Global Poultry Intestinal Health Market

Market Size in USD Billion

CAGR :

%

USD

8.32 Billion

USD

14.96 Billion

2025

2033

USD

8.32 Billion

USD

14.96 Billion

2025

2033

| 2026 –2033 | |

| USD 8.32 Billion | |

| USD 14.96 Billion | |

|

|

|

|

Poultry Intestinal Health Market Size

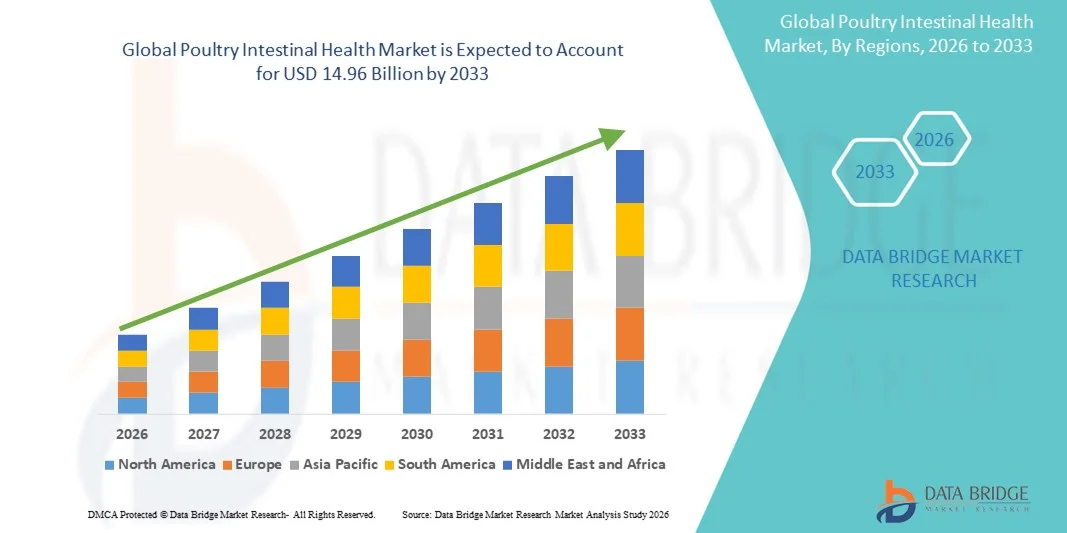

- The global poultry intestinal health market size was valued at USD 8.32 billion in 2025 and is expected to reach USD 14.96 billion by 2033, at a CAGR of 7.60% during the forecast period

- The market growth is largely fueled by the increasing adoption of functional feed additives and innovative gut health solutions in poultry production, driven by the rising demand for antibiotic-free and high-quality poultry products

- Furthermore, growing awareness among poultry farmers and integrators regarding flock performance, disease prevention, and gut health management is driving the adoption of probiotics, prebiotics, phytogenics, and immunostimulants. These converging factors are accelerating the uptake of intestinal health solutions, thereby significantly boosting the market’s expansion

Poultry Intestinal Health Market Analysis

- Intestinal health solutions, including probiotics, prebiotics, phytogenics, and immunostimulants, are increasingly critical for maintaining gut integrity, improving nutrient absorption, and enhancing immunity in poultry flocks, which directly impacts productivity and farm profitability

- The escalating demand for these solutions is primarily fueled by regulatory restrictions on antibiotic use, rising consumer preference for safe and natural poultry products, and advancements in feed additive technology, supporting the growing importance of intestinal health management in modern poultry operations

- Asia-Pacific dominated the poultry intestinal health market with a share of 32.4% in 2025, due to expanding commercial poultry production, increasing adoption of feed additives for gut health, and a strong presence of large-scale poultry farms

- North America is expected to be the fastest growing region in the poultry intestinal health market during the forecast period due to high adoption of advanced feed additives, strong demand for antibiotic-free poultry, and increasing investments in poultry nutrition

- Dry segment dominated the market with a market share of 58.3% in 2025, due to its convenience in feed mixing, longer shelf life, and ease of storage and transportation. Dry additives are widely adopted in large-scale poultry operations for their consistent dosing, cost-effectiveness, and compatibility with various feed types. Poultry producers often prefer dry formulations for integrated feeding programs that ensure uniform distribution of functional ingredients across flocks. The segment’s dominance is also supported by established manufacturing practices and availability of multi-strain dry probiotic and prebiotic blends

