Global Primary Antibodies Market

Market Size in USD Billion

CAGR :

%

USD

45.78 Billion

USD

82.87 Billion

2025

2033

USD

45.78 Billion

USD

82.87 Billion

2025

2033

| 2026 –2033 | |

| USD 45.78 Billion | |

| USD 82.87 Billion | |

|

|

|

|

Primary Antibodies Market Size

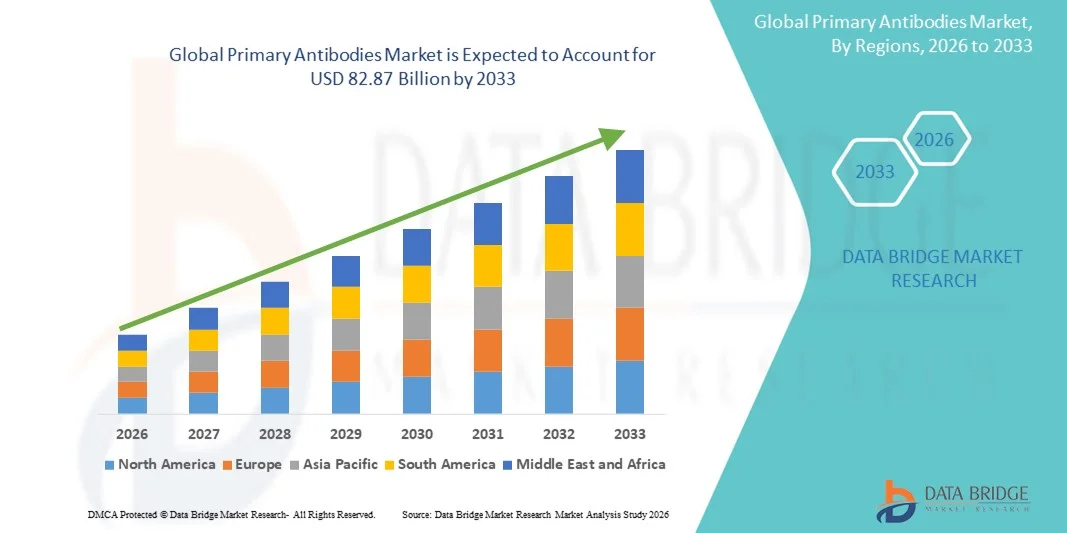

- The global primary antibodies market size was valued at USD 45.78 billion in 2025 and is expected to reach USD 82.87 billion by 2033, at a CAGR of 7.70% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within life sciences research, biotechnology, and clinical diagnostics, leading to increased utilization of advanced immunoassay and protein analysis techniques across academic, pharmaceutical, and clinical laboratory settings

- Furthermore, rising demand for highly specific, reliable, and reproducible research tools is establishing primary antibodies as essential components of modern molecular and cellular analysis workflows. These converging factors are accelerating the uptake of Primary Antibodies solutions, thereby significantly boosting the industry’s growth

Primary Antibodies Market Analysis

- Primary antibodies, which bind specifically to target antigens, are increasingly vital components of modern life sciences research and clinical diagnostics across academic, pharmaceutical, and biotechnology settings due to their critical role in protein detection, quantification, and functional analysis techniques such as Western blotting, immunohistochemistry, and flow cytometry

- The escalating demand for primary antibodies is primarily fueled by the widespread adoption of proteomics research, rising prevalence of chronic and infectious diseases, and growing investments in drug discovery, biomarker identification, and personalized medicine

- North America dominated the primary antibodies market, accounting for approximately 41.22% of the global revenue share in 2025. This dominance is supported by strong funding for biomedical research, a well-established pharmaceutical and biotechnology ecosystem, and high adoption of advanced research tools across academic institutes, CROs, and diagnostic laboratories in the U.S. and Canada

- Asia-Pacific is expected to be the fastest-growing region in the primary antibodies market during the forecast period, registering an estimated CAGR Growth is driven by expanding biotechnology research, increasing government support for life sciences, rising healthcare expenditure, and rapid growth of pharmaceutical R&D activities in countries such as China, India, and South Korea

