Global Pressure Labels Market

Market Size in USD Billion

CAGR :

%

USD

24.05 Billion

USD

34.25 Billion

2025

2033

USD

24.05 Billion

USD

34.25 Billion

2025

2033

| 2026 –2033 | |

| USD 24.05 Billion | |

| USD 34.25 Billion | |

|

|

|

|

Pressure Labels Market Size

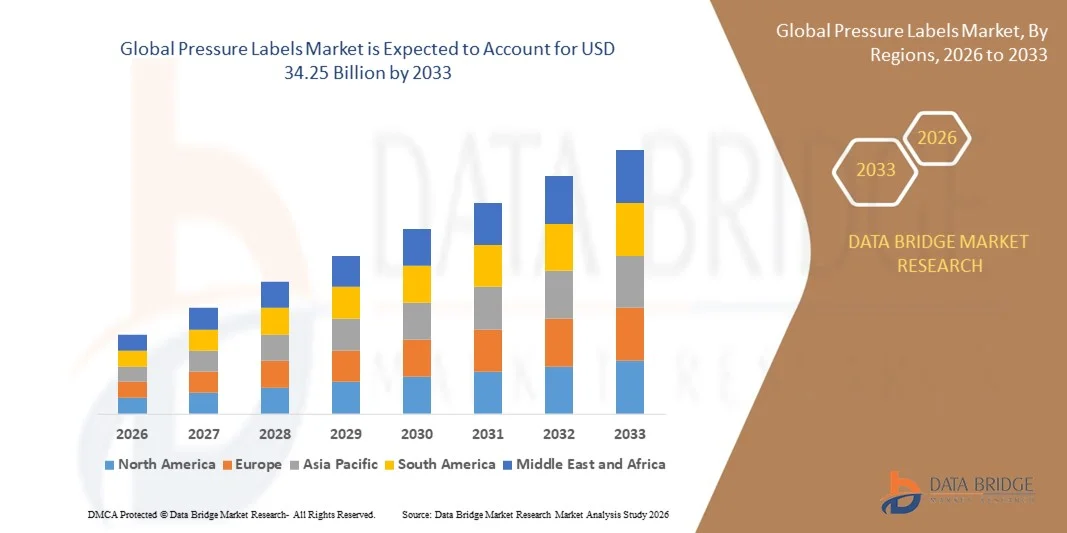

- The global pressure labels market size was valued at USD 24.05 billion in 2025 and is expected to reach USD 34.25 billion by 2033, at a CAGR of 4.52% during the forecast period

- The market growth is largely driven by the increasing demand for durable, high-quality, and visually appealing packaging solutions across industries such as food & beverages, pharmaceuticals, and consumer goods. The rise in packaged product consumption and the shift toward informative, sustainable, and regulatory-compliant labeling are strengthening the adoption of pressure labels in global packaging operations

- Furthermore, technological advancements in printing techniques, adhesive formulations, and material innovations are improving label performance, sustainability, and cost-efficiency. These developments enable manufacturers to deliver high-quality, customizable, and recyclable labeling solutions, thereby enhancing brand visibility and compliance standards across end-use sectors

Pressure Labels Market Analysis

- Pressure labels, known for their self-adhesive properties and versatility across diverse substrates, play a crucial role in modern packaging and product identification across industries such as food, healthcare, and personal care. Their ability to adhere without heat or water, combined with excellent durability and design flexibility, makes them an essential component of efficient and aesthetic packaging systems

- The growing adoption of sustainable materials, eco-friendly adhesives, and digital printing technologies is further accelerating market growth. Rising consumer preference for sustainable packaging, coupled with stringent labeling regulations and brand differentiation needs, continues to drive innovation and expansion in the global pressure labels market

- Asia-Pacific dominated the pressure labels market in 2025, due to the expanding packaging industry, rising demand for consumer goods, and increasing production of food and beverage products across the region

- North America is expected to be the fastest growing region in the pressure labels market during the forecast period due to

