Global Precision Agriculture Market

Market Size in USD Billion

CAGR :

%

USD

8.00 Billion

USD

21.89 Billion

2024

2032

USD

8.00 Billion

USD

21.89 Billion

2024

2032

| 2025 –2032 | |

| USD 8.00 Billion | |

| USD 21.89 Billion | |

|

|

|

|

What is the Global Precision Agriculture Market Size and Growth Rate?

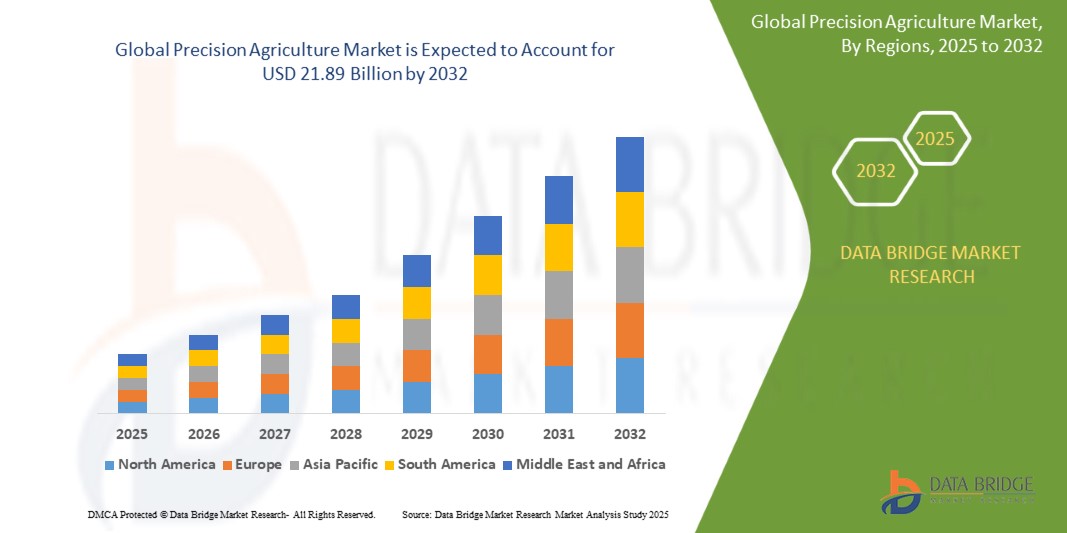

- The global precision agriculture market size was valued at USD 8.00 billion in 2024 and is expected to reach USD 21.89 billion by 2032, at a CAGR of 13.40% during the forecast period

- The precision agriculture market is witnessing significant growth due to advancements in technology and innovative methods aimed at improving crop yields and reducing waste

- Recent developments include the use of drones equipped with multispectral cameras to monitor crop health and optimize input usage. These aerial imaging technologies enable farmers to identify specific areas that require attention, such as irrigation or pest control, leading to more targeted interventions

What are the Major Takeaways of Precision Agriculture Market?

- The integration of Internet of Things (IoT) devices has revolutionized data collection. Sensors deployed in fields collect real-time data on soil moisture, temperature, and nutrient levels, providing valuable insights for decision-making. This data-driven approach allows for precise applications of water, fertilizers, and pesticides, significantly enhancing efficiency and sustainability

- Machine learning and AI are increasingly employed to analyze vast datasets, predicting crop performance and optimizing planting schedules. This technological synergy has led to a more proactive approach in farming, minimizing risks and maximizing productivity

- North America dominated the precision agriculture market with the largest revenue share of 33.6% in 2024, attributed to widespread adoption of advanced agricultural technologies, a well-established commercial farming sector, and strong emphasis on yield enhancement and sustainability

- Asia-Pacific precision agriculture market is projected to grow at the fastest CAGR of 11.2% from 2025 to 2032, driven by rising food demand, rapid population growth, and government initiatives to modernize agriculture

- The Guidance Technology segment dominated the precision agriculture market with the largest revenue share of 41.8% in 2024, driven by the widespread adoption of GPS-enabled tractor guidance systems, automated steering, and real-time navigation tools

Report Scope and Precision Agriculture Market Segmentation

|

Attributes |

Precision Agriculture Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Precision Agriculture Market?

