Global Pressed Ceramic Packages Market

Market Size in USD Billion

CAGR :

%

USD

80.53 Billion

USD

123.58 Billion

2024

2032

USD

80.53 Billion

USD

123.58 Billion

2024

2032

| 2025 –2032 | |

| USD 80.53 Billion | |

| USD 123.58 Billion | |

|

|

|

|

Pressed Ceramic Packages Market Size

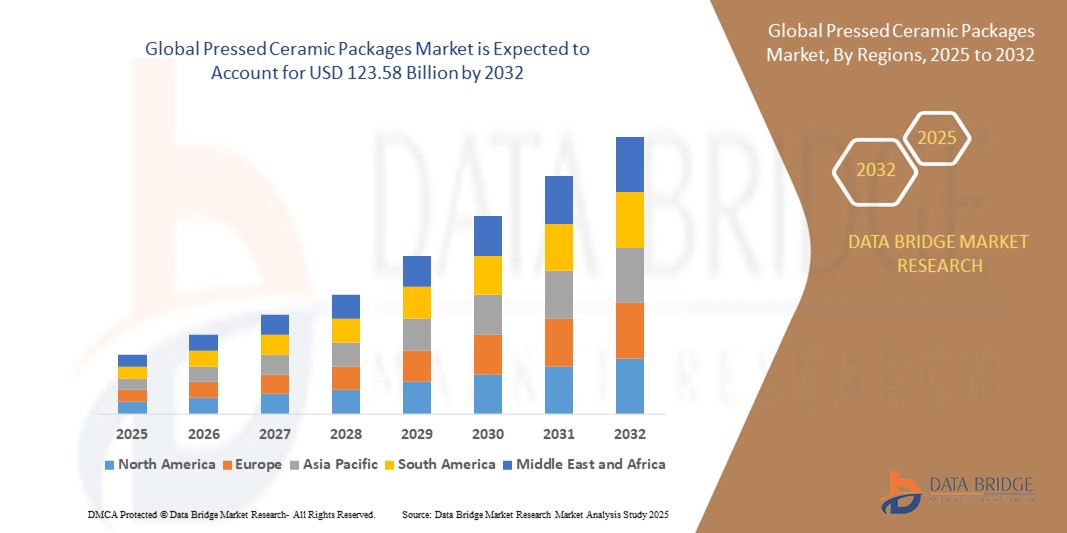

- The global pressed ceramic packages market size was valued at USD 80.53 billion in 2024 and is expected to reach USD 123.58 billion by 2032, at a CAGR of 5.50% during the forecast period

- The market growth is primarily driven by increasing demand for high-reliability packaging solutions in electronics, automotive, and aerospace industries, coupled with the rising adoption of advanced sensors and MEMS technologies

- Growing awareness of the benefits of ceramic packages, such as thermal stability, hermetic sealing, and durability, is further boosting demand across OEM and aftermarket channels

Pressed Ceramic Packages Market Analysis

- The pressed ceramic packages market is experiencing robust growth due to the rising need for compact, reliable, and high-performance packaging solutions in advanced electronic devices

- The demand from automotive, telecommunications, and consumer electronics sectors is prompting manufacturers to innovate with cost-effective, high-strength, and thermally efficient ceramic packaging solutions

- North America dominates the pressed ceramic packages market with the largest revenue share of 37.2% in 2024, driven by a well-established electronics industry and increasing investments in automotive and aerospace technologies

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fuelled by rapid industrialization, expanding electronics manufacturing, and growing demand for advanced packaging in countries such as China, Japan, South Korea, and India

- The Ceramic-metal sealing (CERTM) segment dominated the largest market revenue share of 38.5% in 2024, driven by its superior thermal and mechanical properties, making it ideal for high-reliability applications in electronics, aerospace, and automotive industries

Report Scope and Pressed Ceramic Packages Market Segmentation

|

Attributes |

Pressed Ceramic Packages Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pressed Ceramic Packages Market Trends

Increasing Adoption of Advanced Materials and Manufacturing Techniques

- The global pressed ceramic packages market is experiencing a notable trend toward the integration of advanced materials such as high-purity alumina and zirconia, enhancing thermal conductivity and reliability

- Advanced manufacturing techniques, including high-pressure sintering and precision molding, are improving the durability and precision of pressed ceramic packages

- These advancements enable the production of packages suitable for high-frequency and high-power applications, such as RF and microwave components

- For instances, companies are leveraging these technologies to develop ceramic packages that support 5G and IoT applications, optimizing performance in compact and high-performance electronic devices

- This trend is increasing the appeal of pressed ceramic packages for industries requiring robust and efficient packaging solutions, such as automotive and consumer electronics

- Material innovations also allow for better hermetic sealing, particularly in ceramic-metal sealing (CERTM) and glass-metal sealing (GTMS) types, enhancing protection for sensitive components

