Global Powertrain Market

Market Size in USD Billion

CAGR :

%

USD

812.20 Billion

USD

2,554.52 Billion

2024

2032

USD

812.20 Billion

USD

2,554.52 Billion

2024

2032

| 2025 –2032 | |

| USD 812.20 Billion | |

| USD 2,554.52 Billion | |

|

|

|

|

Powertrain Market Size

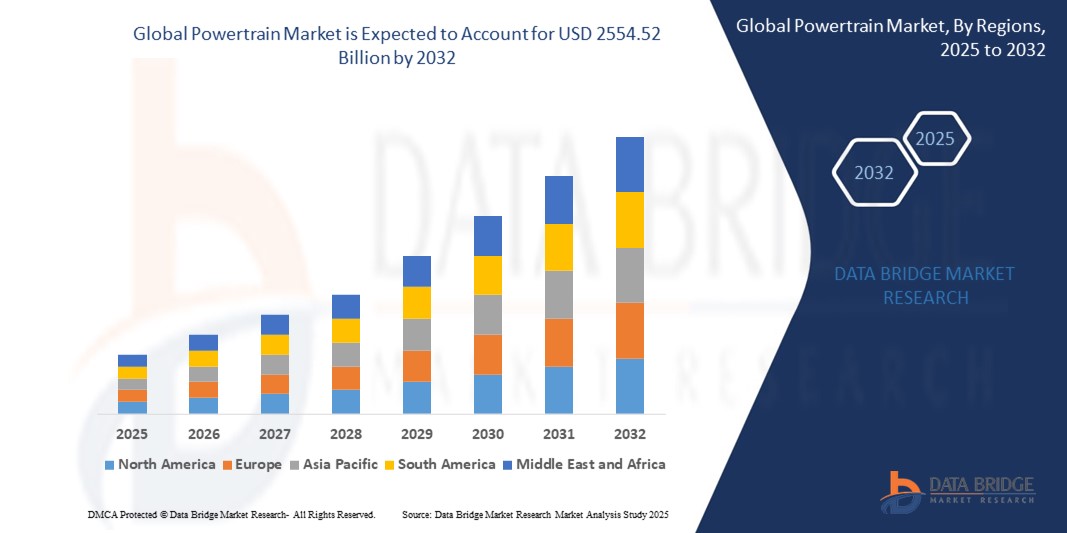

- The Global Powertrain Market size was valued at USD 812.20 Billion in 2024 and is expected to reach USD 2554.52 Billion by 2032, at a CAGR of 15.40% during the forecast period

- Rapid expansion of the automotive sector, especially in emerging markets like Asia-Pacific, is significantly increasing the demand for powertrain systems. Urbanization, rising disposable incomes, and growing vehicle ownership rates are major contributors to this growth.

- Stringent global emission regulations and environmental mandates are compelling manufacturers to develop cleaner, more efficient powertrains. Regulatory pressure is fostering innovation in hybrid and electric powertrains to reduce the carbon footprint of vehicles.

Powertrain Market Analysis

- Luxury sports car manufacturers are embracing electrification. Brands like Porsche, Maserati, and Audi are introducing high-performance electric models, such as the Porsche Taycan Turbo GT, attracting affluent buyers seeking green technology without compromising on performance.

- Advancements in powertrain technologies are shaping the future of mobility. Geely's Global Intelligent New Energy Architecture (GEA) platform exemplifies this trend by integrating AI, electrification, and smart connectivity, supporting various energy types including battery electric and hybrid systems.

- These trends indicate a dynamic and evolving powertrain landscape, where electrification, technological innovation, and regional strategies play pivotal roles in shaping the future of the automotive industry.

- Asia Pacific dominates the Powertrain Market with the largest revenue share of 43.06% in 2024, due to global shift towards electrification, including hybrid and battery electric vehicles (BEVs), is transforming the powertrain landscape. Consumers and governments alike are pushing for greener alternatives, accelerating the adoption of electric powertrain technologies.

- Asia-Pacific is expected to be the fastest growing region in the Powertrain Market due to fuel prices and environmental awareness have led consumers to prioritize vehicles with higher fuel efficiency. This demand is driving automakers to invest in advanced powertrain technologies that offer improved mileage and lower emissions.

