Global Powder Coatings Equipment Market

Market Size in USD Billion

CAGR :

%

USD

2.59 Billion

USD

6.43 Billion

2025

2033

USD

2.59 Billion

USD

6.43 Billion

2025

2033

| 2026 –2033 | |

| USD 2.59 Billion | |

| USD 6.43 Billion | |

|

|

|

|

Powder Coatings Equipment Market Size

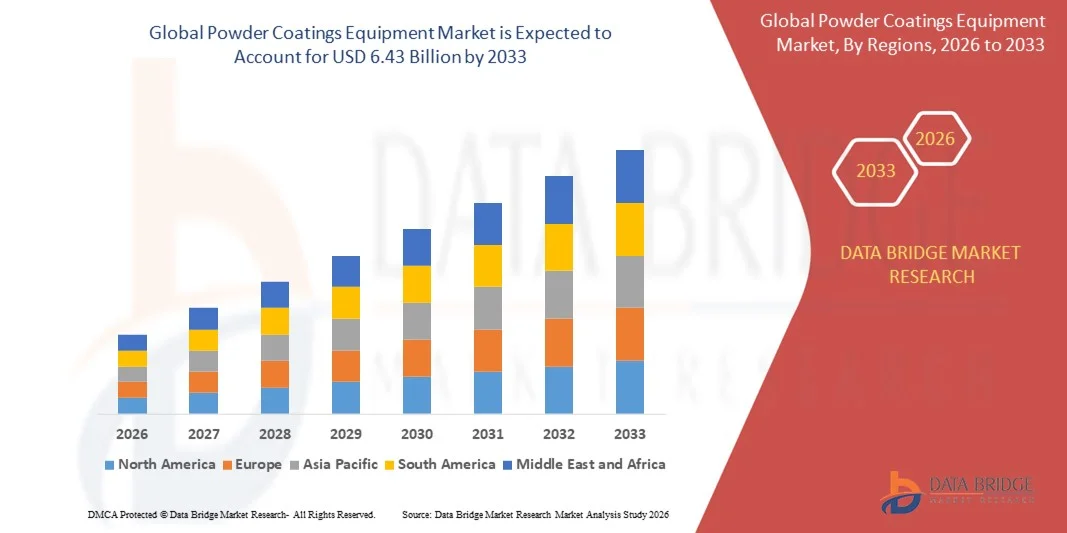

- The global powder coatings equipment market size was valued at USD 2.59 billion in 2025 and is expected to reach USD 6.43 billion by 2033, at a CAGR of 12.00% during the forecast period

- The market growth is largely fuelled by the rising demand for durable, eco-friendly, and high-performance coatings across automotive, construction, and industrial sectors

- Increasing adoption of automated and energy-efficient powder coating equipment is also driving market expansion, as manufacturers focus on reducing operational costs and improving coating quality

Powder Coatings Equipment Market Analysis

- The market is witnessing increasing innovation in powder coating technologies, including electrostatic spray systems, automated coating lines, and robotic solutions, which are enhancing productivity and consistency

- Growing environmental regulations restricting volatile organic compounds (VOCs) in liquid coatings are pushing manufacturers toward powder coatings, which are more sustainable and safer for workers, further driving adoption globally

- Asia-Pacific powder coatings equipment market ed the powder coatings equipment market with the largest revenue share of 47.2% in 2025, driven by rapid industrialization, urbanization, and rising demand for automotive, construction, and consumer appliances in countries such as China, Japan, and India

- North America region is expected to witness the highest growth rate in the global powder coatings equipment market, driven by technological advancements, modernization of manufacturing facilities, and rising demand for high-performance and environmentally compliant coatings

- The powder coating guns segment held the largest market revenue share in 2025, driven by their critical role in precise and efficient powder application, ease of integration with automated and manual systems, and widespread use across automotive, appliance, and metal fabrication industries. Guns offer uniform coating, reduced overspray, and compatibility with various powder formulations, making them a preferred choice for end-users seeking high-quality finishes

Report Scope and Powder Coatings Equipment Market Segmentation

|

Attributes |

Powder Coatings Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Nordson Corporation (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Powder Coatings Equipment Market Trends

Rising Demand for Eco-Friendly and Durable Coating Solutions

- The increasing focus on environmentally friendly and long-lasting coating technologies is significantly shaping the powder coatings equipment market, as manufacturers and end-users seek sustainable alternatives to liquid paints. Powder coating equipment is gaining traction due to its ability to reduce volatile organic compound (VOC) emissions, enhance surface durability, and provide uniform finishes, strengthening adoption across automotive, construction, and industrial manufacturing sectors. This trend encourages equipment suppliers to innovate with advanced, energy-efficient systems that meet evolving regulatory and environmental standards

- Growing awareness regarding sustainability, operational efficiency, and compliance with environmental regulations has accelerated the demand for automated and high-performance powder coating systems. Companies are actively investing in equipment capable of improving material utilization, reducing overspray, and minimizing waste, which also supports cost savings and environmental goals. Collaboration between equipment manufacturers and coating suppliers is helping enhance performance and customization for end-users

