Global Precious Metals E Waste Recovery Market

Market Size in USD Billion

CAGR :

%

USD

6.76 Billion

USD

10.61 Billion

2024

2032

USD

6.76 Billion

USD

10.61 Billion

2024

2032

| 2025 –2032 | |

| USD 6.76 Billion | |

| USD 10.61 Billion | |

|

|

|

|

Precious Metals E-Waste Recovery Market Size

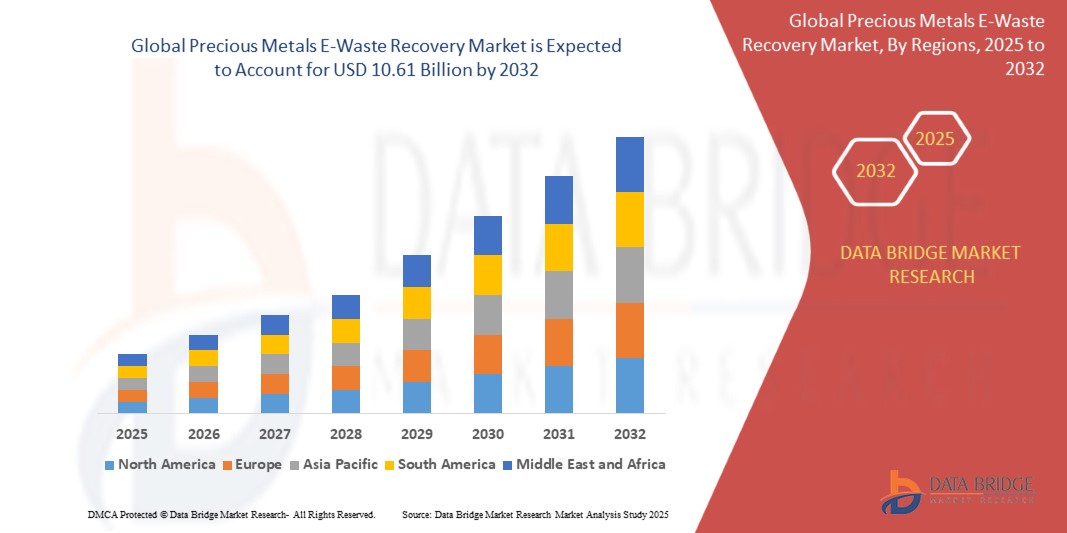

- The global precious metals e-waste recovery market size was valued at USD 6.76 billion in 2024 and is expected to reach USD 10.61 billion by 2032, at a CAGR of 5.8% during the forecast period

- The market growth is largely fueled by the rising generation of electronic waste worldwide and the increasing demand for precious metals such as gold, silver, platinum, and palladium in consumer electronics, automotive, and industrial applications. Growing concerns over resource scarcity and the high economic value of these metals are driving large-scale recovery efforts, supported by government regulations on e-waste management and recycling

- Furthermore, advancements in recovery technologies, including hydrometallurgical, pyrometallurgical, and biotechnological processes, are enhancing efficiency and sustainability in metal extraction. These converging factors are accelerating the adoption of precious metals recovery practices, thereby significantly boosting the industry’s growth

Precious Metals E-Waste Recovery Market Analysis

- Precious metals e-waste recovery involves extracting valuable metals such as gold, silver, platinum, and palladium from discarded electronic products through mechanical, chemical, and biological methods. These recovered metals are reused across electronics manufacturing, automotive, aerospace, and healthcare industries, reducing dependence on primary mining and supporting a circular economy

- The escalating demand for recovered precious metals is primarily fueled by the rapid rise in global e-waste volumes, strict environmental regulations, and the growing need for sustainable sourcing of critical materials. In addition, the increasing adoption of electric vehicles and advanced electronic devices is further strengthening market demand for efficient and eco-friendly recovery solutions

- North America dominated the precious metals e-waste recovery market with a share of 35.5% in 2024, due to stringent regulations on electronic waste management and strong initiatives toward a circular economy

- Asia-Pacific is expected to be the fastest growing region in the precious metals e-waste recovery market during the forecast period due to rapid urbanization, increasing e-waste generation, and large-scale electronics production in China, Japan, India, and South Korea

- Consumer electronics segment dominated the market with a market share of 46.3% in 2024, due to massive volumes of discarded smartphones, laptops, tablets, and household gadgets. Frequent product upgrades, shorter replacement cycles, and rising global e-waste generation make this source the most concentrated pool for precious metals recovery. With the high content of gold, silver, and palladium embedded in small circuit boards, consumer electronics continue to be a primary driver for recyclers

Report Scope and Precious Metals E-Waste Recovery Market Segmentation

|

Attributes |

Precious Metals E-Waste Recovery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Precious Metals E-Waste Recovery Market Trends

