Global Pressure Washer Market

Market Size in USD Billion

CAGR :

%

USD

2.79 Billion

USD

3.65 Billion

2024

2032

USD

2.79 Billion

USD

3.65 Billion

2024

2032

| 2025 –2032 | |

| USD 2.79 Billion | |

| USD 3.65 Billion | |

|

|

|

|

Pressure Washer Market Size

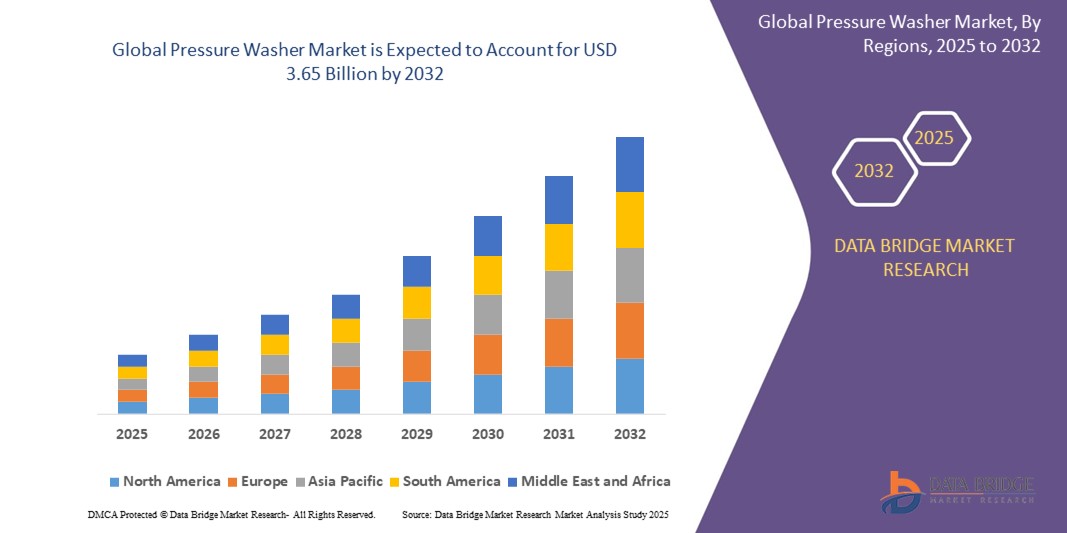

- The global pressure washer market size was valued at USD 2.79 billion in 2024 and is expected to reach USD 3.65 billion by 2032, at a CAGR of 3.40% during the forecast period

- The market growth is primarily driven by increasing demand for efficient cleaning solutions across residential, commercial, and industrial sectors, coupled with advancements in pressure washer technology, such as energy-efficient electric models and eco-friendly designs

- Rising consumer awareness of hygiene, outdoor maintenance, and the growing popularity of DIY home improvement projects are further propelling the adoption of pressure washers, making them a preferred choice for cleaning applications

Pressure Washer Market Analysis

- Pressure washers, utilizing high-pressure water jets for cleaning surfaces, vehicles, and equipment, are increasingly integral to residential, commercial, and industrial cleaning solutions due to their efficiency, versatility, and ability to reduce manual labor

- The surge in demand for pressure washers is fueled by growing urbanization, increased focus on cleanliness and maintenance, and the rising adoption of advanced cleaning technologies in emerging markets

- North America dominated the largest revenue share of 38.5% in 2024, driven by high consumer spending on home improvement, widespread adoption of pressure washers in residential and commercial settings, and the presence of leading manufacturers

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, attributed to rapid urbanization, rising disposable incomes, and increasing demand for industrial and agricultural cleaning solutions

- The electric-based segment dominated the largest market revenue share of 55% in 2024, driven by its eco-friendliness, lower water consumption, and ease of use for residential and light commercial applications

Report Scope and Pressure Washer Market Segmentation

|

Attributes |

Pressure Washer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pressure Washer Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The global pressure washer market is experiencing a notable trend toward integrating Artificial Intelligence (AI) and Big Data analytics to enhance cleaning efficiency and user experience

- These technologies enable advanced data processing, offering insights into equipment performance, usage patterns, and maintenance needs