Report Scope and Poultry Intestinal Health Market Segmentation

|

Attributes |

Poultry Intestinal Health Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Poultry Intestinal Health Market Trends

Rising Adoption of Natural and Functional Feed Additives for Gut Health

- The global poultry intestinal health market is witnessing a growing trend in the adoption of natural and functional feed additives such as probiotics, prebiotics, phytogenics, and immunostimulants, aimed at improving gut integrity, nutrient absorption, and overall flock performance, which directly enhances growth rates and reduces mortality in commercial poultry operations

- For instance, EW Nutrition launched Protect D, a proprietary blend of phytomolecules, which supports poultry performance even under Eimeria-related challenges, encouraging broader adoption of phytogenic feed additives across commercial farms and promoting a shift towards natural alternatives to antibiotics

- Feed additives are increasingly being integrated into standard poultry nutrition programs to enhance immunity, reduce disease incidence, and improve feed efficiency, leading to consistent flock health, higher production yields, and better economic returns for poultry producers

- The trend towards natural and functional additives is further driven by regulatory restrictions on antibiotic use in poultry, prompting producers to seek alternative gut health solutions that maintain bird performance, ensure food safety, and comply with evolving industry standards

- Companies such as Chr. Hansen are developing multi-strain probiotics and specialized feed solutions designed to stabilize the intestinal microbiome, supporting better digestion, enhancing nutrient absorption, and demonstrating innovation and leadership in the functional additives space

- The rising adoption of these natural and functional gut health solutions is shaping the poultry industry by promoting healthier flocks, reducing reliance on antibiotics, improving farm profitability, and supporting sustainable production practices, thus consolidating the importance of intestinal health products in modern poultry operations

Poultry Intestinal Health Market Dynamics

Driver

Growing Demand for Antibiotic-Free and High-Quality Poultry Products

- The increasing consumer preference for safe, high-quality, and antibiotic-free poultry products is a primary driver of the poultry intestinal health market, encouraging farmers to adopt functional feed additives that enhance gut health, optimize growth performance, and support flock immunity

- For instance, in 2024, Godrej Agrovet introduced a range of probiotics and prebiotics tailored for commercial poultry operations, which helped maintain flock performance, supported antibiotic-free production programs, and drove market growth by offering scalable solutions for large-scale poultry farms

- Rising awareness among poultry producers regarding preventive health, improved immunity, and feed efficiency is accelerating the adoption of intestinal health solutions across broiler and layer farms, enabling consistent production outputs and reducing losses due to gastrointestinal diseases

- Growing regulatory pressures and food safety standards are compelling poultry integrators to implement gut health programs that reduce disease outbreaks, maintain antibiotic-free certifications, and meet consumer expectations, further boosting demand for functional additives

- The combined influence of consumer preferences, regulatory compliance, and performance enhancement is solidifying the role of antibiotic-free and high-quality poultry production as a sustained driver for market expansion, supporting innovation and investment in next-generation intestinal health solutions

Restraint/Challenge

Variable Efficacy of Feed Additives

- The efficacy of poultry intestinal health products can vary across different breeds, environmental conditions, and management practices, posing a challenge to achieving consistent performance and limiting adoption in some farms

- For instance, some small-scale poultry operations report inconsistent results with single-strain probiotics, making producers hesitant to fully invest in gut health solutions and slowing broader market penetration

- Variability in farm conditions, feed composition, and flock health status can impact the performance outcomes of feed additives, affecting producer confidence and creating uncertainty about expected benefits

- Ensuring consistent results requires proper strain selection, dosage management, and integration with overall nutrition programs, which can be challenging for smaller or less-experienced poultry operations

- Overcoming these challenges by developing more robust, multi-strain, and adaptable gut health solutions will be critical to drive wider adoption, ensure consistent flock performance, and sustain long-term growth in the poultry intestinal health market

Poultry Intestinal Health Market Scope

The market is segmented on the basis of additive and form.