- Industry trends emphasizing automation and digitalization are influencing purchasing decisions, with manufacturers increasingly opting for equipment integrated with IoT-enabled monitoring, robotics, and process controls. These technologies help reduce labor dependency, improve precision, and ensure consistent coating quality. Manufacturers are also leveraging marketing campaigns and trade shows to highlight sustainability and operational benefits to decision-makers

- For instance, in 2024, Nordson Corporation in the U.S. and Gema Switzerland expanded their portfolio of automated powder coating systems, introducing solutions that offer higher efficiency, improved coating uniformity, and reduced environmental impact. These innovations were targeted at automotive, appliance, and industrial sectors, addressing growing regulatory pressures and sustainability commitments. The launch also helped the companies strengthen their market positioning and build long-term partnerships with end-users

- While demand for powder coating equipment is growing, long-term market expansion relies on continuous R&D, cost-effective system development, and ensuring compatibility with diverse industrial applications. Manufacturers are also focusing on improving equipment scalability, energy efficiency, and reliability to achieve wider adoption across industries

Powder Coatings Equipment Market Dynamics

Driver

Growing Adoption of Eco-Friendly and Automated Coating Solutions

- Increasing awareness of environmental sustainability and VOC regulations is driving adoption of powder coating equipment, as manufacturers seek to reduce emissions and comply with green building and industrial standards. This trend also encourages innovation in energy-efficient and automated coating systems.

- Expanding applications in automotive, construction, appliances, and industrial manufacturing are influencing market growth. Powder coating equipment helps achieve high-quality, uniform coatings while reducing material waste, supporting both environmental and cost-efficiency objectives

- Equipment manufacturers are actively promoting powder coating systems through trade shows, marketing campaigns, and industry collaborations. This strategy is supported by growing demand for sustainable, high-performance coatings, and encourages partnerships to improve equipment performance and technical support

- For instance, in 2023, Gema Switzerland and Nordson Corporation in the U.S. reported increased deployment of automated and robotic powder coating equipment in automotive and appliance manufacturing. These systems were implemented to improve efficiency, reduce waste, and meet stringent environmental and regulatory standards, driving higher customer adoption and product differentiation

- Although rising sustainability and automation trends support growth, broader adoption depends on cost optimization, availability of skilled operators, and maintenance capabilities. Investment in energy-efficient, user-friendly, and technologically advanced equipment will be critical to meeting global demand and sustaining competitive advantage

Restraint/Challenge

High Capital Cost And Technical Complexity

- The high initial investment required for powder coating equipment, coupled with complex operation and maintenance, remains a key challenge, limiting adoption among small and medium-sized manufacturers. Training, installation, and integration costs add to capital expenditure concerns

- Limited awareness of advanced coating technologies and lack of skilled operators restrict adoption, particularly in emerging markets. Manufacturers may face challenges in achieving consistent coating quality without experienced personnel, which can slow market growth

- Supply chain constraints, servicing, and maintenance requirements also impact equipment deployment. Downtime for repairs, replacement parts availability, and logistical challenges can affect operational efficiency, particularly in regions with underdeveloped service networks

- For instance, in 2024, several small- and medium-sized coating companies in Southeast Asia reported delays in adopting automated powder coating systems due to high investment costs, lack of trained operators, and limited service infrastructure, slowing the overall market penetration

- Overcoming these challenges will require development of cost-efficient, energy-saving, and user-friendly equipment, enhanced training programs, and improved technical support. Collaboration between manufacturers, suppliers, and service providers can unlock long-term growth potential for the global powder coatings equipment market

Powder Coatings Equipment Market Scope

The market is segmented on the basis of component, and end-use industry.

- By Component

On the basis of component, the powder coatings equipment market is segmented into guns, ovens, powder coating booths and systems, sieving systems, and others. The powder coating guns segment held the largest market revenue share in 2025, driven by their critical role in precise and efficient powder application, ease of integration with automated and manual systems, and widespread use across automotive, appliance, and metal fabrication industries. Guns offer uniform coating, reduced overspray, and compatibility with various powder formulations, making them a preferred choice for end-users seeking high-quality finishes.

The ovens segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption of energy-efficient curing systems and demand for faster production cycles. Ovens are essential for achieving consistent coating durability and finish quality, supporting scalability in industrial applications. Advanced curing ovens with improved temperature control and automation are particularly popular for large-scale manufacturing operations, enhancing throughput while minimizing energy consumption.

- By End-Use Industry

On the basis of end-use industry, the powder coatings equipment market is segmented into general metal, agricultural and construction, appliance, automotive, architectural, furniture, and others. The automotive segment held the largest revenue share in 2025, attributed to the high adoption of powder coatings for vehicle parts, enhanced corrosion resistance, and compliance with stringent environmental regulations. Powder coatings are widely used for durability, aesthetic appeal, and environmental benefits, making them integral to automotive manufacturing.

The architectural segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for sustainable and decorative powder-coated finishes in building facades, window frames, and interior elements. Growth in commercial and residential construction, coupled with rising awareness of low-VOC and eco-friendly coatings, is accelerating the adoption of powder coating systems in architectural applications.

