Global Power Sports Batteries Market

Market Size in USD Billion

CAGR :

%

USD

11.50 Billion

USD

18.05 Billion

2025

2033

USD

11.50 Billion

USD

18.05 Billion

2025

2033

| 2026 –2033 | |

| USD 11.50 Billion | |

| USD 18.05 Billion | |

|

|

|

|

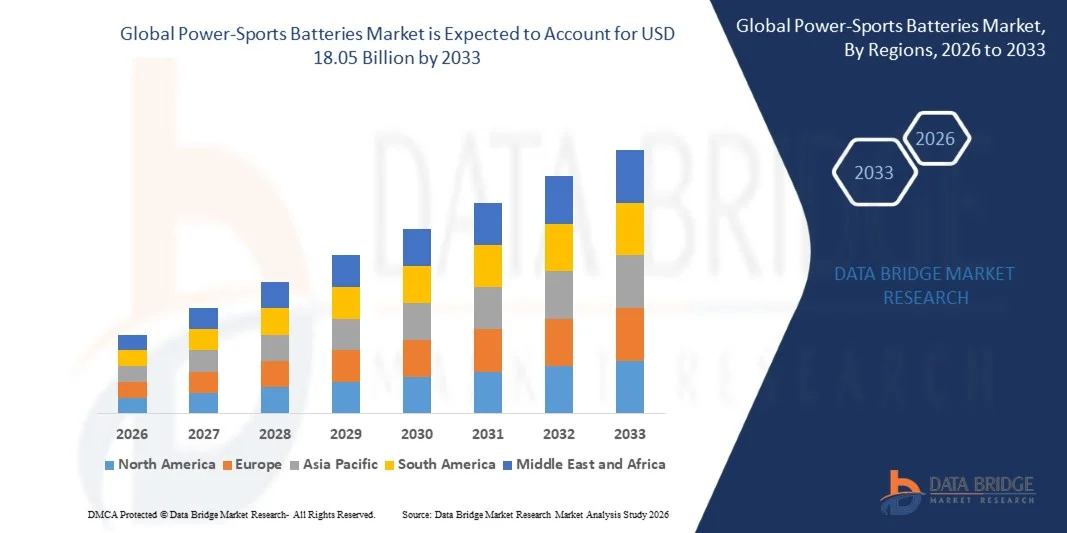

What is the Global Power-Sports Batteries Market Size and Growth Rate?

- The global power-sports batteries market size was valued at USD 11.50 billion in 2025 and is expected to reach USD 18.05 billion by 2033, at a CAGR of5.80% during the forecast period

- The power-sports batteries market has a huge potential to grow over the forecast period of 2021 to 2028, due to the rapid increase in incorporation of electronic systems in vehicles, counting GPS, Bluetooth and navigation systems that need constant power supply

- In addition, increase in two wheeler productions associated with increase in the demand for fleet of motorcycles and scooters is also largely influencing the growth of the power-sports batteries market

What are the Major Takeaways of Power-Sports Batteries Market?

- The rise in disposable income of the population is another driver flourishing the growth of power-sports batteries market, which in turn is raising the growth of the target market

- In addition, the rising trend of off-highway sports as well as shifting inclination toward off-highway sports, such as short-course racing, desert racing and hill climbing will also boost the growth of the power-sports batteries market in the above mentioned forecast period

- Asia-Pacific dominated the power-sports batteries market with an 41.8% revenue share in 2025, driven by high production and sales of motorcycles, scooters, ATVs, and utility vehicles across China, India, Japan, and Southeast Asia

- North America is expected to register the fastest CAGR of 8.21% from 2026 to 2033, driven by increasing popularity of recreational power-sports activities, off-road sports, and utility vehicles across the U.S. and Canada

- The Motorcycles segment dominated the market with a 42.6% share in 2025, driven by the large global motorcycle parc, high replacement frequency, and widespread use across commuter, premium, and racing categories

Report Scope and Power-Sports Batteries Market Segmentation

|

Attributes |

Power-Sports Batteries Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Power-Sports Batteries Market?

“Increasing Shift Toward Lightweight, High-Performance, and Lithium-Based Power-Sports Batteries”

- The power-sports batteries market is witnessing a strong shift toward lightweight, compact, and high-energy-density batteries, particularly lithium-ion and lithium iron phosphate (LiFePO₄), to improve vehicle performance and handling

- Manufacturers are introducing high-cranking-power, fast-charging, and maintenance-free batteries designed for motorcycles, ATVs, UTVs, snowmobiles, and personal watercraft

- Growing demand for space-efficient and vibration-resistant battery designs is driving adoption across racing, recreational, and utility power-sports applications

- For instance, companies such as GS Yuasa, Exide Technologies, Clarios, and EnerSys are expanding lithium-based and advanced AGM battery portfolios for high-performance power-sports vehicles

- Increasing focus on longer service life, quick recharge capability, and improved cold-cranking performance is accelerating the replacement of conventional lead-acid batteries

- As power-sports vehicles become more performance-oriented and technologically advanced, high-efficiency batteries will remain critical for reliability, durability, and rider experience

What are the Key Drivers of Power-Sports Batteries Market?

