Global Power Management Ic Market

Market Size in USD Billion

CAGR :

%

USD

37.49 Billion

USD

63.47 Billion

2024

2032

USD

37.49 Billion

USD

63.47 Billion

2024

2032

| 2025 –2032 | |

| USD 37.49 Billion | |

| USD 63.47 Billion | |

|

|

|

|

Power Management IC Market Size

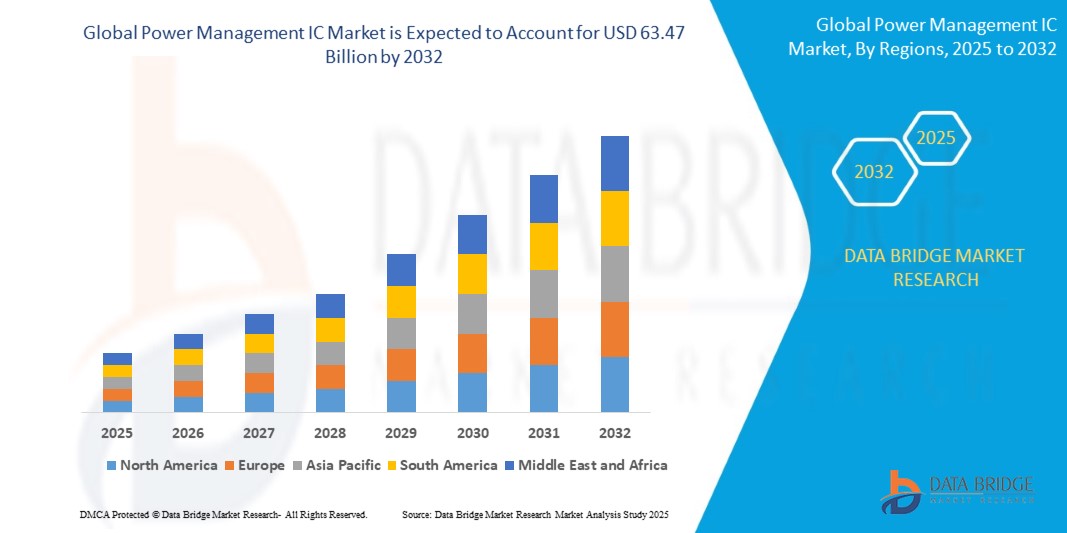

- The global power management IC market size was valued at USD 37.49 billion in 2024 and is expected to reach USD 63.47 billion by 2032, at a CAGR of 6.8% during the forecast period

- The market growth is largely fueled by the increasing adoption of smartphones, electric vehicles, consumer electronics, and industrial automation systems, which require efficient and reliable power management solutions. Technological advancements in low-power and high-efficiency IC designs are enabling longer battery life, reduced energy loss, and compact form factors across diverse applications

- Furthermore, rising demand for energy-efficient and high-performance electronics in automotive, industrial, and IoT sectors is driving the adoption of power management ICs. These converging factors are accelerating the integration of advanced PMIC solutions, thereby significantly boosting the industry’s growth

Power Management IC Market Analysis

- Power management ICs (PMICs) are semiconductor devices that manage the distribution, conversion, and regulation of power within electronic systems. They include voltage regulators, battery management units, and power distribution ICs that ensure stable power delivery, protect against overcurrent and overheating, and optimize energy usage in devices ranging from smartphones to electric vehicles and industrial equipment

- The escalating demand for power management ICs is primarily fueled by the proliferation of portable and connected devices, the rapid expansion of electric vehicle and renewable energy markets, and the need for energy-efficient solutions in industrial automation and smart electronics. Advanced features such as high-precision voltage control, power sequencing, and thermal protection are further driving market growth

- Asia-Pacific dominated the power management IC market with a share of 44.4% in 2024, due to rapid adoption of consumer electronics, smartphones, and electric vehicles, along with a growing semiconductor manufacturing ecosystem

- North America is expected to be the fastest growing region in the power management IC market during the forecast period due to robust demand for power-efficient ICs in consumer electronics, electric vehicles, and industrial automation

