Global Pre Printed Liners Market

Market Size in USD Billion

CAGR :

%

USD

3.61 Billion

USD

4.68 Billion

2025

2033

USD

3.61 Billion

USD

4.68 Billion

2025

2033

| 2026 –2033 | |

| USD 3.61 Billion | |

| USD 4.68 Billion | |

|

|

|

|

Pre-Printed Liners Market Size

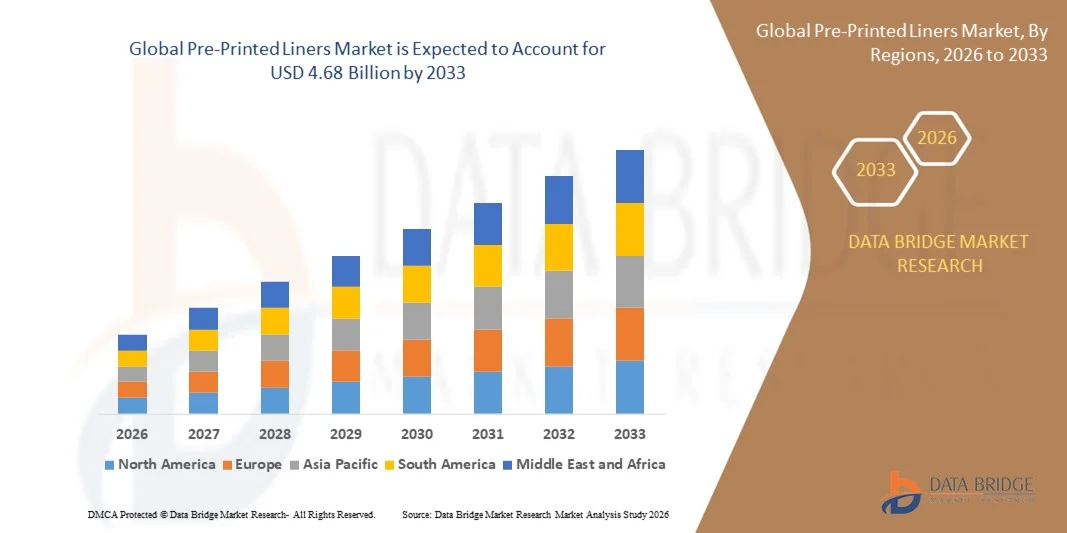

- The global pre-printed liners market size was valued at USD 3.61 billion in 2025 and is expected to reach USD 4.68 billion by 2033, at a CAGR of 3.30% during the forecast period

- The market growth is largely fuelled by the rising demand for high-quality packaging aesthetics adopted by brand owners

- Growing use of lightweight corrugated packaging solutions across e-commerce and FMCG industries

Pre-Printed Liners Market Analysis

- The pre-printed liners market is experiencing steady growth due to the surging need for visually appealing packaging that strengthens brand identity

- Manufacturers are increasingly adopting flexographic and digital printing technologies to achieve superior print clarity and faster turnaround times

- North America dominated the pre-printed liners market with the largest revenue share in 2025, driven by the strong presence of established packaging converters and the growing need for high-quality, visually appealing packaging solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global pre-printed liners market, driven by rising manufacturing activities, expanding consumer goods demand, and growing preference for cost-efficient and visually appealing printed packaging across emerging economies

- The bleached segment held the largest market revenue share in 2025 driven by its superior print clarity, smooth surface finish, and strong preference among premium brands seeking high-quality packaging aesthetics. Bleached liners offer enhanced visual appeal and are widely used across food, cosmetics, and consumer goods applications due to their ability to deliver vibrant and precise printed designs.

Report Scope and Pre-Printed Liners Market Segmentation

|

Attributes |

Pre-Printed Liners Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pre-Printed Liners Market Trends

Growing Adoption Of High-Quality And Customizable Packaging Solutions

- The rising demand for visually appealing and brand-focused packaging is reshaping the pre-printed liners market. Manufacturers are increasingly adopting high-resolution printing technologies to enhance shelf appeal and ensure consistent brand communication across packaging formats. This trend is particularly strong among FMCG brands aiming to differentiate products in crowded retail environments

- The shift toward sustainable and recyclable packaging materials is accelerating the use of lightweight pre-printed liners designed to reduce waste while maintaining durability. As consumer preference moves toward eco-friendly options, companies are investing in improved paper grades and inks to meet sustainability targets without compromising print quality

- Growing e-commerce penetration is driving demand for sturdy yet aesthetically enhanced packaging. Pre-printed liners offer a cost-effective way to maintain brand visibility during transit while ensuring product safety. This dual advantage is boosting their adoption among online-first brands and logistics players

- For instance, in 2024, several packaging companies in Europe introduced water-based ink pre-printed liners for food and consumer goods, reducing environmental impact while maintaining vibrant print clarity. These innovations have helped brands enhance compliance with sustainability regulations

- While the adoption of high-quality pre-printed liners continues to rise, sustained growth will depend on further technological advancements, cost efficiency, and the ability of manufacturers to offer flexible design customization that meets diverse brand requirements

