Global Power Distribution Unit Pdu Data Center Power Market

Market Size in USD Billion

CAGR :

%

USD

4.44 Billion

USD

8.86 Billion

2025

2033

USD

4.44 Billion

USD

8.86 Billion

2025

2033

| 2026 –2033 | |

| USD 4.44 Billion | |

| USD 8.86 Billion | |

|

|

|

|

Global Power Distribution Unit (PDU) Data Center Power Market Size

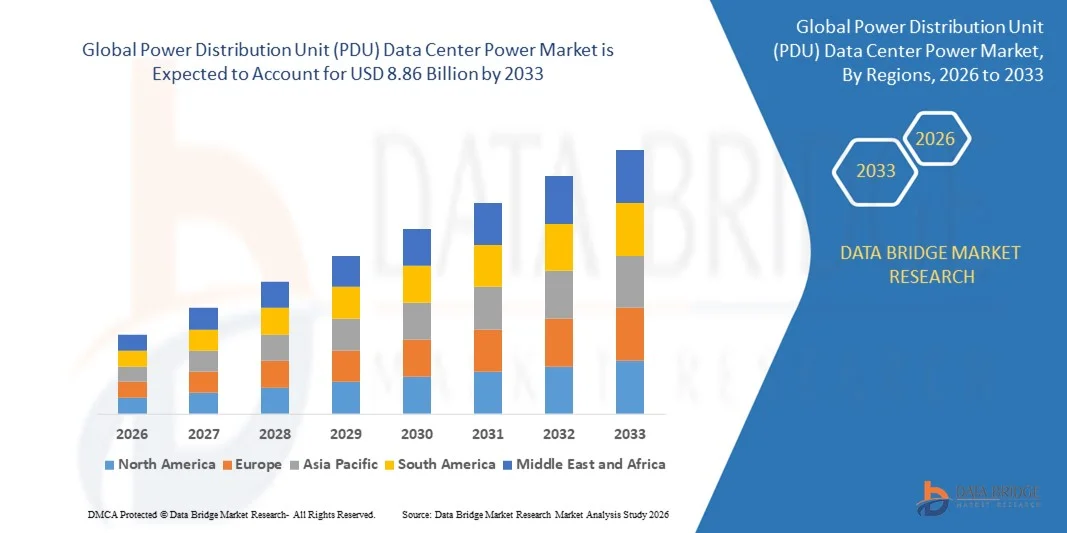

- The global Power Distribution Unit (PDU) Data Center Power Market size was valued at USD 4.44 billion in 2025 and is projected to reach USD 8.86 billion by 2033, growing at a CAGR of 9.01% during the forecast period.

- The market growth is primarily driven by the increasing demand for reliable and efficient power management solutions in data centers, alongside the rapid expansion of cloud computing, AI, and big data analytics, which require uninterrupted and scalable power distribution.

- Additionally, the adoption of advanced PDUs with real-time monitoring, remote management, and energy optimization capabilities is rising as organizations focus on operational efficiency and sustainability, further fueling market expansion and solidifying PDUs as a critical component of modern data center infrastructure.

Global Power Distribution Unit (PDU) Data Center Power Market Analysis

- Power Distribution Units (PDUs), providing reliable and efficient power delivery and management for data center equipment, are increasingly critical components of modern IT infrastructure in both enterprise and hyperscale data centers due to their real-time monitoring, remote management, and energy optimization capabilities.

- The escalating demand for PDUs is primarily fueled by the rapid expansion of cloud computing, edge computing, and AI-driven workloads, growing concerns around data center uptime and energy efficiency, and the rising need for scalable and intelligent power management solutions.

- North America dominated the Global Power Distribution Unit (PDU) Data Center Power Market with the largest revenue share of 34.1% in 2025, driven by early adoption of advanced data center technologies, high investment in cloud infrastructure, and a strong presence of leading PDU manufacturers, with the U.S. witnessing substantial deployment of intelligent PDUs in hyperscale and enterprise data centers to support AI, IoT, and 5G infrastructure.

