Global Preclinical Imaging Market

Market Size in USD Billion

CAGR :

%

USD

2.28 Billion

USD

3.72 Billion

2024

2032

USD

2.28 Billion

USD

3.72 Billion

2024

2032

| 2025 –2032 | |

| USD 2.28 Billion | |

| USD 3.72 Billion | |

|

|

|

|

Preclinical Imaging Market Size

- The global preclinical imaging market size was valued at USD 2.28 billion in 2024 and is expected to reach USD 3.72 billion by 2032, at a CAGR of 6.3% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced imaging technologies in drug discovery, biomedical research, and preclinical studies, driving enhanced visualization and accurate evaluation of disease models

- Furthermore, rising demand for high-resolution, non-invasive imaging solutions that accelerate translational research and reduce experimental costs is positioning preclinical imaging as a critical tool in pharmaceutical and academic research. These converging factors are accelerating the uptake of preclinical imaging solutions, thereby significantly boosting the industry's growth

Preclinical Imaging Market Analysis

- Preclinical imaging, offering advanced visualization of biological processes in live animal models, is increasingly vital in drug discovery, disease modeling, and translational research due to its non-invasive imaging, high-resolution capabilities, and integration with modern laboratory workflows

- The escalating demand for preclinical imaging is primarily fueled by growing investment in pharmaceutical and biotechnology R&D, rising adoption of advanced imaging modalities, and the need to accelerate drug development while reducing experimental costs

- North America dominated the preclinical imaging market with the largest revenue share of 40.5% in 2024, characterized by strong pharmaceutical research infrastructure, high adoption of advanced imaging technologies, and the presence of key market players, with the U.S. witnessing substantial growth in preclinical imaging system installations across academic, pharmaceutical, and biotech laboratories

- Asia-Pacific is expected to be the fastest-growing region in the preclinical imaging market during the forecast period due to increasing research funding, expanding pharmaceutical and biotech sectors, and rising adoption of imaging solutions in China, Japan, and India

- Systems segment dominated the preclinical imaging market with a market share of 70.5% in 2024, driven by the high demand for imaging modalities such as optical imaging, MRI, PET/SPECT, CT, and ultrasound systems that offer precise and reproducible preclinical data for drug discovery and translational research

Report Scope and Preclinical Imaging Market Segmentation

|

Attributes |

Preclinical Imaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Preclinical Imaging Market Trends

Advancement Through Multi-Modal Imaging and AI Integration

- A significant and accelerating trend in the global preclinical imaging market is the increasing adoption of multi-modal imaging systems combined with artificial intelligence (AI)-driven image analysis. These innovations are enhancing the precision, efficiency, and interpretability of preclinical studies

- For instance, integrated PET/MRI and CT/Optical imaging platforms allow simultaneous structural and functional assessment of disease models, reducing the time and cost of experiments. Similarly, AI-enabled platforms can automatically quantify tumor volumes or track molecular markers with higher accuracy than manual analysis

- AI integration in preclinical imaging enables features such as automated anomaly detection, predictive modeling, and enhanced image reconstruction, providing researchers with more actionable insights. Some advanced systems now utilize machine learning algorithms to optimize imaging parameters based on previous scans, improving reproducibility and throughput

- The seamless combination of imaging modalities and AI-driven analysis facilitates centralized data management and improved decision-making in drug discovery and translational research. Researchers can evaluate multiple biomarkers and physiological parameters in a single workflow, accelerating therapeutic development

- This trend toward intelligent, integrated, and high-throughput imaging systems is fundamentally reshaping expectations for preclinical research efficiency and accuracy. Companies such as Bruker and PerkinElmer are developing AI-assisted multi-modal imaging platforms to provide comprehensive solutions for preclinical studies

- The demand for preclinical imaging systems that combine multi-modality capabilities with AI-based analysis is growing rapidly, driven by pharmaceutical, biotech, and academic institutions seeking more reliable, faster, and cost-effective experimental outcomes

