Global Precision Oncology Drug Portfolio Market

Market Size in USD Billion

CAGR :

%

USD

18.76 Billion

USD

45.46 Billion

2025

2033

USD

18.76 Billion

USD

45.46 Billion

2025

2033

| 2026 –2033 | |

| USD 18.76 Billion | |

| USD 45.46 Billion | |

|

|

|

|

Precision Oncology Drug Portfolio Market Size

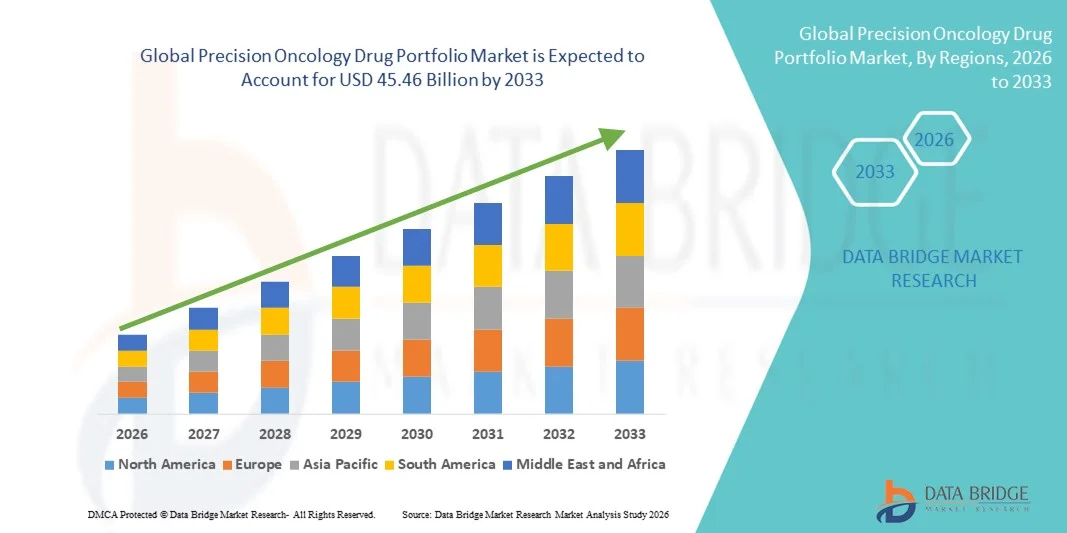

- The global precision oncology drug portfolio market size was valued at USD 18.76 billion in 2025 and is expected to reach USD 45.46 billion by 2033, at a CAGR of 11.70% during the forecast period

- The market growth is largely fueled by rapid advancements in genomics, molecular diagnostics, and personalized medicine, enabling the development of highly targeted oncology therapies

- Furthermore, increasing demand for more effective and individualized cancer treatments, coupled with rising investments in research and development by pharmaceutical and biotech companies, is driving the adoption of Precision Oncology Drug Portfolio solutions, thereby significantly boosting the industry's growth

Precision Oncology Drug Portfolio Market Analysis

- Oncology drugs, offering targeted and personalized treatment options for cancer patients, are increasingly vital components of modern healthcare due to their ability to improve clinical outcomes, reduce side effects, and integrate with precision medicine platforms

- The escalating demand for precision oncology solutions is primarily fueled by the rising global cancer burden, advances in genomic profiling, and growing adoption of biomarker-driven therapies

- North America dominated the Precision Oncology Drug Portfolio market with the largest revenue share of 42.5% in 2025, supported by a strong presence of leading pharmaceutical companies, advanced healthcare infrastructure, and widespread adoption of precision medicine technologies. The U.S. experienced substantial growth in precision oncology drug adoption, driven by innovations in targeted therapies and immuno-oncology drugs

- Asia-Pacific is expected to be the fastest growing region in the Precision Oncology Drug Portfolio market during the forecast period, projected to grow at a CAGR of 15.8%, due to increasing healthcare expenditure, rising cancer incidence, and expanding access to advanced diagnostic and treatment facilities

- The targeted therapy segment dominated the largest market revenue share of 38.7% in 2025, owing to its ability to specifically target cancer cells while minimizing damage to healthy tissues

Report Scope and Precision Oncology Drug Portfolio Market Segmentation

|

Attributes |

Precision Oncology Drug Portfolio Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Precision Oncology Drug Portfolio Market Trends

Rising Focus on Personalized and Targeted Cancer Therapies

- A significant and accelerating trend in the global Precision Oncology Drug Portfolio market is the growing emphasis on personalized and targeted cancer therapies, which leverage detailed molecular and genetic profiling of tumors to deliver more effective treatments. This approach allows oncologists to identify the most appropriate therapies for individual patients, improving treatment outcomes while minimizing side effects