- The monoclonal antibodies segment dominated the largest market revenue share of 58.4% in 2025, driven primarily by their exceptional specificity and reproducibility, which are critical for both diagnostic and therapeutic applications

Report Scope and Primary Antibodies Market Segmentation

|

Attributes |

Primary Antibodies Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Thermo Fisher Scientific (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Primary Antibodies Market Trends

Rising Demand for Target-Specific and High-Affinity Antibodies

- A significant and accelerating trend in the global primary antibodies market is the increasing demand for highly specific, high-affinity antibodies to support advanced research in proteomics, oncology, neuroscience, and immunology. Researchers are prioritizing antibodies that deliver high reproducibility and minimal cross-reactivity to ensure reliable experimental outcomes

- For instance, companies such as Abcam and Cell Signaling Technology continue to expand their portfolios of recombinant primary antibodies designed for improved consistency and lot-to-lot reproducibility, addressing long-standing concerns associated with traditional polyclonal antibodies

- The shift toward recombinant and monoclonal primary antibodies is gaining momentum as laboratories seek standardized reagents suitable for high-throughput and translational research applications. These antibodies provide greater specificity, making them ideal for techniques such as western blotting, immunohistochemistry, and flow cytometry

- Advancements in antibody engineering and validation protocols are further supporting this trend by enabling better performance across multiple applications

- The growing focus on biomarker discovery and precision medicine is also increasing reliance on well-characterized primary antibodies

- As research complexity increases, demand for application-validated and disease-specific antibodies continues to rise, reinforcing this trend across academic, pharmaceutical, and clinical research settings

Primary Antibodies Market Dynamics

Driver

Expanding Life Sciences Research and Biopharmaceutical R&D Activities

- The rapid expansion of life sciences research, coupled with increasing investments in biopharmaceutical R&D, is a key driver accelerating demand for primary antibodies globally

- For instance, in March 2024, Thermo Fisher Scientific expanded its antibody portfolio to support oncology and cell signaling research, reflecting growing industry focus on targeted therapeutic development and translational research

- Primary antibodies play a critical role in protein detection, pathway analysis, and disease mechanism studies, making them indispensable tools in drug discovery and development pipelines. The rising prevalence of chronic diseases such as cancer, autoimmune disorders, and neurological conditions is driving research efforts that heavily depend on antibody-based assays

- Increased government and private funding for biomedical research further supports sustained market growth. Pharmaceutical and biotechnology companies increasingly rely on primary antibodies for preclinical validation and biomarker identification

- The expansion of research infrastructure in emerging economies also contributes to higher adoption rates. Together, these factors are significantly boosting demand for primary antibodies across research and clinical applications

Restraint/Challenge

High Costs and Reproducibility Concerns Associated with Antibodies

- One of the major challenges restraining the growth of the Primary Antibodies market is the high cost associated with premium, well-validated antibodies, particularly recombinant and monoclonal variants

- For instance, researchers have reported reproducibility issues with poorly characterized antibodies, leading to experimental failures and increased research costs, which can discourage adoption among budget-constrained laboratories

- Lot-to-lot variability in polyclonal antibodies remains a concern, impacting experimental consistency and data reliability

- Smaller academic laboratories and research institutes often face budget limitations that restrict access to high-quality antibodies

- The lack of universal validation standards across suppliers further complicates purchasing decisions for end users

- In addition, improper antibody selection or application mismatch can lead to inaccurate results, increasing skepticism among researchers

- Addressing these challenges through better validation practices, transparent data sharing, and cost-effective recombinant antibody production will be critical for sustained market growth

Primary Antibodies Market Scope

The market is segmented on the basis of type, technology, source, research area, application, and end user.