- Battery management segment dominated the market with a market share of 61.8% in 2024, due to the rising proliferation of smartphones, laptops, electric vehicles, and renewable energy systems that rely heavily on efficient battery utilization. These units ensure safe charging and discharging cycles, prevent overcurrent and overheating, and extend overall battery life, making them essential for the longevity of electronic devices. With the rapid electrification of transportation and increasing energy storage deployment, battery management ICs are becoming indispensable, driving strong market demand

Report Scope and Power Management IC Market Segmentation

|

Attributes |

Power Management IC Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Power Management IC Market Trends

Rising Adoption of AI-Integrated, Energy-Efficient PMICs

- The market for power management ICs is increasingly propelled by the adoption of AI-integrated solutions that enable smarter, energy-efficient control across electronic systems. AI-powered PMICs optimize power usage, adapt dynamically, and enhance device longevity for applications from consumer electronics to automotive, industrial automation, and networking

- For instance, Texas Instruments has launched PMICs featuring embedded machine-learning algorithms and intelligent system monitoring to deliver real-time power optimization in IoT and mobile devices. This AI integration is attracting major OEMs looking to offer smarter, longer-lasting products in competitive markets

- Growing miniaturization and greater functionality in end-user devices drive demand for multi-channel, high-density PMICs. These enable precise power delivery for advanced processors and memory in compact devices without excess heat or energy wastage

- The advancement of energy harvesting technologies is creating opportunities for PMICs designed to manage ultra-low power inputs from solar, vibration, or thermal sources. Such integration is increasingly vital for remote IoT sensors, wearables, and smart buildings

- In addition, PMICs with adaptive voltage regulation and cross-domain compatibility support a wide variety of end products, enhancing design flexibility for manufacturers developing multifunctional or dynamically powered systems

- Market momentum is accelerating for PMICs that support advanced battery technologies such as lithium-ion and solid-state batteries, ensuring reliable charging, protection, and fuel-gauging for electric vehicles, mobile gadgets, and medical equipment

Power Management IC Market Dynamics

Driver

Growing Demand for IoT (Internet of Things) Devices

- The proliferation of connected IoT devices across consumer, commercial, and industrial sectors is a major driver for growth in the PMIC market. These devices require constant, efficient power management for sensors, communications modules, and microcontrollers

- For instance, Analog Devices provides PMICs specifically optimized for wireless sensors and smart home devices, enabling efficient battery use and extended operational lifetimes for IoT deployments. Their tailored solutions have gained traction among device makers seeking market-leading reliability

- The rapid development of smart cities, industrial automation, and connected healthcare ecosystems accelerates demand for PMICs able to orchestrate seamless power flow across multiple device functions and wireless standards

- Miniaturization and stricter energy efficiency standards for wearables and portable IoT devices challenge manufacturers to select PMICs that deliver low quiescent current and support ultra-compact form factors

- The expanding market for smart meters and networked embedded controls further drives demand for power management solutions with enhanced EMI performance and rugged design, supporting reliable operation in diverse and harsh environments

Restraint/Challenge

High Software Expenses

- The growing complexity of PMICs and their integration with advanced system-on-chip (SoC) architectures has led to high software development and maintenance costs. Designing, testing, and updating firmware for sophisticated power management features often requires extensive investment

- For instance, Infineon Technologies faces significant software expenses when pairing its highly configurable PMICs with AI-based embedded systems, as ongoing support, customization, and cybersecurity measures all require dedicated engineering resources

- Customization requirements from OEMs, especially in the automotive, mobile, and industrial automation sectors, increase the need for advanced driver and interface software, impacting profitability and time-to-market

- In addition, sustaining interoperability and real-time diagnostics across multiple platforms and operating systems adds to software expense, with manufacturers challenged to maintain compatibility and robust security

- The necessity for user-friendly interfaces and remote configurability in modern smart devices compels additional software investment, raising barriers for market entry and expansion

Power Management IC Market Scope

The market is segmented on the basis of voltage regulators and power management units.

