Global Primary Care Poc Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

18.37 Billion

USD

29.72 Billion

2024

2032

USD

18.37 Billion

USD

29.72 Billion

2024

2032

| 2025 –2032 | |

| USD 18.37 Billion | |

| USD 29.72 Billion | |

|

|

|

|

Primary Care POC Diagnostics Market Size

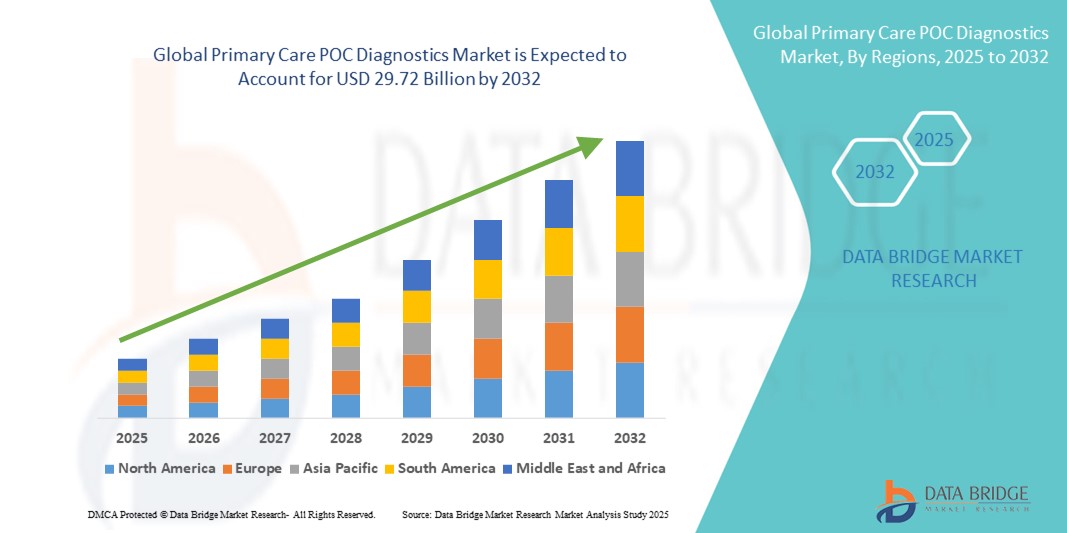

- The global primary care POC diagnostics market size was valued at USD 18.37 billion in 2024 and is expected to reach USD 29.72 billion by 2032, at a CAGR of 6.20% during the forecast period

- The market growth is largely fueled by the increasing adoption and technological advancements in point-of-care diagnostic solutions within primary care settings, leading to faster, decentralized diagnostic services in both urban and remote healthcare environments

- Furthermore, the rising demand for quick, user-friendly, and accurate diagnostic tools for conditions such as diabetes, cardiovascular diseases, infectious diseases, and respiratory illnesses is positioning primary care POC diagnostics as a vital component of modern clinical workflows

Primary Care POC Diagnostics Market Analysis

- Primary Care Point-of-Care (POC) Diagnostics are becoming increasingly vital in modern healthcare due to their ability to deliver rapid, accurate results at the site of patient care, improving clinical decision-making and reducing the burden on centralized laboratories

- The escalating demand for primary care POC diagnostics is primarily fueled by the growing need for early disease detection, rising prevalence of chronic conditions, increased access to decentralized healthcare, and the convenience of immediate diagnostic results

- North America dominated the primary care POC diagnostics market with the largest revenue share of 38.7% in 2024, driven by advanced healthcare infrastructure, early adoption of innovative diagnostic technologies, and strong presence of key market players. The U.S. led regional growth due to high awareness, favorable reimbursement policies, and increasing use of POC testing in clinics and homecare settings

- Asia-Pacific is expected to be the fastest growing region in the primary care POC diagnostics market during the forecast period, owing to rising healthcare expenditure, increasing urbanization, expanding access to healthcare facilities in rural areas, and growing government initiatives for disease screening programs

- The prescription-based testing segment dominated the primary care POC diagnostics market with a market share of 58.7% in 2024, due to higher physician trust, clinical accuracy, and regulatory approval