- By Type

On the basis of type, the Primary Antibodies market is segmented into monoclonal antibodies and polyclonal antibodies. The monoclonal antibodies segment dominated the largest market revenue share of 58.4% in 2025, driven primarily by their exceptional specificity and reproducibility, which are critical for both diagnostic and therapeutic applications. These antibodies are widely used in cancer research, immunology, and infectious disease studies, offering consistent binding to a single epitope, which ensures accurate detection and quantification in high-throughput assays. Monoclonal antibodies are the foundation for numerous immunoassays, targeted therapies, and biomarker validation, contributing to their dominance. In addition, advances in recombinant technologies and hybridoma development have improved yield, purity, and cost-efficiency, making them highly attractive to pharmaceutical and academic institutions. Leading manufacturers, including Thermo Fisher Scientific, Abcam, and Cell Signaling Technology, continue expanding their monoclonal portfolios, ensuring broad availability across multiple research applications. The segment also benefits from regulatory acceptance in clinical trials, which encourages widespread adoption. Its dominance is further strengthened by the rising demand for precision medicine, personalized diagnostics, and high-throughput screening assays in both developed and emerging markets. Monoclonal antibodies also enable reproducible experimental outcomes, which is crucial for publication and patent validation, solidifying their market leadership. Overall, the segment’s robust pipeline, extensive application spectrum, and technological improvements sustain its large market share.

The polyclonal antibodies segment is expected to witness the fastest CAGR of 9.8% from 2026 to 2033, fueled by their cost-effectiveness, ease of production, and the ability to recognize multiple epitopes, which is advantageous in applications requiring broad antigen coverage. Polyclonal antibodies are frequently used in immunoprecipitation, protein detection, and preliminary screening assays in both academic and industrial research. Their growing adoption in emerging markets and smaller research laboratories is accelerating market growth, as these institutions often prioritize versatile and affordable solutions. In addition, affinity-purified polyclonal antibodies and antibody cocktails enhance sensitivity and specificity, driving demand across complex research studies. The segment is further supported by rising interest in infectious disease research, immunology studies, and early-stage drug screening. Manufacturers are also focusing on quality improvements and validation protocols for polyclonals, which increases their reliability and appeal. The availability of ready-to-use kits and pre-validated polyclonal antibodies contributes to time and cost savings for laboratories, further boosting adoption. Increasing use in stem cell research, neurobiology, and translational medicine creates additional growth opportunities. Moreover, rising investments in biotechnology startups and contract research organizations (CROs) are expected to further accelerate demand. The segment’s versatility in detecting diverse antigens across multiple research contexts positions it as the fastest-growing type in the global Primary Antibodies market.

- By Technology

On the basis of technology, the market is segmented into immunohistochemistry (IHC), immunofluorescence (IF), Western blotting, flow cytometry, immunoprecipitation, ELISA, and other technologies. The ELISA segment dominated the market with a revenue share of 35.6% in 2025, owing to its high sensitivity, quantification capabilities, and applicability in both research and diagnostic settings. ELISA assays are extensively used for disease biomarker detection, therapeutic monitoring, and vaccine development. The segment’s dominance is further strengthened by the adoption in pharmaceutical and clinical laboratories for high-throughput analysis. ELISA platforms are cost-effective, versatile, and compatible with monoclonal and polyclonal antibodies, which drives broad usage. The availability of pre-coated ELISA kits, automation options, and validated protocols improves efficiency and reduces human error, promoting adoption across diverse research fields. The segment benefits from increasing demand for proteomics, infectious disease research, and oncology studies. Moreover, ELISA is widely used in both developed and emerging markets due to its reliability and reproducibility. Continuous technological improvements, including enhanced detection chemistries and multiplexing options, further reinforce market dominance. Leading suppliers are expanding ELISA kits for new biomarkers, supporting sustained growth. ELISA’s widespread acceptance in academic, pharmaceutical, and diagnostic sectors secures its top position in the technology segment.

The flow cytometry segment is expected to witness the fastest CAGR of 10.2% from 2026 to 2033, driven by its ability to provide high-resolution analysis of cell populations, protein expression, and immune profiling. Flow cytometry is increasingly applied in immunology, stem cell research, oncology, and drug discovery. The technology enables multiparametric analysis, rapid data acquisition, and integration with automated platforms, which enhances experimental throughput. Rising adoption in research institutes, biopharmaceutical companies, and clinical diagnostics laboratories contributes to growth. In addition, the expansion of personalized medicine and immunotherapy studies boosts demand for advanced cell analysis techniques. The segment benefits from technological innovations, such as spectral flow cytometry, which allows detailed phenotyping and deeper insight into cellular heterogeneity. Growing investments in laboratory infrastructure, particularly in emerging markets, are further increasing adoption. The ability to combine flow cytometry with monoclonal antibodies for highly specific detection drives its popularity. Increasing demand for standardized, reproducible, and quantitative data in biomedical research ensures this technology segment maintains rapid growth over the forecast period.