Pre-Printed Liners Market Dynamics

Driver

Growing Demand For Premium And Sustainable Packaging Across Industries

- The rise in premium product offerings across FMCG, food, beverages, and personal care sectors is boosting the need for high-quality printing on packaging materials. Brands increasingly seek packaging solutions that communicate value, enhance customer experience, and support strong visual identity. This trend is accelerating the demand for pre-printed liners as companies aim to strengthen shelf impact and brand loyalty

- Consumer awareness regarding sustainable packaging is also shaping market growth. Many manufacturers are adopting recyclable paper-based liners to reduce plastic usage and align with global sustainability initiatives. The shift is further supported by stringent packaging regulations in several countries that encourage greener material use and improved waste management

- Advancements in printing technologies, such as digital and flexographic printing, have enabled faster turnaround times, improved print precision, and reduced waste. These innovations help manufacturers achieve consistent quality while optimizing production efficiency. As a result, companies are increasingly integrating pre-printed liners into large-scale packaging workflows to meet growing customization needs

- For instance, in 2023, multiple packaging converters in North America upgraded to high-speed digital printing systems, resulting in enhanced customization capabilities and improved operational efficiency for brand owners. These systems support small-batch printing, rapid design changes, and higher color accuracy. The improved operational flexibility has strengthened supply chain responsiveness for major packaging users

- While the demand for premium and eco-friendly packaging continues to rise, the market must address cost pressures and ensure scalable production capabilities to meet growing industry requirements. Manufacturers are exploring advanced materials and optimized production workflows to balance cost and quality. Strengthening supply chains will be essential to maintaining consistent and timely delivery

Restraint/Challenge

Volatility In Raw Material Prices And High Production Costs

- The pre-printed liners market faces significant pricing challenges due to fluctuations in the cost of raw materials such as paper, adhesives, and printing inks. These variations impact production expenses and often lead to higher pricing for end users, limiting adoption among cost-sensitive businesses. Such volatility creates planning uncertainties for manufacturers and disrupts long-term contract stability

- High initial investments associated with advanced printing technologies and equipment pose additional barriers, especially for small and mid-sized manufacturers. Not all converters can afford continuous upgrades, leading to capability gaps within the industry. This also restricts innovation adoption and limits access to high-resolution printing for smaller market participants

- Limited availability of high-grade recyclable paper in some regions further constrains production capacity and increases supply chain pressure. This affects delivery timelines and reduces flexibility for brands requiring fast turnaround. The rising demand for sustainable materials also intensifies competition among manufacturers, creating further supply constraints

- For instance, in 2023, several packaging firms in Asia reported delays in liner production due to shortages of sustainable paper substrates, resulting in increased reliance on imports and higher operational costs. These delays affected order fulfillment cycles and increased lead times for major FMCG and e-commerce brands. The situation highlighted the need for stronger regional raw material sourcing strategies

- While ongoing innovation aims to reduce material dependency and optimize production, overcoming cost and supply chain constraints will be essential for ensuring long-term, stable growth in the pre-printed liners market. The industry is focusing on localized sourcing, material optimization, and improved recycling systems. These efforts are expected to enhance resilience and reduce operational volatility

Pre-Printed Liners Market Scope

The market is segmented on the basis of product, print type, and end-use industry

- By Product

On the basis of product, the pre-printed liners market is segmented into bleached and unbleached. The bleached segment held the largest market revenue share in 2025 driven by its superior print clarity, smooth surface finish, and strong preference among premium brands seeking high-quality packaging aesthetics. Bleached liners offer enhanced visual appeal and are widely used across food, cosmetics, and consumer goods applications due to their ability to deliver vibrant and precise printed designs.

The unbleached segment is expected to witness the fastest growth rate from 2026 to 2033, supported by the rising demand for sustainable, natural-looking, and eco-friendly packaging formats. Unbleached liners are increasingly adopted by brands aiming to reduce chemical processing and promote recyclable packaging. Their cost-effectiveness and alignment with global sustainability trends make them a preferred choice across e-commerce and bulk packaging applications.

- By Print Type

On the basis of print type, the pre-printed liners market is segmented into offset printer, flexographic printer, rotogravure printer, and letterpress printer. The flexographic printer segment held the largest market revenue share in 2025 driven by its versatility, high efficiency, and suitability for large-volume printing runs. Flexographic printing supports a wide range of substrates and offers faster production speeds, making it the most widely used printing method for packaging converters.

The digital and offset printing category is expected to witness rapid growth from 2026 to 2033 due to increasing demand for short-run printing, customization, and high-resolution graphics. Technological advancements in digital and offset printing systems enable faster job changes, reduced setup times, and enhanced color precision, supporting brand owners seeking premium-quality printed liners for targeted campaigns.

- By End-Use

On the basis of end-use, the pre-printed liners market is segmented into food, beverages, electrical and electronics, healthcare, personal care and cosmetics, textiles and apparel, homecare, chemical and fertilizers, e-commerce, and others. The food segment held the largest market revenue share in 2025 driven by the growing need for visually appealing, functional, and compliant packaging materials. Pre-printed liners are extensively used in food packaging to ensure branding consistency, regulatory labeling, and improved shelf presentation.