- For instance, in March 2023, Pfizer launched a next-generation targeted therapy for non-small cell lung cancer (NSCLC) patients with uncommon EGFR mutations, reflecting the shift toward patient-specific treatment regimens. Similarly, in February 2022, Roche expanded its portfolio of biomarker-driven therapies with a companion diagnostic for colorectal cancer, enabling precision-guided therapy selection

- There is also a rising integration of liquid biopsy technologies and high-throughput genomic screening in clinical practice, which is enhancing early detection, monitoring, and adaptive treatment planning. This trend is not only accelerating drug adoption but also reshaping the standard of care in oncology

- The increasing collaboration between pharmaceutical companies, diagnostic firms, and research institutions is fostering innovation in combination therapies, further strengthening the market’s focus on highly personalized treatment protocols

Precision Oncology Drug Portfolio Market Dynamics

Driver

Expanding Prevalence of Cancer and Supportive Healthcare Infrastructure

- The growing global incidence of cancer, particularly lung, breast, colorectal, and hematological malignancies, is creating substantial demand for precision oncology drugs. Patients and healthcare providers are increasingly seeking therapies that improve survival outcomes and reduce adverse reactions compared to conventional chemotherapy

- For instance, in January 2022, the American Cancer Society reported that targeted therapies significantly improved survival outcomes for patients with metastatic breast cancer, encouraging hospitals and clinics to adopt precision medicine strategies. In December 2023, Memorial Sloan Kettering Cancer Center integrated next-generation sequencing for over 5,000 oncology patients to optimize treatment selection, highlighting how healthcare infrastructure is supporting this market growth

- Furthermore, increasing awareness among healthcare professionals and patients regarding genomics-driven therapies, coupled with government initiatives, favorable reimbursement policies, and investment in oncology research, is driving adoption

- The expansion of diagnostic laboratories, coupled with the establishment of precision oncology centers of excellence in the U.S., is facilitating better access to these advanced treatments, which continues to propel the market forward

- In addition, partnerships between pharmaceutical companies and digital health platforms are enabling real-time monitoring of treatment response and patient outcomes, improving clinical decision-making and boosting confidence in precision therapy adoption

Restraint/Challenge

High Development Costs and Regulatory Complexities

- Despite the market growth, significant challenges remain, including high research and development (R&D) costs, long clinical trial durations, and stringent regulatory approvals, which can slow the introduction of new therapies and increase prices for patients

- For instances, in May 2024, a report by Evaluate Pharma highlighted that development costs for personalized cancer therapies can exceed $1 billion per drug, creating pricing barriers and limiting access in both developed and emerging markets. Similarly, in October 2023, FDA reviews for a novel targeted therapy for gastric cancer were delayed due to additional data requests on long-term safety, demonstrating regulatory hurdles impacting market speed

- In addition, variability in reimbursement frameworks across states and insurance providers can restrict the adoption of these high-cost therapies. This is particularly challenging for combination therapies or rare mutation-targeted drugs, where limited patient populations may make payers hesitant to cover costs

- Companies are also challenged to conduct extensive real-world evidence studies to demonstrate cost-effectiveness and treatment benefit, which increases the complexity and time needed to achieve market penetration

- Overcoming these barriers requires strategic collaborations between pharmaceutical firms, healthcare providers, and regulatory agencies, as well as patient support programs to improve accessibility and affordability of precision oncology treatments

Precision Oncology Drug Portfolio Market Scope

The market is segmented on the basis of therapy type and cancer type.

- By Therapy Type

On the basis of therapy type, the Precision Oncology Drug Portfolio market is segmented into targeted therapy, immunotherapy, hormone therapy, chemotherapy, and combination therapy. The targeted therapy segment dominated the largest market revenue share of 38.7% in 2025, owing to its ability to specifically target cancer cells while minimizing damage to healthy tissues. Its growing adoption is driven by the availability of biomarker-driven treatments and companion diagnostics. Hospitals and oncology centers prefer targeted therapies due to improved efficacy and patient outcomes. High prevalence of lung, breast, and colorectal cancers has accelerated demand. Pharmaceutical companies are continuously developing novel small molecule and monoclonal antibody-based therapies. Regulatory approvals for new targeted therapies in key regions further support growth. Patient preference for precision medicine approaches also contributes to market dominance. Targeted therapies are increasingly integrated with immunotherapies for combination regimens. The segment benefits from rising awareness of genetic testing and personalized treatment plans. Cost-effectiveness in reducing adverse effects strengthens adoption in developed markets. Clinical guidelines favor targeted therapy for specific cancer mutations, reinforcing dominance. Ongoing research into novel targets expands therapeutic potential.