- Asia-Pacific is expected to be the fastest-growing region in the Global Power Distribution Unit (PDU) Data Center Power Market during the forecast period due to increasing digitalization, expanding data center investments, and rising demand for reliable power solutions in rapidly urbanizing economies such as China and India.

- The intelligent PDU segment dominated the market with the largest revenue share of 61.5% in 2025, driven by the increasing demand for real-time monitoring, remote management, and energy optimization in modern data centers.

Report Scope and Global Power Distribution Unit (PDU) Data Center Power Market Segmentation

|

Attributes |

Power Distribution Unit (PDU) Data Center Power Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Global Power Distribution Unit (PDU) Data Center Power Market Trends

Enhanced Efficiency Through AI and Remote Management Integration

- A significant and accelerating trend in the Global Power Distribution Unit (PDU) Data Center Power Market is the increasing integration with artificial intelligence (AI) and advanced remote monitoring and management platforms. This fusion of technologies is significantly enhancing operational efficiency, predictive maintenance, and energy optimization in data centers.

- For instance, intelligent PDUs from Vertiv and APC by Schneider Electric offer real-time monitoring and remote management capabilities, allowing data center operators to track power usage, temperature, and load balancing through a centralized dashboard, reducing downtime and improving energy efficiency.

- AI integration in PDUs enables features such as predictive load management, automated alerts for abnormal power consumption, and intelligent energy distribution to optimize efficiency and reduce costs. For example, Raritan’s PX intelligent PDUs can analyze historical power usage patterns and suggest adjustments to prevent overloading or underutilization of circuits.

- The seamless integration of PDUs with cloud-based management platforms allows IT teams to centrally monitor and control power across multiple racks, rooms, or even geographically dispersed data centers. Through a single interface, operators can manage power distribution, track energy usage, and schedule maintenance tasks, creating a highly automated and resilient infrastructure.

- This trend toward more intelligent, connected, and automated PDUs is fundamentally reshaping expectations for data center power management. Consequently, companies such as Eaton and Delta Electronics are developing AI-enabled PDUs with features like automated load balancing, predictive maintenance alerts, and remote configuration capabilities.

- The demand for PDUs that offer seamless AI and remote management integration is growing rapidly across enterprise, hyperscale, and edge data centers, as organizations increasingly prioritize reliability, efficiency, and real-time control over critical infrastructure.

Global Power Distribution Unit (PDU) Data Center Power Market Dynamics

Driver

Growing Need Due to Rising Data Center Demand and Power Management Requirements

- The increasing reliance on data-intensive applications, cloud computing, and hyperscale IT infrastructure, coupled with the growing focus on energy efficiency and uptime reliability, is a significant driver for the heightened demand for advanced Power Distribution Units (PDUs).

- For instance, in March 2025, Vertiv introduced an AI-enabled intelligent PDU with predictive load balancing and real-time energy analytics, aiming to optimize power usage in modern data centers. Such innovations by key players are expected to drive market growth over the forecast period.

- As organizations seek to prevent downtime and ensure operational continuity, PDUs offer advanced features such as remote monitoring, environmental sensors, overload protection, and energy usage analytics, providing a compelling upgrade over traditional power strips or basic PDUs.

- Furthermore, the rapid adoption of edge data centers and hybrid cloud infrastructure is increasing the need for scalable, modular, and intelligent power distribution solutions, making PDUs an integral component of modern IT environments.

- The ability to remotely manage power for individual racks, monitor load in real time, and optimize energy consumption are key factors propelling the adoption of intelligent PDUs in enterprise, hyperscale, and colocation data centers. The trend towards modular and easy-to-deploy PDU systems, alongside increased availability of cost-effective intelligent options, further contributes to market expansion.

Restraint/Challenge

Concerns Regarding Cybersecurity and High Initial Costs

- Concerns surrounding the cybersecurity vulnerabilities of connected PDUs pose a significant challenge to broader market penetration. As intelligent PDUs rely on network connectivity and software, they can be susceptible to hacking attempts and unauthorized access, raising concerns about the security of critical IT infrastructure.