Preclinical Imaging Market Dynamics

Driver

Rising Demand for Accelerated Drug Development and Research Efficiency

- The growing pressure to reduce the cost and duration of drug discovery and development is a key driver for the adoption of preclinical imaging solutions. High-resolution imaging enables better evaluation of pharmacokinetics, efficacy, and toxicity in animal models before clinical trials

- For instance, in 2024, Bruker expanded its preclinical imaging portfolio with high-throughput micro-PET/CT systems, enhancing drug screening and translational research capabilities. Such technological advancements are expected to accelerate market growth

- Preclinical imaging allows non-invasive monitoring of biological processes, tumor progression, and biomarker expression, providing valuable data for early-stage research and therapeutic evaluation

- In addition, the growing adoption of imaging platforms by pharmaceutical companies, CROs, and academic institutions for integrated research workflows is propelling market demand. The ability to quantify molecular and physiological changes in vivo helps streamline R&D and improve success rates in clinical trials

Restraint/Challenge

High Equipment Costs and Technical Complexity

- The relatively high cost of advanced preclinical imaging systems, including multi-modal and AI-integrated platforms, remains a barrier to adoption, particularly for smaller research labs and institutions in developing regions

- For instance, comprehensive optical/PET/MRI systems require substantial capital investment, in addition to ongoing maintenance and software updates, which may deter some potential buyers

- Moreover, the technical expertise required to operate complex imaging systems and analyze large datasets can pose challenges, limiting widespread adoption. Training personnel and standardizing imaging protocols across labs are critical for optimal utilization

- While some lower-cost and modular solutions are emerging, the perceived premium for high-end preclinical imaging technology can still hinder broader market penetration

- Overcoming these challenges through cost-effective system designs, user-friendly interfaces, AI-assisted automation, and training programs will be vital for sustained growth and adoption in both developed and emerging markets

Preclinical Imaging Market Scope

The market is segmented on the basis of product, reagents, application, and end user.

- By Product

On the basis of product, the preclinical imaging market is segmented into systems and services. Systems dominated the market with the largest revenue share of 70.5% in 2024, driven by the high demand for imaging modalities such as optical imaging, MRI, PET/SPECT, CT, and ultrasound systems. These systems are critical for non-invasive, high-resolution monitoring of disease progression, drug distribution, and therapeutic efficacy in animal models. The dominance of the systems segment is also fueled by the increasing adoption in pharmaceutical and biotechnology R&D, as well as in academic research institutes, where precise imaging data is required for translational research. Researchers often prioritize systems that provide multi-modality capabilities, allowing simultaneous structural and functional imaging, which significantly reduces experimental time and cost. In addition, the availability of advanced features, such as AI-assisted image analysis and high-throughput capabilities, further reinforces the adoption of preclinical imaging systems.

Services are anticipated to witness the fastest growth rate over the forecast period due to the rising trend of outsourcing preclinical imaging studies to contract research organizations (CROs) and specialized imaging service providers. Services provide flexible and cost-effective solutions for organizations that do not wish to invest in expensive imaging equipment or lack trained personnel. These offerings often include multi-modality imaging, image processing, data analysis, and reporting, enabling smaller biotech firms and academic labs to access high-quality imaging solutions. The increasing complexity of preclinical studies and growing focus on translational research are also accelerating the adoption of imaging services.

- By Reagents

On the basis of reagents, the preclinical imaging market is segmented into preclinical optical imaging reagents, preclinical nuclear imaging reagents, preclinical mri contrast agents, preclinical ultrasound contrast agents, and preclinical ct contrast agents. Preclinical Optical Imaging Reagents dominated the market with an estimated share of 35% in 2024, driven by their wide application in fluorescence and bioluminescence imaging studies. These reagents enable sensitive detection of biological processes at the molecular and cellular levels, making them essential for cancer research, drug screening, and biomarker evaluation. The ease of use, cost-effectiveness, and compatibility with high-throughput optical imaging systems contribute to their market dominance. Academic and pharmaceutical researchers prefer optical imaging reagents for longitudinal studies, allowing repeated imaging of the same subjects over time without invasive procedures. The reagents’ ability to provide real-time insights into gene expression, protein interactions, and disease progression further strengthens their adoption.

