Global Prescription Dermatology Therapeutics Market

Market Size in USD Billion

CAGR :

%

USD

45.72 Billion

USD

90.03 Billion

2025

2033

USD

45.72 Billion

USD

90.03 Billion

2025

2033

| 2026 –2033 | |

| USD 45.72 Billion | |

| USD 90.03 Billion | |

|

|

|

|

Prescription Dermatology Therapeutics Market Size

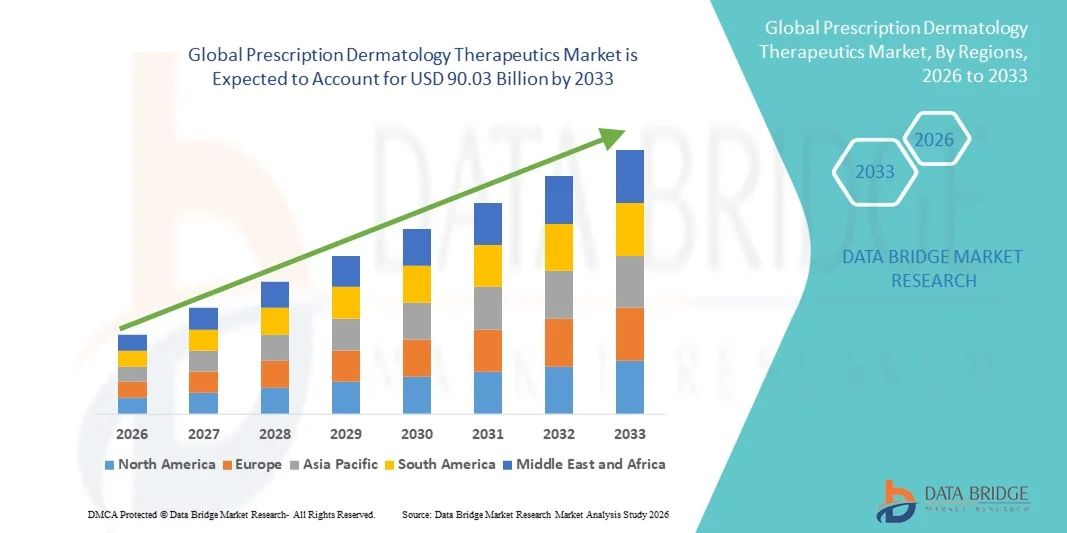

- The global prescription dermatology therapeutics market size was valued at USD 45.72 billion in 2025 and is expected to reach USD 90.03 billion by 2033, at a CAGR of 8.84% during the forecast period

- The market growth is primarily driven by the increasing prevalence of chronic skin conditions such as psoriasis, eczema, acne, and dermatitis, coupled with rising awareness and diagnosis rates. Advancements in targeted therapies and biologics are enhancing treatment outcomes, further stimulating market expansion

- In addition, growing consumer demand for effective, safe, and personalized dermatological treatments is establishing prescription therapeutics as a preferred choice among patients and healthcare providers. These factors are collectively propelling the adoption of innovative dermatology solutions, thereby significantly boosting the industry's growth

Prescription Dermatology Therapeutics Market Analysis

- Prescription dermatology therapeutics, including topical, oral, and biologic treatments, are increasingly essential for managing chronic and acute skin conditions across outpatient and hospital settings due to their targeted efficacy, safety profiles, and integration into personalized treatment regimens

- The rising demand for prescription dermatology therapeutics is primarily fueled by the growing prevalence of skin diseases, increasing awareness and early diagnosis, and a preference for clinically proven treatments over over-the-counter remedies

- North America dominated the prescription dermatology therapeutics market with the largest revenue share of 39.6% in 2025, driven by high healthcare expenditure, widespread access to dermatologists, and the presence of major pharmaceutical companies innovating in biologics and targeted therapies, with the U.S. leading in adoption of new treatment modalities for conditions such as psoriasis, acne, and dermatitis

