Global Pre Owned Luxury Watches Market

Market Size in USD Billion

CAGR :

%

USD

28.77 Billion

USD

69.22 Billion

2024

2032

USD

28.77 Billion

USD

69.22 Billion

2024

2032

| 2025 –2032 | |

| USD 28.77 Billion | |

| USD 69.22 Billion | |

|

|

|

|

Pre Owned Luxury Watches Market Size

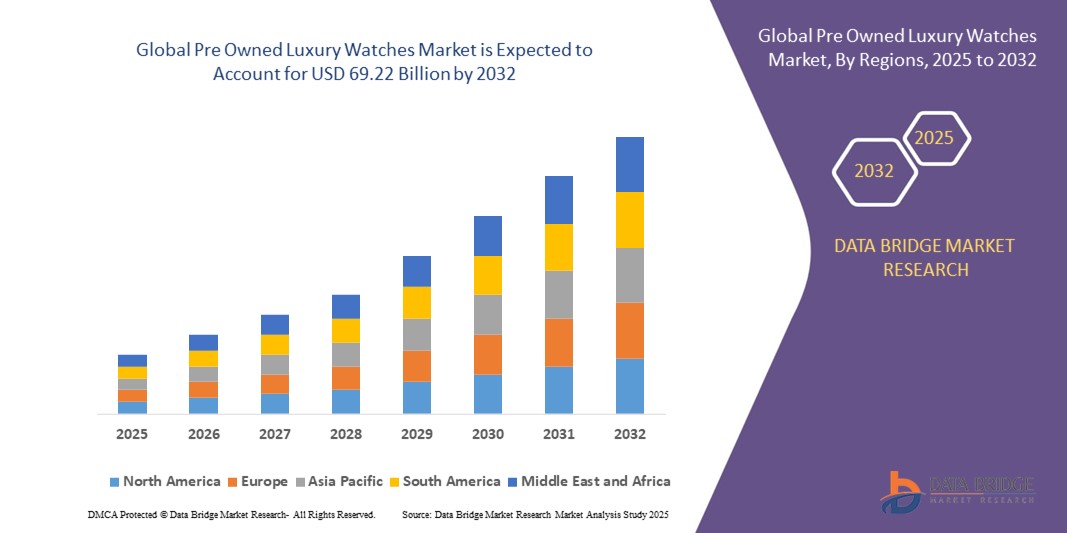

- The global pre owned luxury watches market size was valued at USD 28.77 billion in 2024 and is expected to reach USD 69.22 billion by 2032, at a CAGR of 11.60% during the forecast period

- The market growth is largely fueled by the increasing consumer inclination toward sustainable luxury consumption and the growing awareness around circular fashion, which has elevated the acceptance of pre-owned luxury goods

- Furthermore, rising demand for rare, vintage, and investment-grade timepieces—coupled with the expansion of digital resale platforms offering authentication and certification—is driving the market forward by enhancing buyer confidence and global accessibility

Pre Owned Luxury Watches Market Analysis

- Pre-owned luxury watches are previously owned timepieces from high-end brands that retain significant value and appeal due to their craftsmanship, heritage, and limited availability. These watches are sold through certified resale platforms, auction houses, and authorized dealers that offer authentication, refurbishment, and warranty services

- The growing demand for pre-owned luxury watches is primarily driven by the rising aspiration for luxury at a more accessible price point, the cultural shift toward sustainable and value-driven consumption, and the increased digitization of resale platforms that enable secure, global transactions

- North America dominated pre owned luxury watches market with a share of 34.7% in 2024, due to strong consumer interest in value-retaining assets and the rising appeal of sustainable luxury consumption

- Asia-Pacific is expected to be the fastest growing region in the pre owned luxury watches market during the forecast period due to rapid urbanization, rising disposable incomes, and growing aspirational consumption across key markets including China, Japan, and India

- Automatic pre-owned luxury watches segment dominated the market with a market share of 66.7% in 2024, due to its high consumer preference due to convenience, precision, and the perception of superior craftsmanship. These watches, powered by wrist motion, eliminate the need for daily winding and are often associated with high-end horology brands, making them more attractive in the resale market. Collectors and enthusiasts value automatic movements for their mechanical complexity and long-term investment potential

Report Scope and Pre Owned Luxury Watches Market Segmentation

|

Attributes |

Pre Owned Luxury Watches Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pre Owned Luxury Watches Market Trends

Growing Popularity of Certified Pre-Owned (CPO) Programs

- Certified pre-owned programs are gaining momentum, providing buyers with authentication guarantees, repair histories, and warranties that elevate trust in the secondary luxury market while promoting the appeal of previously owned pieces

- For instance, prominent industry players such as WatchBox, Chrono24, and Watches of Switzerland are expanding dedicated CPO platforms where customers access authenticated, refurbished luxury watches featuring detailed provenance and after-sales support

