Global Power To Gas Market

Market Size in USD Billion

CAGR :

%

USD

46.76 Billion

USD

110.52 Billion

2025

2033

USD

46.76 Billion

USD

110.52 Billion

2025

2033

| 2026 –2033 | |

| USD 46.76 Billion | |

| USD 110.52 Billion | |

|

|

|

|

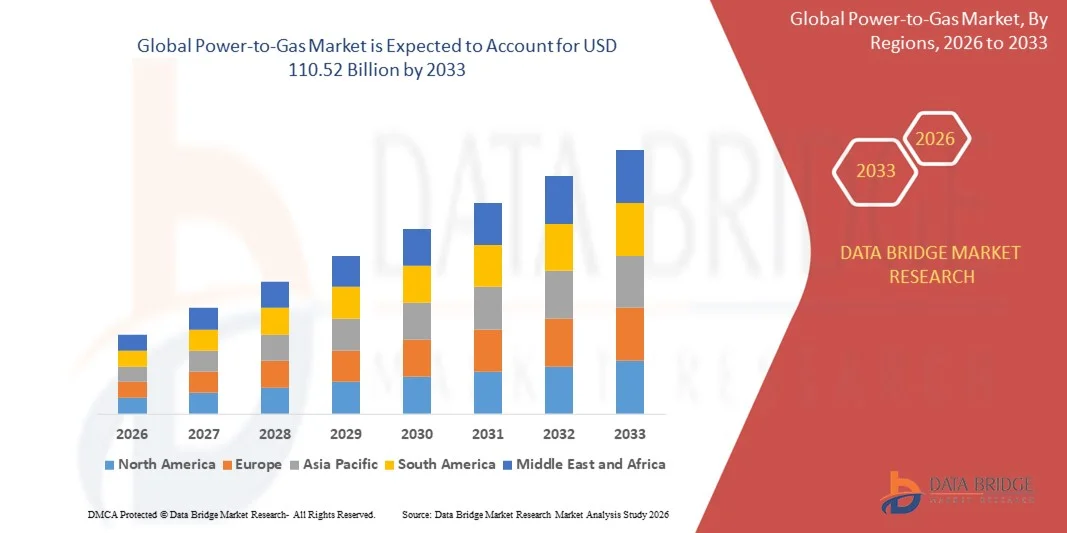

What is the Global Power-to-Gas Market Size and Growth Rate?

- The global power-to-gas market size was valued at USD 46.76 billion in 2025 and is expected to reach USD 110.52 billion by 2033, at a CAGR of11.35% during the forecast period

- Major factors that are expected to boost the growth of the power-to-gas market in the forecast period are the rise in the efficient consumption of renewable energy resources and the joined management of power and gas networks

- On the other hand, the rise in the capital price of the power-to-gas systems and the decrease in the efficiency and energy loss are couple of the factors that are anticipated to impede the growth of the efficient in the timeline period

What are the Major Takeaways of Power-to-Gas Market?

- The likely usage of hydrogen in the mobility solutions and hydrogen can be utilized as an alternative for natural gas will further provide lucrative opportunities for the growth of the power-to-gas market in the coming years

- However, the controlling limit for hydrogen blending in the natural gas network and the convenience of low-cost natural gas and battery technologies might further create challenges for the growth of the power-to-gas market in the near future

- Europe dominated the Power-to-Gas market with a 40.8% revenue share in 2025, driven by strong renewable energy penetration, aggressive decarbonization targets, and early adoption of hydrogen and synthetic gas technologies across Germany, France, the U.K., and the Nordic countries

- Asia-Pacific is projected to register the fastest CAGR of 8.36% from 2026 to 2033, driven by rapid semiconductor expansion, strong electronics manufacturing ecosystems, 5G deployment, and rising adoption of embedded systems across China, Japan, India, South Korea, and Southeast Asia

- The Electrolysis segment dominated the market with a 63.2% share in 2025, driven by widespread deployment of water electrolyzers for green hydrogen production using renewable electricity

Report Scope and Power-to-Gas Market Segmentation

|

Attributes |

Power-to-Gas Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Power-to-Gas Market?

