Global Preoperative Surgical Planning Software Market

Market Size in USD Billion

CAGR :

%

USD

127.82 Billion

USD

182.46 Billion

2025

2033

USD

127.82 Billion

USD

182.46 Billion

2025

2033

| 2026 –2033 | |

| USD 127.82 Billion | |

| USD 182.46 Billion | |

|

|

|

|

Preoperative Surgical Planning Software Market Size

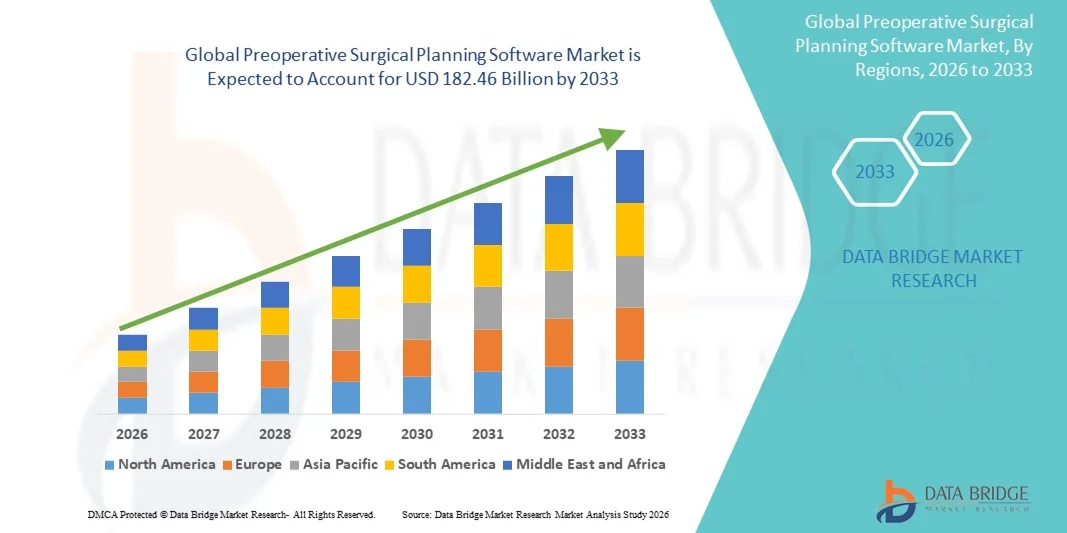

- The global preoperative surgical planning software market size was valued at USD 127.82 billion in 2025 and is expected to reach USD 182.46 billion by 2033, at a CAGR of 4.55% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced digital health technologies in surgical workflows, along with rapid technological progress in medical imaging, 3D visualization, and AI-based analytics. These advancements are enabling surgeons to perform more accurate, personalized, and efficient preoperative planning across a wide range of surgical specialties

- Furthermore, rising demand for minimally invasive procedures, improved surgical outcomes, and reduced operative risks is establishing preoperative surgical planning software as a critical component of modern healthcare systems. The growing integration of these solutions with hospital information systems and imaging platforms is accelerating the uptake of Preoperative Surgical Planning Software, thereby significantly boosting the overall growth of the market

Preoperative Surgical Planning Software Market Analysis

- Preoperative surgical planning software, which enables detailed visualization, simulation, and assessment of surgical procedures prior to operation, is increasingly vital in modern healthcare due to its role in improving surgical accuracy, reducing operative risks, and enhancing patient-specific treatment planning across multiple surgical specialties

- The escalating demand for preoperative surgical planning software is primarily driven by the growing adoption of minimally invasive and complex surgical procedures, increasing reliance on advanced medical imaging, and rising emphasis on precision medicine and improved patient outcomes. Continuous advancements in AI, 3D modeling, and virtual reality are further accelerating market adoption

- North America dominated the preoperative surgical planning software market with the largest revenue share of approximately 37.9% in 2025, supported by advanced healthcare infrastructure, high adoption of digital surgical technologies, and the strong presence of leading software developers. The U.S. led regional growth due to widespread use in orthopedic, neurosurgical, and cardiovascular procedures

- Asia-Pacific is expected to be the fastest-growing region in the preoperative surgical planning software market during the forecast period, driven by expanding healthcare infrastructure, increasing surgical volumes, rising investments in healthcare IT, and growing adoption of advanced surgical planning solutions in countries such as China, India, and Japan

- The On-Premise segment dominated the largest market revenue share of 57.6% in 2025, primarily due to strong adoption among large hospitals and specialty surgical centers that require high levels of data security and system customization

Report Scope and Preoperative Surgical Planning Software Market Segmentation

|

Attributes |

Preoperative Surgical Planning Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Preoperative Surgical Planning Software Market Trends