Growing Adoption of Eco-Friendly Biotechnological Recovery Methods

- The market for precious metals e-waste recovery is being reshaped by the growing adoption of eco-friendly biotechnological methods. Conventional recovery techniques such as pyrometallurgy and hydrometallurgy have been criticized for their high energy use and release of toxic chemicals, pushing industries toward microbial and bioleaching approaches that are safer and more sustainable

- For instance, EnviroLeach Technologies has been advancing alternative bio-metallurgical processes to recover gold and other valuable metals from e-waste. Their use of non-toxic leaching reagents and eco-friendly recovery systems demonstrates how biotech-driven innovation is becoming central to reducing environmental impact in this segment

- Growing regulatory and societal pressure to minimize the ecological footprint of mining is driving interest in biotechnology-based recycling. Bioleaching using bacteria such as Acidithiobacillus ferrooxidans can extract metals without the harmful emissions linked to traditional recovery methods, making it a viable solution for large-scale operations

- The integration of circular economy principles within the electronics industry is further supporting bio-based recovery solutions. Companies are increasingly partnering with recycling firms adopting these methods as part of corporate commitments to sustainability and resource security

- In addition, advancements in precision biotechnology are enabling selective recovery of metals such as gold, palladium, and platinum while minimizing energy use and secondary waste generation. These innovations make bio-recovery both cost-effective and environmentally responsible

- The alignment of these methods with government-backed sustainability initiatives and green technology investments is accelerating commercialization. As circular strategies gain prominence, eco-friendly biotechnological recovery is expected to become mainstream in e-waste recycling infrastructure

Precious Metals E-Waste Recovery Market Dynamics

Driver

Increasing Consumption of Electronic Devices

- The sharp rise in global consumption of electronic devices such as smartphones, laptops, and consumer appliances is driving unprecedented demand for precious metals e-waste recovery. Electronic gadgets contain significant amounts of gold, silver, palladium, and platinum, creating large-scale recovery opportunities once devices reach end-of-life

- For instance, Apple has made headlines with its Daisy recycling robot, which disassembles iPhones to recover valuable metals such as gold and rare earths. Such initiatives illustrate how the surge in consumer electronics production and disposal is fueling the growth of the e-waste recycling and recovery market

- The shorter lifecycle of electronic devices due to rapid technological obsolescence further intensifies e-waste generation. With consumers upgrading devices more frequently, the volume of precious metal-bearing waste entering recycling channels is consistently rising

- In addition, the expanding middle class in developing economies is increasing adoption of smartphones, home appliances, and connected electronics, driving further long-term demand for e-waste management infrastructure and recovery technologies

- The increasing scarcity and rising prices of virgin precious metals are reinforcing the need for sustainable recovery from discarded electronics. Recovery meets supply chain needs and also provides manufacturers with cost savings and reduced dependence on mining activities

Restraint/Challenge

Lack of Proper E-Waste Collection Infrastructure

- One of the major challenges hindering market growth is the lack of robust e-waste collection infrastructure across many regions. Without efficient collection and segregation systems, vast amounts of precious metal-rich e-waste never reach recycling facilities, reducing recovery efficiency

- For instance, in several developing regions, informal recycling dominates e-waste recovery with limited regulation or safety standards. Companies such as Umicore, which focus on advanced and environmentally responsible recovery, often face material shortages due to weak collection networks in high-volume e-waste markets

- The lack of consumer awareness regarding proper disposal methods further reduces the inflow of e-waste to authorized facilities. Many households dispose of old devices through informal dealers or mix them with general waste, reducing effective recovery rates for valuable metals

- In addition, logistical challenges and inefficiencies in collection supply chains hinder large-scale integration of recycling facilities. Transporting electronic waste from dispersed collection points to centralized plants remains costly and fragmented in many countries

- Policy enforcement gaps also limit the effectiveness of e-waste collection campaigns. Even where extended producer responsibility (EPR) laws exist, weak monitoring mechanisms reduce compliance and fail to ensure that e-waste is funneled into organized recovery systems

Precious Metals E-Waste Recovery Market Scope

The market is segmented on the basis of type, source of e-waste, method of recovery, and end-use industry.

• By Type

On the basis of type, the precious metals e-waste recovery market is segmented into gold, silver, platinum, palladium, and others. The gold segment dominated the largest market revenue share in 2024, attributed to its extensive use in printed circuit boards, connectors, and semiconductor devices due to superior conductivity and resistance to corrosion. Its high intrinsic value and recyclability make gold recovery one of the most lucrative segments in e-waste recycling. The consistent demand from electronics manufacturing and investment markets ensures steady recovery efforts, with specialized hydrometallurgical and electrochemical processes enhancing efficiency.

