturers must ensure consistent product quality, affordability, and scalability to support sustainable adoption, while also investing in education and training for optimal use of growth enhancers

Restraint/Challenge

High Cost of Advanced Feed Additives and Limited Accessibility in Emerging Regions

- The relatively high cost of advanced feed additives and natural growth enhancers limits adoption among smallholder poultry farmers, particularly in emerging markets. Cost-sensitive producers may face challenges in switching from conventional feed supplements, which could slow overall market growth

- Limited availability of high-quality, standardized feed additives in certain regions restricts market penetration. Distribution inefficiencies, infrastructure gaps, and inconsistent product supply can hinder widespread adoption, affecting both production efficiency and overall profitability

- Variability in product efficacy due to formulation differences or regional conditions can impact performance outcomes, making producers hesitant to adopt new solutions without proven results. Inconsistent results may also affect consumer confidence in poultry products

- For instance, in 2023, poultry producers in Sub-Saharan Africa reported limited access to probiotic and enzyme-based feed supplements due to high costs and logistical challenges, affecting growth promoter uptake and market expansion, while increasing reliance on conventional feed additives

- While feed technology continues to evolve, addressing cost, accessibility, and efficacy challenges is crucial. Stakeholders must focus on localized solutions, distribution networks, and scalable product offerings to unlock long-term growth potential, while promoting education and awareness among farmers about best practices and benefits

Poultry Growth Promoters and Performance Enhancers Market Scope

The poultry growth promoters and performance enhancers market is segmented into product, and nature of chemicals.

- By Product

On the basis of product, the poultry growth promoters and performance enhancers market is segmented into Antibiotic Growth Promoters, Hormonal Growth Promoters, Beta-Agonist Growth Promoters, Feed Enzymes Growth Promoters, Probiotic Growth Promoters, Organic Acid Growth Promoters, Phytogenic, and Others. The Probiotic Growth Promoters segment held the largest market revenue share in 2025, driven by the increasing demand for antibiotic-free poultry products and the efficacy of probiotics in improving gut health, feed conversion, and overall flock performance. Probiotic-based solutions are widely preferred by commercial poultry farms due to their safety, regulatory compliance, and ability to enhance productivity.

The Feed Enzymes Growth Promoters segment is expected to witness the fastest growth rate from 2026 to 2033, driven by their ability to improve nutrient digestibility, feed efficiency, and growth rates in poultry. Enzyme-based growth enhancers are increasingly adopted in large-scale and small-scale operations for optimizing feed utilization and reducing production costs, making them an attractive solution across various poultry production systems.

- By Nature of Chemicals

On the basis of the nature of chemicals, the market is segmented into Microbial Products, Prebiotics and Probiotics, Yeast Products, Enzymes / Herbs, and Oils and Spices. The Prebiotics and Probiotics segment held the largest market share in 2025 due to growing consumer preference for natural, antibiotic-free growth solutions and their proven effectiveness in maintaining gut health and boosting immunity in poultry.

The Enzymes / Herbs segment is projected to witness the fastest growth rate from 2026 to 2033, driven by their multifunctional benefits in enhancing feed digestibility, growth performance, and overall flock health. The increasing focus on sustainable and natural poultry production methods is accelerating the adoption of enzyme and herb-based growth promoters in both commercial and small-scale poultry farms.

Poultry Growth Promoters and Performance Enhancers Market Regional Analysis

- North America dominated the poultry growth promoters and performance enhancers market with the largest revenue share of 32.5% in 2025, driven by rising demand for antibiotic-free poultry products, advanced poultry farming practices, and growing adoption of natural and synthetic growth enhancers.

- Poultry producers in the region prioritize improved feed conversion ratios, higher egg and meat yields, and enhanced flock health, which supports the adoption of advanced growth promoters.

- The widespread adoption is further supported by well-established poultry supply chains, access to high-quality feed additives, and regulatory frameworks promoting food safety, establishing growth promoters as a standard practice across commercial poultry operations.

