Global Premium Alcoholic Beverages Market

Market Size in USD Billion

CAGR :

%

USD

1.84 Billion

USD

2.53 Billion

2024

2032

USD

1.84 Billion

USD

2.53 Billion

2024

2032

| 2025 –2032 | |

| USD 1.84 Billion | |

| USD 2.53 Billion | |

|

|

|

|

Global Premium Alcoholic Beverages Market Size

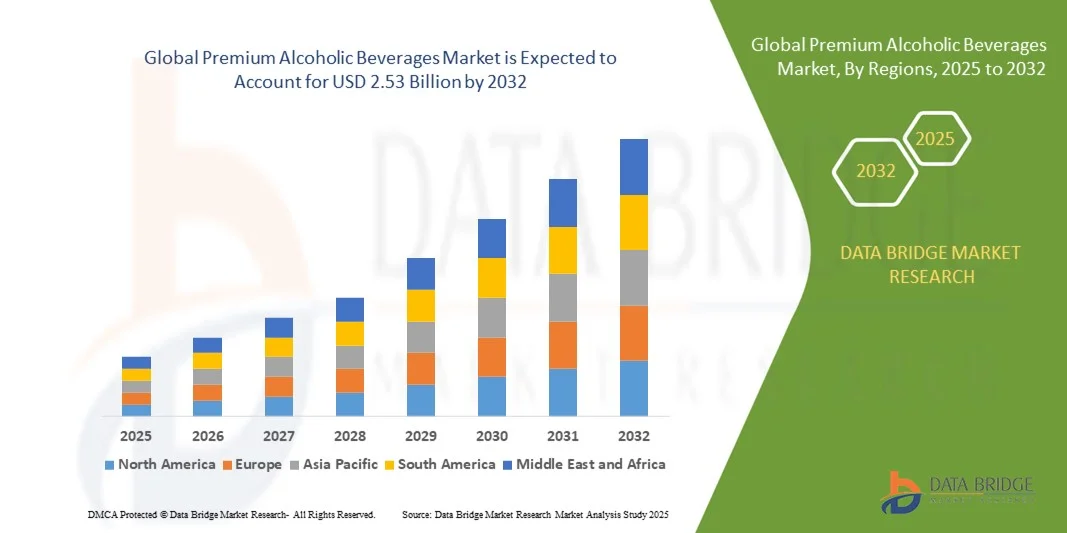

- The global Premium Alcoholic Beverages Market size was valued at USD 1.84 billion in 2024 and is expected to reach USD 2.53 billion by 2032, at a CAGR of 4.00% during the forecast period.

- The market growth is primarily driven by rising consumer preference for high-quality, artisanal, and craft alcoholic beverages, along with increasing disposable incomes and changing lifestyle trends worldwide.

- Additionally, growing awareness of premium brands, innovative packaging, and the influence of social media on consumer choices are propelling demand. These combined factors are fostering a shift toward luxury and experiential drinking, thereby substantially fueling market expansion.

Global Premium Alcoholic Beverages Market Analysis

- Premium alcoholic beverages, including high-end spirits, wines, and craft beers, are increasingly sought after due to their superior quality, unique flavors, and association with luxury lifestyles, making them a key segment in the global alcoholic beverages industry.

- The rising demand for premium alcoholic beverages is primarily driven by increasing disposable incomes, evolving consumer preferences toward craft and artisanal products, and a growing culture of socializing and luxury experiences.

- North America dominated the Global Premium Alcoholic Beverages Market with the largest revenue share of 34.3% in 2024, supported by early adoption of premium brands, high per capita alcohol consumption, and a strong presence of major global players, with the U.S. witnessing significant growth in craft spirits and luxury wines due to innovation, branding, and lifestyle trends.

- Asia-Pacific is expected to be the fastest-growing region in the Global Premium Alcoholic Beverages Market during the forecast period, driven by rising urbanization, growing middle-class populations, and increasing disposable incomes fueling demand for high-quality and imported alcoholic beverages.

- The spirits segment dominated the market with the largest market revenue share of 45.6% in 2024, driven by strong global demand for whiskey, vodka, gin, and other high-end distilled beverages.

