Global Primary Petrochemicals Market

Market Size in USD Billion

CAGR :

%

USD

1.48 Billion

USD

2.51 Billion

2024

2032

USD

1.48 Billion

USD

2.51 Billion

2024

2032

| 2025 –2032 | |

| USD 1.48 Billion | |

| USD 2.51 Billion | |

|

|

|

|

Primary Petrochemicals Market Analysis

The primary petrochemicals market is experiencing robust growth, driven by increasing demand across various industries such as automotive, construction, packaging, and electronics. With advancements in manufacturing technologies, companies are investing in more efficient and sustainable production processes, enabling higher yields and reduced environmental impacts. The market's expansion is also supported by significant capacity additions and the development of new production facilities in key regions such as North America, Asia-Pacific, and the Middle East. Innovations in petrochemical feedstocks, including the use of bio-based and recycled materials, are gaining traction as industries seek to align with environmental regulations and consumer preferences for greener solutions. In addition, advancements in carbon capture and storage (CCS) technologies are helping to mitigate emissions and enhance the sustainability of petrochemical operations. As the demand for downstream products grows, particularly in sectors such as electronics and renewable energy, the primary petrochemicals market is projected to maintain its growth trajectory. This shift is being further propelled by policy support from governments and investments in renewable energy, which are aimed at reducing carbon footprints and fostering a transition to more sustainable production methods.

Primary Petrochemicals Market Size

The global Primary Petrochemicals market size was valued at USD 1.48 billion in 2024 and is projected to reach USD 2.51 billion by 2032, with a CAGR of 6.80% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Primary Petrochemicals Market Trends

“Increasing Shift towards Sustainable Production Practices”

One significant trend in the primary petrochemicals market is the shift towards sustainable production practices. Companies are increasingly adopting bio-based and recycled feedstocks to reduce their carbon footprint and align with global environmental standards. For instance, Dow's collaboration with New Energy Blue to produce bio-based ethylene from agricultural residues exemplifies the industry's movement toward greener solutions. This trend is driven by growing consumer and regulatory pressure for eco-friendly manufacturing, prompting investments in technologies that support carbon capture and recycling. Furthermore, advancements in catalytic cracking and reforming processes are enhancing the efficiency of petrochemical production, enabling manufacturers to meet rising demand for products such as polyethylene and polypropylene while minimizing emissions. The integration of sustainable practices is meeting environmental demands and opening new market opportunities in regions focused on achieving net-zero carbon goals, such as Europe and North America.

Report Scope and Primary Petrochemicals Market Segmentation

|

Attributes |

Primary Petrochemicals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

LyondellBasell Industries Holdings B.V. (Netherlands), BASF (Germany), TotalEnergies (France), Royal Dutch Shell (Netherlands/UK), China Petrochemical Corporation (China), DuPont (U.S.), Dow (U.S.), Reliance Industries Limited (India), SABIC (Saudi Arabia), BP p.l.c. (UK), Chevron Phillips Chemical Company LLC (U.S.), Formosa Petrochemical Co., Ltd. (Taiwan), CNPC (China), and Exxon Mobil Corporation (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Primary Petrochemicals Market Definition

Primary petrochemicals are fundamental chemical compounds derived from petroleum and natural gas that serve as building blocks for the production of various products. These include basic materials such as ethylene, propylene, butadiene, benzene, and methanol, which are used to manufacture a wide range of downstream products such as plastics, synthetic rubbers, fibers, and other chemical intermediates.

Primary Petrochemicals Market Dynamics

Drivers

- Growing Demand from End-Use Industries

The growing demand from end-use industries is a major driver for the primary petrochemicals market, fueled by the need for versatile and cost-effective materials in sectors such as automotive, construction, packaging, and consumer goods. For instance, the global automotive industry has been shifting towards lightweight materials to enhance fuel efficiency and performance, leading to an increased demand for polymers such as polypropylene and polyethylene, which are essential for manufacturing vehicle parts. In addition, the construction sector relies on primary petrochemicals for products such as PVC pipes and insulation materials, supporting urban development and infrastructure projects worldwide. The robust demand for these materials underscores the essential role of primary petrochemicals in meeting the evolving needs of various industries, solidifying its position as a market driver.

- Rapid Urbanization and Infrastructure

Rapid urbanization and infrastructure development are significant drivers for the primary petrochemicals market, as they contribute to increased consumption of essential materials such as PVC and other synthetic compounds used in construction. According to the United Nations, more than 55% of the world’s population now resides in urban areas, and this number is expected to reach 68% by 2050. This surge in urban growth has led to a spike in demand for durable, cost-effective construction materials, with PVC being a prime instance due to its versatility, durability, and affordability. For instance, in countries such as China and India, massive infrastructure projects, such as the development of smart cities and extensive public transport networks, are driving significant demand for primary petrochemicals. In the U.S., the demand for construction materials such as PVC for piping and building exteriors has also risen, bolstering the growth of the primary petrochemicals market and solidifying its role as a crucial market driver.