Pressed Ceramic Packages Market Dynamics

Driver

Growing Demand for Miniaturized and High-Performance Electronics

- The rising consumer and industrial demand for compact, high-performance electronic devices, such as smartphones, wearables, and automotive electronics, is a key driver for the pressed ceramic packages market

- Pressed ceramic packages provide superior thermal management, electrical insulation, and structural integrity, making them ideal for applications such as transistors, sensors, lasers, and MEMS switches

- Regulatory requirements for reliable and durable electronic components in industries such as automotive and aerospace are further boosting market growth

- The expansion of 5G, IoT, and electric vehicle (EV) technologies is increasing the need for advanced packaging solutions, supported by faster data transmission and enhanced connectivity

- Manufacturers are increasingly incorporating pressed ceramic packages as standard components to meet performance expectations and enhance device reliability

Restraint/Challenge

High Production Costs and Supply Chain Complexities

- The high initial costs associated with advanced materials, specialized manufacturing processes, and integration of pressed ceramic packages can be a barrier, particularly in cost-sensitive markets

- Producing complex ceramic packages, such as those for oscillating crystals or photo diodes, requires sophisticated equipment and expertise, increasing overall costs

- Supply chain challenges, including the availability of high-purity raw materials such as alumina and zirconia, can lead to production delays and cost fluctuations

- In addition, ensuring compatibility with diverse applications across global markets adds complexity to manufacturing and distribution

- These factors may limit market adoption in regions with lower purchasing power or where alternative packaging solutions are more cost-effective

Pressed Ceramic Packages market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the global pressed ceramic packages market is segmented into Ceramic-metal sealing (CERTM), Glass-metal sealing (GTMS), Passivation glass, Transponder glass, and Reed glass. The Ceramic-metal sealing (CERTM) segment dominated the largest market revenue share of 38.5% in 2024, driven by its superior thermal and mechanical properties, making it ideal for high-reliability applications in electronics, aerospace, and automotive industries. Its robust hermetic sealing capabilities ensure protection for sensitive components in harsh environments.

The Glass-metal sealing (GTMS) segment is expected to witness the fastest growth rate of 8.2% from 2025 to 2032, fueled by increasing demand in automotive and consumer electronics for reliable sealing solutions in compact, high-performance devices. Advancements in material science and manufacturing techniques, such as improved glass-to-metal bonding, further enhance its adoption.

- By Application

On the basis of application, the global pressed ceramic packages market is segmented into Transistors, Sensors, Lasers, Photo diodes, Airbag ignitors, Oscillating crystals, MEMS switches, and Others. The Transistors segment dominated the market with a revenue share of 32.0% in 2024, driven by the widespread use of pressed ceramic packages in semiconductor manufacturing for reliable encapsulation and thermal management. The growing demand for miniaturized and high-performance electronic components further supports this segment’s dominance.

The Sensors segment is anticipated to experience the fastest growth rate of 9.1% from 2025 to 2032, propelled by the increasing adoption of sensors in automotive, IoT, and industrial automation applications. Pressed ceramic packages provide enhanced durability and precision, critical for sensors operating in demanding environments.

Pressed Ceramic Packages Market Regional Analysis

- North America dominates the pressed ceramic packages market with the largest revenue share of 37.2% in 2024, driven by a well-established electronics industry and increasing investments in automotive and aerospace technologies

- Consumers and industries prioritize pressed ceramic packages for their superior thermal management, hermetic sealing, and durability, particularly in applications requiring high-performance electronic components

- Growth is supported by advancements in material science, such as high-purity alumina and zirconia, and increasing adoption in both OEM and aftermarket segments across various industries

U.S. Pressed Ceramic Packages Market Insight

The U.S. pressed ceramic packages market captured the largest revenue share of 79.1% in 2024 within North America, fueled by strong demand in the semiconductor and automotive sectors, alongside growing adoption in aerospace applications. The trend towards miniaturization of electronic devices and increasing regulations promoting reliable packaging solutions further boost market expansion. Manufacturers’ integration of ceramic packages in high-frequency components complements aftermarket sales, creating a diverse product ecosystem.

Europe Pressed Ceramic Packages Market Insight

The Europe pressed ceramic packages market is expected to witness significant growth, supported by regulatory emphasis on electronic component reliability and performance. Industries seek packages that enhance thermal conductivity and ensure hermetic sealing. The growth is prominent in both new electronic device manufacturing and retrofit projects, with countries such as Germany and France showing significant uptake due to rising demand in automotive and telecommunications sectors.

U.K. Pressed Ceramic Packages Market Insight

The U.K. market for pressed ceramic packages is expected to witness rapid growth, driven by demand for high-reliability packaging in electronics and automotive applications. Increased interest in advanced technologies, such as 5G and IoT, and rising awareness of durability benefits encourage adoption. Evolving regulations for electronic safety and performance influence industry choices, balancing package type with compliance.