The immunotherapy segment is expected to witness the fastest CAGR of 19.5% from 2026 to 2033, driven by advancements in checkpoint inhibitors, CAR-T cell therapies, and cancer vaccines. Its ability to harness the patient’s immune system for long-term remission has fueled adoption across multiple cancer types. Increasing approvals of novel immunotherapy drugs globally support growth. Combination with targeted therapy is enhancing clinical outcomes. Hospitals and specialized cancer centers are adopting immunotherapy protocols for lung, melanoma, and hematologic malignancies. Rising incidence of advanced-stage cancers encourages adoption of immune-based treatments. Government and private funding for immuno-oncology research accelerates market growth. Immunotherapy offers hope for refractory and relapsed cases, boosting demand. Biotech startups are introducing innovative therapies at competitive costs. Improved safety profiles compared to conventional chemotherapy increase physician preference. Expanded access programs in emerging markets drive usage. Growing patient awareness of immunotherapy benefits reinforces adoption. Continuous pipeline innovations ensure a robust growth trajectory.

- By Cancer Type

On the basis of cancer type, the market is segmented into lung cancer, breast cancer, colorectal cancer, prostate cancer, melanoma, and hematologic malignancies. The lung cancer segment dominated the largest market revenue share of 27.9% in 2025, due to its high global prevalence and mortality rates. Adoption of targeted therapies and immunotherapies in non-small cell lung cancer (NSCLC) has boosted segment growth. Hospitals and oncology centers focus on precision medicine approaches to improve survival rates. Biomarker testing such as EGFR, ALK, and PD-L1 drives therapy selection. Rising awareness about early diagnosis and advanced treatment options supports market leadership. Pharmaceutical companies are launching novel therapies specifically for lung cancer subtypes. Combination therapy regimens further enhance patient outcomes. Increasing prevalence of smoking and environmental risk factors in emerging regions contributes to adoption. Lung cancer research and clinical trials attract significant funding. Government initiatives for cancer screening improve early intervention rates. Patient preference for therapies with lower adverse effects strengthens dominance. Clinical guidelines recommend precision treatment strategies, reinforcing market share.

The melanoma segment is expected to witness the fastest CAGR of 20.3% from 2026 to 2033, driven by the success of checkpoint inhibitors and personalized immunotherapies. Rising incidence of skin cancers and better diagnostic tools support rapid adoption. Hospitals and specialized dermatology-oncology centers increasingly implement immunotherapy protocols. Combination therapy with targeted drugs improves survival rates. Pharmaceutical companies are expanding their pipeline with BRAF and MEK inhibitors. Patient demand for treatments with higher efficacy and fewer side effects accelerates growth. Global awareness campaigns about melanoma prevention and early detection enhance adoption. Advanced therapies are increasingly covered by insurance and reimbursement programs. Access to novel clinical trials boosts segment growth. Research into adoptive cell therapy and vaccines opens new opportunities. Regional expansion in North America and Europe drives early adoption. Adoption in emerging markets is increasing due to medical tourism and specialized care. Favorable regulatory pathways for breakthrough therapies support the high CAGR.

Precision Oncology Drug Portfolio Market Regional Analysis

- North America dominated the precision oncology drug portfolio market with the largest revenue share of approximately 42.5% in 2025, supported by a strong presence of leading pharmaceutical companies, advanced healthcare infrastructure, and widespread adoption of precision medicine technologies

- The market experienced substantial growth in precision oncology drug adoption, driven by innovations in targeted therapies, immuno-oncology drugs, and a robust pipeline of novel candidates

- Consumers and healthcare providers in the region increasingly value therapies that provide personalized treatment based on genomic profiling and biomarker-driven approaches. High R&D investment, coupled with a favorable regulatory environment, further supports market expansion. Strategic collaborations between pharma and diagnostic companies accelerate the commercialization of precision oncology solutions

U.S. Precision Oncology Drug Portfolio Market Insight

The U.S. precision oncology drug portfolio market captured the largest revenue share of 83% in 2025 within North America, fueled by rapid adoption of precision medicine approaches, comprehensive genomic testing programs, and increasing integration of targeted therapeutics in clinical oncology. The growth is further supported by the adoption of companion diagnostics, reimbursement support, and early access programs for novel therapies. Expansion of hospital oncology centers and precision medicine clinics also drives adoption.