Increasing Shift Toward Large-Scale, Integrated, and Renewable-Based Power-to-Gas Systems

- The power-to-Gas market is witnessing rising adoption of integrated electrolysis and methanation systems designed to convert surplus renewable electricity into hydrogen or synthetic methane

- Technology providers are introducing high-capacity, modular, and flexible electrolyzers that can rapidly respond to fluctuating renewable power inputs from wind and solar sources

- Growing focus on grid balancing, seasonal energy storage, and decarbonization of gas networks is accelerating deployment of Power-to-Gas solutions across utilities and industrial users

- For instance, companies such as Siemens, Nel ASA, thyssenkrupp, MAN Energy Solutions, and ITM Power are expanding large-scale Power-to-Gas projects with improved efficiency, scalability, and system integration

- Increasing need to store excess renewable energy and reduce curtailment is driving investment in hydrogen injection and synthetic methane production

- As energy systems shift toward low-carbon models, Power-to-Gas technologies will remain critical for renewable energy integration, long-duration storage, and sector coupling

What are the Key Drivers of Power-to-Gas Market?

- Rising demand for green hydrogen and renewable synthetic fuels to support decarbonization of power, gas, transport, and industrial sectors

- For instance, in 2024–2025, leading companies such as Nel ASA, McPhy Energy, and Sunfire GmbH expanded electrolyzer capacities and participated in large-scale Power-to-Gas demonstration projects

- Growing penetration of wind and solar energy is increasing the need for flexible energy storage solutions across Europe, Asia-Pacific, and North America

- Supportive government policies, hydrogen strategies, and carbon reduction targets are accelerating commercial adoption of Power-to-Gas systems

- Advancements in electrolysis efficiency, system automation, and catalyst technologies are improving operational performance and cost competitiveness

- Supported by strong investment in renewable infrastructure and hydrogen economies, the Power-to-Gas market is expected to witness robust long-term growth

Which Factor is Challenging the Growth of the Power-to-Gas Market?

- High capital expenditure and system integration costs associated with large-scale electrolyzers and methanation units limit widespread deployment

- For instance, during 2024–2025, rising material costs, supply-chain constraints, and project financing challenges delayed several power-to-gas installations

- Limited availability of hydrogen transport, storage infrastructure, and grid injection standards creates regulatory and technical barriers

- Efficiency losses during electricity-to-gas conversion affect overall system economics

- Competition from alternative energy storage technologies such as batteries and pumped hydro reduces short-term adoption in some regions

- To address these challenges, companies are focusing on cost reduction, standardization, policy alignment, and infrastructure development to scale global adoption of Power-to-Gas solutions

How is the Power-to-Gas Market Segmented?

The market is segmented on the basis of technology, capacity, and end user.

- By Technology

On the basis of technology, the power-to-gas market is segmented into Electrolysis and Methanation. The Electrolysis segment dominated the market with a 63.2% share in 2025, driven by widespread deployment of water electrolyzers for green hydrogen production using renewable electricity. Electrolysis technologies, including alkaline, PEM, and solid oxide electrolyzers, are extensively adopted due to their scalability, operational flexibility, and direct compatibility with wind and solar energy sources. Growing investments in hydrogen hubs, industrial decarbonization projects, and grid-balancing applications further support segment dominance.

The Methanation segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rising interest in converting hydrogen and captured CO₂ into synthetic methane. Increasing focus on utilizing existing gas infrastructure, seasonal energy storage, and carbon recycling is accelerating adoption of biological and catalytic methanation technologies across Europe and Asia-Pacific.