Report Scope and Primary Care POC Diagnostics Market Segmentation

|

Attributes |

Primary Care POC Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Primary Care POC Diagnostics Market Trends

Enhanced Convenience and Interconnectivity in Diagnostic Solutions

- A significant and accelerating trend in the global primary care POC diagnostics market is the deepening integration with advanced technologies and connected ecosystems, enabling greater user convenience and control across healthcare settings

- For instance, some modern diagnostic devices in primary care now feature seamless connectivity with digital platforms and patient monitoring systems, allowing clinicians to access results remotely and act on real-time data. These platforms facilitate streamlined workflows, quicker decision-making, and reduced diagnostic turnaround time

- Technological innovation is enabling smart diagnostic devices to learn from user input and patterns, improving diagnostic accuracy over time. Certain solutions now provide intelligent alerts or recommendations for further testing based on initial findings—helping healthcare providers make proactive decisions in patient care

- The ability to integrate these diagnostic tools with centralized health management systems allows providers to view patient data alongside other health metrics like vitals and medication compliance, enhancing overall treatment coordination in primary care

- This trend toward smarter, more connected, and intuitive diagnostic systems is reshaping expectations in primary care, pushing companies to develop user-friendly POC solutions that can seamlessly operate within existing digital healthcare ecosystems

- Demand for such interoperable and easy-to-use diagnostics is rapidly growing across clinics, homecare environments, and urgent care settings, as providers prioritize solutions that support comprehensive, accessible, and efficient patient care

Primary Care POC Diagnostics Market Dynamics

Driver

Growing Need Due to Rising Disease Burden and Decentralized Healthcare Adoption

- The increasing prevalence of chronic and infectious diseases, along with the rising demand for rapid, accessible diagnostic solutions, is a significant driver of growth in the Primary Care POC Diagnostics market

- For instance, in April 2024, Onity, Inc. (a subsidiary of Honeywell International, Inc.) announced a technological advancement in IoT-based diagnostic tools designed to support remote testing and monitoring in decentralized healthcare settings. Such innovations by key players are expected to propel market expansion during the forecast period

- As patients and healthcare providers seek faster diagnostic turnaround times and enhanced disease management, POC diagnostic tools offer critical benefits such as real-time results, portability, and reduced dependency on centralized labs—making them ideal for primary care settings

- Furthermore, the growing adoption of digital health and connected care ecosystems is making POC diagnostics a core element of smart healthcare systems. These diagnostics integrate with electronic health records (EHRs) and telemedicine platforms, facilitating seamless care coordination and data sharing

- The convenience of rapid testing at the point of care, minimal sample requirements, and user-friendly interfaces has led to widespread adoption in clinics, homecare, and even retail health settings. Additionally, the increasing availability of easy-to-use and affordable POC devices supports broader implementation, especially in underserved regions

Restraint/Challenge

Concerns Regarding Cybersecurity and High Initial Costs

- Concerns around the data security of connected diagnostic devices pose a significant challenge to broader adoption. As many POC diagnostics rely on network connectivity to transmit patient data, they are vulnerable to potential cybersecurity breaches, leading to concerns among healthcare providers and patients alike

- For instance, reports of data leaks and vulnerabilities in IoT healthcare devices have made some stakeholders cautious about adopting connected diagnostic tools

- To address these concerns, manufacturers must implement secure data encryption, robust authentication protocols, and ensure regular software updates to protect sensitive health information. Leading companies in the diagnostics sector emphasize their cybersecurity infrastructure as a key feature in building market trust

- In addition, the relatively high initial cost of advanced Primary Care POC Diagnostics—particularly those integrated with AI, digital interfaces, or telehealth platforms—may deter adoption in cost-sensitive regions. While basic POC devices have become more affordable, comprehensive systems with multiple testing capabilities and smart features remain out of reach for many smaller clinics or rural providers

- Although prices are gradually declining due to increased competition and technological maturation, the perception of high costs can still slow uptake, particularly where budget constraints limit healthcare investment

- Overcoming these barriers through improved data protection, awareness campaigns on digital health safety, and the development of cost-effective POC solutions will be essential for long-term, widespread market growth

Primary Care POC Diagnostics Market Scope

The market is segmented on the basis of platform, prescription, end-user, and product.