- By Additive

On the basis of additive, the poultry intestinal health market is segmented into probiotics, prebiotics, phytogenics, and immunostimulants. The probiotics segment dominated the market with the largest market revenue share of 41.5% in 2025, driven by their proven ability to improve gut microflora, enhance nutrient absorption, and strengthen immunity in poultry. Farmers increasingly prefer probiotics due to their effectiveness in preventing gastrointestinal infections and promoting overall flock health. The rising focus on antibiotic-free poultry production has further reinforced the demand for probiotics as a natural and safe intestinal health solution. Probiotic additives also integrate seamlessly with feed formulations, supporting consistent growth performance and flock productivity. The segment’s strong presence in both conventional and commercial poultry operations contributes to its sustained market leadership.

The phytogenics segment is anticipated to witness the fastest growth rate of 20.8% from 2026 to 2033, fueled by their natural origin, bioactive compounds, and potential to enhance digestive efficiency. For instance, companies such as Delacon are actively innovating plant-based phytogenic additives that improve feed palatability, boost enzyme activity, and reduce pathogen load in poultry intestines. The growing consumer preference for poultry raised with natural supplements has accelerated the adoption of phytogenics in commercial feed. Phytogenics also offer additional benefits such as antioxidant and anti-inflammatory effects, supporting gut integrity and overall health. Increasing research and product development in this segment further drive its rapid growth across North America and Europe.

- By Form

On the basis of form, the poultry intestinal health market is segmented into dry and liquid. The dry form segment dominated the market with the largest market revenue share of 58.3% in 2025, owing to its convenience in feed mixing, longer shelf life, and ease of storage and transportation. Dry additives are widely adopted in large-scale poultry operations for their consistent dosing, cost-effectiveness, and compatibility with various feed types. Poultry producers often prefer dry formulations for integrated feeding programs that ensure uniform distribution of functional ingredients across flocks. The segment’s dominance is also supported by established manufacturing practices and availability of multi-strain dry probiotic and prebiotic blends.

The liquid form segment is expected to witness the fastest CAGR from 2026 to 2033, driven by its rapid absorption, ease of application through water systems, and suitability for targeted nutritional interventions. For instance, companies such as Novus International have developed liquid intestinal health supplements that can be administered directly in drinking water, improving gut health during critical growth stages. Liquid formulations are particularly advantageous for broilers and layers during early life or stress periods, ensuring quick gut colonization and immunity enhancement. The growing preference for flexible, precision-based supplementation strategies in modern poultry farms fuels the adoption of liquid forms. Improved solubility and synergistic combinations with other feed additives further contribute to its accelerating market growth.

Poultry Intestinal Health Market Regional Analysis

- Asia-Pacific dominated the poultry intestinal health market with the largest revenue share of 32.4% in 2025, driven by expanding commercial poultry production, increasing adoption of feed additives for gut health, and a strong presence of large-scale poultry farms

- The region’s cost-effective feed additive manufacturing, rising investments in animal nutrition, and growing demand for antibiotic-free poultry products are accelerating market expansion

- The availability of skilled labor, favorable government policies, and rapid growth of poultry farming across developing economies are contributing to increased consumption of intestinal health solutions in both broiler and layer operations

China Poultry Intestinal Health Market Insight

China held the largest share in the Asia-Pacific poultry intestinal health market in 2025, owing to its position as a global leader in poultry production and feed additive consumption. The country's strong poultry industry, favorable government regulations supporting animal nutrition, and extensive feed additive manufacturing capabilities are major growth drivers. Demand is also bolstered by rising adoption of probiotics, prebiotics, and other gut health solutions to improve flock productivity and reduce disease incidence.

India Poultry Intestinal Health Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by a rapidly expanding poultry sector, increasing investments in modern feed processing infrastructure, and rising consumer demand for high-quality poultry products. For instance, companies such as Godrej Agrovet are promoting gut health solutions to enhance productivity and reduce antibiotic use. In addition, government initiatives supporting poultry health and nutrition, along with rising awareness among farmers, are contributing to robust market expansion.

Europe Poultry Intestinal Health Market Insight

The Europe poultry intestinal health market is expanding steadily, supported by stringent regulations on antibiotic use, growing demand for functional feed additives, and increasing focus on sustainable poultry farming practices. The region emphasizes high-quality feed formulations, animal welfare, and environmental compliance. Increasing research on natural additives such as phytogenics and immunostimulants is further enhancing market growth.

Germany Poultry Intestinal Health Market Insight

Germany’s market is driven by its strong poultry industry, advanced feed additive manufacturing, and a focus on animal health and productivity. The country has well-established R&D networks and partnerships between feed companies and academic institutions, fostering continuous innovation in gut health solutions. Demand is particularly strong for probiotics and prebiotics to maintain intestinal integrity and reduce disease outbreaks.