- Water based segment dominated the market with a market share of 47.69% in 2025, due to its eco-friendly profile, low VOC emissions, and suitability for paper labelstocks. Water-based applications are widely used in food and pharmaceutical labeling where safety and environmental compliance are essential. Their excellent print adhesion and cost-effectiveness further drive market preference

Report Scope and Pressure Labels Market Segmentation

|

Attributes |

Pressure Labels Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pressure Labels Market Trends

Growing Adoption of Sustainable and Recyclable Label Materials

- The market for pressure labels is witnessing a strong transformation toward sustainability as manufacturers increasingly adopt eco-friendly and recyclable materials in label production. This shift is driven by rising environmental awareness, tightening regulations on plastic waste, and growing consumer preference for sustainable packaging solutions across industries such as food and beverages, personal care, and logistics

- For instance, Avery Dennison Corporation has introduced its “CleanFlake” technology designed for easy label separation and recycling in PET bottle streams, enabling enhanced recyclability without compromising label performance. Similarly, UPM Raflatac has launched paper-based and filmic label materials made from renewable sources to support circular packaging goals for brand owners

- Manufacturers are focusing on developing innovative pressure label materials such as recycled paper, biodegradable films, and water-based adhesives to reduce carbon footprint and improve end-of-life recyclability. These advancements are encouraging brands to transition from conventional plastics to sustainable alternatives

- Sustainable labeling solutions are becoming a key part of brand identity as companies utilize recyclable and compostable label materials to reinforce their environmental commitments. This approach enhances consumer trust and aligns with corporate sustainability initiatives while supporting regulatory compliance

- The shift toward renewable raw materials and closed-loop recycling models is reshaping production processes and supply chains in the labeling industry. These efforts are further accelerating collaboration among packaging suppliers and end users to enhance sustainability outcomes through joint innovation and responsible sourcing

- The overall trend highlights an industry-wide commitment toward environmental responsibility, integrating sustainability as a core design and business strategy. As regulatory bodies tighten environmental standards globally, the future growth trajectory of the pressure labels market is expected to rely heavily on sustainable and recyclable label material adoption

Pressure Labels Market Dynamics

Driver

Rising Demand for High-Quality Packaging and Branding Solutions

- Pressure labels are increasingly being adopted due to their ability to provide attractive and durable packaging solutions across sectors such as beverages, cosmetics, and pharmaceuticals. The need for superior visual appeal and reliable adhesion is encouraging companies to upgrade their labeling technologies for better branding impact

- For instance, CCL Industries has expanded its portfolio of premium pressure-sensitive labels for beverage and personal care brands, focusing on high-quality finishes and enhanced print resolution. Such advancements reflect the growing preference among manufacturers for pressure labels that convey brand value through design innovation and functionality

- The versatility of pressure labels allows their application on diverse materials including glass, plastic, and metal surfaces while maintaining high print quality and resistance to environmental conditions. This adaptability makes them a preferred option for industries requiring durable and visually distinct labeling solutions

- As brands seek greater differentiation on retail shelves, pressure labels provide flexibility for creative design, tactile finishes, and customization through digital printing technologies. This capability significantly enhances consumer engagement and helps brand owners achieve consistent messaging across product lines

- The rising emphasis on product authenticity, traceability, and anti-counterfeit labeling further strengthens demand for advanced pressure label solutions with features such as QR codes and tamper-evident materials. Collectively, these factors are driving sustained growth in the adoption of pressure labels for premium and functional packaging applications

Restraint/Challenge

Fluctuating Raw Material Costs Impacting Production Margins

- Volatility in raw material prices, particularly paper, adhesives, and film substrates, remains a critical challenge for pressure label manufacturers. Rising production costs and supply chain disruptions are exerting pressure on profit margins, especially for small and medium-scale producers operating on tight budgets

- For instance, LINTEC Corporation reported a marked increase in adhesive and paper input costs in early 2025, driving the need for pricing adjustments and efficiency improvements in its labeling operations. Such fluctuations affect producers’ ability to maintain stable pricing and consistent profitability

- Dependence on petroleum-based films and specialty coatings makes the pressure label industry sensitive to crude oil price variations and geopolitical disruptions. Companies are therefore focusing on diversifying supply sources and entering long-term procurement agreements to mitigate raw material risks

