Global Power Packed Liquid Vitamin Market

Market Size in USD Million

CAGR :

%

USD

643.86 Million

USD

1,026.22 Million

2024

2032

USD

643.86 Million

USD

1,026.22 Million

2024

2032

| 2025 –2032 | |

| USD 643.86 Million | |

| USD 1,026.22 Million | |

|

|

|

|

Power-Packed Liquid Vitamin Market Size

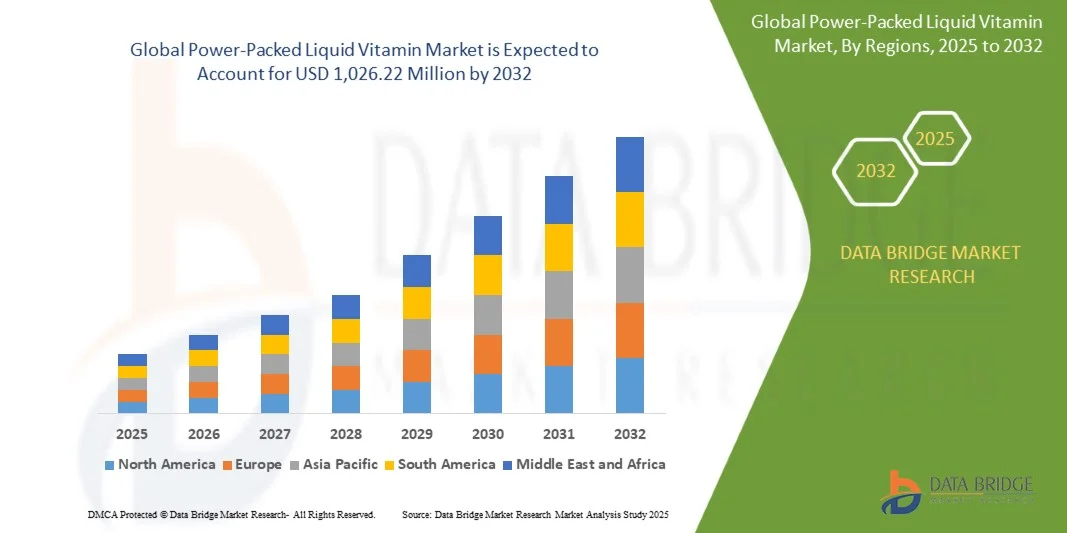

- The global power-packed liquid vitamin market size was valued at USD 643.86 million in 2024 and is expected to reach USD 1,026.22 million by 2032, at a CAGR of 6.00% during the forecast period

- The market growth is largely fuelled by the rising consumer preference for convenient, fast-absorbing, and bioavailable nutritional supplements, especially among health-conscious populations

- Increasing awareness regarding immunity-boosting, energy-enhancing, and overall wellness benefits of liquid vitamins is driving demand across all age groups and demographics

Power-Packed Liquid Vitamin Market Analysis

- Rapid adoption of liquid vitamins in the functional food and beverage segment is creating substantial growth opportunities, particularly in urban regions with high health awareness.

- Advancements in formulation technology, such as flavor masking and enhanced bioavailability, are enhancing consumer acceptance and repeat usage

- Asia-Pacific dominated the power-packed liquid vitamin market with the largest revenue share of 38.5% in 2024, driven by rising health awareness, increasing disposable incomes, and growing demand for convenient nutritional supplements

- North America region is expected to witness the highest growth rate in the global power-packed liquid vitamin market, driven by advanced distribution networks, high consumer spending on health products, and increasing adoption of fortified liquid vitamin products

- The water-soluble segment held the largest market revenue share in 2024, driven by its wide usage in fortified beverages, dietary supplements, and functional drinks. Water-soluble vitamins such as B-complex and vitamin C are preferred due to their rapid absorption, ease of formulation, and compatibility with liquid delivery formats, making them highly popular among health-conscious consumers

Report Scope and Power-Packed Liquid Vitamin Market Segmentation

|

Attributes |

Power-Packed Liquid Vitamin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Power-Packed Liquid Vitamin Market Trends

“Increasing Demand for Convenient and Fast-Absorbing Nutritional Supplements”

- The growing preference for liquid vitamins over traditional tablets and capsules is transforming the dietary supplement landscape by offering faster absorption and ease of consumption. The portability and ready-to-drink format allow consumers to meet daily nutrient requirements conveniently, resulting in improved compliance and overall wellness. Increasing urbanization and busy lifestyles are further encouraging consumers to adopt quick, on-the-go nutrition solutions, boosting market penetration

- Rising health consciousness and a focus on immunity-boosting supplements are accelerating the adoption of fortified liquid vitamin formulations. These products are particularly popular among busy professionals, students, and elderly consumers who require convenient, nutrient-rich solutions. In addition, the popularity of personalized nutrition and functional beverages is fueling innovation in liquid vitamin blends, expanding product variety in the market