- Hybrid and Plug-In Hybrid Vehicle segment dominates the Powertrain Market with a market share of 18.3% in 2024, driven by Innovations such as direct injection, turbocharging, variable valve timing, lightweight materials, and intelligent powertrain management systems are enhancing both performance and efficiency. Integration of AI and IoT is further optimizing powertrain adaptability and responsiveness.

Report Scope and Powertrain Market Segmentation

|

Attributes |

Powertrain Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Powertrain Market Trends

“Electrification and Hybridization Drive Market Evolution”

- A major and accelerating trend in the global powertrain market is the rapid shift toward electrification and hybridization. Automakers are increasingly integrating electric and hybrid powertrains to meet stringent emissions regulations and consumer demand for eco-friendly vehicles. This transition is fundamentally reshaping the competitive landscape, with leading manufacturers investing heavily in battery technology, electric motors, and advanced control systems.

- The convergence of powertrain technologies with digital platforms and connected vehicle ecosystems is enhancing both performance and user convenience. Modern powertrains are now often integrated with vehicle telematics, predictive maintenance systems, and AI-driven energy management. This allows for real-time monitoring, remote diagnostics, and optimized energy usage, contributing to a more seamless and intelligent driving experience.

- Manufacturers are developing modular powertrain platforms that can accommodate a range of propulsion systems—from internal combustion engines to plug-in hybrids and full electrics. This flexibility enables automakers to quickly adapt to shifting market demands and regulatory requirements, while also streamlining production and reducing costs.

- Asia Pacific currently dominates the market, supported by Consumers are increasingly seeking vehicles that offer superior driving dynamics, including responsive acceleration and smooth power delivery.

- Asia Pacific is emerging as the fastest-growing region fueled by alliances between automakers, technology firms, and suppliers are fostering the development of next-generation powertrain solutions, enabling companies to leverage shared expertise and enter new markets more effectively.

Powertrain Market Dynamics

Driver

“Shift Toward Electrification and Stringent Emission Regulations”

- The global automotive industry is witnessing a significant transition toward electrified powertrains—including hybrid, plug-in hybrid, and battery electric vehicles—driven by increasingly stringent emission regulations and government incentives.

- For instance, in early 2025, Volkswagen announced the launch of its next-generation modular electric drive matrix (MEB+) platform, enabling higher efficiency and extended range for its EV lineup, in response to the EU’s 2035 ban on new internal combustion engine (ICE) vehicle sales.

- Advanced powertrain technologies, such as integrated electric drive units and high-efficiency transmissions, are enabling automakers to meet regulatory targets while delivering improved vehicle performance and lower total cost of ownership.

- This trend is accelerating investment in research and development, as well as strategic collaborations between OEMs and technology suppliers, to develop scalable and flexible powertrain solutions for diverse vehicle segments.

Restraint/Challenge

“High Development Costs and Infrastructure Limitations”

- The development and integration of advanced powertrain systems—especially electrified and hybrid architectures—require significant capital investment in R&D, manufacturing retooling, and workforce upskilling.

- For instance, Ford Motor Company reported a temporary slowdown in its EV powertrain rollout due to escalating costs of battery raw materials and the need for new supplier partnerships to secure critical minerals.

- The high upfront cost of electrified powertrains, coupled with limited charging infrastructure in emerging markets, poses a challenge for mass-market adoption, particularly in cost-sensitive regions.

- Additionally, the complexity of integrating new powertrain technologies with legacy vehicle platforms can lead to technical bottlenecks, longer development cycles, and increased warranty risks, potentially impacting profitability and market competitiveness.

Powertrain Market Scope

The market is segmented on the basis of Vehicle Type, Vehicle Drive Type, Vehicle Class, Component, Powertrain Type, Sales Channels

- By Vehicle Type

On the basis of Vehicle Type, the Powertrain Market is segmented into Hybrid and Plug-In Hybrid Vehicle, Battery Electric Vehicle, 48V Mild Hybrid Vehicle, Full Cell Electric Vehicle, Passenger and Commercial Vehicles. The Hybrid and Plug-In Hybrid Vehicle segment dominates the largest market revenue share of 38.3% in 2024, driven by opportunities for powertrain development and aftermarket solutions tailored to local needs.

