Global Prescription Drugs Market

Market Size in USD Billion

CAGR :

%

USD

1,230.28 Billion

USD

2,451.41 Billion

2024

2032

USD

1,230.28 Billion

USD

2,451.41 Billion

2024

2032

| 2025 –2032 | |

| USD 1,230.28 Billion | |

| USD 2,451.41 Billion | |

|

|

|

|

Prescription Drugs Market Size

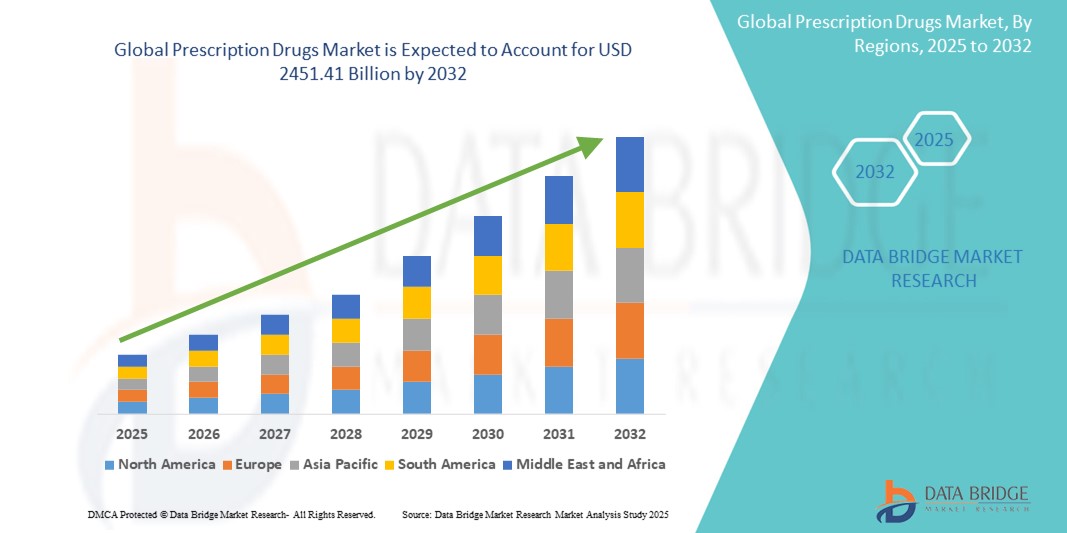

- The global prescription drugs market size was valued at USD 1,230.28 billion in 2024 and is expected to reach USD 2,451.41 billion by 2032, at a CAGR of 9.00% during the forecast period

- The market growth is largely fueled by the rising prevalence of chronic diseases, aging populations, and the increasing need for long-term disease management, driving demand for effective prescription drug therapies across therapeutic areas such as cardiovascular, oncology, diabetes, and neurology

- Furthermore, ongoing advancements in drug development, personalized medicine, and the expansion of healthcare access in emerging economies are significantly accelerating the adoption of prescription drugs, thereby boosting the industry's growth and transforming patient care on a global scale

Prescription Drugs Market Analysis

- Prescription drugs, serving as essential components of modern medical treatment, are increasingly vital in managing chronic and acute health conditions due to their therapeutic efficacy, accessibility through healthcare systems, and integration into long-term care protocols

- The escalating demand for prescription drugs is primarily fueled by the rising prevalence of chronic diseases, increasing healthcare expenditure, and the growing aging population globally. In addition, the development of innovative pharmaceuticals and biologics continues to enhance treatment options and drive market expansion

- North America dominated the prescription drugs market with the largest revenue share of 39.90% in 2024, driven by high healthcare spending, strong R&D infrastructure, favourable reimbursement policies, and the widespread availability of advanced treatment options. The U.S., in particular, is a major contributor due to its robust pharmaceutical industry, growing demand for specialty drugs, and continuous pipeline of FDA approvals

- Asia-Pacific is expected to be the fastest growing region in the prescription drugs market during the forecast period, with a projected CAGR of 7.9%, attributed to rising healthcare awareness, growing middle-class population, increasing access to healthcare services, and government initiatives to strengthen pharmaceutical production and distribution

- The branded drugs segment dominated the prescription drugs market with a market share of 62.5% in 2024, attributed to patent exclusivity, strong marketing strategies, and clinical preference in specialty therapeutics

Report Scope and Prescription Drugs Market Segmentation

|

Attributes |

Prescription Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Prescription Drugs Market Trends