Preclinical Nuclear Imaging Reagents (PET/SPECT tracers) are expected to witness the fastest growth during the forecast period due to increasing demand for functional imaging studies in drug development. These reagents allow precise quantitative imaging of physiological and metabolic processes in vivo, helping researchers track drug biodistribution, receptor binding, and therapeutic response. The growing focus on targeted therapies and personalized medicine is driving the need for nuclear imaging reagents, particularly in oncology and neuroscience research. Regulatory approvals and advancements in radiochemistry are also supporting the expansion of this segment.

- By Application

On the basis of application, the preclinical imaging market is segmented into research and development, drug discovery, bio-distribution, cancer cell detection, bio-markers, and others. Research and Development dominated the market with an estimated share of 40% in 2024, driven by the critical role of imaging in understanding disease mechanisms, evaluating therapeutic interventions, and optimizing study designs. Preclinical imaging allows researchers to monitor disease progression, assess pharmacodynamics, and validate novel biomarkers, making it indispensable in early-stage R&D. The ability to perform longitudinal studies with non-invasive imaging reduces animal usage and experimental costs, further enhancing its adoption. Pharmaceutical and biotech companies heavily rely on imaging data to support translational research and preclinical-to-clinical correlation. The segment’s dominance is also reinforced by ongoing investments in new imaging technologies, multi-modality platforms, and AI-enabled analysis tools.

Drug Discovery is anticipated to witness the fastest growth during forecast period, due to the increasing need for precise evaluation of drug efficacy, safety, and pharmacokinetics in animal models before clinical trials. Imaging-based drug discovery accelerates candidate selection, reduces development timelines, and improves success rates in preclinical studies. The growing emphasis on personalized medicine and targeted therapies further fuels demand, as imaging allows accurate assessment of molecular interactions and therapeutic responses. This segment is also benefiting from partnerships between imaging solution providers and pharmaceutical companies to offer integrated imaging services for drug development pipelines.

- By End User

On the basis of end user, the preclinical imaging market is segmented into contract research organizations (CROS), pharmaceutical & biotech companies, academic & government research institutes, diagnostics centers, and others. Pharmaceutical & Biotech Companies dominated the market with an estimated share of 50% in 2024, as they extensively utilize preclinical imaging to evaluate drug candidates, optimize dosage, and monitor therapeutic outcomes in vivo. The adoption is driven by the need for high-quality, reproducible data to support regulatory submissions and clinical trial planning. Companies prioritize systems and reagents that offer reliability, accuracy, and multi-modality capabilities, often integrating imaging platforms directly into R&D workflows. The market dominance is reinforced by significant investments in drug discovery and translational research, especially in oncology, neurology, and rare diseases.

Contract Research Organizations (CROs) are expected to witness the fastest growth during forecast period, due to the rising trend of outsourcing preclinical studies to specialized service providers. CROs provide access to advanced imaging technologies, trained personnel, and multi-modality platforms without requiring substantial capital investment from pharmaceutical and biotech firms. The growth of this segment is fueled by the increasing number of small and mid-sized biotech companies that lack in-house imaging capabilities and seek cost-effective, flexible solutions for preclinical research. In addition, the expanding capabilities of CROs, including AI-assisted image analysis and integrated data management, are enhancing their adoption across global markets.

Preclinical Imaging Market Regional Analysis

- North America dominated the preclinical imaging market with the largest revenue share of 40.5% in 2024, characterized by strong pharmaceutical research infrastructure, high adoption of advanced imaging technologies, and the presence of key market players

- Researchers and institutions in the region highly value the precision, reproducibility, and multi-modality capabilities offered by preclinical imaging systems, enabling non-invasive monitoring of disease progression, drug efficacy, and biomarker evaluation in animal models

- This widespread adoption is further supported by well-established academic and government research institutes, high R&D spending, and the presence of key market players such as Bruker, PerkinElmer, and Siemens Healthineers, establishing preclinical imaging as a critical tool in drug discovery and translational research

U.S. Preclinical Imaging Market Insight

The U.S. preclinical imaging market captured the largest revenue share of approximately 82% in North America in 2024, driven by a robust pharmaceutical and biotechnology R&D ecosystem and early adoption of advanced imaging technologies. Researchers prioritize non-invasive, high-resolution imaging for disease modeling, drug screening, and biomarker evaluation, which accelerates translational research. The growing demand for multi-modality imaging systems and AI-assisted image analysis further propels market expansion. In addition, strong government and private R&D funding, along with the presence of key market players such as Bruker, PerkinElmer, and Siemens Healthineers, reinforces the adoption of preclinical imaging solutions across academic, pharmaceutical, and biotech institutions.