Europe Precision Oncology Drug Portfolio Market Insight

The Europe precision oncology drug portfolio market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing investments in healthcare infrastructure, adoption of molecular diagnostics, and growing awareness of personalized oncology therapies. Countries like Germany, France, and Italy are leading the adoption of targeted therapies supported by national healthcare programs. Collaborative initiatives between biotech firms and academic centers enhance clinical trial activity and early access to innovative therapies.

U.K. Precision Oncology Drug Portfolio Market Insight

The U.K. precision oncology drug portfolio market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the integration of precision oncology in the National Health Service (NHS) programs and increasing demand for targeted cancer treatments. The government’s support for genomic testing, cancer screening initiatives, and clinical trial networks further propels growth. The U.K. also benefits from strong pharmaceutical research hubs facilitating innovative drug development.

Germany Precision Oncology Drug Portfolio Market Insight

The Germany precision oncology drug portfolio market is expected to expand at a considerable CAGR, fueled by increasing awareness of precision oncology, strong healthcare infrastructure, and adoption of advanced diagnostic platforms. Germany’s emphasis on innovative therapies and sustainable healthcare solutions promotes the integration of precision oncology drugs in routine treatment regimens. Collaborations with leading biotech and pharmaceutical companies further strengthen the market.

Asia-Pacific Precision Oncology Drug Portfolio Market Insight

The Asia-Pacific precision oncology drug portfolio market is poised to grow at the fastest CAGR of 15.8% during the forecast period, driven by increasing healthcare expenditure, rising cancer incidence, and expanding access to advanced diagnostic and treatment facilities in countries such as China, India, and Japan. Growing government support for oncology programs, rising awareness of targeted therapies, and the expanding middle-class patient base accelerate adoption.

Japan Precision Oncology Drug Portfolio Market Insight

The Japanese precision oncology drug portfolio market is gaining momentum due to advanced healthcare infrastructure, a high prevalence of cancer, and strong government initiatives promoting precision medicine. Rapid adoption of next-generation sequencing (NGS) and companion diagnostics supports the use of targeted therapies. Aging population and increasing patient awareness drive demand for personalized treatment approaches.

China Precision Oncology Drug Portfolio Market Insight

China precision oncology drug portfolio market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to expanding healthcare access, growing cancer prevalence, rising investment in biotechnology, and increasing adoption of precision medicine programs. Domestic pharmaceutical companies are investing in R&D to develop targeted therapies and immuno-oncology drugs, supported by government initiatives promoting innovation and early access programs.

Precision Oncology Drug Portfolio Market Share

The Precision Oncology Drug Portfolio industry is primarily led by well-established companies, including:

- Roche (Switzerland)

- Novartis (Switzerland)

- Pfizer (U.S.)

- Merck & Co. (U.S.)

- Bristol-Myers Squibb (U.S.)

- AstraZeneca (U.K.)

- Johnson & Johnson (U.S.)

- Amgen (U.S.)

- Bayer (Germany)

- AbbVie (U.S.)

- Sanofi (France)

- Takeda (Japan)

- GlaxoSmithKline (U.K.)

- Eli Lilly and Company (U.S.)

- BeiGene (China)

- Incyte Corporation (U.S.)

- Seattle Genetics (U.S.)

- Blueprint Medicines (U.S.)

- Genmab (Denmark)

- Adaptive Biotechnologies (U.S.)

Latest Developments in Global Precision Oncology Drug Portfolio Market

- In August 2021, the PD‑1 inhibitor penpulimab was first approved for medical use in China, marking an important precision oncology immunotherapy milestone; it later received U.S. approval in April 2025, expanding its role in targeting programmed cell death pathways in cancer treatment

- In January 2025, datopotamab deruxtecan (Datroway) received FDA approval for the treatment of unresectable or metastatic hormone receptor‑positive, HER2‑negative breast cancer — the first TROP2‑directed antibody‑drug conjugate for this indication, offering a novel targeted therapy in the precision oncology portfolio

- In June 2025, BioNTech and Bristol Myers Squibb announced a major collaboration to develop and commercialize the experimental cancer antibody BNT327, aimed at expanding precision oncology treatment options across multiple tumor types, with significant upfront and milestone funding committed

- In June 2025, the FDA approved perioperative pembrolizumab (Keytruda) as the first immunotherapy‑based regimen for resectable head and neck squamous cell carcinoma, establishing a precision oncology treatment standard in this historically treatment‑resistant cancer

- In August 2025, Bayer struck a USD 1.3 billion deal with Kumquat Biosciences to co‑develop a KRAS G12D inhibitor — a precision oncology drug candidate targeting a common cancer mutation lacking effective therapies — bolstering Bayer’s targeted treatment portfolio

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.