- In addition, energy price hikes and freight cost increases have amplified overall production expenses, leading to longer lead times and reduced cost competitiveness for exporters in certain regions. Maintaining affordability while ensuring quality and sustainability remains a major industry concern

- Addressing these challenges through strategic material sourcing, adoption of alternative bio-based substrates, and advances in production efficiency will be crucial for sustaining profitability. In the long term, stabilizing supply chains and cost structures will help ensure balanced growth and maintain competitive advantage in the pressure labels market

Pressure Labels Market Scope

The market is segmented on the basis of type, labelstocks, composition, printing technology, mode of application, and end user.

- By Type

On the basis of type, the pressure labels market is segmented into release liner labels and linerless labels. The release liner labels segment dominated the market with the largest revenue share in 2025, primarily due to their versatility and compatibility with various printing technologies and adhesives. These labels provide excellent surface protection during printing and application, ensuring high-quality finishes and precise labeling across food, pharmaceutical, and logistics industries. Their superior durability, easy peel-off functionality, and wide material compatibility make them the preferred choice for high-volume packaging operations.

The linerless labels segment is projected to register the fastest growth from 2026 to 2033, driven by the increasing focus on sustainability and cost efficiency. Linerless labels eliminate the need for backing paper, reducing waste generation and material costs. They also enable higher label roll capacity, improving operational efficiency in large-scale labeling systems. The growing adoption of eco-friendly solutions by major packaging manufacturers and retailers is significantly accelerating the use of linerless labeling formats.

- By Labelstocks

On the basis of labelstocks, the market is divided into paper, plastic, and others. The paper segment accounted for the largest share in 2025 due to its cost-effectiveness, printability, and wide usage in food, beverage, and retail industries. Paper-based labelstocks are valued for their eco-friendly nature and ability to support high-quality graphics, making them ideal for product branding and regulatory labeling. The increasing preference for biodegradable packaging materials further enhances the dominance of paper labelstocks in consumer goods applications.

The plastic segment is expected to grow at the fastest rate during 2026–2033, driven by its superior durability, moisture resistance, and flexibility. Plastic labelstocks such as polypropylene and polyethylene offer extended product life, especially in outdoor and industrial environments. Their compatibility with advanced printing technologies and transparent labeling designs supports premium packaging solutions for beverages, cosmetics, and pharmaceuticals.

- By Composition

Based on composition, the pressure labels market is segmented into facestock, adhesives, and topcoat. The facestock segment dominated the market in 2025, owing to its critical role in determining label performance, appearance, and printability. High-quality facestock materials such as paper and film provide strength, flexibility, and adaptability to diverse surfaces and applications. The demand for customized and visually appealing product packaging continues to drive innovations in facestock materials for better print resolution and durability.

The adhesives segment is projected to record the fastest growth during the forecast period, driven by advancements in pressure-sensitive adhesive technologies offering improved tack and clean removability. Growing adoption in refrigerated and high-moisture applications, along with enhanced chemical and temperature resistance, contributes to their increasing demand. Manufacturers are focusing on solvent-free and bio-based adhesive formulations to support sustainability goals in labeling.

- By Printing Technology

On the basis of printing technology, the market is categorized into digital printing, flexography, lithography, screen printing, gravure, letterpress, and offset. The flexography segment held the largest market share in 2025 due to its high-speed production, versatility across substrates, and cost efficiency in large-volume printing. Flexographic printing is widely preferred in food and beverage labeling because of its ability to deliver consistent quality and compatibility with eco-friendly inks. Its adaptability to different labelstock materials further reinforces its strong market position.

The digital printing segment is anticipated to exhibit the fastest growth rate from 2026 to 2033, fueled by the demand for short-run, customizable labels and reduced turnaround times. Digital printing enables high-resolution graphics, variable data printing, and minimal waste, catering to dynamic branding needs. The increasing penetration of e-commerce and personalized product packaging trends is accelerating digital printing adoption in the labeling sector.