• By Voltage Regulators

On the basis of voltage regulators, the power management IC market is segmented into linear voltage regulators and switching voltage regulators. The switching voltage regulators segment dominated the largest market revenue share in 2024, attributed to their high efficiency and capability to step up or step down voltages with minimal power loss. They are widely used in applications ranging from consumer electronics to industrial equipment, where energy efficiency and thermal management are critical. The demand for switching regulators is further supported by the increasing adoption of portable devices and electric vehicles, both of which require longer battery life and reliable power conversion. Their adaptability to handle varying input voltages while delivering stable outputs makes them the preferred choice across multiple high-performance electronic applications.

The linear voltage regulators segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by their simplicity, low noise generation, and compact design, which make them particularly suitable for noise-sensitive applications such as audio equipment, medical devices, and communication systems. Even though they are less efficient compared to switching regulators, linear regulators are gaining traction in scenarios where clean, stable power is more important than energy efficiency. Their easy integration into circuit designs and cost-effectiveness also enhance their adoption in small consumer electronics and IoT devices. The growing demand for wearable devices and compact electronics is expected to significantly drive the growth of this segment.

• By Power Management Units

On the basis of power management units, the power management IC market is segmented into battery management units and power distribution units. The battery management units segment accounted for the largest market revenue share of 61.8% in 2024, supported by the rising proliferation of smartphones, laptops, electric vehicles, and renewable energy systems that rely heavily on efficient battery utilization. These units ensure safe charging and discharging cycles, prevent overcurrent and overheating, and extend overall battery life, making them essential for the longevity of electronic devices. With the rapid electrification of transportation and increasing energy storage deployment, battery management ICs are becoming indispensable, driving strong market demand.

The power distribution units segment is projected to register the fastest CAGR from 2025 to 2032, propelled by the rising need for reliable energy distribution across data centers, industrial automation systems, and connected infrastructure. These units provide optimized load balancing, monitoring, and fault protection, which are crucial for supporting critical operations in enterprise and industrial applications. The expansion of cloud computing, AI-driven data processing, and smart grids is significantly enhancing the adoption of advanced power distribution ICs. Moreover, the push for energy efficiency in large-scale infrastructure is expected to accelerate the demand for smart, scalable power distribution solutions.

Power Management IC Market Regional Analysis

- Asia-Pacific dominated the power management IC market with the largest revenue share of 44.4% in 2024, driven by rapid adoption of consumer electronics, smartphones, and electric vehicles, along with a growing semiconductor manufacturing ecosystem

- The region’s cost-effective manufacturing capabilities, rising investments in semiconductor fabs, and government incentives for electronics production are accelerating market expansion

- The availability of skilled engineering talent, favorable policies for electronics and EV sectors, and rapid industrialization across developing economies are contributing to increased demand for power management ICs

China Power Management IC Market Insight

China held the largest share in the Asia-Pacific power management IC market in 2024, owing to its position as a global leader in semiconductor manufacturing and electronics production. The country’s extensive industrial base, government support for chip design and fabrication, and export capabilities are major growth drivers. Demand is further strengthened by rapid adoption of electric vehicles, smartphones, and industrial automation, as well as ongoing investments in advanced power-efficient IC designs.

India Power Management IC Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rising smartphone penetration, expanding electric vehicle adoption, and growing semiconductor fabrication initiatives. Government programs such as “Make in India” and incentives for local chip production are driving the development of the power management IC market. In addition, increasing electronics exports, emerging EV infrastructure, and R&D investments in energy-efficient IC solutions are contributing to robust market expansion.

Europe Power Management IC Market Insight

The Europe power management IC market is growing steadily, supported by high demand for energy-efficient electronics, automotive electrification, and industrial automation solutions. Stringent energy regulations and emphasis on sustainable, low-power semiconductor devices are driving innovation in power management ICs. Investments in advanced automotive and industrial electronics are further boosting demand, with a focus on high-performance, low-power solutions for critical applications.

Germany Power Management IC Market Insight

Germany’s power management IC market is driven by its leadership in automotive electronics, industrial automation, and precision engineering. The country has strong R&D networks and collaborations between semiconductor manufacturers and academic institutions, fostering continuous innovation in low-power and high-efficiency IC solutions. Demand is particularly strong for automotive, industrial, and renewable energy applications, reflecting Germany’s focus on sustainability and technology leadership.