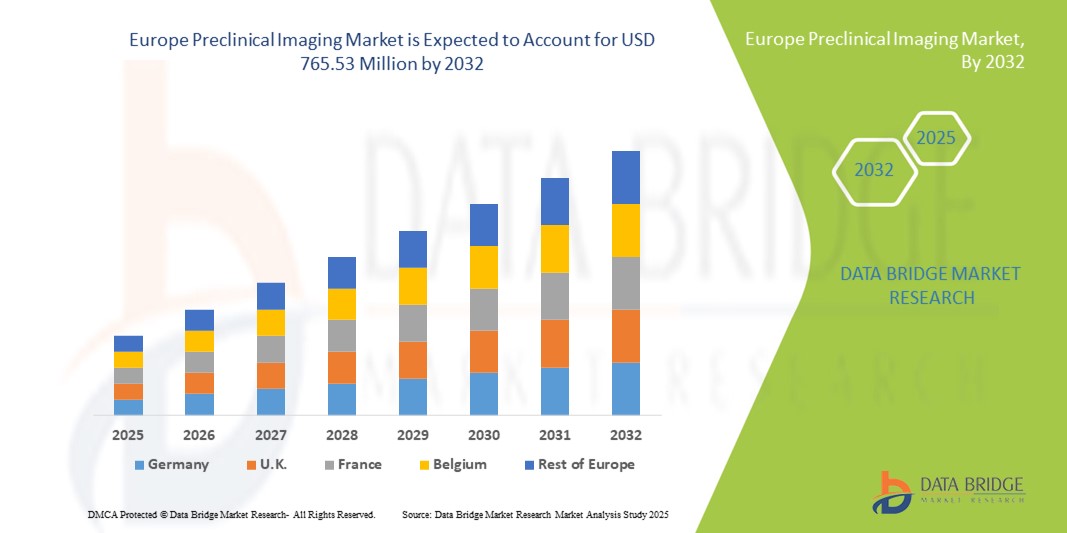

Europe Preclinical Imaging Market Insight

The Europe preclinical imaging market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by high investment in biomedical research, strict regulatory compliance requirements, and a rising need for accurate preclinical data. Increasing adoption of multi-modal and AI-integrated imaging platforms, along with a focus on translational research in countries such as Germany, France, and the U.K., is fostering market growth. The region is witnessing significant uptake across pharmaceutical R&D, academic institutions, and contract research organizations, with imaging systems being incorporated into both new research setups and facility upgrades.

U.K. Preclinical Imaging Market Insight

The U.K. preclinical imaging market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising investment in biotechnology and pharmaceutical research and a focus on improving preclinical study efficiency. Concerns regarding the accuracy and reproducibility of drug evaluation studies are encouraging the adoption of advanced imaging platforms. In addition, the U.K.’s strong research infrastructure, increasing collaborations with global imaging solution providers, and growing awareness of AI-assisted imaging analysis are expected to continue stimulating market growth.

Germany Preclinical Imaging Market Insight

The Germany preclinical imaging market is expected to expand at a considerable CAGR during the forecast period, driven by a strong focus on innovative R&D, digitalization in life sciences, and the demand for precise, high-resolution imaging data. Germany’s well-developed research infrastructure, combined with an emphasis on sustainability and technology-driven solutions, is promoting the adoption of imaging systems in pharmaceutical, academic, and biotech research. Multi-modality platforms and AI-based image processing are becoming increasingly prevalent, aligning with local preferences for accurate and reproducible preclinical data.