- Asia-Pacific is expected to be the fastest growing region in the prescription dermatology therapeutics market during the forecast period due to rising healthcare access, growing awareness of skin conditions, and increasing investment in dermatology-focused R&D

- Acne and Rosacea Drugs segment dominated the prescription dermatology therapeutics market with a market share of 33.9% in 2025, driven by the high prevalence of acne among adolescents and adults, growing awareness of effective treatments, and the introduction of innovative topical and oral therapies

Report Scope and Prescription Dermatology Therapeutics Market Segmentation

|

Attributes |

Prescription Dermatology Therapeutics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Prescription Dermatology Therapeutics Market Trends

Rising Adoption of Biologics and Targeted Therapies

- A significant and accelerating trend in the global prescription dermatology therapeutics market is the increasing adoption of biologic and targeted therapies for chronic skin conditions such as psoriasis, atopic dermatitis, and severe acne, offering higher efficacy and fewer side effects compared to conventional treatments

- For instance, Dupixent (dupilumab) has gained widespread use for atopic dermatitis, providing patients with a targeted therapy that reduces inflammation while minimizing systemic side effects compared to traditional immunosuppressants

- Biologics and targeted therapies allow dermatologists to personalize treatment plans based on disease severity, genetic factors, and patient response, improving adherence and long-term outcomes. For instance, drugs such as Humira (adalimumab) for psoriasis are tailored to patient profiles to optimize therapeutic benefits

- The integration of advanced therapies with digital health platforms for treatment monitoring and adherence tracking is enhancing patient management and outcomes. Through apps and telehealth services, patients can report responses and side effects, enabling proactive adjustments by physicians

- This trend toward innovative, personalized, and more effective treatment options is redefining patient expectations in dermatology care. Consequently, companies such as AbbVie and LEO Pharma are expanding their biologic pipelines with next-generation therapies targeting inflammatory skin diseases

- Rising collaborations between pharmaceutical companies and biotech firms are accelerating the development of next-generation dermatology drugs, focusing on improved efficacy and fewer adverse effects

- The demand for advanced prescription dermatology therapeutics is growing rapidly across both chronic and acute skin conditions, as patients increasingly prioritize efficacy, safety, and convenience in treatment selection

Prescription Dermatology Therapeutics Market Dynamics

Driver

Increasing Prevalence of Chronic Skin Conditions and Awareness

- The rising global prevalence of chronic skin conditions such as acne, psoriasis, eczema, and dermatitis, along with growing awareness of effective treatments, is a significant driver for the increased adoption of prescription dermatology therapeutics

- For instance, the American Academy of Dermatology reported a marked increase in psoriasis diagnoses in 2025, prompting greater demand for biologics and systemic therapies

- As more patients seek professional dermatological care and evidence-based treatments, prescription therapeutics provide targeted and reliable solutions, improving patient outcomes. For instance, dermatologists increasingly recommend topical retinoids and systemic therapies for moderate-to-severe acne

- In addition, the expansion of dermatology-focused healthcare infrastructure and teledermatology services is making prescription treatments more accessible to a wider population, especially in urban and semi-urban areas

- Increasing digital platforms and e-pharmacies are making prescription dermatology therapeutics more accessible to remote and underserved populations, expanding market reach

- Growth in dermatology-focused education and awareness programs is enhancing patient compliance and encouraging timely initiation of prescription therapies

- The growing focus on preventive dermatology and early intervention for skin disorders is further boosting the uptake of prescription therapeutics. For instance, early treatment of hyperpigmentation or rosacea can prevent disease progression and reduce long-term complications

Restraint/Challenge

High Cost of Treatments and Regulatory Hurdles

- The high cost of advanced prescription dermatology therapeutics, particularly biologics and targeted therapies, presents a significant challenge to widespread adoption, especially in price-sensitive regions and among patients without insurance coverage

- For instance, the annual cost of biologics such as Humira or Cosentyx can be prohibitive for many patients, limiting access despite their clinical efficacy