“Enhanced Convenience in the Prescription Drugs Market”

- A significant and accelerating trend in the global prescription drugs market is the growing emphasis on improving patient convenience and access to essential medications. This includes advancements in drug formulations, packaging, and delivery systems aimed at making medication administration easier, especially for elderly patients and those with chronic illnesses

- For instance, extended-release tablets, transdermal patches, and orally disintegrating tablets are gaining popularity due to their ease of use and ability to reduce dosing frequency. These innovations help enhance treatment adherence and patient outcomes by simplifying complex medication regimens

- Pharmaceutical companies are increasingly focusing on patient-centric drug designs, such as blister packaging with clear dosage instructions and color-coded labeling, which minimize confusion and medication errors. Such packaging improvements contribute to a safer and more user-friendly experience for patients

- The expansion of telemedicine and online pharmacies has further contributed to convenience by allowing patients to consult healthcare providers remotely and receive their prescription drugs through home delivery services. This model has proven particularly beneficial in remote and underserved regions where access to physical healthcare facilities may be limited

- This trend towards more accessible and user-friendly drug delivery and consumption is reshaping the Prescription Drugs market, prompting manufacturers to develop formulations that are not only clinically effective but also aligned with patients’ daily routines and preferences

- The demand for prescription drugs that offer improved convenience in terms of administration, packaging, and delivery is rapidly growing across both developed and developing regions. As patients increasingly prioritize ease of use and accessibility, the market is responding with innovative, patient-focused solutions

Prescription Drugs Market Dynamics

Driver

“Growing Need Due to Rising Health Concerns and Chronic Disease Burden”

- The increasing global burden of chronic diseases such as diabetes, cardiovascular disorders, cancer, and respiratory conditions, coupled with a growing aging population, is a significant driver fueling the demand for prescription drugs. The rise in lifestyle-related health issues and a heightened awareness of preventive care have further accelerated the need for advanced pharmaceutical therapies

- For instance, in April 2024, major pharmaceutical players introduced next-generation cardiovascular drugs and immunotherapies aimed at improving treatment outcomes in patients with high unmet clinical needs. Such strategic innovations and product launches are expected to drive Prescription Drugs market growth in the forecast period

- As patients and healthcare providers prioritize effective and timely treatment, prescription drugs offer targeted, regulated, and clinically validated solutions for managing a wide range of acute and chronic health conditions. The development of specialty drugs, personalized medicines, and biologics is further enhancing therapeutic options and efficacy

- Furthermore, the expanding healthcare infrastructure, increasing access to health insurance, and growing government initiatives to ensure medicine availability are making prescription drugs more accessible across both developed and developing nations. Public-private partnerships and subsidy programs are also playing a key role in improving affordability and coverage

- The convenience of regulated dosages, physician oversight, and evidence-based treatment plans provided by prescription drugs makes them a preferred choice over over-the-counter options for managing complex health conditions. In addition, the rise of e-prescriptions and digital pharmacy services is making drug procurement more seamless for patients across geographies

Restraint/Challenge

“Concerns Regarding Side Effects, Drug Pricing, and Accessibility”

- Concerns regarding potential side effects, long-term health risks, and drug interactions present a significant challenge to the broader adoption of prescription drugs. Adverse reactions or complications from misuse or overuse can lead to patient hesitancy, particularly in cases involving strong medications or newer drug classes

- For instance, publicized incidents of drug recalls or safety warnings have heightened consumer awareness and caution when starting new prescriptions, often leading to delays in treatment or reduced adherence to medical advice

- Addressing these concerns through transparent communication, robust clinical trials, post-market surveillance, and proper patient education is essential to build trust in prescription therapies. Pharmaceutical companies are increasingly investing in pharmacovigilance systems and patient support programs to ensure drug safety and compliance

- In addition, the high cost of certain prescription drugs, especially specialty and biologic medications, remains a barrier to access for many patients—particularly in low- and middle-income regions. Despite the rise of generics and biosimilars, affordability continues to be a key concern for healthcare systems and end-users alike

- While insurance coverage and generic options have improved access, the perception of high drug prices and limited availability in rural or underserved areas still hampers widespread adoption. Collaborative efforts involving governments, healthcare providers, and drug manufacturers will be critical to ensuring equitable access to essential medicines

Prescription Drugs Market Scope

The market is segmented on the basis of type, therapy area, route of administration, end user, and distribution channel

• By Type

On the basis of type, the prescription drugs market is segmented into branded and generic. The branded drugs segment dominated the market with the largest revenue share of 62.5% in 2024, attributed to patent exclusivity, strong marketing strategies, and clinical preference in specialty therapeutics.