- The shift toward digital sales is expanding the market reach of pre-owned luxury watches, as e-commerce platforms offer broad selection, robust authentication services, and transparent pricing for collectors and first-time buyers

- Intense focus on sustainability and circular fashion trends is driving interest in pre-owned luxury watches among environmentally conscious consumers who value extending product life cycles and minimizing resource consumption

- Investment appeal of secondhand luxury watches is increasing as enthusiasts recognize models from Rolex, Patek Philippe, and Audemars Piguet hold or appreciate in value, making the segment attractive as an alternative asset class

- Asia-Pacific is experiencing rapid expansion supported by rising disposable incomes, a burgeoning middle class, and increased awareness about brand authenticity and investment-grade timepieces through CPO channels

Pre Owned Luxury Watches Market Dynamics

Driver

Rising Demand for Affordable Access to Luxury Timepieces

- Growing consumer enthusiasm for luxury goods at accessible prices fuels demand for pre-owned watches, offering affordable options for entry into premium brands such as Rolex, Omega, and Cartier without the full retail cost barrier

- In instance, the European and North American markets are witnessing strong uptake among younger buyers and collectors, drawn to the value and prestige available in pre-owned segments as well as the opportunity to access discontinued or exclusive models that are not available as new purchases

- Expansion of online and offline certified retailers heightens convenience and confidence for buyers, enabling wide distribution and support through physical boutiques and digital showrooms

- Evolving purchasing behavior in emerging regions such as Asia-Pacific and Middle East, coupled with rising affluence, is accelerating the desire for luxury watches as both status symbols and personal investments

- Customization services and flexible financing options offered by CPO platforms are increasing accessibility, helping buyers acquire desirable luxury models by spreading payments over time or personalizing selections

Restraint/Challenge

Concerns Over Counterfeit Products and Authentication Integrity

- The proliferation of counterfeit timepieces, unauthorized dealers, and falsely labeled products threatens market legitimacy, requiring dealers and brands to invest heavily in stringent verification, digital tracking, and expert inspection processes

- In instance, brands and platforms such as eBay and Watchfinder are developing robust authentication protocols and digital certificates along with partnerships with expert horologists to safeguard buyers and uphold industry reputations

- Building consumer trust in the secondary market can be challenged by inadequate transparency or inconsistent authentication procedures, particularly across smaller, independent retailers without established certification standards

- Regulatory variations in cross-border sales and import/export controls may complicate authentication, pricing, and delivery of pre-owned luxury watches, constraining market fluidity and consumer confidence

- Economic uncertainties and fluctuating consumer spending may expose vulnerabilities in the secondhand luxury market, especially during downturn periods when investment value and liquidity of collectible watches can be impacted

Pre Owned Luxury Watches Market Scope

The market is segmented on the basis of type and distribution channel.

- By Type

On the basis of type, the pre-owned luxury watches market is segmented into automatic pre-owned luxury watches and manual pre-owned luxury watches. The automatic segment held the largest market revenue share of 66.7% in 2024, driven by its high consumer preference due to convenience, precision, and the perception of superior craftsmanship. These watches, powered by wrist motion, eliminate the need for daily winding and are often associated with high-end horology brands, making them more attractive in the resale market. Collectors and enthusiasts value automatic movements for their mechanical complexity and long-term investment potential. Moreover, growing awareness around sustainability and circular economy practices supports demand for automatic pre-owned models, particularly among eco-conscious luxury buyers. Their enduring aesthetic and technological appeal continue to drive resale value and demand across both male and female demographics.

The manual pre-owned luxury watches segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising demand among purists and horological collectors who value the tradition, craftsmanship, and tactile engagement of manual winding. Manual watches often carry historical significance and rarity, making them prized possessions in vintage and high-value auction categories. As consumers increasingly seek heritage timepieces and limited-edition models, manual watches gain traction for their uniqueness and nostalgic value. Growth is further supported by the expansion of watch authentication services and specialized platforms that ensure the quality and provenance of these mechanical pieces. Enthusiasts drawn to minimalist designs and smaller case profiles also favor manual options, especially in emerging markets with growing luxury awareness.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into offline and online channels. The offline segment accounted for the largest revenue share in 2024, fueled by the strong presence of authorized retailers, luxury resellers, and brick-and-mortar boutiques that provide in-person authentication, warranty services, and personalized customer experiences. High-value pre-owned purchases often require trust and verification, which physical stores effectively deliver through expert appraisal and transparency. Offline channels are particularly dominant in regions such as Europe and the U.S., where heritage luxury watch culture and physical presence of major brands influence buyer preferences. Many customers still prefer to physically inspect timepieces before purchase, especially when investing in high-end models. The added assurance of post-sale services and the ability to trade-in or upgrade watches in-store further reinforce offline dominance.