- For instance, reports of vulnerabilities in networked power management devices have made some organizations cautious about adopting fully connected PDU solutions.

- Addressing these cybersecurity concerns through secure authentication protocols, encrypted communications, and regular firmware updates is crucial for building trust among data center operators. Companies such as Raritan and Eaton emphasize their advanced security measures and compliance certifications to reassure potential buyers. Additionally, the relatively high initial cost of intelligent PDU systems compared to basic PDUs can be a barrier to adoption for price-sensitive organizations or smaller data centers. While entry-level intelligent PDUs are becoming more affordable, premium features such as AI-driven analytics, remote monitoring, and environmental sensors often come with higher upfront investment.

- While prices are gradually decreasing, the perceived premium for advanced PDU technology can still limit adoption, particularly for operators who do not yet require sophisticated features.

- Overcoming these challenges through enhanced cybersecurity measures, education on best practices for secure PDU deployment, and the development of more cost-effective solutions will be vital for sustained market growth.

Global Power Distribution Unit (PDU) Data Center Power Market Scope

Power distribution unit (PDU) data center power market is segmented on the basis of component, data center type, end user type, and vertical.

- By Component

On the basis of component, the Global Power Distribution Unit (PDU) Data Center Power Market is segmented into Intelligent Power Distribution Units (iPDUs) and Non-Intelligent Power Distribution Units (PDUs). The intelligent PDU segment dominated the market with the largest revenue share of 61.5% in 2025, driven by the increasing demand for real-time monitoring, remote management, and energy optimization in modern data centers. iPDUs provide critical capabilities such as environmental sensing, predictive load balancing, and remote power cycling, enabling data center operators to maintain uptime while reducing operational costs. Conversely, non-intelligent PDUs continue to find use in smaller facilities due to their simplicity and lower cost, but their adoption is limited where advanced management features are required.

The non-intelligent PDU segment is expected to witness the fastest CAGR of 19.8% from 2026 to 2033, fueled by growing deployments in small-scale and edge data centers that require cost-effective power distribution solutions.

- By Data Center Size

On the basis of data center size, the Global PDU Data Center Power Market is segmented into small and mid-sized data centers and large data centers. Large data centers accounted for the largest market revenue share of 57.2% in 2025, driven by the proliferation of hyperscale cloud facilities, enterprise IT hubs, and colocation centers that require high-density, reliable, and intelligent power distribution. These facilities benefit from advanced PDUs that support real-time monitoring, automated alerts, and load balancing to optimize uptime and energy efficiency.

Small and mid-sized data centers are expected to witness the fastest CAGR of 21.3% from 2026 to 2033, due to rapid digitalization across SMEs, increasing edge computing deployments, and growing adoption of modular and scalable PDUs that allow these facilities to achieve enterprise-level reliability at lower costs.

- By End User Type

On the basis of end user type, the Global PDU Data Center Power Market is segmented into enterprises, colocation providers, cloud providers, and hyperscale data centers. Hyperscale data centers dominated the market with the largest revenue share of 48.6% in 2025, as these facilities require high-capacity, intelligent PDUs to manage power across thousands of racks efficiently while supporting AI, IoT, and big data workloads. Enterprises continue to adopt PDUs to modernize their IT infrastructure, ensure uptime, and achieve energy efficiency goals.

The colocation and cloud provider segments are expected to witness the fastest CAGR of 22.1% from 2026 to 2033, driven by increasing demand for outsourced data center services, multi-tenant facilities, and remote management capabilities that intelligent PDUs provide for optimized power distribution and monitoring.

- By Vertical

On the basis of vertical, the Global PDU Data Center Power Market is segmented into BFSI, media and entertainment, government and defense, healthcare, manufacturing, retail, telecommunications and IT, and others. The BFSI segment dominated the market with the largest revenue share of 39.8% in 2025, as financial institutions require secure, reliable, and energy-efficient data centers to handle critical transactions, customer data, and compliance reporting.