- AI-powered pressure washers can optimize cleaning by analyzing surface types and adjusting water pressure or flow automatically, reducing water and energy waste

- For instances, some manufacturers are developing AI-driven systems that detect the object being cleaned and adjust settings for optimal performance, with features such as automatic shut-off to conserve resources

- This trend enhances the appeal of pressure washers for residential, commercial, and industrial users by improving efficiency and sustainability

- Big Data analytics can track usage trends across fleets of pressure washers, enabling predictive maintenance to prevent downtime and extend equipment lifespan

Pressure Washer Market Dynamics

Driver

“Rising Demand for Efficient and Eco-Friendly Cleaning Solutions”

- Increasing consumer and industrial demand for high-efficiency cleaning tools, such as pressure washers, is a key driver for market growth, particularly for tasks such as vehicle cleaning, garden maintenance, and industrial equipment sanitation

- Pressure washers offer superior cleaning capabilities compared to traditional methods, removing dirt, grime, and grease with less water and detergent, aligning with sustainability goals

- Government initiatives promoting hygiene and cleanliness, especially in public spaces and industries such as food processing and automotive, are boosting adoption

- The rise of urbanization and construction activities globally is driving demand for pressure washers to clean building exteriors, equipment, and construction sites

- Advancements in electric and battery-powered pressure washers, which are quieter and more eco-friendly, are meeting consumer preferences for sustainable cleaning solutions

Restraint/Challenge

“High Initial Costs and Safety Concerns”

- The high upfront costs of purchasing and installing advanced pressure washer systems, particularly those with AI or IoT integration, can be a barrier, especially for residential users and small businesses in cost-sensitive market

- Retrofitting existing cleaning systems with advanced pressure washers can be complex and expensive, limiting adoption in some sectors

- Safety concerns related to high-pressure water jets, which can damage surfaces or cause injuries if mishandled, pose a challenge to widespread use, particularly for inexperienced users

- Data security and privacy issues arise with smart pressure washers that collect usage data, raising concerns about breaches or misuse, especially in regions with stringent data protection regulations

- The lack of standardized regulations across countries for equipment safety and data management complicates operations for manufacturers and service providers, potentially hindering market growth

Pressure Washer market Scope

The market is segmented on the basis of type, application, operation, output, and end-user.

- By Type

On the basis of type, the market is segmented into electric based, gas based, and fuel based. The electric-based segment dominated the largest market revenue share of 55% in 2024, driven by its eco-friendliness, lower water consumption, and ease of use for residential and light commercial applications. Electric pressure washers are favored for their low maintenance, lack of harmful emissions, and suitability for household tasks such as cleaning cars, patios, and home exteriors.

The gas-based segment is expected to witness the fastest growth rate, with a CAGR of 4.8% from 2025 to 2032, due to its higher power output, making it ideal for heavy-duty industrial applications. Gas-based pressure washers are particularly effective for removing stubborn stains and managing large-scale industrial waste, catering to sectors such as construction and automotive.

- By Application

On the basis of application, the global pressure washer market is segmented into car washer, garden washer, home exterior washer, and industrial. The garden washer segment dominated the market with a revenue share of 30.8% in 2024, driven by the increasing popularity of home gardening and outdoor landscaping. The rise in DIY home improvement projects and the need for maintaining garden aesthetics further fuel demand for garden washers among homeowners.

The home exterior washer segment is anticipated to experience the fastest growth rate, with a CAGR of 5.2% from 2025 to 2032. This growth is propelled by the increasing trend of home improvement and renovation projects, where pressure washers are essential for cleaning driveways, patios, decks, and home facades to prevent mold and enhance curb appeal. Advancements in high-performance pressure washers designed for exterior use also drive adoption.

- By Operation

On the basis of operation, the market is segmented into hot-water and cold-water. The hot-water segment dominated for the largest market revenue share of 67% in 2024, owing to its superior ability to dissolve grease, oil, and stubborn stains, making it highly effective for industrial and commercial applications such as food processing and automotive cleaning. Hot-water pressure washers also reduce the need for chemical detergents, leading to cost savings.