Increasing Adoption of Digital and Image-Based Surgical Planning Solutions

- A significant and accelerating trend in the global preoperative surgical planning software market is the growing adoption of digital, image-based planning tools to enhance surgical accuracy, reduce intraoperative risks, and improve patient outcomes. Surgeons are increasingly using software platforms to visualize anatomy, simulate procedures, and plan surgical approaches prior to operations

- For instance, in 2024, Materialise expanded the clinical capabilities of its Mimics Innovation Suite to support advanced 3D surgical planning for orthopedic and cranio-maxillofacial procedures, reflecting the rising demand for precision-driven preoperative planning tools

- The increasing use of 3D imaging, CT, and MRI data integration within planning software is enabling more personalized and procedure-specific surgical preparation

- Hospitals and surgical centers are increasingly prioritizing workflow efficiency and outcome predictability, encouraging adoption of preoperative planning solutions across multiple surgical specialties

- The shift toward minimally invasive and complex surgical procedures is further reinforcing the need for accurate preoperative visualization and simulation tools

- Overall, the growing reliance on digital surgical planning is reshaping clinical workflows and setting new standards for precision and safety in surgical care

Preoperative Surgical Planning Software Market Dynamics

Driver

Rising Demand for Surgical Precision and Improved Patient Outcomes

- The increasing volume of complex surgical procedures, coupled with a strong focus on reducing surgical errors and improving patient outcomes, is a major driver for the Preoperative Surgical Planning Software market. These solutions help surgeons anticipate challenges and optimize surgical strategies before entering the operating room

- For instance, in 2023, several large hospitals in Europe adopted preoperative planning software for joint replacement surgeries, reporting improved implant positioning accuracy and reduced procedure times

- Growing adoption of value-based healthcare models is encouraging providers to invest in technologies that reduce complications, shorten hospital stays, and lower overall treatment costs

- The expanding aging population and rising prevalence of orthopedic, cardiovascular, and neurological conditions are increasing the demand for advanced surgical planning tools

- In addition, increased investment in digital health infrastructure by hospitals and healthcare systems is supporting the widespread adoption of preoperative surgical planning software

Restraint/Challenge

High Implementation Costs and Workflow Integration Challenges

- Despite its benefits, the high cost of implementation and integration complexity associated with preoperative surgical planning software remains a key challenge, particularly for small and mid-sized hospitals. These systems often require advanced imaging infrastructure, training, and compatibility with existing hospital IT systems

- For instance, several community hospitals in emerging markets have reported delays in adopting surgical planning software due to budget limitations and lack of trained personnel

- Integration with existing radiology systems, electronic health records (EHRs), and surgical workflows can be time-consuming and resource-intensive

- Resistance to change among clinical staff and the learning curve associated with advanced planning tools can also slow adoption rates

- Addressing these challenges through cost-effective solutions, scalable deployment models, and comprehensive training programs will be essential for sustained growth of the Preoperative Surgical Planning Software market

Preoperative Surgical Planning Software Market Scope

The market is segmented on the basis of type, application, and end user.

- By Type

On the basis of type, the Preoperative Surgical Planning Software market is segmented into Off-Premise and On-Premise solutions. The On-Premise segment dominated the largest market revenue share of 57.6% in 2025, primarily due to strong adoption among large hospitals and specialty surgical centers that require high levels of data security and system customization. On-premise software allows healthcare institutions to store sensitive patient imaging and surgical data within their internal IT infrastructure, ensuring compliance with strict data protection and privacy regulations. Many hospitals prefer on-premise deployment for seamless integration with existing PACS, HIS, and EMR systems. Additionally, on-premise solutions offer greater control over software upgrades, customization, and performance optimization for complex surgical workflows. Surgeons benefit from stable system performance and real-time access to high-resolution imaging and 3D models. The dominance of this segment is further supported by long-term contracts and higher upfront investments made by large healthcare providers.

The Off-Premise segment is expected to witness the fastest CAGR of 22.9% from 2026 to 2033, driven by increasing adoption of cloud-based and web-hosted surgical planning platforms. Off-premise solutions offer flexibility, lower upfront costs, and ease of deployment, making them attractive to small and mid-sized hospitals and outpatient surgical centers. These platforms enable surgeons to access planning tools remotely, collaborate across locations, and leverage cloud computing for advanced visualization and analytics. Growing acceptance of cloud technologies in healthcare, along with improvements in cybersecurity and regulatory compliance, is accelerating adoption. The ability to receive automatic updates, scalable storage, and AI-enabled planning tools further supports rapid growth in this segment.