The generic drugs segment is anticipated to grow at the fastest CAGR of 7.4% from 2025 to 2032, driven by patent expirations, increasing demand for cost-effective treatments, and favorable regulatory support.

• By Therapy Area

On the basis of therapy area, the prescription drugs market is segmented into oncology, immunology, ophthalmology, respiratory, dermatology, gastroenterology, urology, gynaecology, endocrinology, and others. The oncology segment held the largest market share of 28.3% in 2024, driven by high cancer prevalence and rising adoption of targeted therapies.

The immunology segment is expected to register the fastest CAGR of 8.1% from 2025 to 2032, owing to increasing cases of autoimmune disorders and advancements in biologics.

• By Route of Administration

On the basis of route of administration, the prescription drugs market is segmented into oral, topical, parenteral, and others. The oral segment accounted for the largest revenue share of 51.2% in 2024, due to ease of use and widespread application in chronic disease management.

The parenteral segment is projected to grow at the fastest CAGR of 7.9% from 2025 to 2032, driven by increased use of injectable therapies in oncology, diabetes, and immunology.

• By End-Users

On the basis of end-users, the prescription drugs market is segmented into hospitals, specialty clinics, homecare, and others. The hospital segment held the largest market share of 48.7% in 2024, supported by high patient volume, availability of advanced therapies, and inpatient prescriptions.

The homecare segment is expected to grow at the fastest CAGR of 8.5% from 2025 to 2032, driven by patient preference for convenience, aging demographics, and growing home-based care models.

• By Distribution Channel

On the basis of distribution channel, the prescription drugs market is segmented into hospital pharmacy, retail pharmacy, online pharmacy, and others. The hospital pharmacy segment led the market with a share of 42.1% in 2024, due to centralized drug dispensing and institutional procurement. The online pharmacy segment is projected to record the fastest CAGR of 9.2% from 2025 to 2032, fueled by growing digital health trends, doorstep delivery models, and convenience for chronic users.

Prescription Drugs Market Regional Analysis

- North America dominated the prescription drugs market with the largest revenue share of 39.90% in 2024, driven by rising healthcare expenditure, a high burden of chronic diseases, and strong pharmaceutical R&D infrastructure

- Consumers in the region benefit from advanced healthcare systems, widespread insurance coverage, and access to innovative therapies across diverse therapeutic areas including oncology, immunology, and cardiology

- This widespread usage is further supported by favorable regulatory frameworks, high levels of awareness, and robust pharmaceutical supply chains, making North America a leading region for both branded and generic prescription drugs

U.S. Prescription Drugs Market Insight

The U.S. prescription drugs market captured the largest revenue share of 71% in 2024 within North America, driven by the country’s mature pharmaceutical industry and rapid uptake of specialty drugs and biologics. Factors such as an aging population, strong healthcare infrastructure, and technological advancements in drug delivery contribute to sustained growth. In addition, increased adoption of telehealth, e-prescriptions, and the growing prevalence of chronic and lifestyle-related conditions further propel the U.S. market. Pharmaceutical companies continue to invest heavily in R&D and regulatory approvals, strengthening the industry’s dominance.

Europe Prescription Drugs Market Insight

The Europe prescription drugs market is projected to expand at a substantial CAGR throughout the forecast period, supported by universal healthcare systems, a focus on cost-effective drug access, and robust pharmacovigilance mechanisms. Government initiatives to encourage the use of generics, combined with aging populations and rising demand for chronic disease treatment, are driving market growth.Increased urbanization, regulatory harmonization across the EU, and pharmaceutical innovations are also contributing to prescription drug uptake across both Western and Eastern European markets.

U.K. Prescription Drugs Market Insight

The U.K. prescription drugs market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by a strong emphasis on national health services and increasing demand for accessible therapies. Escalating cases of cancer, diabetes, and mental health disorders are increasing prescription volumes, while government pressure to reduce healthcare costs is boosting generic drug penetration. The rise of digital healthcare services, including online prescriptions and teleconsultations, is expected to support continued market growth.