- Regulatory complexities in approving new dermatology therapeutics, including stringent clinical trial requirements and varying regional guidelines, can delay market entry and increase development costs. For instance, companies seeking FDA and EMA approval for novel psoriasis therapies must undergo extensive multi-phase trials

- In addition, patient concerns over potential side effects and long-term safety of newer therapies can impact prescription rates. For instance, some patients may avoid systemic immunomodulators due to fears of infection risk or other adverse effects

- Limited availability of biologics and advanced therapies in emerging markets due to supply chain and logistical challenges further restrains adoption

- Patent expirations and generic competition for certain dermatology drugs can create market uncertainties, affecting investment in new product development

- Overcoming these challenges through patient assistance programs, price optimization strategies, and streamlined regulatory pathways will be crucial for sustained market growth

Prescription Dermatology Therapeutics Market Scope

The market is segmented on the basis of product type and distribution channel.

- By Product Type

On the basis of product type, the prescription dermatology therapeutics market is segmented into acne and rosacea drugs, fungal infection drugs, psoriasis drugs, hyperpigmentation/melisma drugs, skin cancer drugs, hair loss and hair removal drugs, antiaging and photo damage drugs, and dermatitis and seborrhea drugs. The Acne and Rosacea Drugs segment dominated the market with the largest revenue share of 33.9% in 2025, driven by the high prevalence of acne and rosacea among adolescents and adults. These drugs, including topical retinoids, antibiotics, and combination therapies, are widely prescribed by dermatologists due to their proven efficacy in reducing inflammation, preventing scarring, and improving overall skin appearance. In addition, growing awareness of early treatment benefits and increasing patient inclination towards clinically approved therapeutics have further boosted demand. The segment also benefits from continuous R&D efforts, resulting in new formulations that enhance tolerability and reduce side effects, increasing patient adherence. Rising social media influence and aesthetic concerns among young adults have contributed to the increased adoption of prescription acne therapies globally. Furthermore, the segment’s dominance is supported by the strong presence of key market players who actively promote these drugs through dermatology networks and telemedicine platforms.

The Psoriasis Drugs segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the increasing prevalence of chronic inflammatory skin conditions and the expanding adoption of biologics and targeted therapies. Psoriasis drugs, including systemic immunomodulators, biologics, and newer oral therapies, offer better efficacy and reduced side effects compared to traditional treatments, driving market adoption. Biologic therapies such as TNF-α inhibitors and IL-17/IL-23 inhibitors are gaining popularity due to their ability to target specific immune pathways, providing sustained symptom relief. The market growth is further supported by increased patient awareness and willingness to invest in long-term treatment regimens for chronic skin conditions. Rising healthcare infrastructure and reimbursement support in developed regions are enabling wider access to advanced psoriasis therapies. Ongoing innovations by pharmaceutical companies in this segment, such as personalized treatment approaches and combination therapies, are expected to accelerate adoption across global markets.

- By Distribution Channel

On the basis of distribution channel, the prescription dermatology therapeutics market is segmented into hospital pharmacies, retail pharmacies, and mail order pharmacies. The Retail Pharmacies segment dominated the market with the largest revenue share in 2025, driven by convenience, wide availability, and strong pharmacy networks that allow patients to access prescription dermatology drugs directly. Retail pharmacies often provide counseling services, patient education, and promotional support for new dermatology drugs, making them a preferred channel for both urban and semi-urban populations. The convenience of immediate drug availability, combined with insurance coverage in many regions, further reinforces the segment’s dominance. In addition, retail pharmacies play a crucial role in brand promotion for leading dermatology therapeutics companies, ensuring visibility and trust among consumers. The increasing trend of pharmacy chains and organized retail further strengthens this segment’s reach and market share.