- By Platform

On the basis of platform, the primary care POC diagnostics market is segmented into lateral flow assays, dipsticks, microfluidics, molecular diagnostics, and immunoassays. The lateral flow assays segment accounted for the largest revenue share of 36.4% in 2024, owing to their affordability, rapid results, and wide applicability across infectious disease diagnostics.

The Microfluidics segment is projected to witness the fastest CAGR of 22.1% from 2025 to 2032, driven by its growing use in multiplex testing, reduced reagent use, and potential for portable, high-throughput diagnostics.

- By Prescription

On the basis of prescription, the primary care POC diagnostics market is segmented into prescription-based testing and OTC (Over-the-Counter) Testing. The prescription-based testing segment held the largest market share of 58.7% in 2024, due to higher physician trust, clinical accuracy, and regulatory approval.

The OTC Testing segment is expected to expand at the fastest CAGR of 20.6% during the forecast period, attributed to the growing consumer preference for at-home diagnostics and increased availability of user-friendly testing kits for glucose, pregnancy, and infectious diseases.

- By End-User

On the basis of end-user, the primary care POC diagnostics market is segmented into professional diagnostic centers, home care, research laboratories, and other end users. Professional diagnostic centers led the market with the largest revenue share of 41.9% in 2024, driven by high test volumes, skilled personnel, and availability of diverse POC testing platforms.

The Home Care segment is projected to register the highest CAGR of 24.3% from 2025 to 2032, fueled by the increasing prevalence of chronic conditions and the convenience of testing in non-clinical settings.

- By Product

On the basis of product, the primary care POC diagnostics market is segmented into glucose, cardio-metabolic, infectious disease, coagulation, pregnancy and fertility, tumor/cancer marker, urinalysis, cholesterol, hematology, drugs-of-abuse, fecal occult, and other POC products. The Glucose segment captured the highest revenue share of 27.8% in 2024, largely due to the global burden of diabetes and the widespread use of blood glucose meters.

The Infectious Disease segment is anticipated to witness the fastest CAGR of 23.5% from 2025 to 2032, propelled by increased global focus on epidemic preparedness, early detection, and rapid response, particularly in low-resource and rural settings.

Primary Care POC Diagnostics Market Regional Analysis

- North America dominated the primary care POC diagnostics market with the largest revenue share of 38.7% in 2024, driven by a growing demand for rapid diagnostics in home and clinical settings, alongside increased awareness of early disease detection and chronic disease monitoring solutions

- Consumers and healthcare providers in the region highly value the convenience, speed, and accessibility offered by POC diagnostic tools, particularly in primary care, where timely results can influence immediate treatment decisions

- This widespread adoption is further supported by high healthcare spending, a technologically advanced infrastructure, and the growing preference for decentralized healthcare models, positioning POC diagnostics as a key component in modern medical practice

U.S. Primary Care POC Diagnostics Market Insight

The U.S. primary care POC diagnostics market captured the largest revenue share of 58% in 2024 within North America, fueled by the rapid adoption of connected diagnostic devices and increasing implementation of value-based healthcare. Rising patient preference for quick, in-office testing, especially for chronic conditions like diabetes and cardiovascular diseases, is accelerating market growth. Additionally, widespread integration of telehealth and EHR systems is enhancing the utility of POC diagnostics in both urban and remote care environments.

Europe Primary Care POC Diagnostics Market Insight

The Europe primary care POC diagnostics market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing demand for patient-centered care and a shift toward decentralization of diagnostic services. The region’s robust regulatory framework, aging population, and adoption of innovative technologies are supporting the proliferation of POC diagnostics across primary care clinics, pharmacies, and home settings.

U.K. Primary Care POC Diagnostics Market Insight

The U.K. primary care POC diagnostics market is anticipated to grow at a noteworthy CAGR, driven by government support for early disease screening, rising demand for point-of-care testing in general practices, and public health efforts to manage chronic and infectious diseases. The U.K.'s strong digital health infrastructure and growing investments in primary care services continue to accelerate market expansion.