Germany Prescription Drugs Market Insight

The Germany prescription drugs market is expected to expand at a considerable CAGR during the forecast period, driven by its advanced healthcare infrastructure and strong pharmaceutical manufacturing base. Germany’s emphasis on innovation, biosimilar adoption, and health insurance reimbursement policies has fostered a competitive and high-value prescription drugs environment. Furthermore, increased government focus on improving healthcare efficiency and sustainability continues to support the growth of prescription drug utilization across hospitals and specialty care settings.

Asia-Pacific Prescription Drugs Market Insight

The Asia-Pacific prescription drugs market is poised to grow at the fastest CAGR of 7.9% from 2025 to 2032, propelled by rising healthcare investments, population growth, and increasing prevalence of chronic conditions in countries such as China, India, and Japan. Government initiatives to improve healthcare infrastructure and promote access to essential medicines are encouraging pharmaceutical expansion across the region. As APAC becomes a key hub for drug manufacturing and clinical trials, the affordability and accessibility of prescription medications continue to improve across both urban and rural areas.

Japan Prescription Drugs Market Insight

The Japan prescription drugs market is gaining momentum, supported by a rapidly aging population, a high incidence of chronic illnesses, and widespread access to universal healthcare. Japan’s advanced pharmaceutical innovation ecosystem and emphasis on personalized medicine are contributing to the adoption of targeted therapies, especially in oncology and neurology. Technological integration in healthcare delivery and increased digital prescription usage are further stimulating market growth in both inpatient and outpatient settings.

China Prescription Drugs Market Insight

The China prescription drugs market accounted for the largest revenue share in Asia-Pacific in 2024, driven by a large and aging population, rapid urbanization, and healthcare reforms aimed at expanding access to affordable treatments. China is one of the largest markets for both branded and generic prescription drugs, with significant growth in therapeutic areas such as oncology, cardiology, and diabetes. Supportive regulatory changes, growing health insurance coverage, and the rise of domestic pharmaceutical manufacturers are key drivers enhancing drug availability and affordability across the nation.

Prescription Drugs Market Share

The prescription drugs industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Teva Pharmaceutical Industries Ltd. (Ireland)

- Sanofi (France)

- Pfizer Inc. (U.S.)

- GSK plc. (U.K.)

- Novartis AG (Switzerland)

- Merck & Co., Inc. (U.S.)

- AstraZeneca (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- Hikma Pharmaceuticals PLC (U.K.)

- Bristol-Myers Squibb Company (U.S.)

- Bayer AG (Germany)

- Boehringer Ingelheim International GmbH (Germany)

- Dr. Reddy's Laboratories Ltd. (India)

- Gilead Sciences, Inc. (U.S.)

- Amgen Inc. (U.S.)

- Lilly (U.S.)

- AbbVie Inc. (U.S.)

- Lupin (India)

Latest Developments in Global Prescription Drugs Market

- In April 2023, Pfizer Inc. announced a strategic collaboration with Samsung Biologics to increase production capacity for biologic prescription drugs targeting oncology and inflammatory diseases. This move highlights Pfizer’s commitment to strengthening its global supply chain and improving access to critical therapies in underserved markets, particularly in Asia-Pacific and emerging regions

- In March 2023, Roche introduced a next-generation personalized cancer therapy, inavolisib, in Phase III clinical trials targeting breast cancer with PI3K mutations. This development showcases the company’s focus on precision medicine and innovation in the oncology prescription drug segment, which remains one of the highest-revenue-generating therapeutic areas globally

- In March 2023, Sanofi announced its acquisition of Provention Bio, Inc., a U.S.-based biopharmaceutical company focused on autoimmune diseases. This acquisition strengthens Sanofi’s prescription drug portfolio in the immunology space, particularly with the addition of TZIELD, the first and only approved drug to delay the onset of type 1 diabetes

- In February 2023, Johnson & Johnson launched a global access initiative for its long-acting HIV treatment cabotegravir through licensing agreements with generic manufacturers. This move is designed to increase access to affordable HIV medications in low- and middle-income countries, emphasizing the company’s focus on equitable healthcare through expanded prescription drug access

- January 2023, Eli Lilly and Company received FDA approval for its novel obesity treatment, tirzepatide, under the brand name Zepbound. As part of its expanding endocrinology portfolio, this approval represents a major advancement in metabolic disorder therapeutics and is expected to contribute significantly to the company’s prescription drug revenue in the coming years

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.