- Rising demand for high-performance and durable batteries to support increased engine power, electronic features, and onboard accessories in modern power-sports vehicles

- For instance, in 2024–2025, manufacturers such as Trojan Battery, BS-Battery, and Fullriver Battery launched enhanced AGM and lithium batteries with higher cold-cranking amps and extended cycle life

- Growing popularity of recreational power-sports activities, off-road sports, and motorsports events across the U.S., Europe, and Asia-Pacific is boosting battery replacement demand

- Advancements in battery chemistry, thermal stability, and battery management systems (BMS) have improved safety, efficiency, and lifespan

- Rising adoption of electric and hybrid power-sports vehicles, including electric motorcycles and ATVs, is creating new growth opportunities for advanced battery technologies

- Supported by expanding vehicle parc, frequent battery replacement cycles, and continuous innovation, the power-sports batteries market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Power-Sports Batteries Market?

- Higher costs of lithium-based and premium AGM batteries compared to conventional lead-acid alternatives limit adoption among price-sensitive consumers

- For instance, during 2024–2025, fluctuations in lithium prices, raw material costs, and supply chain constraints increased battery manufacturing expenses for global suppliers

- Performance sensitivity to extreme temperatures, improper charging, and limited charging infrastructure can impact battery reliability in certain regions

- Limited consumer awareness regarding battery maintenance, compatibility, and lifecycle benefits slows adoption of advanced battery technologies

- Competition from low-cost conventional batteries and aftermarket alternatives creates pricing pressure and affects profit margins

- To address these challenges, manufacturers are focusing on cost optimization, consumer education, and improved battery durability to support wider adoption of Power-Sports Batteries

How is the Power-Sports Batteries Market Segmented?

The market is segmented on the basis of vehicle type, battery type, voltage range, and distribution channel.

- By Vehicle Type

On the basis of vehicle type, the power-sports batteries market is segmented into Motorcycles, Scooters and Mopeds, ATVs and Quads, Golf Carts, Water Sports, Snowmobiles, UTVs, and Lawn Mowers. The Motorcycles segment dominated the market with a 42.6% share in 2025, driven by the large global motorcycle parc, high replacement frequency, and widespread use across commuter, premium, and racing categories. Motorcycles require compact, lightweight batteries with high cold-cranking amps, making AGM and lithium batteries highly preferred. Strong demand from Asia-Pacific and Europe further supports dominance.

The UTVs segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising adoption of UTVs for recreational, agricultural, and utility applications. Increasing use of high-power accessories, winches, GPS systems, and electronic controls is driving demand for higher-capacity and durable batteries, boosting growth across North America and emerging markets.

- By Battery Type

On the basis of battery type, the market is segmented into Conventional Batteries, Absorbent Glass Mat (AGM) Batteries, Lithium Batteries, and Others. The AGM Batteries segment held the largest market share of 38.9% in 2025, due to their maintenance-free design, vibration resistance, spill-proof construction, and superior cold-cranking performance. AGM batteries are widely used across motorcycles, ATVs, and UTVs, offering a balance between cost, durability, and performance.

The Lithium Batteries segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for lightweight, fast-charging, and long-life batteries. Lithium batteries offer significantly lower weight, higher energy density, and longer cycle life, making them attractive for high-performance and electric power-sports vehicles. Declining lithium costs and growing consumer awareness are further accelerating adoption.

- By Voltage Range

Based on voltage range, the power-sports batteries market is segmented into 6 Volt, 12 Volt, 24 Volt, 36 Volt, 48 Volt, and Others. The 12 Volt segment dominated the market with a 51.4% share in 2025, as it is the standard voltage configuration for most motorcycles, ATVs, scooters, and lawn mowers. High compatibility, ease of replacement, and extensive OEM adoption continue to drive strong demand for 12-volt batteries globally.

The 48 Volt segment is expected to register the fastest CAGR from 2026 to 2033, supported by growing use in electric golf carts, UTVs, and electric power-sports vehicles. Increasing electrification, higher power requirements, and improved battery management systems are boosting demand for higher-voltage battery packs, particularly in commercial, recreational, and fleet-based applications.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Original Equipment Manufacturer (OEM) and Aftermarket/Replacement. The Aftermarket/Replacement segment dominated the market with a 59.2% share in 2025, driven by shorter battery lifespans, frequent usage in rugged environments, and high replacement cycles in power-sports vehicles. Consumers prefer aftermarket options due to wider availability, competitive pricing, and compatibility with multiple vehicle models.

The OEM segment is anticipated to grow at the fastest CAGR from 2026 to 2033, driven by rising production of new power-sports vehicles and increasing OEM integration of advanced AGM and lithium batteries. Strong partnerships between battery manufacturers and vehicle OEMs, along with the growing trend of factory-fitted high-performance batteries, are supporting accelerated OEM channel growth.