The Battery Electric Vehicle segment is anticipated to witness the fastest growth rate of 16.7% from 2025 to 2032, fueled by alliances between automakers, technology firms, and suppliers are fostering the development of next-generation powertrain solutions, enabling companies to leverage shared expertise and enter new markets more effectively.

- By Vehicle Drive Type

On the basis of Vehicle Drive Type, the Powertrain Market is segmented into Front Wheel Drive, Rear Wheel Drive, All Wheel Drive. The Front Wheel Drive segment held the largest market revenue share in 2024 driven by the rise of modular vehicle architectures that can accommodate multiple fuel types (e.g., gasoline, hybrid, electric) is providing automakers with flexibility to adapt to changing regulatory and consumer demands.

The Rear-Wheel-Drive segment is expected to witness the fastest CAGR from 2025 to 2032, driven by Modular and Flexible Platforms.

- By Vehicle Class

On the basis of Vehicle Class, the Powertrain Market is segmented into Mid-Priced, Luxury. The Mid-Priced segment held the largest market revenue share in 2024 driven by Rising Demand for Automated Transmissions.

The Luxury segment is expected to witness the fastest CAGR from 2025 to 2032, driven by Focus on Cost Reduction and Scalability.

- By Component

On the basis of Component, the Powertrain Market is segmented into Battery, Power Electronic Controller, Motor/Generator, Converter, Transmission, On-Board Charger, Electric Vehicle Drive Module, EV Power Distribution Model, EV Thermal Systems. The Battery segment held the largest market revenue share in 2024 driven by Innovations such as direct injection, turbocharging, variable valve timing, lightweight materials, and intelligent powertrain management systems are enhancing both performance and efficiency. Integration of AI and IoT is further optimizing powertrain adaptability and responsiveness.

The Power Electronic Controller segment is expected to witness the fastest CAGR from 2025 to 2032, driven by global shift towards electrification, including hybrid and battery electric vehicles (BEVs), is transforming the powertrain landscape. Consumers and governments alike are pushing for greener alternatives, accelerating the adoption of electric powertrain technologies.

- By Powertrain Type

On the basis of Powertrain Type, the Powertrain Market is segmented into BEV Powertrain, MHEV Powertrain, Series Hybrid Powertrain, Parallel Hybrid Powertrain, Series-Parallel Hybrid Powertrain. The BEV Powertrain segment held the largest market revenue share in 2024 driven by Rising fuel prices and environmental awareness have led consumers to prioritize vehicles with higher fuel efficiency. This demand is driving automakers to invest in advanced powertrain technologies that offer improved mileage and lower emissions.

The MHEV Powertrain segment is expected to witness the fastest CAGR from 2025 to 2032, driven by Innovations such as direct injection, turbocharging, variable valve timing, lightweight materials, and intelligent powertrain management systems are enhancing both performance and efficiency. Integration of AI and IoT is further optimizing powertrain adaptability and responsiveness.

- By Sales Channels

On the basis of Sales Channels, the Powertrain Market is segmented into OEM, Aftermarket. The OEM segment held the largest market revenue share in 2024 driven by Many governments are offering subsidies, tax breaks, and incentives for the development and purchase of low-emission and electric vehicles. These policies are encouraging manufacturers to accelerate the transition to advanced powertrain systems.

The Aftermarket segment is expected to witness the fastest CAGR from 2025 to 2032, driven by Consumers are increasingly seeking vehicles that offer superior driving dynamics, including responsive acceleration and smooth power delivery. This is pushing manufacturers to develop powertrains that balance performance with efficiency.

Powertrain Market Regional Analysis

- Asia Pacific dominates the Powertrain Market with the largest revenue share of 43.06% in 2024, driven by Expansion in Emerging Markets.

- Stringent global emission regulations and environmental mandates are compelling manufacturers to develop cleaner, more efficient powertrains. Regulatory pressure is fostering innovation in hybrid and electric powertrains to reduce the carbon footprint of vehicles.

- The global shift towards electrification, including hybrid and battery electric vehicles (BEVs), is transforming the powertrain landscape. Consumers and governments alike are pushing for greener alternatives, accelerating the adoption of electric powertrain technologies.