The palladium segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by its rising use in multilayer ceramic capacitors, sensors, and connectors in modern electronics. Increasing demand from electric vehicles, 5G infrastructure, and advanced medical devices has significantly amplified palladium recovery needs. Its high catalytic properties also contribute to value in both electronics and automotive sectors, motivating recyclers to adopt innovative recovery technologies.

• By Source of E-Waste

On the basis of source of e-waste, the market is segmented into consumer electronics, industrial electronics, medical devices, automotive electronics, and others. Consumer electronics dominated the market share of 46.3% in 2024, supported by massive volumes of discarded smartphones, laptops, tablets, and household gadgets. Frequent product upgrades, shorter replacement cycles, and rising global e-waste generation make this source the most concentrated pool for precious metals recovery. With the high content of gold, silver, and palladium embedded in small circuit boards, consumer electronics continue to be a primary driver for recyclers.

The automotive electronics segment is expected to record the fastest CAGR during 2025–2032, spurred by rapid electrification of vehicles, adoption of advanced infotainment, safety, and battery management systems. Increasing volumes of end-of-life electric vehicles and hybrid cars are leading to higher recovery of platinum, palladium, and silver from sensors and electronic modules. Regulatory pushes for sustainable automotive recycling and growing demand for precious metals in EV technologies further boost this segment.

• By Method of Recovery

On the basis of method of recovery, the market is segmented into mechanical processing, hydrometallurgical processes, pyrometallurgical processes, biotechnological processes, electrochemical processes, and others. Hydrometallurgical processes dominated the market share in 2024, driven by their ability to achieve high recovery rates for gold, silver, and palladium through selective leaching and solvent extraction. The method is favored for its scalability, adaptability to different e-waste types, and comparatively lower emissions compared to pyrometallurgy. It remains widely adopted across large recycling facilities as an efficient and sustainable recovery technique.

The biotechnological processes segment is projected to grow at the fastest rate from 2025 to 2032, owing to increasing research and adoption of eco-friendly methods using microbes and bioleaching. These processes offer cost-effectiveness, reduced environmental impact, and suitability for low-grade waste where traditional methods are uneconomical. Rising focus on green recovery technologies and supportive government funding for sustainable recycling innovation are expected to accelerate the growth of this segment.

• By End-Use Industry

On the basis of end-use industry, the market is segmented into electronics manufacturing, automotive industry, healthcare industry, aerospace and defense, and others. Electronics manufacturing held the largest revenue share in 2024, reflecting the industry’s reliance on a stable supply of gold, silver, platinum, and palladium recovered from e-waste for production of semiconductors, circuit boards, and connectors. Growing demand for high-performance devices and cost-efficiency in sourcing recovered metals make this the dominant segment. The sector also benefits from increasing circular economy initiatives by major electronics brands.

The healthcare industry is forecasted to witness the fastest growth from 2025 to 2032, owing to rising adoption of advanced medical electronics, diagnostic devices, and surgical instruments that require high-purity precious metals. With the rising disposal of obsolete medical equipment and regulatory standards emphasizing proper waste management, healthcare e-waste has become a valuable recovery source. The increasing role of precious metals in implants, imaging equipment, and life-support devices strengthens the industry’s reliance on sustainable recovery solutions.

Precious Metals E-Waste Recovery Market Regional Analysis

- North America dominated the precious metals e-waste recovery market with the largest revenue share of 35.5% in 2024, driven by stringent regulations on electronic waste management and strong initiatives toward a circular economy

- The region benefits from advanced recycling infrastructure, high volumes of discarded consumer electronics, and strong government incentives for sustainable practices

- Increasing adoption of electric vehicles and renewable energy storage systems is also creating fresh streams of e-waste rich in gold, palladium, and silver

U.S. Precious Metals E-Waste Recovery Market Insight

The U.S. market captured the largest revenue share in 2024 within North America, fueled by rapid technological adoption, frequent device replacement cycles, and strict enforcement of e-waste recycling policies. Major electronics and automotive manufacturers are increasingly partnering with recycling firms to secure sustainable sources of precious metals. The growing focus on urban mining, alongside rising investments in hydrometallurgical and biotechnological recovery methods, is strengthening the U.S. market position.

Europe Precious Metals E-Waste Recovery Market Insight

The Europe market is projected to expand at a significant CAGR during the forecast period, primarily due to the EU’s stringent Waste Electrical and Electronic Equipment (WEEE) Directive and aggressive sustainability targets. Rising e-waste volumes from industrial electronics and automotive components, coupled with an emphasis on resource efficiency, are driving adoption of advanced recycling technologies. European recyclers are also focusing on low-carbon recovery methods to align with green economy goals.