- By Source

On the basis of source, the market is segmented into mouse, rabbit, goat, and other sources. The mouse-derived antibodies segment dominated the largest market share of 44.5% in 2025, driven by the widespread use of mouse monoclonal antibodies in diagnostics, research, and therapeutics. Mouse antibodies are highly standardized, reproducible, and suitable for hybridoma production, making them ideal for clinical applications. They are extensively employed in immunoassays, flow cytometry, ELISA, and immunohistochemistry. The segment also benefits from broad availability, established protocols, and compatibility with automated systems in laboratories. Leading companies continue to innovate mouse antibodies for high specificity and reduced cross-reactivity, increasing their adoption. Their use in oncology research, biomarker discovery, and infectious disease studies further reinforces market dominance. Mouse antibodies are also preferred for generating humanized antibodies, enhancing their therapeutic potential. Strong academic and pharmaceutical research focus on monoclonal antibody development ensures continued leadership of this source. Overall, mouse-derived antibodies remain the most reliable and widely adopted source globally.

The rabbit-derived antibodies segment is expected to witness the fastest CAGR of 9.5% from 2026 to 2033, owing to their superior affinity, ability to recognize a wide range of epitopes, and suitability for polyclonal antibody production. Rabbit antibodies are highly sensitive and widely used in Western blotting, immunofluorescence, ELISA, and immunohistochemistry. Their adaptability to complex proteins and post-translational modifications supports broad research applications, including proteomics, cancer studies, and drug development. The segment also benefits from increasing use in emerging markets due to improved cost-efficiency and availability of pre-validated antibodies. Rising adoption by pharmaceutical companies, CROs, and academic institutions accelerates growth. Rabbit antibodies’ high affinity and versatility in multiplexed assays further reinforce rapid uptake. In addition, improved immunization and purification technologies enhance reliability, attracting more end-users. Continuous research in infectious diseases, neurobiology, and stem cell biology further supports market expansion. The rabbit segment’s versatility and sensitivity make it the fastest-growing source in the global Primary Antibodies market.

- By Research Area

On the basis of research area, the market is segmented into infectious diseases, immunology, oncology, stem cells, neurobiology, and others. The oncology segment dominated the largest revenue share of 36.7% in 2025, driven by the rising prevalence of cancer, increasing funding for oncology research, and the extensive use of antibodies in biomarker discovery, diagnostics, and therapeutic studies. Antibodies play a crucial role in understanding tumor biology, immune checkpoint analysis, and personalized medicine development. Academic and pharmaceutical institutions heavily rely on monoclonal and polyclonal antibodies to identify novel targets and develop targeted therapies. The dominance is reinforced by growing adoption of antibody-drug conjugates, immunotherapies, and high-throughput screening assays in cancer research. Ongoing technological innovations in antibody labeling, multiplex assays, and imaging enhance the reliability and reproducibility of oncology studies. Increasing clinical trials and collaboration between biotech companies and academic institutes further strengthen this segment. High demand for proteomic profiling, immunohistochemistry, and biomarker validation ensures sustained dominance of oncology research applications in the global market.

The stem cell research segment is expected to witness the fastest CAGR of 10.1% from 2026 to 2033, driven by increasing interest in regenerative medicine, tissue engineering, and cell therapy development. Antibodies are essential for stem cell identification, differentiation monitoring, and quality control in laboratory and clinical studies. Rising investments in stem cell research by academic institutes and pharmaceutical companies accelerate adoption. The segment benefits from technological advancements in antibody-based cell tracking, flow cytometry, and high-content imaging. Growing collaborations in regenerative medicine projects and increasing demand for pluripotent and multipotent stem cell studies further support growth. The versatility of antibodies in identifying cellular markers and monitoring differentiation pathways contributes to segment expansion. Stem cell therapy pipelines and translational research initiatives in emerging markets create additional opportunities. Continuous funding and policy support in regenerative medicine reinforce the rapid growth of this research area.