- By Application

On the basis of application, the Preoperative Surgical Planning Software market is segmented into Orthopedic Surgery, Neurosurgery, Dental and Orthodontics Application, and Others. The Orthopedic Surgery segment accounted for the largest market revenue share of 41.8% in 2025, driven by the high volume of orthopedic procedures such as joint replacements, trauma surgeries, and spinal interventions. Preoperative planning software is extensively used in orthopedics to create precise 3D models, simulate implant positioning, and optimize surgical outcomes. The increasing prevalence of musculoskeletal disorders, aging population, and rising demand for minimally invasive orthopedic procedures support segment dominance. Surgeons rely on these tools to reduce intraoperative risks, improve implant fit, and shorten surgery time. Technological advancements such as AI-based bone modeling and patient-specific instrumentation further enhance adoption in orthopedic applications.

The Dental and Orthodontics Application segment is projected to witness the fastest CAGR of 24.1% from 2026 to 2033, fueled by growing adoption of digital dentistry and computer-assisted treatment planning. Dental professionals increasingly use preoperative planning software for implant placement, orthodontic alignment, and maxillofacial surgery planning. The rise in cosmetic dentistry, dental implants, and orthodontic procedures globally is driving demand. Cloud-based planning tools enable precise visualization, improved patient communication, and enhanced treatment accuracy. Integration with CAD/CAM systems and 3D printing technologies further accelerates growth. Increased adoption by dental clinics and specialized orthodontic centers contributes to the segment’s rapid expansion.

- By End User

On the basis of end user, the Preoperative Surgical Planning Software market is segmented into Hospitals, Orthopedic Clinics, and Rehabilitation Centers. The Hospitals segment held the largest market revenue share of 48.9% in 2025, owing to the high volume of complex surgical procedures performed in hospital settings. Hospitals invest heavily in advanced preoperative planning software to support multidisciplinary surgical teams, improve clinical outcomes, and reduce surgical complications. Integration with hospital imaging systems, electronic medical records, and surgical navigation platforms enhances workflow efficiency. Large hospitals and academic medical centers also use these solutions for training and research purposes. The growing focus on precision surgery and patient-specific treatment planning further reinforces hospital dominance in the market.

The Orthopedic Clinics segment is expected to witness the fastest CAGR of 21.7% from 2026 to 2033, driven by the rapid expansion of specialized orthopedic centers and outpatient surgical facilities. These clinics increasingly adopt preoperative planning software to enhance procedural accuracy, reduce operation time, and improve patient outcomes. The shift toward ambulatory and day-care orthopedic surgeries supports demand for efficient, cost-effective planning tools. Cloud-based and off-premise solutions are particularly attractive to orthopedic clinics due to lower infrastructure requirements. Rising patient demand for advanced orthopedic care and personalized treatment planning continues to accelerate growth in this segment.

Preoperative Surgical Planning Software Market Regional Analysis

- North America dominated the preoperative surgical planning software market with the largest revenue share of approximately 37.9% in 2025, supported by advanced healthcare infrastructure, high adoption of digital surgical technologies, and the strong presence of leading software developer

- Healthcare providers in the region highly value preoperative surgical planning software for its ability to enhance surgical accuracy, reduce operative risks, and improve patient outcomes through detailed visualization and simulation

- This widespread adoption is further supported by high healthcare spending, rapid integration of AI-driven and 3D planning tools, and the growing preference for minimally invasive and precision-guided surgical procedures across hospitals and specialty clinics

U.S. Preoperative Surgical Planning Software Market Insight

The U.S. preoperative surgical planning software market accounted for the majority of regional demand in 2025, driven by widespread use in orthopedic, neurosurgical, and cardiovascular procedures. The increasing volume of complex surgeries, combined with strong investments in healthcare IT and digital operating room technologies, is propelling market growth. Additionally, the presence of major software developers and high adoption of advanced imaging and surgical simulation platforms further strengthens the U.S. market position.

Europe Preoperative Surgical Planning Software Market Insight

The Europe preoperative surgical planning software market is projected to expand at a steady CAGR during the forecast period, driven by increasing adoption of digital healthcare solutions and a strong focus on improving surgical outcomes. The region benefits from well-established healthcare systems, rising demand for minimally invasive procedures, and growing utilization of preoperative planning tools in orthopedic and general surgeries across hospitals and specialty centers.

U.K. Preoperative Surgical Planning Software Market Insight

The U.K. preoperative surgical planning software market is anticipated to grow at a notable CAGR during the forecast period, supported by increasing investments in healthcare digitalization and rising adoption of advanced surgical technologies within the National Health Service (NHS). The demand for improved surgical precision, reduced operating time, and enhanced patient safety is driving the adoption of preoperative planning solutions across public and private healthcare facilities.

