Global Printed Tape Market

Market Size in USD Billion

CAGR :

%

USD

37.20 Billion

USD

79.60 Billion

2024

2032

USD

37.20 Billion

USD

79.60 Billion

2024

2032

| 2025 –2032 | |

| USD 37.20 Billion | |

| USD 79.60 Billion | |

|

|

|

|

Printed Tape Market Size

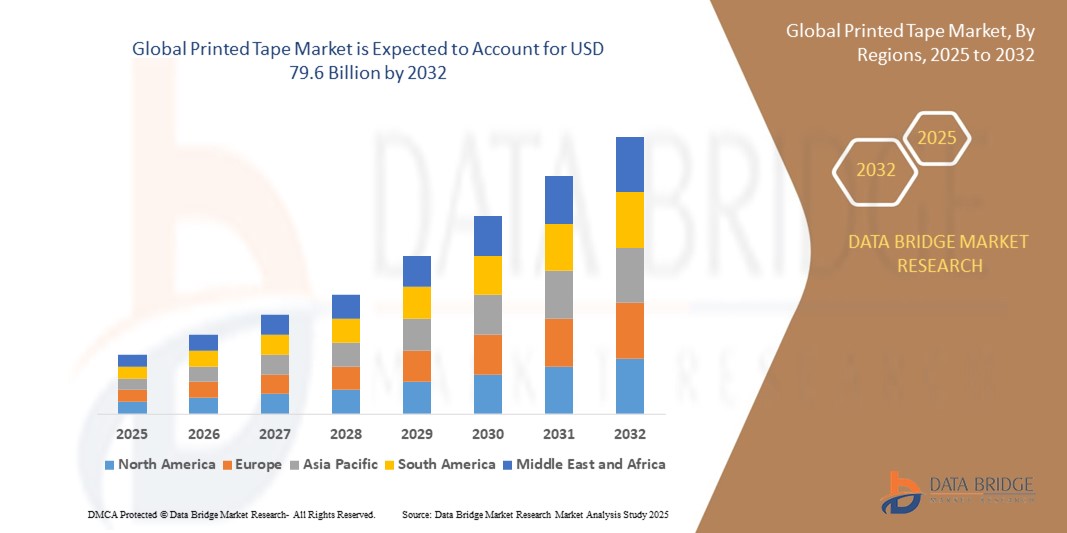

- The global Printed Tape market size was valued at USD 37.2 Billion in 2024 and is expected to reach USD 79.6 Billion by 2032, at a CAGR of 7.6% during the forecast period

- The market growth is largely fueled by the rapid expansion of e-commerce, increasing demand for customized and secure packaging solutions, advancements in printing technologies, rising brand awareness, and the need for enhanced product differentiation across various industries globally, especially in emerging markets.

- Furthermore, growing consumer preference for eco-friendly and sustainable packaging materials, increased adoption of digital printing techniques, expansion of retail and logistics sectors, and the rise in small and medium-sized enterprises investing in brand promotion are further accelerating the growth of the global printed tape market..

Printed Tape Market Analysis

- The printed tape market is experiencing rapid growth driven by increasing e-commerce activities, which demand secure and branded packaging solutions. Advancements in printing technologies, such as digital and flexographic printing, have improved product quality and customization options, attracting diverse industries worldwide.

- Rising consumer awareness about brand identity and packaging aesthetics is pushing companies to adopt printed tapes for enhanced product differentiation. Additionally, expanding retail, logistics, and manufacturing sectors in emerging regions, particularly Asia-Pacific, are creating substantial opportunities for market players to capture new customer segments.

- Asia-Pacific (APAC) dominates the Printed Tape market with a 35.67% revenue share in 2025, driven by rapid industrialization, booming e-commerce growth, rising demand for customized and secure packaging, expanding manufacturing sectors, and increasing investments in advanced printing technologies across key countries like China and India.

- Additionally, government initiatives supporting manufacturing and export industries, growing consumer awareness of brand visibility, rising adoption of eco-friendly packaging materials, expansion of small and medium enterprises, and improvements in digital printing infrastructure further strengthen the growth and competitive edge of the Printed Tape market in the Asia-Pacific region.

- The Acrylic Carton Sealing Tape segment is expected to dominate the Printed Tape market with a significant share of around 36% in 2025, driven by its strong adhesive properties, cost-effectiveness, versatility across packaging applications, excellent durability, and widespread use in e-commerce, logistics, and manufacturing industries.

Report Scope and Printed Tape Market Segmentation

|

Attributes |

Printed Tape Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Printed Tape Market Trends

“Increasing adoption of digital printing enhances customization and production efficiency globally”

- Digital printing technology enables high-quality, vibrant designs on printed tapes, attracting brands seeking distinctive packaging to stand out in competitive markets. Its precision and flexibility allow for quick changes and short production runs, reducing waste and costs compared to traditional printing methods.