- Affordability, taste variety, and inclusion of multiple vitamins and minerals in single formulations are making liquid vitamins attractive for a broad consumer base, promoting repeat purchases and brand loyalty. Consumers benefit from enhanced energy, immunity support, and overall health maintenance. Marketing campaigns emphasizing natural ingredients and flavor enhancements are also increasing consumer acceptance and engagement

- For instance, in 2023, several North American and European beverage companies reported a surge in sales of multivitamin liquid shots, driven by increasing demand for functional beverages that support immunity and daily nutritional needs. The introduction of innovative packaging formats, such as single-serve bottles and squeezable packs, also contributed to higher sales and convenience for on-the-go consumption

- While adoption of liquid vitamins is increasing, market growth depends on continued innovation in formulations, flavor profiles, and packaging to ensure convenience, stability, and consumer satisfaction. Manufacturers must also address storage and transport challenges to maintain nutrient efficacy, which is essential for long-term market growth

Power-Packed Liquid Vitamin Market Dynamics

Driver

“Rising Health Awareness and Expanding Functional Beverage Industry”

- Growing awareness of the importance of daily nutrient intake is driving the demand for liquid vitamin products, fueling market growth across all age groups. Consumers are increasingly prioritizing immunity, energy, and overall wellness, boosting product adoption. Social media campaigns, health apps, and nutrition programs are also reinforcing the importance of liquid supplements, enhancing consumer education and product uptake

- Manufacturers are innovating with multivitamin blends, plant-based ingredients, and functional formulations to cater to diverse consumer preferences, increasing market penetration and competitiveness. Product differentiation strategies, including sugar-free, organic, and fortified options, are enabling brands to target niche consumer segments and premium markets, expanding revenue opportunities

- The expanding functional beverage sector and collaborations with health and fitness brands are further accelerating the adoption of liquid vitamins in retail and online channels worldwide. E-commerce platforms and subscription models are providing easier access and convenience, driving higher sales and brand loyalty among tech-savvy and health-conscious consumers

- For instance, in 2022, beverage companies in the U.S. and Europe introduced new liquid vitamin lines with added probiotics and antioxidants, boosting consumer engagement and driving higher sales volumes. Joint marketing initiatives with gyms, wellness centers, and nutritionists have further amplified market visibility and consumer trust in these products

- While demand is rising steadily, manufacturers face pressure to maintain product quality, regulatory compliance, and affordability to ensure sustained growth. Continuous R&D investments and strategic partnerships with ingredient suppliers are necessary to meet evolving consumer expectations and nutritional standards

Restraint/Challenge

“High Production Costs and Regulatory Compliance Challenges”

- The liquid vitamin market faces challenges due to high production costs associated with nutrient stabilization, flavor masking, and packaging to ensure shelf-life and bioavailability. These factors can limit affordability for price-sensitive consumers. Additional costs arise from advanced preservation techniques, specialized bottling, and cold-chain logistics, which are critical for product efficacy and shelf stability

- Strict regulations concerning labeling, health claims, and nutrient content vary across regions, increasing compliance complexity for manufacturers and delaying product launches. Frequent regulatory updates and regional differences require substantial monitoring, legal support, and testing, adding operational overhead for global manufacturers

- Limited availability of premium-quality raw materials for specific vitamins, minerals, and botanical extracts can restrict production capacity and formulation innovation, impacting market expansion. Supply chain disruptions, seasonal ingredient availability, and competition for high-demand nutrients exacerbate production challenges, affecting timely product delivery

- For instance, in 2023, several North American liquid vitamin manufacturers reported delays in launching new multivitamin products due to sourcing issues and evolving regulatory requirements. These delays also impacted promotional campaigns and seasonal sales, highlighting the need for strategic supplier relationships and contingency planning

- While innovation continues, addressing cost pressures, raw material availability, and stringent regulatory standards remains crucial for stakeholders to achieve long-term growth and meet rising consumer demand. Companies must invest in scalable manufacturing technologies, quality assurance, and regional compliance expertise to sustain market competitiveness

Power-Packed Liquid Vitamin Market Scope

The market is segmented on the basis of solubility and application.

• By Solubility

On the basis of solubility, the power-packed liquid vitamin market is segmented into water-soluble and fat-soluble vitamins. The water-soluble segment held the largest market revenue share in 2024, driven by its wide usage in fortified beverages, dietary supplements, and functional drinks. Water-soluble vitamins such as B-complex and vitamin C are preferred due to their rapid absorption, ease of formulation, and compatibility with liquid delivery formats, making them highly popular among health-conscious consumers.

The fat-soluble segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for vitamins A, D, E, and K in liquid formulations that support bone health, immunity, and skin health. Fat-soluble vitamins are particularly favored in nutraceuticals and specialized functional beverages, as they offer long-term health benefits and can be incorporated into a wide variety of food, drink, and supplement products.

• By Application

On the basis of application, the market is segmented into food and beverages, pharmaceuticals, feed additives, and cosmetics. The food and beverages segment held the largest market revenue share in 2024, fueled by the growing popularity of fortified drinks, nutritional shots, and functional beverages among busy and health-conscious consumers. This segment benefits from strong distribution channels, increasing consumer awareness, and rising preference for convenient liquid nutrition options.