Report Scope and Global Premium Alcoholic Beverages Market Segmentation

|

Attributes |

Premium Alcoholic Beverages Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Premium Alcoholic Beverages Market Trends

Enhanced Consumer Experience Through Digital and AI Integration

- A significant and accelerating trend in the global Premium Alcoholic Beverages Market is the increasing use of digital technologies and AI-driven platforms to enhance consumer engagement, personalized recommendations, and seamless purchasing experiences. This integration is significantly improving convenience and brand interaction for consumers.

- For instance, brands such as Diageo and Pernod Ricard leverage AI-powered apps and chatbots to suggest tailored drink recipes based on user preferences, purchase history, and trending cocktails. Similarly, platforms such as Bacardi’s digital mixology tools allow consumers to explore premium cocktails and receive curated recommendations directly on their devices.

- AI integration in premium alcoholic beverages enables features such as predicting consumer taste preferences, optimizing inventory and distribution, and providing personalized marketing campaigns. For example, some Constellation Brands initiatives use AI to analyze customer feedback and social media trends to launch new products aligned with consumer demand. Furthermore, interactive voice and app-based ordering systems offer consumers the convenience of exploring and purchasing premium drinks hands-free.

- The seamless integration of digital platforms with e-commerce and mobile apps allows consumers to manage their premium beverage collections, receive product updates, and participate in virtual tasting events, creating a more connected and immersive drinking experience.

- This trend towards more intelligent, personalized, and tech-enabled engagement is fundamentally reshaping consumer expectations in the premium alcoholic beverages sector. Consequently, companies such as Moët Hennessy and Campari Group are developing AI-driven tools and platforms to offer virtual tastings, personalized recommendations, and curated luxury experiences.

- The demand for premium alcoholic beverages that offer digital, AI, and personalized experience integration is growing rapidly across both emerging and developed markets, as consumers increasingly prioritize convenience, exclusivity, and tailored luxury experiences.

Global Premium Alcoholic Beverages Market Dynamics

Driver

Growing Demand Due to Rising Consumer Preference for Premiumization and Lifestyle Trends

- The increasing inclination of consumers toward luxury and high-quality alcoholic beverages, combined with evolving lifestyle trends, is a major driver for the growing demand in the premium alcoholic beverages market.

- For instance, in 2024, Diageo launched several limited-edition and artisanal spirits collections, focusing on craft production and sustainable sourcing, reflecting the strategy of key companies to capture the premium segment and drive market growth.

- As consumers seek unique flavors, authenticity, and premium experiences, high-end alcoholic beverages provide an upgraded alternative to standard products, offering superior taste, packaging, and brand prestige.

- Furthermore, the rising culture of socializing, gifting, and experiential consumption is making premium alcoholic beverages an integral part of celebrations and luxury lifestyles, fostering consistent demand across residential and hospitality sectors.

- Convenience in purchasing through online platforms, subscription services, and experiential tasting events, coupled with brand storytelling and curated collections, are key factors propelling the adoption of premium alcoholic beverages. The trend toward e-commerce, digital engagement, and exposure to global brands further contributes to market growth.

Restraint/Challenge

High Price Points and Regulatory Constraints

- The relatively high cost of premium alcoholic beverages can limit accessibility for price-sensitive consumers, particularly in emerging markets, posing a challenge to broader market penetration.

- For instance, limited-edition whiskies or imported wines often command a significant price premium, which can deter adoption among budget-conscious consumers.

- Additionally, strict government regulations, taxes, and import duties in certain countries can increase retail prices and restrict the availability of premium products, affecting sales and market expansion.

- While marketing campaigns and digital platforms by companies such as Pernod Ricard and Moët Hennessy aim to educate consumers on the value and craftsmanship of premium products, price perception remains a barrier in certain segments.

- Overcoming these challenges through product innovation, smaller pack sizes, localized production, strategic pricing, and digital marketing campaigns will be vital for sustained growth in the premium alcoholic beverages market.

Global Premium Alcoholic Beverages Market Scope

Premium alcoholic beverages market is segmented on the basis of type, packaging and distribution channel.

- By Type

On the basis of type, the Global Premium Alcoholic Beverages Market is segmented into beer, wine, spirits, and others. The spirits segment dominated the market with the largest market revenue share of 45.6% in 2024, driven by strong global demand for whiskey, vodka, gin, and other high-end distilled beverages. Consumers increasingly prefer premium spirits for gifting, celebrations, and luxury consumption, which is supported by brand innovation, limited editions, and experiential marketing initiatives.