- By Application

On the basis of application, the market is segmented into proteomics, drug development, genomics, and other applications. The drug development segment dominated the largest market revenue share of 40.3% in 2025, owing to the extensive use of antibodies in preclinical and clinical studies, target validation, therapeutic discovery, and pharmacokinetic analysis. Antibodies enable identification of biomarkers, disease pathways, and treatment responses, making them essential in biopharmaceutical pipelines. The segment’s dominance is reinforced by growing R&D expenditure in pharmaceutical and biotech companies, especially in oncology, infectious disease, and immunology. ELISA, Western blotting, and flow cytometry applications further enhance utility in drug development. Continuous innovation in antibody engineering, high-affinity reagents, and assay platforms strengthens adoption. The need for rapid and reliable preclinical testing drives consistent demand. Collaborations between research institutes and pharmaceutical companies further bolster growth. The segment also benefits from regulatory guidelines encouraging the use of validated antibody-based assays.

The proteomics segment is expected to witness the fastest CAGR of 9.7% from 2026 to 2033, driven by growing investments in protein expression analysis, functional proteomics, and biomarker discovery studies. Antibodies play a pivotal role in protein identification, interaction mapping, and post-translational modification detection. The segment is further accelerated by the adoption of high-throughput platforms, mass spectrometry integration, and multiplexed antibody arrays. Increasing academic research, contract research, and pharmaceutical R&D activities promote adoption. Proteomics applications in disease mechanism studies, drug target discovery, and personalized medicine reinforce segment growth. Technological advances and expansion of proteomics-focused laboratories in emerging markets are also contributing to rapid growth. Overall, proteomics represents the fastest-growing application for antibodies globally.

- By End User

On the basis of end user, the market is segmented into pharmaceutical and biotechnological companies, academic and research institutes, and contract research organizations (CROs). The pharmaceutical and biotechnology companies segment dominated the market with a revenue share of 52.1% in 2025, driven by the critical role of antibodies in therapeutic development, drug screening, and biomarker validation. Growing R&D investment, particularly in oncology, immunology, and infectious diseases, ensures continuous demand. The segment also benefits from collaborations between biotech startups and large pharmaceutical firms for antibody-based therapeutics and diagnostics. Advanced antibody engineering, high-throughput assay integration, and regulatory compliance further strengthen adoption. High demand for monoclonal antibodies in targeted therapies and immunotherapies supports the segment’s leadership. Increasing focus on personalized medicine, precision diagnostics, and biologics development reinforces market dominance. The pharmaceutical segment’s ability to fund expensive antibody pipelines and invest in cutting-edge technologies ensures its sustained top position in the global market.

The academic and research institutes segment is expected to witness the fastest CAGR of 9.9% from 2026 to 2033, driven by the rising number of universities, laboratories, and government-funded research programs focused on molecular biology, cancer research, and stem cell studies. Academic institutions require reliable, validated, and versatile antibodies for both teaching and research purposes. The growth is further accelerated by increasing adoption of antibody-based assays in genomics, proteomics, and high-throughput screening. Funding initiatives, collaborative research projects, and expansion of research facilities globally contribute to the rising demand. The segment also benefits from partnerships with CROs and biotech firms, facilitating access to specialized antibodies and reagents. Emerging markets, particularly in Asia-Pacific, are witnessing expansion in research infrastructure, driving adoption. The demand for reproducible and standardized research outputs ensures rapid growth in this end-user segment.

Primary Antibodies Market Regional Analysis

- North America dominated the primary antibodies market with the largest revenue share of approximately 41.22% in 2025

- Supported by strong funding for biomedical research, a well-established pharmaceutical and biotechnology ecosystem, and high adoption of advanced research tools across academic institutes, contract research organizations (CROs), and diagnostic laboratories in the U.S. and Canada

- The region’s strong infrastructure and presence of leading antibody manufacturers drive overall market growth

U.S. Primary Antibodies Market Insight

The U.S. primary antibodies market captured the largest revenue share within North America in 2025. Market growth is fueled by the increasing demand for high-quality antibodies in diagnostics, therapeutics, and research applications. Leading manufacturers, robust R&D infrastructure, regulatory support, and high adoption of advanced molecular techniques across academic institutes, CROs, and diagnostic laboratories contribute significantly to the U.S. market dominance.