The online segment is projected to witness the fastest growth rate from 2025 to 2032, driven by the surge of digital-first luxury consumers and the expansion of specialized e-commerce platforms offering authenticated, certified pre-owned watches. The convenience of browsing and comparing a wide range of brands and models from home is reshaping buyer habits, especially among millennials and Gen Z. Platforms such as Chrono24, WatchBox, and eBay Luxe, along with brand-certified online resale programs, are rapidly gaining trust and market share. Technological advancements in digital verification, virtual try-ons, and secure payment systems are addressing buyer concerns about authenticity and fraud. The online channel also enables global access to rare or discontinued models, contributing to its rapid adoption across emerging and developed markets alike.

Pre Owned Luxury Watches Market Regional Analysis

- North America dominated the pre owned luxury watches market with the largest revenue share of 34.7% in 2024, driven by strong consumer interest in value-retaining assets and the rising appeal of sustainable luxury consumption

- The region’s mature luxury goods market, high disposable income levels, and growing awareness of authenticated resale platforms have fueled widespread adoption of pre-owned luxury watches

- Consumers are drawn to the investment potential, limited-edition availability, and access to discontinued models offered by the secondary market

U.S. Pre-Owned Luxury Watches Market Insight

The U.S. held the largest share within the North America pre-owned luxury watches market in 2024, driven by a strong resale infrastructure, tech-savvy consumer behavior, and widespread acceptance of secondhand luxury as both a financial investment and a style statement. The market benefits from a highly developed e-commerce ecosystem, with platforms such as WatchBox, The RealReal, and Crown & Caliber offering extensive inventories and robust authentication guarantees. Consumers across age groups are increasingly drawn to pre-owned timepieces for their historical value, exclusivity, and more accessible pricing. Growing interest in watch collecting, particularly among millennials and Gen Z, is further elevating demand. The rising popularity of vintage models, coupled with the trend toward sustainable consumption, positions the U.S. as a critical driver of North America’s market growth.

Europe Pre-Owned Luxury Watches Market Insight

Europe is projected to witness steady growth in the pre-owned luxury watches market throughout the forecast period, supported by the region’s rich horological heritage and evolving consumer attitudes toward luxury consumption. The cultural appreciation for craftsmanship and legacy brands, coupled with the growing popularity of vintage aesthetics, continues to drive demand for secondhand timepieces. Consumers in Europe are increasingly turning to pre-owned watches for their uniqueness and story and also for their long-term value and reduced environmental impact. The rise of brand-backed certified pre-owned programs, particularly from major Swiss manufacturers, has further legitimized and professionalized the market. Growing trust in authentication processes and resale warranties is reinforcing consumer confidence, encouraging purchases across both online and offline channels.

U.K. Pre-Owned Luxury Watches Market Insight

The U.K. is expected to experience notable growth in the pre-owned luxury watches market, fueled by rising interest in sustainable fashion and a strong demand for collectible and investment-grade timepieces. As consumers become more conscious of the environmental impact of their purchases, the appeal of high-quality secondhand luxury goods continues to strengthen. The U.K.’s vibrant resale environment, supported by both brick-and-mortar boutiques and digital marketplaces, is providing buyers with wider access to authenticated, high-value watches. In addition, favorable tax policies and the appeal of VAT-free shopping for international buyers are making the U.K. a key resale destination. Younger consumers, in particular, are engaging with the pre-owned watch space for its affordability, variety, and connection to cultural identity and status.

Germany Pre-Owned Luxury Watches Market Insight

Germany’s pre-owned luxury watches market is poised for steady expansion, underpinned by the country’s reputation for precision engineering and consumer preference for durable, value-retaining products. German buyers tend to place high importance on product quality and authenticity, making the certified pre-owned segment particularly appealing. With increasing digitization, more German consumers are accessing reputable online resale platforms, which offer detailed product histories and guaranteed provenance. The growing awareness of sustainable consumption is also pushing consumers toward secondhand luxury as a conscious lifestyle choice. The market is further supported by a strong luxury culture in cities such as Munich, Hamburg, and Frankfurt, where consumers are both financially equipped and culturally inclined to invest in luxury timepieces.

Asia-Pacific Pre-Owned Luxury Watches Market Insight

Asia-Pacific is projected to grow at the fastest CAGR from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and growing aspirational consumption across key markets including China, Japan, and India. A youthful, tech-savvy population and an increasing appetite for luxury goods are propelling the shift toward pre-owned timepieces as entry points into premium brands. The market is further boosted by the digital transformation of luxury retail and the emergence of online resale platforms offering authenticated products with localized support. As awareness around investment value and exclusivity grows, high-net-worth individuals and aspirational buyers alike are increasingly seeking out rare and vintage pieces. Government initiatives promoting digital payments and e-commerce expansion are also facilitating access to global inventory, making luxury watches more accessible across tier-1 and tier-2 cities.