Opportunities

- Increasing Technological Advancements in Manufacturing Processes

Technological advancements in manufacturing processes are creating significant opportunities in the primary petrochemicals market by boosting production capacity and improving economic feasibility. Innovations such as enhanced catalytic cracking and advanced extraction techniques have enabled more efficient conversion of raw materials into high-value petrochemicals. For instance, the use of advanced catalysts in fluid catalytic cracking (FCC) has helped refineries maximize the yield of valuable products such as ethylene and propylene, essential for producing plastics and other chemical derivatives. In addition, newer extraction techniques, such as membrane technology, are improving the separation of petrochemical components, reducing energy consumption and operational costs. Companies such as ExxonMobil and Royal Dutch Shell are investing heavily in such advanced technologies to streamline production and increase output. This technological progress is helping petrochemical producers meet the growing global demand for essential products while maintaining cost efficiency, making it a key market opportunity for expansion and competitiveness.

- Rising Global Energy Demand

The rising global energy demand is driving significant growth in the primary petrochemicals market, as these materials are essential in the production of fuels and energy-related products. With the increasing consumption of energy worldwide, industries are relying more on primary petrochemicals such as ethylene and propylene, which serve as building blocks for manufacturing fuels, lubricants, and other energy-related products. For instance, the expansion of electric vehicle (EV) infrastructure and the need for cleaner energy alternatives have spurred the development of petrochemical-based products, such as high-performance lubricants and energy-efficient components. The International Energy Agency (IEA) projects that global energy demand will increase by around 25% by 2040, reinforcing the need for reliable sources of petrochemical production. This trend is motivating major petrochemical companies, including Dow and SABIC, to invest in technologies that enhance production and align with sustainable energy goals. These advancements and investments create opportunities for growth in the primary petrochemicals market as it adapts to evolving energy needs.

Restraints/Challenges

- Environmental Concerns

Environmental concerns are a major challenge for the global primary petrochemicals market, driven by the negative impacts associated with petrochemical production and use. The extraction and processing of fossil fuels contribute significantly to greenhouse gas emissions, which exacerbate climate change. For instance, the production of ethylene and propylene, key building blocks for many petrochemical products, releases large amounts of CO2 and other pollutants. Governments and regulatory bodies worldwide are increasingly enforcing stricter environmental policies to mitigate these effects, compelling companies to invest in cleaner technologies or face potential penalties. In addition, public awareness and advocacy for sustainability are influencing consumer preferences, pushing industries to reconsider their reliance on traditional petrochemicals. As a result, petrochemical manufacturers must navigate these growing environmental pressures, which may impact profitability and market growth. The industry is challenged to balance economic growth with sustainability goals, requiring significant investments in greener alternatives and carbon capture technologies.

- Competition from Alternative Materials

The competition from alternative materials presents a significant challenge to the primary petrochemicals market as the world increasingly shifts toward sustainability. With industries prioritizing eco-friendly practices, the demand for biodegradable and bio-based polymers has risen sharply. For instance, companies such as BASF and TotalEnergies have invested in developing bio-based alternatives, which appeal to environmentally conscious consumers and businesses aiming to reduce their carbon footprints. This shift challenges traditional petrochemical products, as they face pressure to meet sustainability goals set by governments and industry standards. The adoption of alternatives, such as polylactic acid (PLA) and polyhydroxyalkanoates (PHA), is growing in sectors such as packaging and automotive, where consumers are seeking greener materials. The emphasis on reducing environmental impacts is creating headwinds for conventional petrochemical products, leading to potential declines in demand and necessitating investment in cleaner production methods or diversification into more sustainable offerings.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Primary Petrochemicals Market Scope

The market is segmented on the basis of type, application, manufacturing process, and end-user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Ethylene