Europe Primary Antibodies Market Insight

The Europe primary antibodies market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing investments in life sciences research, growing focus on personalized medicine, and technological advancements in antibody production. The region is witnessing strong adoption in research institutions, pharmaceutical companies, and diagnostic laboratories. Countries such as Germany, France, and the U.K. are contributing significantly, supported by well-established biotechnology hubs and favorable government policies promoting biomedical innovation.

U.K. Primary Antibodies Market Insight

The U.K. primary antibodies market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by expanding biomedical research, adoption of antibody-based diagnostics, and increasing government support for life sciences. The U.K.’s strong academic and industrial ecosystem, combined with high awareness of advanced therapeutics and research techniques, continues to stimulate market growth.

Germany Primary Antibodies Market Insight

The Germany primary antibodies market is expected to expand at a considerable CAGR during the forecast period, fueled by advanced research infrastructure, increasing adoption of biopharmaceutical development tools, and growing emphasis on antibody-based therapeutics and diagnostics. Germany’s established biotech sector, along with innovation-focused policies, supports strong growth in both research and clinical applications.

Asia-Pacific Primary Antibodies Market Insight

The Asia-Pacific primary antibodies market is poised to grow at the fastest CAGR during the forecast period, driven by expanding biotechnology research, rising healthcare expenditure, and rapid growth of pharmaceutical R&D activities in countries such as China, India, and South Korea. Increasing government support for life sciences, rising academic and clinical research activities, and the growing need for high-quality antibodies in diagnostics and therapeutics are key factors fueling market expansion.

Japan Primary Antibodies Market Insight

The Japan primary antibodies market is gaining momentum due to the country’s advanced biomedical research infrastructure, increasing focus on personalized medicine, and demand for high-quality research antibodies. Japanese research institutes and pharmaceutical companies are increasingly adopting primary antibodies for therapeutic development and clinical applications, driving market growth.

China Primary Antibodies Market Insight

The China primary antibodies market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid biotechnology growth, increasing R&D expenditure, and high adoption of advanced antibody technologies. China’s expanding life sciences ecosystem, growing demand for diagnostics and therapeutics, and strong domestic manufacturing capabilities are key factors propelling market growth.

Primary Antibodies Market Share

The Primary Antibodies industry is primarily led by well-established companies, including:

• Thermo Fisher Scientific (U.S.)

• Abcam (U.K.)

• Bio-Rad Laboratories (U.S.)

• Cell Signaling Technology (U.S.)

• Merck KGaA (Germany)

• Santa Cruz Biotechnology (U.S.)

• BD Biosciences (U.S.)

• GenScript (China)

• Proteintech (China)

• Novus Biologicals (U.S.)

• Vector Laboratories (U.S.)

• Rockland Immunochemicals (U.S.)

• R&D Systems (U.S.)

• Origene Technologies (U.S.)

• MyBioSource (U.S.)

• Synaptic Systems (Germany)

• AbD Serotec (U.K.)

• Enzo Life Sciences (U.S.)

• Active Motif (U.S.)

• Bio-Techne (U.S.)

Latest Developments in Global Primary Antibodies Market

- In February 2023, Roche introduced the IDH1 R132H (MRQ‑67) rabbit monoclonal primary antibody and the ATRX rabbit polyclonal antibody, designed to improve diagnostic precision for specific glioma mutations and compatible with automated pathology platforms. This launch reflects growing demand for mutation‑specific research and diagnostic antibodies

- In March 2025, Abcam and Thermo Fisher Scientific announced a strategic partnership to co‑develop and co‑market validated primary antibodies for immunohistochemistry (IHC) and Western blot applications, enhancing global access to high‑performance primary antibodies

- In June 2025, Cell Signaling Technology launched a new portfolio of 500+ phospho‑specific primary antibodies targeting key signaling proteins in oncology and immunology research, expanding reagent choices for signaling pathway analysis

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.