Asia-Pacific Preclinical Imaging Market Insight

The Asia-Pacific preclinical imaging market is poised to grow at the fastest CAGR from 2025 to 2032, fueled by increasing government and private investments in R&D, rising pharmaceutical and biotech activity, and expanding academic research facilities in countries such as China, Japan, and India. The growing focus on translational research, adoption of multi-modality imaging systems, and availability of cost-effective imaging solutions are driving market growth. In addition, the region is emerging as a hub for preclinical imaging service providers, making high-quality imaging more accessible to a broader research community.

Japan Preclinical Imaging Market Insight

The Japan preclinical imaging market is gaining momentum due to the country’s high-tech research culture, strong focus on drug discovery, and increasing adoption of advanced imaging systems in academic and pharmaceutical research. The demand for non-invasive, precise imaging is driven by the need to accelerate preclinical studies and enhance translational research. Integration of imaging platforms with AI-assisted analysis tools and other laboratory technologies is further fueling growth. Moreover, Japan’s aging population and focus on healthcare innovation are such asly to spur demand for preclinical imaging in both therapeutic development and diagnostic research.

India Preclinical Imaging Market Insight

The India preclinical imaging market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to expanding pharmaceutical and biotech R&D, rapid urbanization, and increasing adoption of advanced research technologies. India is witnessing growing demand for preclinical imaging services across academic institutions, CROs, and biotech firms. The push towards digital and smart research laboratories, coupled with availability of cost-effective imaging systems and rising domestic service providers, is driving market growth. In addition, the government’s focus on supporting drug development and translational research initiatives further strengthens the adoption of preclinical imaging solutions.

Preclinical Imaging Market Share

The preclinical imaging industry is primarily led by well-established companies, including:

- FUJIFILM VisualSonics, Inc. (U.S.)

- Bruker (Germany)

- PerkinElmer (U.S.)

- MILabs B.V. (Netherlands)

- Mediso Ltd. (Hungary)

- MR Solutions (U.K.)

- Trifoil Imaging LLC (U.S.)

- Aspect Imaging Ltd. (Israel)

- Bioscan, Inc. (U.S.)

- Siemens Healthineers AG (Germany)

- GE Healthcare (U.K.)

- Koninklijke Philips N.V., (Netherlands)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- NIKON CORPORATION (Japan)

- Olympus Corporation (Japan)

- Zeiss Group (Germany)

- Leica Microsystems (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

What are the Recent Developments in Global Preclinical Imaging Market?

- In July 2025, MH3D introduced the Alpha-SPECT Mini, the world’s first compact preclinical single-photon emission computed tomography (SPECT) system based on cadmium zinc telluride (CZT) technology. This system offers ultra-high sensitivity and energy resolution, enabling comprehensive whole-body dynamic imaging of small animals. It is particularly suited for cancer, neurology, and drug research applications

- In February 2025, a collaborative effort between Spain and Portugal led to advancements in preclinical magnetic resonance imaging (MRI) and machine learning research. This collaboration aimed to enhance data compatibility and support future machine learning studies, thereby improving the efficacy and precision of preclinical imaging techniques

- In September 2023, Revvity unveiled several next-generation preclinical imaging technologies, including the global debut of the Vega ultrasound system and the Quantum GX3 microCT structural imaging solution. These innovations aim to enhance disease biology studies and therapeutic candidate evaluations, providing researchers with advanced tools for in vivo and ex vivo imaging

- In May 2022, Fujifilm VisualSonics launched the Vivo F2, the first preclinical ultrasound and photoacoustic imaging system capable of operating across a broad frequency range (71 MHz to 1 MHz). This system offers improved image clarity and frame rates through advanced HD image processing and multi-line processing, supporting detailed in vivo imaging for research applications

- In April 2022, PerkinElmer introduced the Vega imaging system, a fully automated, high-throughput handheld ultrasound platform designed to accelerate preclinical research and drug discovery. This system facilitates non-invasive studies in areas such as cancer, liver and kidney diseases, and cardiology, enhancing the efficiency of in vivo imaging for researchers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.