“Integration of Data-Driven Technologies to Optimize Agricultural Productivity”

- A major and rapidly evolving trend in the global precision agriculture market is the integration of advanced data-driven technologies such as AI, IoT, big data analytics, and satellite imagery to enhance farm efficiency and productivity

- For instance, farmers are increasingly adopting precision tools such as drone-based crop monitoring, real-time soil sensors, and variable rate technology (VRT) to optimize resource usage, reduce input costs, and boost yields

- The combination of AI algorithms with real-time field data allows for predictive analytics in crop health monitoring, disease prevention, and efficient irrigation management, significantly improving decision-making for farmers

- In addition, platforms integrating farm management software with satellite imagery provide comprehensive field insights, enabling precise application of fertilizers, pesticides, and water, enhancing both productivity and sustainability

- Leading players such as Trimble, John Deere, and AGCO Corporation are heavily investing in precision platforms, offering autonomous tractors, data analytics, and smart equipment to modernize farming practices

- As farmers face rising input costs, labor shortages, and climate variability, the demand for connected, intelligent precision agriculture solutions is surging, fundamentally reshaping global agricultural practices towards higher efficiency and sustainability

What are the Key Drivers of Precision Agriculture Market?

- The rising global population and the corresponding need for increased agricultural output with minimal environmental impact are significant factors driving the precision agriculture market

- For instance, in January 2024, John Deere launched its next-generation autonomous tractor equipped with AI-powered field analysis, reducing labor dependency and maximizing operational efficiency

- Growing emphasis on sustainable agriculture, driven by regulatory mandates and corporate sustainability goals, is accelerating the adoption of precision tools that optimize resource utilization and reduce carbon footprints

- Government programs offering subsidies, digital platforms, and incentives for adopting smart farming technologies are also fueling market growth, especially in developing regions

- Increased awareness among farmers regarding the benefits of precision agriculture, such as improved yield consistency, reduced input wastage, and real-time decision-making, is further supporting the market's expansion across both small-scale and large commercial farms

Which Factor is challenging the Growth of the Precision Agriculture Market?

- Despite its growth potential, the precision agriculture market faces barriers such as high initial investment costs, technological complexity, and limited digital infrastructure in rural areas

- For instance, smallholder farmers in emerging economies often struggle with the affordability of advanced equipment and lack access to reliable connectivity, hindering large-scale adoption

- Data privacy concerns, interoperability issues among different systems, and insufficient technical expertise in managing precision tools are additional challenges limiting market growth

- Furthermore, fragmented regulations across regions regarding data ownership, equipment standards, and environmental compliance create complexities for manufacturers and service providers

- Addressing these challenges will require strategic public-private partnerships, investments in digital infrastructure, and the development of affordable, user-friendly Precision Agriculture solutions accessible to farmers globally

How is the Precision Agriculture Market Segmented?

The market is segmented on the basis of technology, application, and offering.

• By Technology

On the basis of technology, the precision agriculture market is segmented into Guidance Technology, Remote Sensing Technology, and Variable-Rate Technology. The Guidance Technology segment dominated the precision agriculture market with the largest revenue share of 41.8% in 2024, driven by the widespread adoption of GPS-enabled tractor guidance systems, automated steering, and real-time navigation tools. These technologies help reduce overlaps, optimize field operations, and lower input costs, making them highly attractive for large-scale and commercial farmers. Increasing emphasis on operational efficiency and resource conservation further propels the growth of this segment.

The Variable-Rate Technology (VRT) segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its ability to deliver precise input application based on real-time field conditions. Rising demand for optimizing fertilizer, pesticide, and seed usage to improve yields while minimizing environmental impact supports the rapid adoption of VRT across global farming operations.