Telecommunications and IT verticals are expected to witness the fastest CAGR of 23.0% from 2026 to 2033, driven by growing cloud services, AI adoption, 5G network rollout, and high-speed data processing requirements. Other sectors, including healthcare and government, are also increasing investments in intelligent PDUs to improve operational efficiency, ensure continuous uptime, and manage growing power and environmental monitoring needs in their data center infrastructures.

Global Power Distribution Unit (PDU) Data Center Power Market Regional Analysis

- North America dominated the Global Power Distribution Unit (PDU) Data Center Power Market with the largest revenue share of 34.1% in 2025, driven by rapid investments in hyperscale, enterprise, and colocation data centers, as well as a growing emphasis on energy-efficient and intelligent power management solutions.

- Data center operators in the region highly value the reliability, real-time monitoring, and remote management capabilities offered by intelligent PDUs, which help optimize power distribution, reduce downtime, and improve overall operational efficiency.

- This widespread adoption is further supported by advanced IT infrastructure, high cloud and edge computing penetration, and the presence of leading PDU manufacturers and service providers, establishing intelligent and modular PDUs as the preferred choice for data centers across North America.

U.S. PDU Data Center Power Market Insight

The U.S. PDU Data Center Power Market captured the largest revenue share of 82% in North America in 2025, driven by rapid expansion of hyperscale and enterprise data centers and a growing emphasis on energy-efficient and intelligent power management solutions. Data center operators increasingly prioritize real-time monitoring, remote management, and load optimization capabilities offered by intelligent PDUs. The adoption of cloud computing, edge infrastructure, and high-density IT deployments further supports market growth. Moreover, the presence of leading PDU manufacturers, coupled with advanced IT infrastructure and high technological awareness, continues to stimulate demand for intelligent and modular PDUs across the U.S.

Europe PDU Data Center Power Market Insight

The Europe PDU Data Center Power Market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing investments in energy-efficient data centers, strict regulatory standards on power reliability, and growing digitalization across industries. Data centers in countries such as Germany, France, and the Netherlands are focusing on intelligent PDUs to optimize energy use, monitor power loads, and improve uptime. The rising adoption of cloud services, colocation facilities, and smart grid integration further accelerates the demand for advanced PDU solutions across both new and existing facilities.

U.K. PDU Data Center Power Market Insight

The U.K. PDU Data Center Power Market is expected to grow at a noteworthy CAGR during the forecast period, fueled by expanding cloud adoption, digital transformation initiatives, and increasing deployment of colocation and hyperscale facilities. Data center operators prioritize intelligent PDUs for remote monitoring, load management, and fault detection, ensuring operational efficiency and reliability. Additionally, the government’s emphasis on energy efficiency and sustainability in IT infrastructure drives investments in modern PDU solutions, positioning intelligent and modular PDUs as a preferred choice for both commercial and enterprise applications in the region.

Germany PDU Data Center Power Market Insight

The Germany PDU Data Center Power Market is projected to expand at a considerable CAGR during the forecast period, driven by growing demand for reliable, energy-efficient, and intelligent power distribution solutions in enterprise and hyperscale data centers. The country’s focus on sustainability, digital infrastructure development, and Industry 4.0 adoption supports the integration of advanced PDUs with real-time monitoring and energy optimization features. Furthermore, Germany’s well-established IT infrastructure and emphasis on technological innovation make it a key market for intelligent PDU adoption across both new constructions and retrofitted data center facilities.

Asia-Pacific PDU Data Center Power Market Insight

The Asia-Pacific PDU Data Center Power Market is poised to grow at the fastest CAGR of 25% from 2026 to 2033, driven by rapid urbanization, increasing data center deployments, and technological advancements in countries such as China, India, Japan, and Singapore. The region’s growth is fueled by strong demand for cloud services, hyperscale facilities, and edge computing infrastructure. Additionally, government initiatives supporting digitalization, smart city projects, and energy-efficient IT infrastructure are accelerating the adoption of intelligent PDUs. The availability of cost-effective PDU solutions from domestic manufacturers further expands market reach to a wider range of data center operators in the region.