Germany Pressed Ceramic Packages Market Insight

Germany is expected to witness rapid growth in pressed ceramic packages, attributed to its advanced electronics manufacturing sector and high industry focus on reliability and energy efficiency. German industries prefer technologically advanced packages, such as ceramic-metal sealing (CERTM), that ensure robust performance and contribute to lower system failures. The integration of these packages in premium electronics and aftermarket options supports sustained market growth.

Asia-Pacific Pressed Ceramic Packages Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding electronics production and rising investments in countries such as China, India, and Japan. Increasing awareness of thermal management, hermetic sealing, and component reliability is boosting demand. Government initiatives promoting advanced manufacturing and electronic safety further encourage the use of pressed ceramic packages.

Japan Pressed Ceramic Packages Market Insight

Japan’s pressed ceramic packages market is expected to witness rapid growth due to strong industry preference for high-quality, technologically advanced packages that enhance component performance and safety. The presence of major electronics manufacturers and integration of ceramic packages in OEM devices accelerate market penetration. Rising interest in aftermarket customization for high-frequency applications also contributes to growth.

China Pressed Ceramic Packages Market Insight

China holds the largest share of the Asia-Pacific pressed ceramic packages market, propelled by rapid industrialization, rising electronics ownership, and increasing demand for reliable packaging solutions. The country’s growing middle class and focus on smart technologies support the adoption of advanced ceramic packages. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Pressed Ceramic Packages Market Share

The pressed ceramic packages industry is primarily led by well-established companies, including:

- Teledyne Technologies (U.S.)

- SCHOTT (Germany)

- Amkor Technology (U.S.)

- KYOCERA Corporation (Japan)

- Materion Corporation (U.S.)

- Egide (France)

- SGA Technologies (U.K.)

- Complete Hermetics (U.S.)

- Special Hermetic Products Inc. (U.S.)

- Coat-X SA (Switzerland)

- Hermetics Solutions Group (U.S.)

- StratEdge (U.S.)

- Mackin Technologies (U.S.)

- Palomar Technologies (U.S.)

- CeramTec Gmbh (Germany)

- Electronic Products Inc. (U.S.)

- NGK Insulators Ltd. (Japan)

- Remtec Inc. (Canada)

What are the Recent Developments in Global Pressed Ceramic Packages Market?

- In January 2024, Lenox Corporation, a leading tableware brand, announced its acquisition of Oneida Consumer LLC, a move aimed at expanding its market presence and strengthening its position in the ceramic tableware sector. The acquisition includes Oneida’s well-known flatware, dinnerware, and cutlery lines. By integrating Oneida’s expertise and product portfolio, Lenox plans to enhance its good/better/best assortment strategy, reach new distribution channels, and drive innovation across retail and hospitality markets. This strategic merger brings together two iconic brands under one umbrella, creating new opportunities for growth and consumer engagement

- In November 2023, Villeroy & Boch, a leading European ceramics manufacturer, launched a sustainable tableware line crafted from recycled ceramic materials. This innovative collection repurposes production waste and unsold items to create new, eco-friendly products, reflecting the company’s commitment to environmental responsibility and circular design. The launch aligns with the growing trend of eco-conscious consumerism, offering stylish and functional options for customers who prioritize sustainability. By integrating recycled content into its manufacturing process, Villeroy & Boch aims to reduce its environmental footprint while maintaining the high quality and craftsmanship

- In August 2023, Duravit AG, a German bathroom manufacturer, announced plans to build the world’s first climate-neutral ceramic production facility in Matane, Québec, Canada. Powered by 99.6% renewable hydropower, the plant will feature an electric roller kiln developed with SACMI, drastically reducing CO₂ emissions by up to 11,000 tons annually. The facility will produce ceramic sanitary ware for the North American market and is expected to begin operations in 2025, creating 240 new jobs. This initiative marks a major leap toward sustainable manufacturing in the ceramics industry

- In April 2023, Kyocera Corporation announced plans to build a new smart factory at the Minami Isahaya Industrial Park in Isahaya City, Nagasaki Prefecture, Japan. This strategic expansion responds to rising global demand for fine ceramic components and semiconductor packages, driven by trends in miniaturization, 5G, EV technologies, and advanced driver assistance systems (ADAS). The facility will span approximately 37 acres, with construction beginning in October 2023 and operations expected to start in 2026. Kyocera aims to boost production capacity while contributing to regional economic development and job creation

- In March 2023, Murata Manufacturing Co., Ltd. completed construction of a new production building in Thailand through its subsidiary Murata Electronics (Thailand), Ltd.. The facility, located in the Amata City Industrial Estate, was built to meet the rising global demand for multilayer ceramic capacitors (MLCCs). Spanning over 80,000 square meters, the two-story smart factory represents an investment of approximately 12 billion yen and is designed to support medium- to long-term production growth. This expansion strengthens Murata’s global manufacturing footprint and reinforces Thailand’s role as a key base for MLCC production

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pressed Ceramic Packages Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pressed Ceramic Packages Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pressed Ceramic Packages Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.