- Propylene

- Butadiene

- Benzene

- Vinyl

- Styrene

- Methanol

- Gasoline

- Acetic Acid

- Formaldehyde

Applications

- Adhesives

- Polymers

- Paints and Coatings

- Dyes

- Surfactants

- Rubber

- Plastics

- Solvents

Manufacturing Processes

- Fluid Catalytic Cracking

- Catalytic Reforming

End-User

- Packaging

- Automobile

- Construction

- Electrical and Electronics

- Aviation

- Consumer Goods

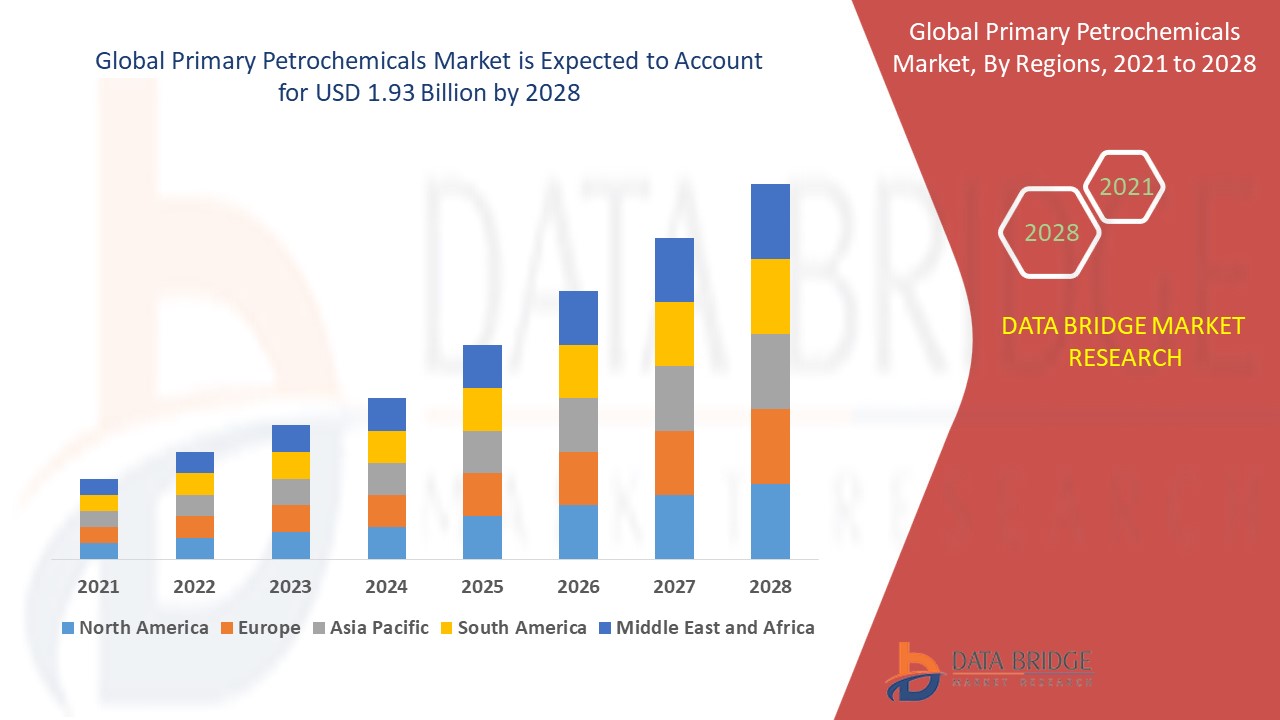

Primary Petrochemicals Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, type, application, manufacturing process, and end-user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the primary petrochemicals market, driven by strong demand from key sectors such as construction and automotive. This growth is supported by significant capacity expansions within the region and increasing investments that enhance production capabilities. In addition, government initiatives and support in emerging economies contribute to market expansion. The demand for downstream products in end-use industries, combined with capacity increases in the base chemical industry, further strengthens the region’s dominant position in the market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Primary Petrochemicals Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Primary Petrochemicals Market Leaders Operating in the Market Are:

- LyondellBasell Industries Holdings B.V. (Netherlands)

- BASF (Germany)

- TotalEnergies (France)

- Royal Dutch Shell (Netherlands/UK)

- China Petrochemical Corporation (China)

- DuPont (U.S.)

- Dow (U.S.)

- Reliance Industries Limited (India)

- SABIC (Saudi Arabia)

- BP p.l.c. (UK)

- Chevron Phillips Chemical Company LLC (U.S.)

- Formosa Petrochemical Co., Ltd. (Taiwan)

- CNPC (China)

- Exxon Mobil Corporation (U.S.)

Latest Developments in Primary Petrochemicals Market

- In November 2023, Dow announced an investment of USD 8.9 billion for the development of a net-zero petrochemical plant project in Alberta's Industrial Heartland, Canada. The facility is expected to produce approximately 3 million tons of low-emission ethylene and polyethylene derivatives, with construction planned to begin in 2024

- In July 2023, SABIC launched its new PCR-based NORYLTM portfolio, which incorporates bio-based and recycled materials into petrochemical products to help reduce the carbon footprint and contribute to a more eco-friendly chemical industry

- In July 2023, ExxonMobil Corporation announced its agreement to acquire Denbury Inc. to strengthen its carbon capture and storage (CCS) capabilities, aimed at reducing carbon emissions in the petrochemical and energy sectors

- In May 2023, Dow Corporate partnered with New Energy Blue to develop bio-based ethylene using renewable agricultural residues. This approach is part of Dow’s initiative to create a sustainable method for producing plastic

- In April 2023, INEOS Group Ltd. completed the acquisition of Mitsui Phenols Singapore Ltd., enhancing its production capacity for petrochemical products such as acetone, cumene, bisphenol A (BPA), phenol, and alpha-methylstyrene

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Primary Petrochemicals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Primary Petrochemicals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Primary Petrochemicals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.