The Hospital Pharmacies segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the rising number of dermatology-focused hospitals, specialty clinics, and outpatient departments. Hospital pharmacies provide direct access to prescribed therapeutics during patient visits, ensuring adherence to treatment plans and immediate initiation of therapies for severe or chronic skin conditions. Integration of hospital pharmacies with teledermatology services and electronic health records further enhances efficiency and patient convenience. The growing preference for hospital-based prescription fulfillment among patients with chronic conditions, coupled with the expansion of hospital networks in emerging regions, contributes to the rapid growth of this distribution channel. In addition, hospital pharmacies benefit from bulk procurement and partnerships with pharmaceutical companies, supporting the availability of advanced dermatology therapeutics at competitive prices.

Prescription Dermatology Therapeutics Market Regional Analysis

- North America dominated the prescription dermatology therapeutics market with the largest revenue share of 39.6% in 2025, driven by high healthcare expenditure, widespread access to dermatologists, and the presence of major pharmaceutical companies innovating in biologics and targeted therapies, with the U.S. leading in adoption of new treatment modalities for conditions such as psoriasis, acne, and dermatitis

- Patients and dermatologists in the region highly value the efficacy, safety, and accessibility of prescription dermatology drugs, particularly biologics and targeted therapies for conditions such as psoriasis, acne, and eczema

- This widespread adoption is further supported by well-established healthcare systems, insurance coverage, high patient awareness, and the presence of major pharmaceutical companies investing in R&D, establishing prescription dermatology therapeutics as the preferred treatment option across outpatient and hospital settings

U.S. Prescription Dermatology Therapeutics Market Insight

The U.S. prescription dermatology therapeutics market captured the largest revenue share of 82% in 2025 within North America, fueled by the high prevalence of chronic skin conditions such as acne, psoriasis, and eczema. Patients are increasingly prioritizing advanced and effective treatments, including biologics and targeted therapies, to achieve better outcomes with fewer side effects. The growing adoption of teledermatology and e-pharmacy services, combined with robust demand for personalized treatment plans and innovative topical and oral therapies, further propels market growth. Moreover, the presence of leading pharmaceutical companies investing in R&D and the availability of comprehensive insurance coverage significantly contribute to the expansion of the U.S. market.

Europe Prescription Dermatology Therapeutics Market Insight

The Europe prescription dermatology therapeutics market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising awareness of chronic and cosmetic skin conditions and the growing preference for clinically proven prescription therapies. The increase in urbanization, higher disposable incomes, and the demand for personalized treatments are fostering the adoption of advanced dermatology therapeutics. European patients and healthcare providers value efficacy, safety, and accessibility, with significant growth observed across hospital pharmacies, retail pharmacies, and specialty clinics. The market also benefits from strong healthcare infrastructure and regulatory support promoting the use of novel therapeutics.

U.K. Prescription Dermatology Therapeutics Market Insight

The U.K. prescription dermatology therapeutics market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing consumer awareness about skin health and demand for effective treatments for conditions such as acne, hyperpigmentation, and psoriasis. In addition, concerns regarding long-term skin damage, cosmetic appearance, and chronic disease management are encouraging patients to adopt prescription therapeutics. The U.K.’s strong healthcare system, coupled with the availability of dermatology specialists and e-pharmacy platforms, is expected to continue stimulating market growth.

Germany Prescription Dermatology Therapeutics Market Insight

The Germany prescription dermatology therapeutics market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of advanced dermatological treatments and the preference for innovative biologics and targeted therapies. Germany’s well-developed healthcare infrastructure, combined with a focus on R&D and high patient standards, promotes the adoption of prescription dermatology drugs across outpatient and hospital settings. Integration with digital health platforms, patient monitoring apps, and teledermatology services is also becoming increasingly prevalent, supporting adherence to treatment regimens and enhancing patient outcomes.

Asia-Pacific Prescription Dermatology Therapeutics Market Insight

The Asia-Pacific prescription dermatology therapeutics market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by increasing prevalence of skin conditions, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. The region's growing inclination towards personalized healthcare and access to modern dermatology facilities is driving adoption of prescription therapeutics. Furthermore, expansion of healthcare infrastructure, increased insurance penetration, and awareness campaigns are making advanced treatments more accessible to a wider patient population.