• By Application

On the basis of application, the precision agriculture market is segmented into Yield Monitoring, Crop Scouting, Field Mapping, Variable Rate Application, Weather Tracking and Forecasting, Inventory Management, Farm Labour Management, Financial Management, and Others. The Yield Monitoring segment accounted for the largest market revenue share of 29.4% in 2024, owing to its critical role in providing farmers with real-time insights into crop performance, productivity levels, and operational inefficiencies. Accurate yield data enables better decision-making for future planting, resource management, and profitability enhancement.

The Variable Rate Application segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing efforts to optimize input application and maximize crop performance while addressing sustainability concerns. Precision application of seeds, fertilizers, and pesticides improves resource use efficiency, reduces waste, and enhances yields, making this application increasingly popular among farmers worldwide.

• By Offerings

On the basis of offerings, the precision agriculture market is segmented into Hardware, Software, and Services. The Hardware segment dominated the market with the largest revenue share of 52.6% in 2024, driven by the essential role of physical equipment such as sensors, GPS systems, drones, and autonomous machinery in implementing precision farming practices. Farmers increasingly rely on advanced hardware solutions for accurate field data collection, machinery automation, and improved operational control.

The Software segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by the rising integration of AI, big data analytics, and farm management platforms that transform raw field data into actionable insights. Increasing demand for real-time monitoring, predictive analytics, and centralized farm management solutions drives the rapid expansion of software offerings in the market.

Which Region Holds the Largest Share of the Precision Agriculture Market?

- North America dominated the precision agriculture market with the largest revenue share of 33.6% in 2024, attributed to widespread adoption of advanced agricultural technologies, a well-established commercial farming sector, and strong emphasis on yield enhancement and sustainability

- The region benefits from increased demand for genetically modified crops, pest-resistant seed varieties, and environmentally conscious farming inputs, supported by robust R&D infrastructure and favorable regulatory frameworks

- Major markets such as the U.S. and Canada continue to lead in deploying precision farming tools, satellite monitoring, and AI-driven crop management, driven by food security concerns and the need to maximize land productivity

U.S. Precision Agriculture Market Insight

The U.S. precision agriculture market accounted for the largest share within North America in 2024, fueled by the country's leadership in agri-tech innovations, strong focus on maximizing crop yields, and increasing consumer demand for sustainable, high-quality produce. Ongoing advancements in precision farming equipment, genetically enhanced seeds, and climate-smart agricultural practices continue to drive market growth, particularly across key crops such as corn, soybeans, and wheat.

Canada Precision Agriculture Market Insight

The Canada precision agriculture market is witnessing steady growth, supported by the country's large-scale production of grains, oilseeds, and horticultural crops. Growing emphasis on climate-resilient agriculture, soil fertility improvement, and sustainable farming inputs is encouraging the adoption of advanced precision agriculture solutions. Canadian farmers are increasingly investing in technologies that enhance productivity while aligning with national environmental targets and global export standards.

Which Region is the Fastest Growing Region in the Precision Agriculture Market?

Asia-Pacific precision agriculture market is projected to grow at the fastest CAGR of 11.2% from 2025 to 2032, driven by rising food demand, rapid population growth, and government initiatives to modernize agriculture. Expanding farmland, increasing awareness of high-yield, pest-resistant crops, and growing investments in precision technologies are accelerating market growth across countries such as China, India, Japan, and Southeast Asia. Technological advancements in crop protection, digital farming tools, and sustainability-focused policies are further supporting the region's strong market momentum.

China Precision Agriculture Market Insight

The China precision agriculture market captured the largest revenue share within Asia-Pacific in 2024, driven by the nation's large agricultural base, growing food demand, and state-led programs promoting advanced farming practices. Increasing adoption of genetically enhanced crops, soil improvement techniques, and modern crop protection products is boosting productivity, particularly in grains, fruits, and vegetable cultivation, supporting national food security goals.