Powder Coatings Equipment Market Regional Analysis

- Asia-Pacific powder coatings equipment market ed the powder coatings equipment market with the largest revenue share of 47.2% in 2025, driven by rapid industrialization, urbanization, and rising demand for automotive, construction, and consumer appliances in countries such as China, Japan, and India

- The region's growing manufacturing capabilities, supportive government policies, and increasing awareness of environmentally friendly coating technologies are accelerating adoption

- In addition, APAC is emerging as a hub for cost-effective equipment manufacturing, enhancing accessibility for domestic and regional end-users

China Powder Coatings Equipment Market Insight

The China powder coatings equipment market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to high industrial output, rapid urban infrastructure development, and growing demand for sustainable surface finishing solutions. China is one of the largest markets for powder coating systems, with significant adoption across automotive, furniture, and appliance manufacturing. Rising focus on energy efficiency, eco-compliance, and availability of affordable automated coating equipment are key factors propelling market growth.

Japan Powder Coatings Equipment Market Insight

The Japan powder coatings equipment market is expected to witness steady growth from 2026 to 2033, driven by technological advancements, precision manufacturing, and adoption of eco-conscious industrial practices. Japan’s emphasis on high-quality production, coupled with demand from automotive and electronics industries, supports widespread use of advanced powder coating systems. Integration with Industry 4.0 initiatives and automation is further fueling growth across both residential and industrial manufacturing applications.

North America Powder Coatings Equipment Market Insight

North America is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid industrialization, high adoption of automated coating systems, and increasing demand for durable and eco-friendly surface finishing solutions. Manufacturers and end-users in the region highly value the efficiency, precision, and reduced environmental impact offered by powder coating equipment, supporting adoption across automotive, appliance, and general metal industries. This widespread adoption is further encouraged by advanced manufacturing infrastructure, high capital availability, and regulatory support for sustainable coating technologies, establishing powder coating systems as a preferred solution for industrial applications

U.S. Powder Coatings Equipment Market Insight

The U.S. powder coatings equipment market is expected to witness the fastest growth rate from 2026 to 2033, fueled by growing demand for energy-efficient coating processes and rising industrial output. Increasing adoption of automated and high-performance coating systems across automotive, construction, and appliance manufacturing is driving market growth. Moreover, government incentives promoting environmentally friendly surface finishing and the preference for durable, low-maintenance coatings are contributing to market expansion.

Europe Powder Coatings Equipment Market Insight

The Europe powder coatings equipment market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent environmental regulations and the growing need for high-quality, sustainable coatings. Rising urbanization and industrial modernization across Germany, France, and Italy are fostering the adoption of advanced powder coating systems. The region is witnessing notable growth across automotive, architectural, and general metal sectors, with new and retrofitted production facilities adopting eco-friendly coating technologies.

Germany Powder Coatings Equipment Market Insight

The Germany powder coatings equipment market is expected to witness significant growth from 2026 to 2033, fueled by increasing focus on digitalized and energy-efficient manufacturing solutions. Germany’s strong industrial base and commitment to sustainability promote the adoption of automated coating lines, particularly in the automotive and appliance industries. Integration with smart manufacturing systems and rising demand for high-performance coatings are key factors supporting market expansion.

Powder Coatings Equipment Market Share

The Powder Coatings Equipment industry is primarily led by well-established companies, including:

• Gema Switzerland GmbH (Switzerland)

• KCISPRAY (U.K.)

• Mitsuba Systems (India) LLP (India)

• MS Oberflächentechnik AG (Germany)

• Parker Ionics (U.S.)

• SAMES KREMLIN (France)

• The Eastwood Company (U.S.)

• Eisenmann Corporation (Germany)

• Ocean WP Theme (U.S.)

• Pittsburgh Spray (U.S.)

• Powder X Coating Systems, llc. (U.S.)

• RED LINE INDUSTRIES LIMITED (U.K.)

• Reliant Finishing Systems (U.S.)

• STATFIELD EQUIPMENTS PVT. LTD. (India)

Latest Developments in Global Powder Coatings Equipment Market

- In June 2024, Xtrutech Ltd introduced the XTDC2 drum cooler with interchangeable configurations. The XTDC2 can be combined with the XTS24 twin screw extruder to form a fully integrated extruder line, enhancing production flexibility, optimizing cooling efficiency, and boosting overall manufacturing productivity, thereby strengthening its market position

- In May 2023, Hillenbrand Inc. (Coperion GmbH) completed the acquisition of Schenck Process FPM, aimed at integrating advanced technologies into its powder coatings equipment and expanding its product portfolio. This strategic move enhances operational capabilities, allows the company to offer more comprehensive solutions, and strengthens its competitive position in the global powder coatings equipment market

- In March 2022, Hosokawa Alpine AG launched the ACM 5 NEX, a new classifier mill in the ACM series, designed for ultra-fine grinding with integrated powder coating classification. The system improves processing efficiency, ensures consistent particle size, and supports manufacturers in achieving higher-quality coating results, positively impacting product performance and customer satisfaction

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Powder Coatings Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Powder Coatings Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Powder Coatings Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.