Germany Primary Care POC Diagnostics Market Insight

The Germany primary care POC diagnostics market is expected to expand at a considerable CAGR, supported by high healthcare spending, strong adoption of innovative diagnostic technologies, and a patient population increasingly seeking convenience and immediacy in testing. Germany’s emphasis on sustainability and digital transformation in healthcare further fuels the integration of advanced POC diagnostic devices in clinics and homecare.

Asia-Pacific Primary Care POC Diagnostics Market Insight

The Asia-Pacific primary care POC diagnostics market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing urbanization, rising healthcare awareness, and investments in healthcare infrastructure across countries such as China, Japan, and India. The expansion of primary care facilities, digital health initiatives, and growing demand for accessible diagnostics in rural regions are propelling the use of POC solutions.

Japan Primary Care POC Diagnostics Market Insight

The Japan primary care POC diagnostics market is gaining momentum due to its highly developed medical technology sector, aging population, and focus on efficient chronic disease management. The demand for compact, accurate, and user-friendly POC devices is growing, particularly in homecare and primary clinics. Integration with national digital health platforms is also enhancing adoption across urban and rural settings.

China Primary Care POC Diagnostics Market Insight

The China primary care POC diagnostics market accounted for the largest revenue share in Asia-Pacific in 2024, driven by a rising middle class, rapid healthcare digitization, and strong government support for early diagnosis and public health monitoring. China is a key manufacturing and innovation hub for diagnostic devices, making POC solutions both affordable and widely available for mass deployment in community clinics and rural health centers.

Primary Care POC Diagnostics Market Share

The Primary Care POC Diagnostics industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Siemens Healthineers AG (Germany)

- QuidelOrtho Corporation (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Danaher Corporation (U.S.)

- BD (U.S.)

- Chembio Diagnostics, Inc. (U.S.)

- EKF Diagnostics Holdings plc (U.K.)

- Trinity Biotech Plc (Ireland)

- Werfen (U.S.)

- Nova Biomedical (U.S.)

- PTS Diagnostics (U.S.)

- SEKISUI Diagnostics (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- BIOMÉRIEUX (France)

Latest Developments in Global Primary Care POC Diagnostics Market

- In June 2025, Axim Biotechnologies, Inc. (U.S.) filed a Pre-Submission (Pre‑Sub Q) with the U.S. FDA seeking a CLIA waiver for its TearScan Lf, a rapid POC test measuring tear lactoferrin to diagnose Aqueous Deficient Dry Eye Disease. If approved, it will allow eye care professionals to perform testing in non‑lab settings, significantly expanding clinical adoption beyond certified labs

- In June 2024, the U.S. Biomedical Advanced Research and Development Authority (BARDA) partnered with Lumos Diagnostics to support clinical studies and pursue a CLIA‑waiver application for Lumos’s innovative ultrarapid diagnostics platform. This collaboration aims to bring high‑quality, near‑patient testing for sepsis and other critical conditions directly into emergency and primary care settings

- In June 2024, BIOMÉRIEUX received FDA approval for its BIOFIRE SPOTFIRE platform, designed for point-of-care (POC) testing for respiratory infections and sore throat conditions. This innovative platform aims to enhance rapid diagnosis and improve patient management by delivering timely results in clinical settings

- In May 2024, Cipla announced a strategic investment agreement with Achira Labs Private Limited, a company focused on the commercialization of point-of-care test kits in India. This collaboration aims to expand access to advanced diagnostic solutions and address healthcare needs in the region

- In March 2023, Health Canada granted approval to bioLytical Laboratories Inc. for its INSTI Multiplex HIV-1/2 Syphilis Antibody Test. This test is designed to provide rapid and accurate results, facilitating timely treatment and management of sexually transmitted infections

- In November 2022, LumiraDx Healthcare, based in the UK, introduced its highly sensitive C - reactive protein (CRP) point-of-care (POC) antigen test throughout India. This POC CRP test is applicable in various clinical environments and aims to minimize unnecessary antibiotic prescriptions that contribute to antimicrobial resistance (AMR)

- In October 2022, Genes2Me Pvt. Ltd. unveiled the Rapi-Q Point of Care RT PCR solution for detecting human papillomavirus (HPV) and tuberculosis. This user-friendly device provides rapid results in under 45 minutes and is CE-IVD marked, ensuring superior performance, high sensitivity, and reliable detection

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.