U.K. Power Management IC Market Insight

The U.K. market is supported by a mature electronics industry, growing adoption of renewable energy solutions, and investments in semiconductor design capabilities. Efforts to strengthen local supply chains, coupled with research-driven development in low-power IC technologies, are encouraging market growth. The region also benefits from collaborations between universities, startups, and established semiconductor companies for innovation in energy-efficient power management solutions.

North America Power Management IC Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by robust demand for power-efficient ICs in consumer electronics, electric vehicles, and industrial automation. The region’s focus on smart devices, advanced automotive electronics, and semiconductor innovation is fueling growth. In addition, increasing reshoring of semiconductor manufacturing, investments in EV infrastructure, and rising adoption of energy-efficient electronics are supporting market expansion.

U.S. Power Management IC Market Insight

The U.S. accounted for the largest share in the North America power management IC market in 2024, underpinned by its advanced semiconductor industry, strong R&D infrastructure, and leadership in electric vehicle and consumer electronics markets. The country’s focus on innovation, regulatory compliance, and sustainability is encouraging the use of energy-efficient power management ICs. Presence of key players, strategic partnerships, and a mature distribution network further solidify the U.S.'s leading position in the region.

Power Management IC Market Share

The power management IC industry is primarily led by well-established companies, including:

- Texas Instruments Inc. (U.S.)

- Analog Devices, Inc. (U.S.)

- Infineon Technologies AG (Germany)

- STMicroelectronics NV (Switzerland)

- NXP Semiconductors N.V. (Netherlands)

- Renesas Electronics Corporation (Japan)

- On Semiconductor Corporation (U.S.)

- ROHM Co., Ltd. (Japan)

- Power Integrations, Inc. (U.S.)

- Dialog Semiconductor plc (U.K.)

- Toshiba Electronic Devices & Storage Corporation (Japan)

- Microchip Technology Inc. (U.S.)

Latest Developments in Global Power Management IC Market

- In July 2024, Renesas Electronics introduced a comprehensive space-ready power management reference design for AMD's Versal AI Edge Adaptive SoC. Developed in collaboration with AMD, the design integrates key space-grade components, including radiation-tolerant voltage regulators and GaN FET drivers, to ensure reliable power delivery in space applications. This solution enhances system health monitoring through an intuitive interface and supports both rad-hard and rad-tolerant solutions, making it suitable for next-generation satellite payload systems that demand tight voltage tolerances, high current, and efficient power conversion

- In May 2024, Yageo Corporation announced its plan to acquire a 20.23% stake in uPI Semiconductor Corp for approximately USD 162.35 million (NT$5.31 billion). This strategic investment aims to strengthen Yageo's presence in the AI and high-performance computing (HPC) applications market. uPI's expertise in power management chip design complements Yageo's existing portfolio, enhancing its capabilities in providing high-density power solutions for AI-related applications and HPC devices

- In March 2024, Infinix launched its first self-developed power management chip, the Cheetah X1, designed to optimize charging efficiency in its NOTE 40 series smartphones. The chip supports All-Round FastCharge 2.0 technology, integrating three modules to adapt to eight different charging scenarios. Features such as high-precision power monitoring and enhanced security measures result in improved battery life, faster charging, and reliable performance for consumers

- In January 2024, Texas Instruments expanded its power management IC portfolio with new devices targeting automotive and industrial applications. These PMICs offer integrated voltage regulation, power sequencing, and fault protection, addressing the growing demand for efficient power solutions in electric vehicles and industrial automation. The new devices enhance system reliability while reducing component count, enabling more compact and cost-effective designs

- In November 2023, Analog Devices launched a series of high-efficiency DC-DC converters for edge computing applications. These converters provide precise voltage regulation and low ripple, ensuring stable power delivery to processors and memory modules in edge devices. Optimized for thermal performance and compact form factors, they are suitable for deployment in environments with limited space and strict power requirements

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Power Management Ic Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Power Management Ic Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Power Management Ic Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.