Global Pressure Reducing Valve Market

Market Size in USD Billion

CAGR :

%

USD

3.25 Billion

USD

4.48 Billion

2024

2032

USD

3.25 Billion

USD

4.48 Billion

2024

2032

| 2025 –2032 | |

| USD 3.25 Billion | |

| USD 4.48 Billion | |

|

|

|

|

Pressure Reducing Valve Market Size

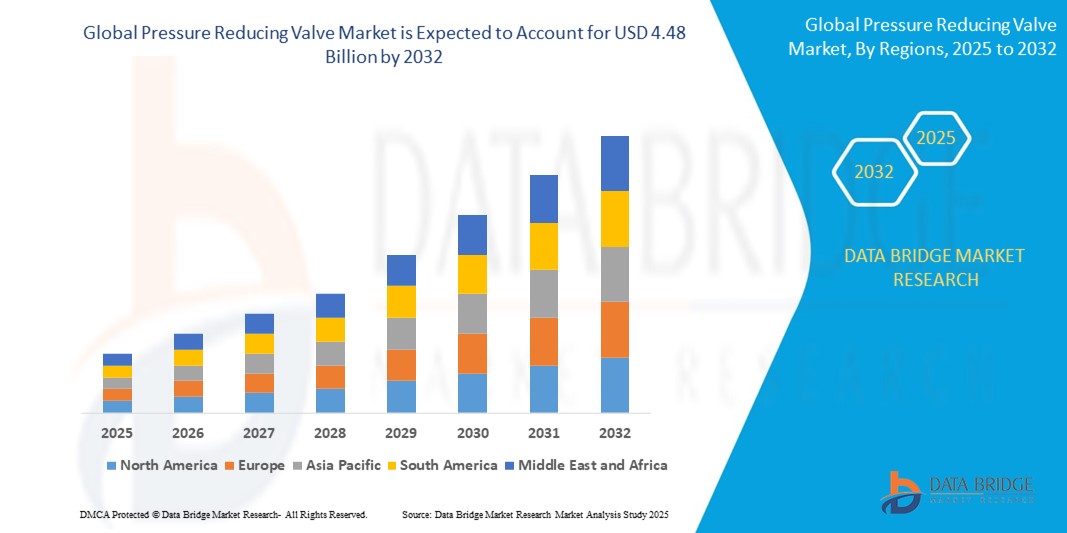

- The global pressure reducing valve market size was valued at USD 3.25 billion in 2024 and is expected to reach USD 4.48 billion by 2032, at a CAGR of 4.10% during the forecast period

- The market growth is driven by increasing demand for efficient pressure management systems across industries, advancements in valve technology, and the rising need for energy-efficient solutions in industrial processes

- Growing industrialization, particularly in emerging economies, and the need for reliable pressure control in critical applications such as oil and gas, power generation, and chemical processing are key factors accelerating market expansion

Pressure Reducing Valve Market Analysis

- Pressure reducing valves, critical for regulating and maintaining optimal pressure levels in fluid and gas systems, are integral to industrial operations, ensuring safety, efficiency, and equipment longevity

- The surge in demand is fueled by rapid industrialization, stringent safety regulations, and the growing adoption of automated and smart valve technologies in industrial settings

- North America dominated the pressure reducing valve market with the largest revenue share of 38% in 2024, driven by advanced industrial infrastructure, high adoption of automation technologies, and the presence of major industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid urbanization, increasing industrial activities, and rising investments in infrastructure development

- The direct acting segment is expected to dominated the largest market revenue share of 55.2% in 2024, driven by its simplicity, reliability, and lack of need for external power sources, making it ideal for residential, commercial, and industrial applications

Report Scope and Pressure Reducing Valve Market Segmentation

|

Attributes |

Pressure Reducing Valve Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Pressure Reducing Valve Market Trends

“Increasing Integration of Smart Technologies and IoT”

- The global pressure reducing valve (PRV) market is experiencing a notable trend toward the integration of smart technologies and Internet of Things (IoT) capabilities

- These advancements enable real-time monitoring, remote control, and predictive maintenance, enhancing operational efficiency and reducing downtime in industrial applications

- Smart PRVs equipped with IoT sensors can analyze pressure, temperature, and flow data to optimize system performance and detect potential issues before they escalate