- By Capacity

On the basis of capacity, the power-to-gas market is segmented into Less than 100 kW, 100 kW–1,000 kW, and 1,000 kW and above. The 100 kW–1,000 kW segment dominated the market with a 41.6% share in 2025, supported by strong adoption in pilot projects, industrial facilities, and medium-scale renewable integration systems. This capacity range offers an optimal balance between investment cost, operational efficiency, and scalability, making it suitable for commercial demonstrations and early-stage grid applications.

The 1,000 kW and above segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing deployment of large-scale Power-to-Gas plants for utility-level energy storage, hydrogen production, and gas grid injection. Expansion of renewable energy capacity and national hydrogen strategies are accelerating demand for high-capacity systems.

- By End User

On the basis of end user, the power-to-gas market is segmented into Commercial, Utilities, and Industrial sectors. The Utilities segment dominated the market with a 45.8% share in 2025, driven by strong adoption of Power-to-Gas systems for grid balancing, renewable energy storage, and gas network decarbonization. Electric and gas utilities are actively investing in large-scale electrolyzers and hydrogen blending projects to manage renewable intermittency and enhance energy system flexibility.

The Industrial segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising demand for green hydrogen in refining, chemicals, steel production, and synthetic fuel manufacturing. Increasing carbon reduction commitments and hydrogen-based process transformation are accelerating industrial adoption of Power-to-Gas technologies globally.

Which Region Holds the Largest Share of the Power-to-Gas Market?

- Europe dominated the power-to-gas market with a 40.8% revenue share in 2025, driven by strong renewable energy penetration, aggressive decarbonization targets, and early adoption of hydrogen and synthetic gas technologies across Germany, France, the U.K., and the Nordic countries. Large-scale integration of wind and solar power, combined with the need for long-duration energy storage and grid balancing, continues to fuel Power-to-Gas deployment

- Leading European companies and utilities are actively investing in electrolysis-based hydrogen production, methanation plants, and gas grid injection projects, supported by EU hydrogen strategies and funding programs

- Strong policy support, advanced gas infrastructure, cross-border energy collaboration, and high concentration of Power-to-Gas pilot and commercial projects reinforce Europe’s leadership in the global market

Germany Power-to-Gas Market Insight

Germany leads the European power-to-gas market, driven by high renewable energy penetration, strong government support for green hydrogen, and large-scale electrolyzer deployment. The country actively uses Power-to-Gas for grid balancing, hydrogen blending, and industrial decarbonization. Extensive pilot and commercial projects, supported by utilities and industrial players, reinforce Germany’s leadership in integrating renewable power with gas infrastructure.

France Power-to-Gas Market Insight

France shows steady growth supported by national hydrogen strategies, renewable integration goals, and investments in synthetic methane and hydrogen injection projects. Gas transmission operators and industrial users are increasingly adopting power-to-gas technologies to decarbonize energy systems. Strong regulatory backing and collaboration between utilities and technology providers continue to strengthen market adoption across the country.

Asia-Pacific Power-to-Gas Market

Asia-Pacific is projected to register the fastest CAGR of 8.36% from 2026 to 2033, driven by rapid semiconductor expansion, strong electronics manufacturing ecosystems, 5G deployment, and rising adoption of embedded systems across China, Japan, India, South Korea, and Southeast Asia. High-volume production of consumer electronics, automotive ECUs, PCBs, and IoT devices increases demand for efficient signal analysis tools. Growth in AI hardware, smart devices, industrial automation, and digital infrastructure continues to accelerate the need for portable, high-accuracy logic analyzers across engineering and manufacturing applications.

China Power-to-Gas Market Insight

China is the largest contributor in Asia-Pacific, driven by massive renewable capacity expansion, rising industrial hydrogen demand, and strong government backing for clean energy storage solutions. Power-to-Gas adoption supports grid stability, energy storage, and decarbonization of heavy industries. Growing investment in large-scale electrolyzers and hydrogen infrastructure accelerates domestic and export-oriented market growth.