U.K. Poultry Intestinal Health Market Insight

The U.K. market is supported by a mature poultry sector, increasing adoption of antibiotic alternatives, and growing interest in natural feed additives. With rising focus on research, collaboration between feed manufacturers and universities, and investments in functional additives, the U.K. continues to play a significant role in high-value poultry intestinal health solutions.

North America Poultry Intestinal Health Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by high adoption of advanced feed additives, strong demand for antibiotic-free poultry, and increasing investments in poultry nutrition. A focus on productivity, animal welfare, and preventive health management is boosting demand. In addition, rising collaboration between poultry integrators and feed additive companies is supporting market expansion.

U.S. Poultry Intestinal Health Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its expansive poultry industry, strong research infrastructure, and significant investment in feed additive production. The country’s emphasis on gut health management, preventive nutrition, and sustainable poultry practices is encouraging widespread adoption of probiotics, prebiotics, and immunostimulants. Presence of key players and advanced distribution networks further solidify the U.S.'s leading position in the region.

Poultry Intestinal Health Market Share

The poultry intestinal health industry is primarily led by well-established companies, including:

- DSM (Netherlands)

- ADM (U.S.)

- DuPont (U.S.)

- Kemin Industries, Inc. (U.S.)

- Cargill, Incorporated (U.S.)

- Novozymes (Denmark)

- Nutreco (Netherlands)

- Chr. Hansen Holding A/S (Denmark)

- Bluestar Adisseo Co., Ltd (China)

- Alltech (U.S.)

- Evonik Industries (Germany)

- Dr. Eckel Animal Nutrition GmbH & Co. KG (Germany)

- Lallemand Inc (Canada)

- Biorigin (Brazil)

- AB Vista (U.K.)

- Land O'Lakes, Inc (U.S.)

- Lesaffre (France)

- Unique Biotech (India)

Latest Developments in Global Poultry Intestinal Health Market

- In November 2025, Ecobiol from Evonik was upgraded to deliver 46% faster onset of activity in poultry gut colonization — the enhanced probiotic improves feed conversion, strengthens gut integrity, and supports bird immunity, particularly under stress conditions. This product innovation accelerates adoption of probiotic-based intestinal health solutions among commercial poultry producers, establishing Evonik as a leader in high-performance gut health additives and driving wider acceptance of advanced microbial interventions

- In September 2025, ARGIS was commercially released by ARGIS BioSolutions as a direct‑fed probiotic for poultry and swine feed — this innovative Bacillus‑strain additive enhances gut microbiota stability, improves nutrient absorption, and boosts weight-gain efficiency under commercial conditions. Its heat‑ and pH‑stable, non‑GMO formulation provides producers with a reliable, cost-effective solution that can reduce feed costs, improve flock performance, and support the growing demand for natural intestinal health products, strengthening ARGIS BioSolutions’ market position in functional feed additives

- In 2025, Enviva DUO was launched by Chr. Hansen, combining two non-spore-forming bacterial strains designed to stabilize the intestinal microbiome and improve resilience under challenging production conditions — this product broadens the scope of microbial solutions beyond traditional probiotics, offering targeted gut health support during disease pressure or environmental stress. Its introduction supports the growing trend toward multi-strain, precision-focused feed additives, enhancing Chr. Hansen’s footprint in innovative poultry nutrition solutions

- In September 2022, the 8th Conference on Poultry Intestinal Health was held in Manila, The Philippines — the event addressed critical topics including intestinal microbiota, infectious disease pathogenesis, gut health markers, diagnostics, and innovative management practices. By facilitating knowledge exchange and showcasing research advancements, the conference provided poultry producers, feed manufacturers, and researchers with actionable insights to improve flock health, adopt evidence-based gut health interventions, and ultimately enhance market adoption of intestinal health solutions

- In September 2021, Protect D was launched by EW Nutrition as a proprietary blend of phytomolecules designed to support gut health in poultry — trials demonstrated its effectiveness in maintaining bird performance and farm profitability even during Eimeria-related challenges. This product reinforced EW Nutrition’s position in natural, plant-based intestinal health solutions and contributed to increased awareness and adoption of phytogenic feed additives in commercial poultry operations, driving growth in the segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.