The e-commerce segment is expected to witness the fastest growth rate from 2026 to 2033, propelled by the booming online retail sector and increasing demand for durable, branded, and sustainable packaging solutions. Pre-printed liners play a key role in enhancing unboxing experiences and ensuring strong brand visibility throughout the supply chain, making them highly preferred among major e-commerce platforms.

Pre-Printed Liners Market Regional Analysis

- North America dominated the pre-printed liners market with the largest revenue share in 2025, driven by the strong presence of established packaging converters and the growing need for high-quality, visually appealing packaging solutions

- Companies in the region prioritize premium branding, advanced print quality, and sustainable packaging formats, such as recyclable and paper-based liners, boosting demand across key industries

- This widespread adoption is further supported by robust manufacturing capabilities, rising investments in printing technologies, and the growing preference for efficient, large-scale packaging solutions across food, beverage, personal care, and e-commerce sectors

U.S. Pre-Printed Liners Market Insight

The U.S. pre-printed liners market captured the largest revenue share in 2025 within North America, fueled by the strong demand for premium packaging and rapid adoption of digital and flexographic printing technologies. Manufacturers are increasingly investing in advanced equipment to meet brand requirements for customization, faster turnaround times, and sustainable products. Growing e-commerce penetration and rising consumer expectations for visually appealing packaging continue to drive market expansion. Moreover, stringent packaging standards and the push toward recyclable materials further strengthen market growth across industries.

Europe Pre-Printed Liners Market Insight

The Europe pre-printed liners market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by strict sustainability regulations and the rising adoption of eco-friendly packaging solutions. The region’s focus on reducing plastic waste and promoting fiber-based packaging is accelerating demand for high-quality printed liners. European industries, especially food, personal care, and pharmaceuticals, increasingly prefer premium printed substrates to enhance shelf appeal. In addition, ongoing investments in digital printing and automation support widespread integration into both new production lines and retrofitted packaging facilities.

U.K. Pre-Printed Liners Market Insight

The U.K. pre-printed liners market is expected to witness the fastest growth rate from 2026 to 2033, supported by strong demand for sustainable, branded packaging across retail, food delivery, and personal care sectors. Rising concerns over plastic waste, combined with regulatory pressure to adopt recyclable materials, are encouraging the use of paper-based liners. The rapid growth of e-commerce and demand for premium unboxing experiences also contribute to market expansion. Furthermore, advancements in digital and flexographic printing continue to enhance customization capabilities and production efficiency across the country.

Germany Pre-Printed Liners Market Insight

The Germany pre-printed liners market is expected to witness the fastest growth rate from 2026 to 2033, driven by the country’s strong focus on sustainable manufacturing and high-precision printing solutions. Germany’s advanced industrial base and emphasis on technologically efficient production systems support widespread adoption of premium printed liners. Demand is rising across food, pharmaceuticals, and household goods as companies focus on high-quality, environmentally responsible packaging. Increasing integration of automated printing lines and eco-friendly substrates aligns with consumer expectations for durable, recyclable product packaging.

Asia-Pacific Pre-Printed Liners Market Insight

The Asia-Pacific pre-printed liners market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid industrialization, expanding retail sectors, and rising disposable incomes in countries such as China, Japan, and India. The region’s booming packaging industry, supported by government initiatives promoting manufacturing and sustainability, is accelerating adoption of pre-printed liners. APAC’s strong production capabilities and cost-efficient printing technologies further enhance market penetration, making high-quality printed packaging accessible across both domestic and export-oriented industries.

Japan Pre-Printed Liners Market Insight

The Japan pre-printed liners market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s advanced printing technology ecosystem and high consumer demand for premium, visually refined packaging. Japan’s strong focus on precision, quality, and sustainable materials is driving adoption across food, cosmetics, and electronics sectors. The integration of innovative digital and flexographic printing systems continues to enhance production efficiency. In addition, an aging population and preference for convenience packaging are influencing manufacturers to adopt lightweight, high-quality printed liners.

China Pre-Printed Liners Market Insight

The China pre-printed liners market accounted for the largest market revenue share in Asia-Pacific in 2025, supported by the country’s rapidly expanding manufacturing sector and strong demand for cost-efficient, aesthetically appealing packaging solutions. China is one of the world’s largest producers and consumers of packaging materials, and pre-printed liners are widely adopted across food, e-commerce, consumer goods, and electronics industries. The rise of smart manufacturing, growth of domestic printing technologies, and government support for sustainable packaging solutions continue to propel the market forward.

Pre-Printed Liners Market Share

The Pre-Printed Liners industry is primarily led by well-established companies, including:

- Smurfit Kappa (Ireland)

- DS Smith (U.K.)

- WestRock Company (U.S.)

- Packaging Corporation of America (U.S.)

- The Packaging People PTY LTD (Australia)

- International Paper (U.S.)

- Visy (Australia)

- Paper Australia Pty Ltd (Australia)

- Rayven Inc. (U.S.)

- Packaging Technologies Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pre Printed Liners Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pre Printed Liners Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pre Printed Liners Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.