Japan PDU Data Center Power Market Insight

The Japan PDU Data Center Power Market is gaining momentum due to the country’s advanced IT infrastructure, high adoption of cloud computing, and increasing demand for energy-efficient data center operations. Japanese data center operators prioritize intelligent PDUs for remote monitoring, predictive load management, and optimized energy consumption. The integration of PDUs with automated data center management systems further enhances operational efficiency. Moreover, Japan’s focus on sustainability and technological innovation drives the adoption of modular and smart PDUs, supporting growth across both enterprise and hyperscale data center segments.

China PDU Data Center Power Market Insight

The China PDU Data Center Power Market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, expansion of hyperscale and cloud data centers, and high technological adoption. China is emerging as a hub for manufacturing and deploying advanced PDUs, offering intelligent and cost-effective power distribution solutions. The push for smart cities, digital transformation initiatives, and the growing demand for reliable, energy-efficient data centers are key factors driving market growth. Strong domestic manufacturers, combined with supportive government policies and increasing private sector investment, continue to propel the PDU market in China.

Global Power Distribution Unit (PDU) Data Center Power Market Share

The Power Distribution Unit (PDU) Data Center Power industry is primarily led by well-established companies, including:

• Schneider Electric (France)

• Vertiv Inc. (U.S.)

• Eaton Corporation (U.S.)

• Raritan Inc. (U.S.)

• ABB Ltd. (Switzerland)

• Legrand SA (France)

• CyberPower Systems Inc. (U.S.)

• Panasonic Corporation (Japan)

• Tripp Lite (U.S.)

• Siemens AG (Germany)

• APC by Schneider Electric (U.S.)

• Tyco Electronics / TE Connectivity (U.S.)

• MGE UPS Systems (France)

• H3C Technologies (China)

• Leishi Electric (China)

• Emerson Network Power (U.S.)

• Delta Electronics Inc. (Taiwan)

• Minuteman Power Technologies (U.S.)

• Chatsworth Products (U.S.)

• NetBotz (U.S.)

What are the Recent Developments in Global Power Distribution Unit (PDU) Data Center Power Market?

- In April 2024, Schneider Electric, a global leader in energy management and automation, launched a new line of intelligent PDUs in South Africa, targeting both enterprise and colocation data centers. The initiative emphasizes enhancing power distribution reliability, real-time monitoring, and energy efficiency in critical IT infrastructures. By leveraging advanced metering, predictive load management, and remote control features, Schneider Electric reinforces its position as a leading provider of next-generation PDU solutions in emerging markets.

- In March 2024, Vertiv Inc., a U.S.-based provider of critical digital infrastructure technologies, introduced the Liebert iPDU G5 series, engineered specifically for hyperscale and large commercial data centers. The new units offer modular design, high-density power distribution, and intelligent monitoring capabilities to optimize uptime and energy efficiency. This launch highlights Vertiv’s commitment to delivering reliable and scalable PDU solutions for mission-critical environments globally.

- In March 2024, Eaton Corporation successfully deployed its ePDU solutions for the Bengaluru Digital City Project, aiming to enhance data center power reliability and operational efficiency. The project incorporates real-time energy monitoring, intelligent load balancing, and automated alerts to prevent downtime, underscoring Eaton’s dedication to enabling resilient and energy-efficient IT infrastructure in urban smart city developments.

- In February 2024, Raritan Inc., a leading provider of intelligent rack power distribution solutions, announced a strategic partnership with the Asia-Pacific Colocation Providers Association to develop a standardized smart PDU marketplace for data center operators. The collaboration is designed to improve operational efficiency, simplify procurement, and provide real-time energy management insights, reflecting Raritan’s commitment to innovation and enhanced power management in the data center ecosystem.

- In January 2024, APC by Schneider Electric unveiled the APC Smart-UPS PDU Series at the Data Center World 2024 event. Equipped with advanced monitoring, remote management, and modular configuration features, the new PDU series enables data center operators to efficiently manage power loads, enhance uptime, and optimize energy consumption. This launch highlights APC’s focus on integrating intelligent technology into data center power infrastructure, offering enhanced reliability and operational control for modern IT environments.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.