Japan Power-to-Gas Market Insight

Japan’s power-to-gas market is supported by its long-term hydrogen society vision and focus on energy security. The country adopts Power-to-Gas for renewable integration, grid stabilization, and synthetic fuel production. Strong emphasis on technology reliability, advanced engineering, and hydrogen-based energy systems ensures steady growth and continued deployment of Power-to-Gas solutions.

India Power-to-Gas Market Insight

India is emerging as a high-growth Power-to-Gas market, driven by rapid renewable energy expansion and national green hydrogen initiatives. Increasing demand for clean fuels across refineries, fertilizers, and heavy industries supports adoption. Improving policy frameworks, pilot projects, and investments in hydrogen infrastructure accelerate power-to-gas deployment across industrial and utility applications.

South Korea Power-to-Gas Market Insight

South Korea contributes significantly through strong investments in hydrogen infrastructure, fuel cell systems, and industrial decarbonization. Power-to-Gas solutions support renewable energy integration and clean hydrogen production. Advanced manufacturing capabilities, government-led hydrogen roadmaps, and growing demand from industrial and mobility sectors sustain long-term market growth.

Which are the Top Companies in Power-to-Gas Market?

The power-to-gas industry is primarily led by well-established companies, including:

- Siemens (Germany)

- thyssenkrupp AG (Germany)

- Nel ASA (Norway)

- MAN Energy Solutions SE (Germany)

- ITM Power (U.K.)

- Hydrogenics (Canada)

- McPhy Energy S.A. (France)

- Electrochaea GmbH (Germany)

- Exytron GmbH (Germany)

- GreenHydrogen (Denmark)

- Hitachi Zosen Inova AG (Switzerland)

- Uniper SE (Germany)

- ENTSOG AISBL (Belgium)

- Sempra Energy (U.S.)

- GRT Gaz (France)

- Sunfire GmbH (Germany)

- Ineratec GmbH (Germany)

- Astrea Power Ltd (U.K.)

- Zentrum für Sonnenenergie- und Wasserstoff-Forschung Baden-Württemberg (Germany)

What are the Recent Developments in Global Power-to-Gas Market?

- In June 2024, Siemens Energy secured a USD 1.5 billion long-term maintenance contract spanning 25 years for the Taiba 2 and Qassim 2 gas-fired power plants in Saudi Arabia, under which Siemens will supply technologies supporting nearly 4 GW of combined power generation across western and central regions, strengthening its long-term footprint in large-scale power infrastructure and services

- In May 2024, Nel Hydrogen Electrolyser AS, a wholly owned subsidiary of Nel ASA, entered into a technology licensing agreement with Reliance Industries Limited, granting RIL exclusive rights to use Nel’s alkaline electrolyzers in India and manufacture them globally for internal use, accelerating green hydrogen deployment and local manufacturing capabilities

- In March 2024, ITM Power partnered with Sumitomo Corporation to deliver and install a NEPTUNE electrolyzer at Tokyo Gas Co Ltd’s Yokohama Techno Station, marking Japan’s first import and deployment of a megawatt-scale PEM electrolyzer manufactured overseas, advancing the country’s hydrogen infrastructure and technology adoption

- In March 2024, thyssenkrupp reached an agreement with gas transmission operators Nowega, OGE, and Thyssengas to connect its Duisburg steel plant to the GET H2 hydrogen pipeline network by 2028, supporting industrial decarbonization across Lower Saxony and North Rhine-Westphalia, reinforcing hydrogen’s role in low-carbon steel production

- In September 2023, Fortum Battery Recycling received a USD 4.5 million grant from Business Finland to expand mechanical processing capacity at its Ikaalinen facility, enhancing feedstock supply for its hydrometallurgical plant in Harjavalta, strengthening Europe’s battery recycling and circular economy capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Power To Gas Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Power To Gas Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Power To Gas Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.