U.S. Poultry Growth Promoters and Performance Enhancers Market Insight

The U.S. market captured the largest revenue share in 2025 within North America, fueled by the increasing focus on antibiotic-free poultry production and stringent food safety regulations. Producers are leveraging probiotics, enzymes, and phytogenic additives to improve bird health, feed efficiency, and productivity. Government initiatives promoting sustainable poultry farming, coupled with rising consumer awareness of product safety, are further accelerating market growth.

Europe Poultry Growth Promoters and Performance Enhancers Market Insight

The Europe market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by strict regulatory frameworks on antibiotic usage and the rising demand for natural growth enhancers. Increased urbanization, the trend toward sustainable poultry farming, and adoption of innovative feed additives are fostering market expansion. The market is seeing growth across both broiler and layer segments, with producers incorporating additives into feed formulations for optimized performance.

U.K. Poultry Growth Promoters and Performance Enhancers Market Insight

The U.K. market is expected to witness rapid growth from 2026 to 2033, driven by increasing consumer demand for antibiotic-free poultry and enhanced food safety standards. Producers are adopting probiotics, enzymes, and other performance enhancers to maintain flock health and ensure compliance with strict regulations. The growth of commercial poultry farms and advancements in feed technology are expected to further stimulate market expansion.

Germany Poultry Growth Promoters and Performance Enhancers Market Insight

Germany’s market is expected to witness strong growth from 2026 to 2033, fueled by rising awareness of sustainable farming practices and demand for high-quality poultry products. Technological advancements in feed additives, regulatory mandates limiting antibiotic use, and the adoption of natural growth promoters are driving market adoption. German poultry producers are increasingly integrating enzyme-based and probiotic supplements to improve feed efficiency, flock health, and overall productivity.

Asia-Pacific Poultry Growth Promoters and Performance Enhancers Market Insight

The Asia-Pacific market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and increasing demand for high-quality poultry products in countries such as China, India, and Japan. The adoption of advanced feed additives, natural growth enhancers, and probiotics is expanding across commercial poultry farms. Government initiatives promoting sustainable livestock practices and improving feed efficiency are further propelling market growth.

Japan Poultry Growth Promoters and Performance Enhancers Market Insight

The Japan market is expected to witness significant growth from 2026 to 2033 due to the country’s emphasis on food safety, high standards for poultry production, and technological adoption in farming practices. Producers are increasingly integrating enzyme-based, probiotic, and phytogenic growth promoters to enhance feed efficiency and overall bird performance. The growing preference for antibiotic-free poultry products is further driving market expansion across both broiler and layer operations.

China Poultry Growth Promoters and Performance Enhancers Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s large-scale poultry production, rising consumer awareness of food safety, and increasing adoption of advanced feed additives. Producers are leveraging natural and synthetic growth promoters to improve flock health, enhance productivity, and meet regulatory standards. Government support for sustainable poultry practices and technological advancements in feed formulations are key factors propelling market growth in China.

Poultry Growth Promoters and Performance Enhancers Market Share

The Poultry Growth Promoters and Performance Enhancers industry is primarily led by well-established companies, including:

- Vetoquinol India Animal Health Pvt Ltd (India)

- NOVUS INTERNATIONAL (U.S.)

- Merck Sharp and Dohme Corp. (U.S.)

- DuPont (U.S.)

- Chr. Hansen Holding A/S (Denmark)

- Bupo Animal Health (U.K.)

- Boehringer Ingelheim International GmbH (Germany)

- Biomin (Austria)

- Elanco (U.S.)

- Alltech (U.S.)

- Zoetis (U.S.)

- Koninklijke DSM N.V. (Netherlands)

- Cargill, Incorporated (U.S.)

- Bayer AG (Germany)

- Protexin (U.K.)

- Novozymes (Denmark)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.