The cold-water segment is expected to witness significant growth, with a CAGR of 4.5% from 2025 to 2032, driven by its cost-effectiveness and lower maintenance requirements compared to hot-water models. Cold-water pressure washers are widely adopted for residential cleaning tasks and less demanding commercial applications, contributing to their growing popularity.

- By Output

On the basis of output, the market is segmented into 0-1,500 PSI, 1,501-3,000 PSI, 3,001-4,000 PSI, and above 4,000 PSI. The 1,501–3,000 PSI segment dominated the largest market revenue share of 50% in 2024, as it encompasses both electric and gas-powered pressure washers suitable for a wide range of residential and light commercial tasks, including cleaning vehicles, sidewalks, and concrete surfaces. This segment’s versatility and ability to remove stubborn stains without damaging surfaces drive its dominance.

The 3,001–4,000 PSI segment is projected to grow at the fastest rate, with a CAGR of 5.0% from 2025 to 2032, due to its suitability for heavy-duty applications in industries such as construction and automotive. These pressure washers are highly effective for removing tough stains, paint, and oil residues, meeting the demands of commercial and industrial users.

- By End-User

On the basis of end-user, the market is segmented into residential, commercial, industrial, and agricultural. The residential segment dominated the market with a revenue share of 40% in 2024, driven by the growing number of households, increasing disposable incomes, and rising demand for time-efficient cleaning solutions for tasks such as cleaning driveways, vehicles, and garden furniture. The trend toward DIY home maintenance further supports this segment’s growth.

The commercial segment is anticipated to witness the fastest growth rate, with a CAGR of 5.5% from 2025 to 2032, fueled by the rise of professional cleaning startups and the increasing adoption of pressure washers in sectors such as hospitality, retail, and car washing facilities. The need for maintaining hygiene and aesthetics in commercial spaces, such as restaurants and public areas, drives demand for efficient cleaning solutions.

Pressure Washer Market Regional Analysis

- North America dominated the largest revenue share of 38.5% in 2024, driven by high consumer spending on home improvement, widespread adoption of pressure washers in residential and commercial settings, and the presence of leading manufacturers

- Growth is fueled by rising awareness of hygiene, expanding construction activities, and the popularity of DIY car washing and home maintenance, particularly in regions with diverse cleaning needs

- Technological innovations, such as IoT-enabled models for real-time monitoring and energy-efficient designs, alongside growing adoption in both residential and industrial applications, drive market expansion

U.S. Pressure Washer Market Insight

The U.S. pressure washer market dominated the largest revenue share of 69.7% in 2024 within North America, fueled by robust aftermarket demand and growing consumer awareness of efficient, eco-friendly cleaning solutions. The trend toward home maintenance and vehicle cleaning, coupled with the rise of over 28,000 pressure washing service businesses, boosts market growth. Increasing adoption of electric pressure washers, driven by water conservation initiatives in states such as California, complements both residential and commercial applications.

Europe Pressure Washer Market Insight

The Europe pressure washer market is expected to witness steady growth, supported by a focus on sustainability and advanced cleaning technologies. Consumers demand pressure washers that enhance efficiency while reducing water and energy consumption. Growth is prominent in both residential and industrial sectors, with countries such as Germany and the U.K. showing significant uptake due to rising environmental concerns and infrastructure development.

U.K. Pressure Washer Market Insight

The U.K. market for pressure washers is expected to experience strong growth, driven by demand for efficient cleaning solutions in urban and suburban settings. Increased interest in home and garden maintenance, coupled with rising awareness of eco-friendly electric pressure washers, encourages adoption. Evolving regulations promoting water conservation influence consumer choices, balancing cleaning performance with environmental compliance.

Germany Pressure Washer Market Insight

Germany is expected to witness robust growth in the pressure washer market, attributed to its advanced manufacturing sector and high consumer focus on efficiency and sustainability. German consumers prefer technologically advanced pressure washers, such as electric and battery-powered models, that reduce water usage and operational costs. Integration of these machines in industrial applications and aftermarket residential use supports sustained market growth.

Asia-Pacific Pressure Washer Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid industrialization, expanding automotive and construction sectors, and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of hygiene, vehicle maintenance, and efficient cleaning solutions boosts demand. Government initiatives promoting sustainable cleaning technologies further encourage the adoption of advanced pressure washers.