U.K. Precious Metals E-Waste Recovery Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by government-backed recycling initiatives, strong compliance culture, and rising demand for recovered metals in electronics and automotive sectors. Increasing consumer awareness about sustainable disposal of gadgets and rapid penetration of EVs are key factors strengthening recovery operations.

Germany Precious Metals E-Waste Recovery Market Insight

The Germany market is expected to witness considerable growth, fueled by its advanced industrial base and emphasis on eco-friendly innovation. Strong demand from automotive and electronics manufacturing sectors, combined with Germany’s leadership in sustainable technologies, supports widespread adoption of hydrometallurgical and electrochemical processes. Growing partnerships between recyclers and manufacturers further accelerate the recovery ecosystem.

Asia-Pacific Precious Metals E-Waste Recovery Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rapid urbanization, increasing e-waste generation, and large-scale electronics production in China, Japan, India, and South Korea. Favorable government regulations promoting recycling, along with the presence of major e-waste processing hubs, are propelling growth. Rising adoption of smartphones, EVs, and IoT devices is expanding the pool of recoverable precious metals.

Japan Precious Metals E-Waste Recovery Market Insight

The Japan market is expanding steadily, supported by the country’s focus on high-tech recycling technologies and its early adoption of circular economy policies. The demand for high-purity precious metals in semiconductors, healthcare devices, and advanced electronics makes Japan a critical hub for e-waste recovery. Increasing recovery from automotive electronics, especially in hybrid and electric vehicles, is a key growth driver.

China Precious Metals E-Waste Recovery Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2024, attributed to its vast consumer base, strong electronics manufacturing industry, and government-led efforts to manage e-waste. The rise of urban mining and the presence of large domestic recyclers have significantly increased recovery rates of gold, silver, and palladium. Rapid expansion of EVs and renewable energy sectors is further boosting precious metals demand and recovery operations in China.

Precious Metals E-Waste Recovery Market Share

The precious metals e-waste recovery industry is primarily led by well-established companies, including:

- Amcor Ltd. (Australia)

- Bemis Company, In. (U.S.)

- Essentra plc (U.K.)

- The Dow Chemical Company (U.S.)

- Tekni-Plex, Inc (U.S.)

- Honeywell International Inc (U.S.)

- E. I. du Pont de Nemours and Company (DuPont) (U.S.)

- Constantia Flexibles Group GmbH (Austria)

- ACG Pharmapack (India)

- Huhtamaki Oyj (Finland)

Latest Developments in Global Precious Metals E-Waste Recovery Market

- In February 2024, ReclaimTech Inc. unveiled a state-of-the-art facility in California, USA, equipped with advanced pyrometallurgical technology designed to optimize the recovery of precious metals from electronic waste streams. This development significantly strengthens the U.S. market by boosting processing capacity and improving recovery efficiency while ensuring greater sustainability. The facility enhances metal yields and also reduces overall environmental footprint, positioning North America as a leader in innovative e-waste recycling solutions

- In January 2024, EcoTech Solutions announced a breakthrough in its e-waste recycling process through the adoption of advanced biotechnological methods. This achievement enables higher yields in precious metal extraction, while drastically reducing the reliance on harsh chemicals and energy-intensive methods. The innovation is expected to accelerate the adoption of eco-friendly recovery techniques globally, aligning with increasing regulatory focus on green technologies and sustainable practices in the recycling industry

- In November 2023, Johnson Matthey introduced a mass balance process capable of recovering 100% recycled platinum group metals, a methodology reviewed and validated by Carbon Trust for compliance with industry sustainability standards. This innovation enhances transparency in supply chains and ensures a reliable flow of sustainably sourced PGMs, reinforcing the company’s leadership in circular economy initiatives. The acceptance of this process also raises industry confidence in adopting similar methods, potentially setting a new benchmark for global recycling operations

- In January 2023, DOWA Ecosystem commenced operations at its DESI facility in East Java, Indonesia, dedicated to hazardous waste treatment and recycling. The facility incorporates multiple processes, including waste classification, blending, and detoxification, to enable safe and efficient recovery. This marks a significant step in strengthening Southeast Asia’s recycling capacity, addressing the region’s growing e-waste volumes, and promoting environmentally responsible practices in emerging markets

- In October 2022, Aurubis AG, a leading global provider of non-ferrous metals, expanded its recycling operations in Hamburg, Germany, with the launch of a high-capacity hydrometallurgical recovery line. This expansion improves the company’s ability to recover gold, silver, and palladium from low-grade e-waste, supporting Europe’s ambition to reduce dependency on primary mining. By investing in advanced hydrometallurgical techniques, Aurubis reinforces the region’s leadership in sustainable recycling and strengthens its competitive position in the global market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Precious Metals E Waste Recovery Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Precious Metals E Waste Recovery Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Precious Metals E Waste Recovery Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.