Wine is anticipated to witness the fastest CAGR of 18.3% from 2025 to 2032, fueled by growing interest in fine wines, wine tourism, and sustainable and organic wine production. The rising popularity of wine clubs, virtual tasting experiences, and online retailing is expanding accessibility, particularly among younger, affluent consumers seeking lifestyle-oriented premium products. The focus on quality, provenance, and curated experiences is a key factor driving growth in this segment.

- By Packaging

On the basis of packaging, the Global Premium Alcoholic Beverages Market is segmented into canned, glass bottles, and others. The glass bottle segment dominated the market with a revenue share of 62.1% in 2024, owing to its association with premium quality, durability, and traditional presentation. Glass bottles are preferred by consumers and collectors for their elegance, ability to preserve flavor, and suitability for gifting, especially for spirits and fine wines.

The canned segment is expected to witness the fastest CAGR of 19.5% from 2025 to 2032, driven by convenience, portability, and the rising popularity of ready-to-drink (RTD) alcoholic beverages among millennials and urban consumers. Innovative packaging designs, collaborations with craft breweries, and eco-friendly initiatives further support the adoption of canned formats in the premium alcoholic beverage space.

- By Distribution Channel

On the basis of distribution channel, the Global Premium Alcoholic Beverages Market is segmented into convenience stores, on-premises (bars/restaurants), liquor stores, grocery shops, internet retailing, and supermarkets. The liquor stores segment held the largest market revenue share of 39.8% in 2024, as they provide consumers with a wide variety of premium options, expert advice, and curated selections.

On-premises distribution is anticipated to witness the fastest CAGR of 17.9% from 2025 to 2032, fueled by the recovery and growth of the hospitality sector, premium bar experiences, and experiential marketing initiatives such as tasting events and mixology workshops. The increasing consumer preference for social experiences, combined with rising disposable incomes and urbanization, is driving premium beverage consumption in bars, restaurants, and luxury lounges, creating significant opportunities for growth in this segment.

Global Premium Alcoholic Beverages Market Regional Analysis

- North America dominated the Global Premium Alcoholic Beverages Market with the largest revenue share of 34.3% in 2024, driven by a strong preference for high-quality, luxury alcoholic beverages and increasing consumer spending on lifestyle products.

- Consumers in the region highly value brand heritage, product quality, and exclusive experiences, which are offered by premium spirits, wines, and craft beverages. The region’s established bar culture, fine dining experiences, and gifting traditions further support demand for premium alcoholic beverages.

- This widespread adoption is further supported by high disposable incomes, sophisticated taste preferences, and strong distribution networks, establishing premium alcoholic beverages as a favored choice for both personal consumption and special occasions across residential, commercial, and hospitality sectors.

U.S. Premium Alcoholic Beverages Market Insight

The U.S. premium alcoholic beverages market captured the largest revenue share of 38% in 2024 within North America, fueled by rising consumer disposable incomes, evolving lifestyle preferences, and a growing appreciation for high-quality spirits, wines, and craft beverages. Consumers increasingly prioritize unique flavors, brand heritage, and limited-edition offerings, driving demand for premium products. The expanding trend of home entertaining, gifting culture, and bar/restaurant experiences further propels market growth. Moreover, the rise of e-commerce platforms and direct-to-consumer sales channels is significantly enhancing product accessibility and consumer engagement.

Europe Premium Alcoholic Beverages Market Insight

The Europe premium alcoholic beverages market is projected to expand at a substantial CAGR throughout the forecast period, driven by the region’s strong tradition of wine, whiskey, and craft spirits consumption, coupled with high consumer awareness regarding product quality. Stringent quality regulations, growing interest in sustainable and organic products, and urbanization are fostering premium beverage adoption across residential, commercial, and hospitality sectors. Experiential consumption, including tasting events and luxury gifting, is further accelerating market growth.

U.K. Premium Alcoholic Beverages Market Insight

The U.K. premium alcoholic beverages market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising consumer preference for luxury spirits, craft wines, and innovative alcoholic beverages. Health-conscious consumption trends, interest in small-batch and artisanal products, and growing on-premises consumption in bars, restaurants, and pubs are supporting market expansion. The country’s robust retail infrastructure and e-commerce channels also contribute to wider accessibility of premium products.