- For instances, companies are developing IoT-enabled PRVs that provide actionable insights for industries such as oil and gas, allowing for dynamic pressure adjustments based on real-time environmental conditions

- This trend is increasing the appeal of PRVs for both industrial and commercial applications, driving demand in sectors requiring precise fluid management

- AI and data analytics are also being integrated to process vast datasets, enabling predictive maintenance and improving valve longevity and reliability

Pressure Reducing Valve Market Dynamics

Driver

“Rising Demand for Efficient Fluid Management Systems”

- Growing industrial and urbanization activities are fueling demand for advanced fluid management systems, significantly driving the PRV market

- PRVs are critical for maintaining safe pressure levels in applications such as steam, gas, and liquid systems, ensuring operational safety and efficiency

- Government regulations, particularly in North America, which dominates the market, mandate the use of PRVs in industries such as oil and gas and power generation to prevent system failures and enhance safety

- The adoption of 5G technology and IoT advancements is enabling faster and more reliable data transmission, supporting sophisticated PRV applications in real-time monitoring and control

- Manufacturers are increasingly incorporating PRVs as standard components in industrial systems to meet regulatory standards and improve system reliability

Restraint/Challenge

“High Implementation Costs and Data Security Concerns”

- The high initial costs of PRV hardware, software, and system integration pose a significant barrier, particularly in cost-sensitive emerging markets within Asia-Pacific, the fastest-growing region

- Retrofitting PRVs into existing infrastructure can be complex and expensive, limiting adoption in older facilities

- Data security and privacy concerns are major challenges, as IoT-enabled PRVs collect and transmit sensitive operational data, raising risks of breaches or misuse

- The varied regulatory landscape across regions, such as differing data protection standards in North America and Asia-Pacific, complicates compliance for global manufacturers

- These factors may hinder market growth in regions with high cost sensitivity or stringent data privacy awareness

Pressure Reducing Valve market Scope

The market is segmented on the basis of product type, body material, application, pressure, temperature, and end user industry.

- By Product Type

On the basis of product type, the global pressure reducing valve market is segmented into Direct Acting and Pilot Operating valves. The Direct Acting segment dominated the largest market revenue share of 55.2% in 2024, driven by its simplicity, reliability, and lack of need for external power sources, making it ideal for residential, commercial, and industrial applications. These valves are cost-effective and require minimal maintenance, contributing to their widespread adoption.

The Pilot Operating segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its precision control and suitability for high-flow applications in industries such as oil and gas, power generation, and chemical processing. The integration of smart technologies, including IoT for real-time monitoring, further accelerates adoption.

- By Body Material

On the basis of body material, the global pressure reducing valve market is segmented into Cast Iron, Cast Steel, Ductile Iron, Stainless Steel, Bronze, and Carbon Steel. The Stainless Steel segment is expected to dominate with a 48.3% market revenue share in 2024, owing to its durability, corrosion resistance, and high performance in harsh environments, particularly in industrial applications such as oil and gas and chemical processing.

The Bronze segment is projected to experience the fastest growth from 2025 to 2032, driven by its corrosion resistance and suitability for marine, plumbing, and firefighting applications. Its machinability and durability make it ideal for environments requiring reliable performance, such as naval and offshore industries.

- By Application

On the basis of application, the global pressure reducing valve market is segmented into Steam, Gas, and Liquid applications. The Steam application segment held the largest market revenue share of 38% in 2020 and is expected to maintain dominance in 2024, driven by its ability to control pressure without external power sources, making it critical for industries such as power generation and chemical processing.

The Liquid application segment is anticipated to witness significant growth from 2025 to 2032, propelled by increasing demand for water distribution and wastewater management solutions. The widespread adoption of PRVs in municipal water systems and industrial processes supports this growth.

- By Pressure

On the basis of pressure, the global pressure reducing valve market is segmented into 50-200 psig, 201-500 psig, 501-800 psig, and Above 800 psig. The 50-200 psig segment is expected to hold the largest market revenue share of 49.3% in 2024, driven by its extensive use in low-to-medium pressure applications such as municipal water distribution, HVAC systems, and fire protection networks.