Germany Preoperative Surgical Planning Software Market Insight

The Germany preoperative surgical planning software market is expected to expand at a considerable CAGR, fueled by the country’s strong healthcare infrastructure, technological innovation, and emphasis on precision medicine. German hospitals and surgical centers are increasingly adopting advanced planning software for orthopedic, spinal, and cardiovascular procedures, supported by high-quality imaging capabilities and integration with surgical navigation systems.

Asia-Pacific Preoperative Surgical Planning Software Market Insight

The Asia-Pacific preoperative surgical planning software market is expected to be the fastest-growing region during the forecast period, driven by expanding healthcare infrastructure, increasing surgical volumes, and rising investments in healthcare IT. Growing awareness of advanced surgical planning solutions and increasing adoption of digital healthcare technologies in countries such as China, India, and Japan are significantly accelerating market growth.

Japan Preoperative Surgical Planning Software Market Insight

The Japan preoperative surgical planning software market is gaining momentum due to the country’s advanced medical technology ecosystem, aging population, and increasing demand for precision-based surgical procedures. Japanese healthcare providers are increasingly adopting preoperative planning software to support complex orthopedic and neurological surgeries, improve workflow efficiency, and enhance patient outcomes.

China Preoperative Surgical Planning Software Market Insight

The China preoperative surgical planning software market accounted for a significant revenue share in the Asia-Pacific region in 2025, driven by rapid expansion of hospital infrastructure, rising surgical volumes, and growing investments in digital healthcare solutions. The adoption of advanced surgical planning software is increasing across public and private hospitals, supported by government initiatives to modernize healthcare delivery and improve surgical precision.

Preoperative Surgical Planning Software Market Share

The Preoperative Surgical Planning Software industry is primarily led by well-established companies, including:

• Stryker (U.S.)

• Siemens Healthineers (Germany)

• Philips Healthcare (Netherlands)

• GE Healthcare (U.S.)

• Brainlab AG (Germany)

• Surgical Theater, Inc. (U.S.)

• Zimmer Biomet Holdings, Inc. (U.S.)

• 3D Systems, Inc. (U.S.)

• Medtronic plc (Ireland)

• Planmeca Group (Finland)

• Anatomage, Inc. (U.S.)

• Canon Medical Systems Corporation (Japan)

• Corin Group (U.K.)

Latest Developments in Global Preoperative Surgical Planning Software Market

- In October 2021, Intellijoint Surgical introduced the Intellijoint VIEW preoperative surgical planning software for complete hip arthroplasty, offering surgeons the ability to plan functional cup positioning by taking into account the hip-spine relationship and implant templating. The software integrates seamlessly with the Intellijoint HIP navigation system, enabling surgeons to access and refine surgical plans intraoperatively based on patient-specific anatomical data, thereby enhancing accuracy and outcomes in hip replacement procedures. This launch reflected an early wave of specialized planning software tools tailored to complex orthopedic surgeries

- In November 2021, PrecisionOS received U.S. FDA 510(k) clearance for its InVisionOS preoperative planning tool, a virtual reality (VR)–based surgical planning platform that transforms patient CT scans into interactive 3D reconstructions. Surgeons can observe, dissect, and manipulate anatomical structures using VR headsets like the Oculus Quest 2, providing immersive planning and rehearsal capabilities that improve spatial understanding ahead of actual procedures. The clearance marked one of the first approvals of VR-driven preoperative planning in the U.S. market

- In July 2022, Exactech launched the Equinoxe Shoulder Planning App v2.1 in the United States, enhancing preoperative planning for shoulder arthroplasty. The software gives orthopaedic surgeons enhanced flexibility in choosing optimal implant sizes and positioning based on individual patient anatomy, with advanced tools for visualizing scapula and humerus geometry. This release underscored the industry trend of specialized module upgrades aimed at improving procedure accuracy and surgical outcomes

- In January 2023, Realize Medical announced that its Elucis virtual reality surgical planning software received U.S. FDA 510(k) clearance, enabling surgeons to create and visualize patient-specific 3D anatomical models derived from MRI and CT scans within a VR environment. This approval supported broader clinical adoption of immersive planning platforms that facilitate preoperative analysis and team training

- In April 2024, Siemens Healthineers partnered with NVIDIA to develop GPU-accelerated surgical planning algorithms, enabling real-time 3D rendering and AI-powered surgical simulation for complex cardiovascular and orthopedic procedures. This collaboration represents a significant technological advancement aimed at reducing planning times and improving model fidelity for surgeons across specialties

- In June 2024, Medtronic launched its StealthStation S8 surgical navigation system with integrated preoperative planning software, featuring enhanced visualization capabilities and real-time surgical guidance for spine and cranial procedures. This integrated solution expanded Medtronic’s digital surgical offerings, catering to neurosurgeons and orthopedic surgeons seeking streamlined planning and navigation workflows

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.