The pharmaceuticals segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising use of liquid vitamin formulations in therapeutic supplements, pediatric nutrition, and clinical nutrition products. Liquid vitamins in pharmaceutical applications offer precise dosing, enhanced bioavailability, and ease of administration, particularly for infants, elderly, and patients with swallowing difficulties.

Power-Packed Liquid Vitamin Market Regional Analysis

- Asia-Pacific dominated the power-packed liquid vitamin market with the largest revenue share of 38.5% in 2024, driven by rising health awareness, increasing disposable incomes, and growing demand for convenient nutritional supplements

- Consumers in the region highly value fast-absorbing liquid formulations, fortified products, and ready-to-drink convenience, which enable them to meet daily nutrient requirements efficiently

- This widespread adoption is further supported by rapid urbanization, government initiatives promoting wellness, and the availability of affordable functional beverages, making liquid vitamins a preferred choice across age groups

China Power-Packed Liquid Vitamin Market Insight

The China market captured the largest revenue share in 2024 within Asia-Pacific, fueled by rising preventive healthcare awareness, urban lifestyles, and expanding functional beverage consumption. Consumers are increasingly adopting multivitamin liquid shots, fortified drinks, and ready-to-consume formulations. Strong domestic manufacturing, competitive pricing, and wide retail and e-commerce availability further contribute to market expansion.

U.S. Power-Packed Liquid Vitamin Market Insight

The U.S. market is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising health consciousness and the increasing popularity of functional beverages. Consumers are prioritizing immunity, energy, and overall wellness, driving demand for multivitamin liquid shots, fortified drinks, and ready-to-consume formulations. The growing availability of diverse flavors, plant-based options, and convenient packaging is further contributing to market expansion.

Japan Power-Packed Liquid Vitamin Market Insight

The Japan market is expected to witness the fastest growth rate from 2025 to 2032, driven by a high-tech culture, aging population, and increasing preference for convenient, fast-absorbing supplements. Consumers prioritize product quality, safety, and efficacy, supporting demand for multivitamin and functional liquid formulations. Integration with daily wellness routines and institutional usage further bolsters market growth.

North America Power-Packed Liquid Vitamin Market Insight

North America is expected to witness the fastest growth rate from 2025 to 2032, driven by high health consciousness, rising demand for functional beverages, and established retail and online distribution channels. The U.S. captured the largest revenue share of 79% in 2024, fueled by growing interest in immunity, energy, and overall wellness products. Consumers value convenience, taste variety, and nutrient-rich formulations, boosting adoption across households and institutions.

Europe Power-Packed Liquid Vitamin Market Insight

The Europe market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by wellness trends, adoption of fortified beverages, and regulatory support for nutritional supplements. Consumers prefer high-quality, bioavailable, and safe liquid vitamin products. Retail, e-commerce, and functional beverage sectors are witnessing strong growth, with innovative packaging and flavors enhancing market acceptance.

U.K. Power-Packed Liquid Vitamin Market Insight

The U.K. market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing health awareness, convenience-seeking consumers, and rising demand for immunity and energy-focused products. Developed retail infrastructure and growing online channels facilitate wider product availability. Consumer focus on lifestyle-related nutrient supplementation and preference for easy-to-consume liquid vitamins are further stimulating market growth.

Germany Power-Packed Liquid Vitamin Market Insight

The Germany market is expected to witness the fastest growth rate from 2025 to 2032, fueled by strong health-conscious consumer behavior, advanced distribution networks, and preference for functional beverages. Emphasis on quality, safety, and bioavailability encourages manufacturers to innovate in formulations, flavor profiles, and packaging formats. Integration of liquid vitamins into daily dietary routines is increasingly prevalent, supporting sustained market expansion

Power-Packed Liquid Vitamin Market Share

The Power-Packed Liquid Vitamin industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Cargill, Incorporated (U.S.)

- ADM (U.S.)

- Lonza (Switzerland)

- DSM (Netherlands)

- Bactolac Pharmaceutical, Inc. (U.S.)

- Atlantic Essentials Products, INC. (U.S.)

- Amway India Enterprises Pvt. Ltd. (India)

- AIE Pharmaceuticals, Inc. (U.S.)

- Trace Mineral Research (U.S.)

- Glanbia PLC (Ireland)

- SternVitamin GmbH & Co. KG (Germany)

- Jubilant Life Sciences Limited (India)

- CSPC Pharmaceutical Group Limited (China)

- Adisseo (France)

- Farbest Brands (U.S.)

- Vertellus Holdings LLC (U.S.)

- BTSA BIOTECNOLOGÍAS APLICADAS S.L (Spain)

- Rabar Animal Nutrition (U.S.)

- Zhejiang Garden Biochemical High-Tech Co., Ltd (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Power Packed Liquid Vitamin Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Power Packed Liquid Vitamin Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Power Packed Liquid Vitamin Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.