Which Region Holds the Largest Share of the Power-Sports Batteries Market?

- Asia-Pacific dominated the power-sports batteries market with an 41.8% revenue share in 2025, driven by high production and sales of motorcycles, scooters, ATVs, and utility vehicles across China, India, Japan, and Southeast Asia. Strong presence of two-wheeler manufacturers, expanding recreational vehicle usage, and frequent battery replacement cycles continue to fuel regional demand

- Leading battery manufacturers in Asia-Pacific are expanding AGM and lithium battery production, focusing on cost efficiency, durability, and high cold-cranking performance to serve both OEM and aftermarket channels

- Large consumer base, rising disposable incomes, growing urban mobility, and continuous investment in automotive and power-sports manufacturing ecosystems further strengthen Asia-Pacific’s market leadership

China Power-Sports Batteries Market Insight

China is the largest contributor within Asia-Pacific, supported by massive two-wheeler production volumes, growing adoption of electric motorcycles and scooters, and strong domestic battery manufacturing capacity. Increasing penetration of lithium batteries, competitive pricing, and export-oriented production significantly boost market growth.

India Power-Sports Batteries Market Insight

India shows strong momentum driven by rising motorcycle and scooter ownership, expanding rural mobility, and rapid growth of the aftermarket replacement segment. Government initiatives supporting EVs and local battery manufacturing further enhance demand for advanced power-sports batteries.

Japan Power-Sports Batteries Market Insight

Japan demonstrates steady growth supported by premium motorcycle brands, motorsports culture, and strong demand for high-reliability AGM and lithium batteries. Emphasis on quality, safety, and performance sustains long-term market expansion.

North America Power-Sports Batteries Market

North America is expected to register the fastest CAGR of 8.21% from 2026 to 2033, driven by increasing popularity of recreational power-sports activities, off-road sports, and utility vehicles across the U.S. and Canada. High adoption of ATVs, UTVs, snowmobiles, golf carts, and personal watercraft is significantly boosting battery demand. Growing consumer preference for high-performance, lightweight, and lithium-based batteries further accelerates market growth.

U.S. Power-Sports Batteries Market Insight

The U.S. leads regional growth due to strong recreational vehicle usage, well-established aftermarket networks, and high replacement rates. Rising demand for premium AGM and lithium batteries, along with increasing electrification of power-sports vehicles, supports sustained market expansion.

Canada Power-Sports Batteries Market Insight

Canada contributes steadily, supported by strong demand for snowmobiles, ATVs, and utility vehicles in extreme weather conditions. Preference for durable, cold-resistant batteries and growing recreational vehicle ownership continue to drive adoption.

Which are the Top Companies in Power-Sports Batteries Market?

The power-sports batteries industry is primarily led by well-established companies, including:

- Clarios (U.S.)

- CROWN BATTERY (U.S.)

- Discover Battery (Canada)

- East Penn Manufacturing Company (U.S.)

- ENERSYS (U.S.)

- Exide Technologies (U.S.)

- Fullriver Battery (U.S.)

- Go Power (U.S.)

- GS Yuasa International Ltd. (Japan)

- Harris Battery (U.S.)

- Interstate Batteries (U.S.)

- Johnson Controls (Ireland/U.S.)

- MIDAC S.P.A. (Italy)

- Navitas System, LLC Corporate (U.S.)

- Power Sonic Corporation (U.S.)

- Scorpion Battery, Inc. (U.S.)

- Skyrich Powersport Batteries (China)

- BS-Battery (China)

- Trojan Battery Company (U.S.)

- Whites Powersports (U.S.)

- Batterie Unibat (Belgium)

What are the Recent Developments in Global Power-Sports Batteries Market?

- In December 2023, Interstate Batteries, a leading battery brand operating the largest battery distribution network in North America, announced a strategic partnership with Tractor Supply Company, a U.S.-based rural lifestyle retailer, to exclusively supply automotive, agricultural, commercial, and power-sports batteries, strengthening its aftermarket dominance and expanding retail reach across rural and semi-urban markets

- In June 2023, Braille Battery Inc, a battery manufacturer, revealed plans to expand its “Made in USA” Power-Sports Batteries portfolio by introducing high-capacity lithium and ultra-high cranking batteries for Motorcycle V-Twin models, ATV and UTVs, and personal watercraft, reinforcing its focus on premium performance and domestic manufacturing

- In January 2023, Honda Motor Co and GS Yuasa announced a collaborative agreement to jointly develop high-output, high-capacity lithium-ion batteries, with discussions aimed at establishing a joint venture by the end of 2023, highlighting a long-term commitment to advanced battery innovation and electrification

- In January 2022, Clarios, a major automotive battery manufacturer, announced the development of a next-generation safety battery for electric vehicles, the Smart AGM battery designed to enable real-time performance monitoring, continuous low-voltage power supply, and predictive maintenance, underscoring its emphasis on smart battery technologies and future-ready energy solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.