- By Mode of Application

Based on mode of application, the market is segmented into water-based, solvent-based, hot-melt-based, and radiation-based. The water-based segment dominated the market with the largest share of 47.69% in 2025 due to its eco-friendly profile, low VOC emissions, and suitability for paper labelstocks. Water-based applications are widely used in food and pharmaceutical labeling where safety and environmental compliance are essential. Their excellent print adhesion and cost-effectiveness further drive market preference.

The radiation-based segment is expected to record the fastest growth during 2026–2033, attributed to its quick curing time, high bond strength, and resistance to temperature and chemicals. Radiation-cured adhesives enhance production efficiency, enabling faster labeling lines with minimal downtime. Growing investments in UV and EB curing technologies across packaging industries are boosting demand for radiation-based applications.

- By End User

On the basis of end user, the pressure labels market is segmented into food & beverages, consumer durables, pharmaceutical, home & personal care, and retail labels. The food & beverages segment dominated the market in 2025 due to the massive consumption of packaged products and the need for informative and regulatory-compliant labeling. Pressure labels in this sector offer excellent adhesion, moisture resistance, and aesthetic appeal, ensuring brand visibility and consumer trust.

The pharmaceutical segment is anticipated to witness the fastest growth from 2026 to 2033, driven by stringent labeling regulations and the rising demand for tamper-evident and traceable labeling solutions. Pressure labels play a critical role in ensuring product authenticity, patient safety, and regulatory compliance. The increasing global demand for over-the-counter drugs and medical packaging innovations further supports this segment’s expansion.

Pressure Labels Market Regional Analysis

- Asia-Pacific dominated the pressure labels market with the largest revenue share in 2025, driven by the expanding packaging industry, rising demand for consumer goods, and increasing production of food and beverage products across the region

- The market benefits from the region’s thriving manufacturing base, cost-effective label production, and growing adoption of innovative printing technologies by local converters

- Rapid industrialization, coupled with strong demand for flexible and durable labeling materials, continues to boost regional market growth

China Pressure Labels Market Insight

China held the largest share in the Asia-Pacific pressure labels market in 2025, supported by its massive packaging sector, large-scale manufacturing capacity, and growing investments in advanced printing technologies. The country’s focus on automation, sustainable materials, and the expansion of e-commerce packaging drives consistent demand for pressure-sensitive labels. Rising exports of packaged goods and increasing adoption of eco-friendly labeling solutions are further enhancing market expansion.

India Pressure Labels Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, driven by rapid industrial development, expansion of the FMCG and pharmaceutical sectors, and growing demand for flexible packaging. The country’s shift toward organized retail and branded goods has increased the need for high-quality product labeling. Supportive government initiatives promoting manufacturing and packaging infrastructure, along with growing exports of packaged foods and consumer products, are fueling market growth.

Europe Pressure Labels Market Insight

Europe holds a significant share in the pressure labels market, attributed to the region’s emphasis on sustainability, stringent packaging regulations, and high-quality printing standards. The demand for recyclable label materials and low-emission adhesives is increasing, aligning with the EU’s environmental directives. The presence of established packaging companies and strong adoption of digital printing technologies are further enhancing market expansion.

Germany Pressure Labels Market Insight

Germany’s pressure labels market is driven by its advanced packaging and printing industries, focus on precision labeling solutions, and high-quality production standards. The country’s leadership in machinery and automation technologies ensures efficient label manufacturing and application across sectors such as food, automotive, and pharmaceuticals. Growing investment in recyclable materials and eco-friendly inks is reinforcing Germany’s market position.

U.K. Pressure Labels Market Insight

The U.K. market benefits from a robust consumer goods industry, increasing demand for sustainable labeling, and growing investment in smart and digital labeling solutions. With packaging innovation at the forefront, the U.K. is seeing rising use of pressure-sensitive labels across retail and healthcare sectors. Post-Brexit efforts to localize manufacturing and improve supply chain efficiency are supporting continued market development.

North America Pressure Labels Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising consumer demand for packaged goods, technological advancements in digital printing, and increasing preference for sustainable labeling materials. Growth in e-commerce and logistics labeling, along with strong adoption of automation in packaging operations, supports market expansion. The region also benefits from the presence of leading label manufacturers and innovation-driven production facilities.