Japan Pressure Washer Market Insight

Japan’s pressure washer market is expected to grow rapidly due to strong consumer preference for high-quality, technologically advanced pressure washers that enhance cleaning efficiency and sustainability. The presence of major manufacturers and integration of pressure washers in OEM cleaning solutions accelerate market penetration. Rising interest in aftermarket residential and commercial applications also contributes to growth.

China Pressure Washer Market Insight

China holds the largest share of the Asia-Pacific pressure washer market, propelled by rapid urbanization, increasing vehicle ownership, and growing demand for efficient cleaning solutions. The country’s expanding middle class and focus on infrastructure development support the adoption of advanced pressure washers. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility, particularly for electric and portable models.

Pressure Washer Market Share

The pressure washer industry is primarily led by well-established companies, including:

- FNA Group (U.S.)

- Lavorwash Australia Pty Ltd (Australia)

- Greenworks Tools (U.S.)

- Generac Power Systems, Inc. (U.S.)

- Emerson Electric Co. (U.S.)

- Revive Power Washing (U.S.)

- Kärcher India (India)

- AR North America (U.S.)

- DEWALT (U.S.)

- STANLEY BLACK & DECKER, INC. (U.S.)

- CRAFTSMAN (U.S.)

- Snow Joe, LLC (U.S.)

- Troy-Bilt LLC (U.S.)

- Vortex Industries Inc. (U.S.)

- Northern Tool + Equipment (U.S.)

- MI-T-M Corporation (U.S.)

- Annovi Reverberi Spa (Italy)

- Alkota Cleaning Systems (U.S.)

What are the Recent Developments in Global Pressure Washer Market?

- In May 2024, Lumax Auto Technologies introduced a new range of lubricants and coolants in India, including a PTO-powered pressure washer. This expansion aligns with the growing demand for efficient and versatile pressure washers, particularly in emerging economies. Designed for agricultural and industrial applications, the new product enhances performance and convenience, offering high-pressure cleaning solutions for various sectors. As the Global Pressure Washer Market continues to expand, Lumax’s latest innovation supports sustainability and operational efficiency

- In April 2024, Makita introduced the 40V max XGT 1,300 PSI 1.5 GPM Pressure Washer (GWH01), designed for versatile cleaning applications ranging from worksites to driveways. Powered by 40V max batteries, which are compatible with over 125 Makita XGT tools, this model offers portability and extended runtime. Featuring three power levels, a self-priming siphon hose, and an auto-switching two-bay battery system, the GWH01 ensures efficient high-pressure washing for home and workspace maintenance

- In April 2024, Muc-Off introduced its Mobile Bike Pressure Washer, designed specifically for bicycles with built-in Snow Foam capability. This innovative washer ensures efficient cleaning, keeping bikes looking sharp and running smoothly. Powered by a 40V lithium battery, it offers up to 24 minutes of runtime and features a 20L water tank for remote cleaning. With Boost Mode for extra power and Eco Mode for extended use, it redefines bike maintenance for outdoor enthusiasts

- In January 2024, Kärcher introduced its CleanWave series, featuring two battery-powered commercial-strength cold-water pressure washers. The CleanWave Deluxe model offers up to

- four hours of runtime, powered by maintenance-free lithium-ion batteries, while the CleanWave Classic runs for 1.5 hours using AGM batteries. Designed for cordless operation, these models provide high-pressure cleaning performance with smart features such as ECO mode for extended battery life and auto start/stop functionality. This innovation enhances efficiency and sustainability in professional cleaning applications

- In August 2023, INALSA Home Appliances introduced the JETMAC 2000 Pressure Washer, designed to enhance the cleaning experience across various applications. Featuring a powerful 2000W motor, it delivers 135 bar pressure and a maximum flow rate of 390 l/h, ensuring efficient and uniform cleaning. The dual-purpose suction system allows users to draw water from a tap, bucket, or tub, while the self-priming feature enables high-pressure dispensing. Equipped with adjustable nozzles, a detergent tank, and a spray gun, it offers versatile cleaning solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.