The 201-500 psig segment is projected to experience the fastest growth from 2025 to 2032, fueled by its versatility in industrial applications such as manufacturing, water treatment, and HVAC, where moderate pressure variations are common.

- By Temperature

On the basis of temperature, the global pressure reducing valve market is segmented into 10–100 F, 101-250 F, 251-400 F, 401-550 F, 551-700 F, and Above 700 F. The 101-250 F segment is expected to dominate with a significant market share in 2024, owing to its applicability in a wide range of industrial processes, including water and steam systems, where moderate temperatures are prevalent.

\The Above 700 F segment is anticipated to witness robust growth from 2025 to 2032, driven by its use in high-temperature applications such as power generation and oil and gas, where PRVs must withstand extreme conditions while maintaining performance.

- By End User Industry

The market is segmented into Chemical Industry, Power Generation Industry, Hospitality Industry, Pharmaceuticals Industry, Food and Beverage Industry, Pulp and Paper Industry, Oil and Gas Industry, and Others. The Oil and Gas Industry segment is expected to hold the largest market revenue share of 38.7% in 2024, driven by the critical role of PRVs in maintaining pipeline integrity, preventing overpressure, and ensuring safe fluid handling in upstream, midstream, and downstream operations. The Chemical Industry segment is anticipated to experience rapid growth from 2025 to 2032, fueled by increasing investments in chemical processing and the need for precise pressure control to enhance safety and efficiency in complex systems.

Pressure Reducing Valve Market Regional Analysis

- North America dominated the pressure reducing valve market with the largest revenue share of 38% in 2024, driven by advanced industrial infrastructure, high adoption of automation technologies, and the presence of major industry players

- Consumers and industries prioritize pressure reducing valves (PRVs) for maintaining operational safety, enhancing equipment longevity, and ensuring efficient pressure control across diverse applications such as steam, gas, and liquid systems

- Growth is fueled by technological advancements, including smart PRVs with IoT integration for real-time monitoring, alongside increasing demand in both industrial and commercial sectors

U.S. Pressure Reducing Valve Market Insight

The U.S. pressure reducing valve market captured the largest revenue share of 77.4% in 2024 within North America, fueled by g adoption of energy-efficient systems. The trend towards smart automation and compliance with stringent safety standards, such as those set by OSHA, further accelerates market growth. Both industrial applications and municipal water systems contribute to a diverse market ecosystem.

Europe Pressure Reducing Valve Market Insight

The European pressure reducing valve market is expected to witness significant growth, driven by a focus on energy efficiency, environmental regulations, and advanced manufacturing practices. Consumers and industries prioritize PRVs for precise pressure control and sustainability in applications such as power generation and chemical processing. Countries such as Germany, the U.K., and France show notable adoption due to infrastructure upgrades and regulatory compliance.

U.K. Pressure Reducing Valve Market Insight

The U.K. market for pressure reducing valves is projected to experience rapid growth, fueled by increasing demand for efficient pressure control in industrial and commercial settings. Rising awareness of safety standards and the need for reliable pressure management in power generation and water systems drive adoption. Evolving regulations balancing operational efficiency with safety compliance further support market expansion.

Germany Pressure Reducing Valve Market Insight

Germany is expected to witness a high growth rate in the pressure reducing valve market, attributed to its advanced industrial sector and strong emphasis on energy efficiency and equipment safety. German industries prefer technologically advanced PRVs, particularly stainless steel and pilot-operated valves, for applications in chemical processing and power generation. Integration in both OEM and aftermarket segments sustains market growth.

Asia-Pacific Pressure Reducing Valve Market Insight

The Asia-Pacific region is the fastest-growing market for pressure reducing valves, driven by rapid industrialization, expanding oil and gas infrastructure, and increasing investments in water management systems in countries such as China, India, and Japan. Growing awareness of safety, efficiency, and environmental benefits boosts demand. Government initiatives promoting smart infrastructure and energy efficiency further accelerate adoption.

Japan Pressure Reducing Valve Market Insight

Japan’s pressure reducing valve market is expected to grow rapidly due to strong consumer and industrial demand for high-quality, technologically advanced PRVs that enhance operational safety and efficiency. The presence of major industrial players and integration of PRVs in power generation and manufacturing accelerates market penetration. Rising interest in smart valve technologies also contributes to growth.