U.S. Pressure Labels Market Insight

The U.S. accounted for the largest share in the North America market in 2025, owing to high demand from the food, retail, and pharmaceutical industries. The country’s focus on product traceability, branding, and compliance with labeling standards drives consistent growth. Investments in smart labeling technologies, along with the presence of key global players and strong innovation capabilities, solidify the U.S.'s leadership in the regional market.

Pressure Labels Market Share

The pressure labels industry is primarily led by well-established companies, including:

- Lecta Adestor (Spain)

- H.B. Fuller Company (U.S.)

- Coveris (Austria)

- Mondi (U.K.)

- Henkel Adhesive Technologies India Private Limited (India)

- 3M (U.S.)

- UPM (Finland)

- Constantia Flexibles (Austria)

- CCL Industries Inc. (Canada)

- Avery Dennison Corporation (U.S.)

- Inland Labels (U.S.)

- LINTEC Corporation (Japan)

- NSD International (Netherlands)

- NASTAR (U.S.)

- Technicote (U.S.)

- Reflex Labels Ltd. (U.K.)

- Asia Pulp & Paper (APP) Sinar Mas (Indonesia)

- Zircon Labeling (China)

- Skanem AS (Norway)

- Autajon (France)

- Huhtamaki (Finland)

Latest Developments in Global Pressure Labels Market

- In October 2025, Avery Dennison introduced an advanced portfolio of sustainable pressure-sensitive labels made from recycled and bio-based materials, marking a significant step toward circular packaging innovation. This development reflects the company’s commitment to reducing carbon emissions and promoting resource efficiency across the global packaging value chain. By integrating renewable raw materials and recyclable substrates, Avery Dennison is addressing the rising regulatory and consumer pressure for sustainable labeling. The move enhances the company’s competitive advantage in the eco-conscious packaging segment and drives the broader market transition toward environmentally responsible labeling solutions

- In August 2025, UPM Adhesive Materials invested in a new facility in Johor Bahru, Malaysia, to introduce advanced filmic coating technology tailored for electronics and durable goods applications. This expansion enhances the company’s local production capacity and responsiveness to growing demand from the Asia-Pacific region’s industrial base. The strategic move allows UPM to provide high-performance labeling materials with improved durability, resistance, and aesthetic appeal. It also supports the region’s increasing emphasis on localized manufacturing and technological self-sufficiency, strengthening UPM’s foothold in one of the world’s fastest-growing pressure label markets

- In July 2025, UPM Adhesive Materials completed a major upgrade at its Mills River, U.S., facility, incorporating proprietary coating technology designed for wine and pharmaceutical laminate production. The new technology enhances coating precision, label quality, and adhesion performance, particularly for sensitive and premium product segments. This upgrade enables UPM to meet the growing demand for visually refined, high-durability labels in North America’s premium consumer goods market. By improving manufacturing efficiency and broadening product capabilities, the company reinforces its position as a leading innovator in the pressure labels sector

- In January 2025, Coveris finalized the acquisition of S&K Label, expanding its production capacity and operational footprint across Europe. The acquisition integrates S&K’s advanced labeling expertise and regional market presence into Coveris’s existing network, significantly strengthening its ability to deliver customized labeling solutions to diverse industries. This move enhances Coveris’s strategic positioning in Europe’s evolving packaging landscape, where demand for efficient, high-quality, and sustainable labeling solutions continues to accelerate. It also reflects the industry’s ongoing consolidation trend aimed at expanding service portfolios and achieving economies of scale

- In September 2024, UPM Raflatac earned APR certification for its HDPE-compatible pressure labels, affirming their compatibility with plastic recycling streams. This certification is a major milestone in promoting circular economy practices, ensuring that labeled HDPE containers can be effectively recycled without contamination. The achievement underscores UPM’s dedication to developing sustainable labeling technologies that meet both regulatory and environmental expectations. By aligning with global sustainability standards, the company is driving greater adoption of recyclable packaging materials, which contributes to long-term environmental goals and market differentiation in the pressure labels industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pressure Labels Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pressure Labels Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pressure Labels Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.