Japan Pre-Owned Luxury Watches Market Insight

Japan’s market for pre-owned luxury watches is experiencing robust growth, anchored by a deep-rooted appreciation for craftsmanship, precision, and minimalist design. The country’s aging population, combined with a high level of wealth and discretionary spending, supports consistent demand for legacy watch brands. Japanese consumers are highly discerning and often seek timeless, mechanical timepieces that align with values of tradition and longevity. This preference makes Japan one of the leading markets for certified and well-preserved pre-owned models. A strong culture of care and maintenance also ensures that timepieces in the resale market retain high quality, boosting buyer confidence. The popularity of local resale chains and online platforms with strong authentication standards is further enhancing transparency and convenience for domestic and international buyers.

China Pre-Owned Luxury Watches Market Insight

China held the largest revenue share in the Asia-Pacific region in 2024, driven by a rapidly expanding middle class, high brand consciousness, and the increasing integration of digital retail platforms. Luxury watches are seen as both status symbols and long-term investments in China, which makes the pre-owned market especially attractive to upwardly mobile consumers. Younger generations in urban centers are fueling demand through platforms offering competitive pricing and certified authenticity. China’s emphasis on digital payments, live-commerce, and mobile-first shopping is reshaping the resale experience, making high-end watches more discoverable and purchasable online. Moreover, as the government promotes consumption of domestic and international luxury goods, the ecosystem for secondhand luxury retail is expected to thrive, supported by strong domestic manufacturing, retail partnerships, and growing consumer trust in authenticated resale channels.

Pre Owned Luxury Watches Market Share

The pre owned luxury watches industry is primarily led by well-established companies, including:

- Chrono24 (Germany)

- WatchBox (U.S.)

- eBay Inc. (U.S.)

- Bob's Watches (U.S.)

- Crown & Caliber LLC (U.S.)

- Watchfinder & Co (U.K.)

- TrueFacet, LLC (U.S.)

- Govberg (U.S.)

- The Watch Club (U.K.)

- Watches of Switzerland (U.K.)

Latest Developments in Global Pre Owned Luxury Watches Market

- In November 2024, Subdial successfully secured £1.5 million in funding from the founder of Watchfinder, a pivotal development signaling growing investor interest in the pre-owned luxury watch segment. The funding is expected to support Subdial’s plans for technological advancement, including enhancing its authentication infrastructure, optimizing its online platform, and expanding inventory to include more rare and investment-grade timepieces. This move positions Subdial to scale operations, improve customer experience, and strengthen its competitive edge in a market that increasingly values transparency and product integrity. With backing from an industry pioneer, Subdial is poised to gain a stronger foothold among digitally driven and younger luxury consumers

- In September 2024, LVMH made a historic acquisition by purchasing Patek Philippe, one of the most revered and independently operated Swiss watchmakers. This acquisition reshaped the landscape of the luxury watch industry and also significantly elevated LVMH’s influence within the ultra-premium horology segment. The integration of Patek Philippe into LVMH’s portfolio is expected to strengthen brand equity, impact global pricing dynamics, and further blur the lines between primary and secondary markets. For the pre-owned segment, this deal may drive increased valuation of Patek Philippe watches on the resale market due to heightened brand visibility and perceived exclusivity under LVMH’s stewardship

- In October 2023, CHRONEXT acquired the brand rights and domain of Watchmaster, a prominent European luxury watch retailer, marking a major step in its expansion strategy. This acquisition allowed CHRONEXT to tap into Watchmaster’s existing customer base, digital infrastructure, and regional brand recognition, thereby accelerating its growth in the competitive European resale market. As demand for certified pre-owned watches grows across Europe, CHRONEXT's move supports its goal of becoming a dominant digital-first player by consolidating market share and improving operational scale. The acquisition also reflects the increasing trend of strategic mergers and acquisitions among resale platforms to strengthen market positioning

- In July 2021, Industronics, a publicly listed Malaysian company, launched WatchExchange, the first dedicated luxury watch e-commerce platform in Malaysia and the broader Asia-Pacific region to issue authenticity certificates for pre-owned timepieces. This platform addressed a critical market gap by offering verification services in a region where concerns over counterfeit luxury goods are prominent. The initiative introduced a new level of consumer trust and also set a precedent for authenticated luxury e-commerce in Southeast Asia. By focusing on legitimacy and digital access, WatchExchange positioned itself as a key enabler of secondhand luxury watch adoption in emerging APAC markets where luxury consumption is rising alongside digital engagement

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.