Germany Premium Alcoholic Beverages Market Insight

The Germany premium alcoholic beverages market is expected to expand at a considerable CAGR during the forecast period, fueled by strong consumer appreciation for premium beers, spirits, and wines. Increasing awareness of product quality, sustainability, and authenticity promotes the adoption of high-end alcoholic beverages. The market benefits from Germany’s established distribution networks, sophisticated consumer base, and emphasis on experiential consumption in bars, restaurants, and events.

Asia-Pacific Premium Alcoholic Beverages Market Insight

The Asia-Pacific premium alcoholic beverages market is poised to grow at the fastest CAGR of 22% during the forecast period of 2025 to 2032, driven by rising urbanization, growing middle-class populations, and increasing disposable incomes in countries such as China, Japan, and India. Consumers in the region are increasingly seeking luxury spirits, wines, and innovative alcoholic beverages. The expansion of modern retail, online sales channels, and premium hospitality experiences further supports market growth.

Japan Premium Alcoholic Beverages Market Insight

The Japan premium alcoholic beverages market is gaining momentum due to the country’s strong preference for high-quality wines, whiskies, and craft spirits. Consumers emphasize authenticity, craftsmanship, and premium experiences. The growing popularity of home entertaining, gifting culture, and luxury bar experiences is fueling demand. Aging demographics and the rising interest in sophisticated, low-alcohol premium beverages are also shaping market growth in both residential and commercial sectors.

China Premium Alcoholic Beverages Market Insight

The China premium alcoholic beverages market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, increasing disposable incomes, and growing consumer inclination toward luxury and imported alcoholic beverages. Rising demand for gifting, celebratory occasions, and premium hospitality experiences is driving market expansion. Government initiatives supporting domestic craft spirits and imported wine imports, alongside increasing availability via e-commerce platforms, are also key factors propelling growth.

Global Premium Alcoholic Beverages Market Share

The Premium Alcoholic Beverages industry is primarily led by well-established companies, including:

• Diageo (U.K.)

• Pernod Ricard (France)

• AB InBev (Belgium)

• Bacardi Limited (Bermuda)

• Constellation Brands (U.S.)

• Brown-Forman (U.S.)

• E. & J. Gallo Winery (U.S.)

• Moët Hennessy (France)

• Campari Group (Italy)

• Asahi Group Holdings (Japan)

• Kirin Holdings (Japan)

• Suntory Holdings (Japan)

• Beam Suntory (U.S./Japan)

• Rémy Cointreau (France)

• William Grant & Sons (U.K.)

• Castel Group (France)

• Treasury Wine Estates (Australia)

• Accolade Wines (Australia)

• The Sapporo Group (Japan)

• Young’s Brewery (U.K.)

What are the Recent Developments in Global Premium Alcoholic Beverages Market?

- In April 2023, Diageo (U.K.) launched a limited-edition whiskey series in Asia, highlighting rare cask finishes and artisanal blending techniques. This initiative underscores the company’s dedication to delivering premium, high-quality products tailored to regional consumer preferences. By leveraging its global expertise and heritage, Diageo aims to strengthen brand loyalty and expand its presence in the rapidly growing Global Premium Alcoholic Beverages Market.

- In March 2023, Pernod Ricard (France) introduced a new premium gin portfolio in North America, crafted to cater to the rising demand for sophisticated, craft-inspired spirits. The launch emphasizes Pernod Ricard’s commitment to innovation and premiumization, targeting both bar and home consumption while enhancing the consumer experience with unique flavors and high-quality ingredients.

- In March 2023, AB InBev (Belgium) expanded its premium beer offerings in Latin America by introducing a line of craft-style lagers and ales aimed at urban millennials. This initiative leverages AB InBev’s global brewing expertise to meet the growing consumer demand for artisanal and premium beers, reinforcing its market leadership in the premium segment.

- In February 2023, Bacardi Limited (Bermuda) partnered with leading hospitality groups in Europe to launch exclusive limited-edition rums for upscale bars and restaurants. This collaboration enhances brand visibility in premium venues and strengthens Bacardi’s position as a leading provider of high-quality spirits tailored to luxury experiences.

- In January 2023, Constellation Brands (U.S.) unveiled a new portfolio of ultra-premium wines and ready-to-drink cocktails at international trade shows. Featuring unique varietals and artisanal production methods, these products reflect the company’s commitment to innovation, premiumization, and catering to sophisticated consumer preferences while expanding its global footprint in the premium alcoholic beverages segment.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Premium Alcoholic Beverages Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Premium Alcoholic Beverages Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Premium Alcoholic Beverages Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.