India Precision Agriculture Market Insight

The India precision agriculture market is experiencing rapid growth, fueled by government efforts to enhance food production, promote climate-resilient agriculture, and support smallholder farmers with input subsidies. Rising awareness about yield improvement, soil health management, and the benefits of certified seeds and fertilizers is driving adoption across key crops, including cereals, pulses, oilseeds, and horticulture. Expanding agricultural activities and favorable policies continue to support India's market growth trajectory.

Which are the Top Companies in Precision Agriculture Market?

The precision agriculture industry is primarily led by well-established companies, including:

- AgJunction (U.S.)

- Raven Industries, Inc. (U.S.)

- Deere & Company (U.S.)

- AGCO Corporation (U.S.)

- Trimble Inc. (U.S.)

- Prospera Technologies Ltd. (Israel)

- Descartes Labs Inc. (U.S.)

- Topcon Positioning Systems Inc. (U.S.)

- AgEagle Aerial Systems Inc. (U.S.)

- Ag Leader Technology Inc. (U.S.)

- 365FarmNet GmbH (Germany)

- Abundant Robotics Inc. (U.S.)

- AeroVironment, Inc. (U.S.)

- BASF SE (Germany)

- CLAAS Group (Germany)

- Granular Inc. (U.S.)

- Harvest Automation Inc. (U.S.)

- Hexagon Agriculture (Sweden)

- Kubota Corporation (Japan)

- Naio Technologies (France)

- Parrot SA (France)

- PrecisionHawk Inc. (U.S.)

- Teejet Technologies (U.S.)

- The Toro Company (U.S.)

- Valmont Industries, Inc. (U.S.)

- YANMAR HOLDINGS CO., LTD. (Japan)

What are the Recent Developments in Global Precision Agriculture Market?

- In July 2023, Deere & Company, a leading global manufacturer in agriculture and construction equipment, announced its acquisition of Smart Apply Inc., an innovative provider of agricultural technology solutions. This strategic move aims to leverage Smart Apply’s precision spraying technology to help growers navigate challenges related to regulatory compliance, rising input costs, and labor shortages. The acquisition is expected to enhance customer attraction and engagement for Deere & Company

- In April 2023, AGCO Corporation, a prominent global provider of agricultural equipment, entered into a strategic collaboration with Hexagon, an industrial technology leader. This partnership is focused on expanding AGCO’s factory-fit and aftermarket guidance solutions, enhancing precision and operational efficiency for farmers. By integrating Hexagon's advanced technologies, AGCO aims to provide improved support to agricultural producers, ensuring more effective machinery guidance in various farming operations

- In May 2023, AgEagle Aerial Systems Inc., a global leader in agricultural technology, announced the establishment of a new supply agreement with Wingtra AG. This two-year contract aims to secure a steady supply of RedEdge-P sensor kits for integration with WingtraOne VTOL drones. This collaboration underscores the commitment of both companies to enhance agricultural practices through advanced aerial data collection and analysis, benefiting precision farming techniques

- In March 2023, Case IH Agriculture revealed its collaboration with Agri Technovation to empower producers with precision farming capabilities. The partnership utilizes Case IH’s AFS system, which enables farmers to achieve exceptional accuracy in planting, spraying, and harvesting. Agri Technovation complements this by offering in-depth data analyses throughout the agricultural process, from planting to post-harvest, thereby optimizing overall farm management and productivity

- In May 2022, AGCO Corporation, a global manufacturer and distributor of farm machinery and precision agriculture technologies, acquired JCA Industries. Renowned for developing autonomous software for agricultural machinery and control systems, JCA will enhance AGCO's portfolio. This acquisition aims to accelerate AGCO’s innovation in autonomous agricultural solutions, ensuring farmers benefit from advanced technologies that streamline operations and improve efficiency in modern farming practices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.