Japan Prescription Dermatology Therapeutics Market Insight

The Japan prescription dermatology therapeutics market is gaining momentum due to the country’s high awareness of skincare, growing incidence of chronic skin conditions, and demand for effective treatment solutions. Japanese patients prioritize safety, efficacy, and convenience, driving the adoption of biologics, topical therapies, and oral medications. Integration of prescription treatments with teledermatology and digital monitoring platforms is supporting better treatment adherence. Moreover, Japan’s aging population is expected to increase demand for therapeutics targeting age-related skin issues, such as anti-aging, photo damage, and dermatitis treatments, across both residential and hospital settings.

India Prescription Dermatology Therapeutics Market Insight

The India prescription dermatology therapeutics market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s expanding middle class, rising prevalence of skin conditions, and increasing healthcare awareness. India has a growing number of dermatology clinics, hospital pharmacies, and retail outlets offering prescription therapeutics. The push towards digital health solutions, telemedicine, and e-pharmacy platforms, alongside availability of affordable and innovative drugs, are key factors propelling market growth. Rapid urbanization and government initiatives promoting healthcare access are further supporting adoption in residential, commercial, and clinical settings.

Prescription Dermatology Therapeutics Market Share

The Prescription Dermatology Therapeutics industry is primarily led by well-established companies, including:

- AbbVie Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Novartis AG (Switzerland)

- Amgen, Inc. (U.S.)

- Eli Lilly and Company (U.S.)

- Bausch Health (Canada)

- LEO Pharma A/S, (Denmark)

- Aclaris Therapeutics, Inc. (U.S.)

- Aurobindo Pharma (India)

- Sun Pharmaceutical Industries Ltd. (India)

- GALDERMA (Switzerland)

- Sanofi (France)

- Bristol Myers Squibb Company (U.S.)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- Almirall, S.A., (Spain)

- Biofrontera AG, (Germany)

- Cipher Pharmaceuticals (Canada)

- Dr. Reddy’s Laboratories (India)

What are the Recent Developments in Global Prescription Dermatology Therapeutics Market?

- In October 2025, the FDA extended the approval of Zoryve (roflumilast) cream 0.05% for mild to moderate atopic dermatitis in children ages 2‑5, and earlier in May 2025 approved Zoryve foam 0.3% for plaque psoriasis in adults and adolescents. These regulatory actions significantly broaden the pediatric and psoriasis treatment landscape with a potent PDE4 inhibitor in new age groups and formulations

- In September 2025, the FDA expanded the approval of Opzelura (ruxolitinib) cream 1.5% to include children ages 2–11 with mild to moderate atopic dermatitis, marking it as the first topical JAK inhibitor approved for pediatric AD. This broadens treatment options for young children with chronic eczema, providing a non‑steroidal alternative to corticosteroids and improving pediatric dermatology care

- In July 2025, LEO Pharma’s ANZUPGO® (delgocitinib) cream received FDA approval as the first and only topical treatment specifically indicated for moderate‑to‑severe chronic hand eczema (CHE) in adults. This approval fills a long‑standing treatment gap for patients experiencing persistent, debilitating hand eczema where previous options were limited or suboptimal

- In June 2025, the FDA approved Dupixent (dupilumab) as the only targeted medicine to treat bullous pemphigoid (BP) in adults a rare and debilitating autoimmune skin disease previously lacking effective targeted therapy. This approval expands Dupixent’s dermatology indications beyond atopic dermatitis and offers a new treatment option aimed at sustained remission and reduced dependency on oral corticosteroids for BP patients

- In July 2021, the FDA approved Twyneo (tretinoin & benzoyl peroxide) cream the first fixed‑dose combination topical acne therapy for acne vulgaris in adults and pediatric patients aged 9 and older. This launch simplified acne management by combining two effective actives in one once‑daily treatment, improving adherence and outcomes for the large patient population affected by acne

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.