China Pressure Reducing Valve Market Insight

China holds the largest share of the Asia-Pacific pressure reducing valve market, propelled by rapid industrialization, increasing energy demands, and significant infrastructure development. The country’s growing industrial base and focus on efficient pressure control in oil and gas, chemical, and water management systems drive adoption. Competitive domestic manufacturing and advancements in smart PRV technologies enhance market accessibility.

Pressure Reducing Valve Market Share

The pressure reducing valve industry is primarily led by well-established companies, including:

- Spirax Sarco Limited (U.K.)

- Forbes Marshall (India)

- Nutech Controls (India)

- Armstrong International Inc. (U.S.)

- CONTRO VALVE EQUIPMENT INC. (Canada)

- Richards Industrials (U.S.)

- Honeywell International Inc. (U.S.)

- Watts Water Technologies EMEA (U.S.)

- Eaton (Ireland)

- KSB SE & Co. KGaA (Germany)

- PARKER HANNIFIN CORP (U.S.)

- RWC (Australia)

- Mueller Water Products, Inc. (U.S.)

- TALIS Beteiligungs GmbH (Germany)

- Aalberts N.V. (Netherlands)

- CIRCOR International, Inc. (U.S.)

- ITAP (Italy)

- Caleffi S.p.a. (Italy)

- HAWE Hydraulik SE (Germany)

What are the Recent Developments in Global Pressure Reducing Valve Market?

- In September 2024, IMI plc partnered with Siemens to co-develop advanced smart valve solutions tailored for industrial applications. This collaboration centers on integrating IoT connectivity, ultrasonic flow measurement, and cloud-based diagnostics to elevate the performance of pressure reducing valves. IMI’s TA-Smart valves, featuring real-time monitoring, energy optimization, and predictive maintenance capabilities, are at the heart of this initiative. The partnership aims to deliver intelligent control systems that improve operational efficiency, reduce energy consumption, and support sustainability goals across sectors such as HVAC, manufacturing, and utilities

- In July 2024, Danfoss A/S completed the acquisition of a local valve manufacturer, reinforcing its presence in the pressure reducing valve market. This strategic move expands Danfoss’s product portfolio and enhances its ability to serve industrial clients with advanced fluid control solutions. The acquisition aligns with Danfoss’s broader goals of regionalizing its supply chain, improving responsiveness, and delivering energy-efficient technologies across sectors such as HVAC, water management, and industrial automation. By integrating the new capabilities, Danfoss aims to boost innovation and competitiveness in a rapidly evolving market

- In May 2024, Watts Water Technologies, Inc. announced a strategic partnership with a prominent water management company to co-develop sustainable valve solutions aimed at improving water efficiency and reducing environmental impact. This initiative aligns with Watts’ broader sustainability goals, including a 30% reduction in Scope 1 and 2 emissions by 2034 and increased adoption of smart, connected products. The collaboration focuses on creating valves that support energy conservation, water stewardship, and regulatory compliance, catering to industries seeking eco-conscious infrastructure upgrades. It reflects Watts’ ongoing commitment to innovation that safeguards water resources for future generations

- In March 2024, Honeywell International Inc. launched a cutting-edge smart valve solution integrated with Internet of Things (IoT) technology, designed to enhance real-time monitoring and enable predictive maintenance across utility and industrial systems. These valves allow remote control and diagnostics, helping operators detect anomalies, prevent failures, and optimize performance. The solution supports urban infrastructure by improving safety, reducing downtime, and streamlining operations—especially in gas distribution and water management. Honeywell’s innovation reflects the growing role of smart technologies in modernizing critical infrastructure and advancing digital transformation

- In January 2024, Emerson Electric Co. introduced a new line of eco-friendly pressure reducing valves engineered to improve energy efficiency across industrial applications. These valves are designed to reduce energy consumption by up to 20%, aligning with global sustainability goals and helping manufacturers lower operational costs. Featuring advanced materials and precision control mechanisms, the new models support high-performance fluid regulation while minimizing environmental impact. Emerson’s launch reflects its commitment to innovation in green technologies and its strategic push to expand market share in the industrial automation sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pressure Reducing Valve Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pressure Reducing Valve Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pressure Reducing Valve Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.