China Powertrain Market Insight

The China Powertrain Market captured the largest revenue share of 59% in 2024 within Asia Pacific, fueled by Emissions Reduction Initiatives.

Europe Powertrain Market Insight

The global shift towards electrification, including hybrid and battery electric vehicles (BEVs), is transforming the powertrain landscape. Consumers and governments alike are pushing for greener alternatives, accelerating the adoption of electric powertrain technologies driving market in Europe.

U.K. Powertrain Market Insight

The U.K. Powertrain Market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by Innovations such as direct injection, turbocharging, variable valve timing, lightweight materials, and intelligent powertrain management systems are enhancing both performance and efficiency. Integration of AI and IoT is further optimizing powertrain adaptability and responsiveness.

Germany Powertrain Market Insight

The Germany Powertrain Market is expected to expand at a considerable CAGR during the forecast period, fueled by Many governments are offering subsidies, tax breaks, and incentives for the development and purchase of low-emission and electric vehicles. These policies are encouraging manufacturers to accelerate the transition to advanced powertrain systems.

Asia-Pacific Powertrain Market Insight

The Asia-Pacific Powertrain Market is poised to grow at the fastest CAGR of 17% during the forecast period of 2025 to 2032, driven by Consumers are increasingly seeking vehicles that offer superior driving dynamics, including responsive acceleration and smooth power delivery. This is pushing manufacturers to develop powertrains that balance performance with efficiency.

Japan Powertrain Market Insight

The Japan Powertrain Market is gaining momentum due to Strategic alliances between automakers, technology firms, and suppliers are fostering the development of next-generation powertrain solutions, enabling companies to leverage shared expertise and enter new markets more effectively.

U.S. Powertrain Market Insight

The U.S. Powertrain Market accounted for the largest market revenue share in North America in 2024, driven by the rise of modular vehicle architectures that can accommodate multiple fuel types (e.g., gasoline, hybrid, electric) is providing automakers with flexibility to adapt to changing regulatory and consumer demand.

Powertrain Market Share

The Powertrain Market is primarily led by well-established companies, including:

- Hitachi Astemo, Ltd. (U.S)

- Magna International Inc (Canada)

- Robert Bosch GmbH (Germany),

- Continental AG (Germany)

- Cummins Inc (U.S)

- BorgWarner Inc. (U.S)

- ZF Friedrichshafen AG (Germany)

- DENSO CORPORATION (Japan)

- DANA TM4 INC., (Canada)

- VALEO (France)

- Mitsubishi Electric Corporation (Japan)

- AKKA (Belgium)

- Ricardo (U.K),

- FEV Europe GmbH (Germany)

- ATESTEO GmbH & Co. KG(Germany)

- HORIBA, Ltd. (Japan)

- Applus+ (Spain)

- Intertek Group plc (U.K.)

- IAV (Germany),

Latest Developments in Global Powertrain Market

- In March 2024, Cummins inaugurated a new Powertrain Test Facility in Darlington, U.K., enhancing its capabilities to test advanced diesel, natural gas, hydrogen, and battery-electric powertrains. This facility supports the development of cleaner power solutions, aligning with Cummins' Destination Zero™ strategy.

- In February 2024, At IAA Transportation 2024, Cummins unveiled an integrated drivetrain concept featuring its HELM™ engine platforms, demonstrating advanced diesel, diesel-hybrid, and zero-carbon hydrogen powertrain options.

- In September 2024, Magna introduced its next-generation 800V eDrive system at CES 2024, offering improved efficiency, power-to-weight ratio, and torque density. The system features a unique ability to rotate 90 degrees around the drive axis, enhancing integration flexibility.

- In July 2024, Magna expanded its long-term innovation partnership with Mercedes-Benz, including the production of the eDS Duo electric drive system for the all-new electric model of Mercedes-Benz’s iconic off-roader.

- In January 2024, At IAA Transportation 2024, Bosch announced the reorganization of its commercial-vehicle business within the Mobility sector, focusing on powertrain diversity and technology neutrality. The new setup aims to pool competencies for trucks and off-highway applications, enhancing efficiency and safety.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.