- Customization through digital printing supports brand differentiation by allowing businesses to create unique logos, patterns, and messages on tapes, enhancing consumer recognition and loyalty. This trend is particularly strong in e-commerce, where personalized packaging plays a key role in customer experience and repeat purchases.

- Digital printing accelerates production timelines by simplifying the printing process, eliminating the need for printing plates, and enabling faster turnaround. This agility helps manufacturers respond swiftly to changing market demands and seasonal promotional campaigns, increasing operational efficiency and reducing inventory costs.

- The technology’s ability to print variable data, such as serial numbers or QR codes, on tapes facilitates better supply chain tracking and anti-counterfeiting measures. This adds value for industries requiring secure and traceable packaging, such as pharmaceuticals, electronics, and luxury goods.

- Growing environmental awareness drives adoption of digital printing, which produces less waste and uses eco-friendly inks. Combined with sustainable tape materials, this reduces the carbon footprint of packaging, aligning with corporate social responsibility goals and increasing appeal among eco-conscious consumers.

Printed Tape Market Dynamics

Driver

“Rising e-commerce demand fuels need for secure, customized printed packaging tapes”

- The rapid growth of e-commerce has significantly increased the volume of shipped goods, driving demand for printed tapes that provide secure sealing and brand visibility, ensuring packages arrive intact while promoting businesses through customized designs and logos on packaging materials.

- Online retailers prioritize customer experience, using printed tapes as a marketing tool to enhance brand recognition and differentiate their products from competitors, making secure and visually appealing packaging an essential component of successful order fulfillment and repeat customer engagement.

- Customized printed tapes help prevent tampering and theft during shipping by clearly indicating if packages have been opened or compromised, increasing security and consumer confidence in online purchases, which is critical in the fast-growing e-commerce sector.

- The convenience and scalability of printed tape solutions align well with the high-volume, fast-paced nature of e-commerce logistics, allowing businesses to quickly adapt packaging to seasonal campaigns, promotions, or special events, boosting marketing effectiveness and operational efficiency.

- Increasing demand for sustainable packaging in e-commerce has led to innovations in eco-friendly printed tapes, enabling companies to meet consumer expectations for environmentally responsible products while maintaining the benefits of branding and package security.

Restraint/Challenge

“High production costs and complex regulations hinder printed tape market growth”

- High production costs for advanced printing technologies and premium materials increase overall expenses, limiting adoption by small and medium-sized enterprises and restricting market expansion, especially in price-sensitive regions where cost-efficiency is a key purchasing factor.

- Complex and varying regulatory standards across countries create challenges for manufacturers to ensure compliance, leading to increased operational costs, delays in product launches, and difficulties in entering new markets, thereby slowing down global market growth for printed tapes.

- The need for specialized equipment and skilled labor to operate advanced printing technologies raises initial investment and training costs, which can be a barrier for new entrants and smaller manufacturers aiming to compete with established players in the printed tape industry.

- Environmental regulations related to the use of certain inks, adhesives, and plastic substrates impose restrictions that require manufacturers to invest in research and development for eco-friendly alternatives, increasing costs and complexity in production processes

- Supply chain disruptions and raw material price volatility, especially for specialty components used in printed tapes, contribute to fluctuating production costs and challenges in maintaining consistent product availability, impacting the overall market stability and growth prospects.

Printed Tape Market Scope

The market is segmented on the basis of product type, material type, technology and printing ink and application.

- By Product Type

On the basis of product type, the Printed Tape market is segmented into acrylic carton sealing tape, hot melt carton sealing tape, natural rubber carton sealing tape. The acrylic carton sealing tape segment dominates the largest market revenue share of approximately 36% in 2025, driven by its strong adhesive performance, cost-effectiveness, versatility across diverse packaging applications, resistance to aging and temperature variations, and widespread use in e-commerce, logistics, and manufacturing sectors.

The acrylic carton sealing tape segment is anticipated to witness the fastest growth rate of around 7.1% CAGR from 2025 to 2032, fueled by increasing demand for durable, eco-friendly adhesives, expanding e-commerce and logistics sectors, technological advancements in tape formulations, and growing preference for sustainable packaging solutions globally.

- By Material Type

On the basis of material type, the Printed Tape market is segmented in to polyvinyl chloride, polypropylene, polyamide, polyethylene, others. The polyvinyl chloride segment drives the Printed Tape market due to its excellent durability, strong adhesive properties, resistance to moisture and chemicals, cost-effectiveness, and versatility across various industries such as packaging, construction, and automotive, making it a preferred choice for reliable and long-lasting printed tapes.

The polyvinyl chloride segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rising demand for durable, weather-resistant tapes in industrial applications, advancements in PVC formulations, growing adoption in construction and automotive sectors, and increasing preference for cost-effective, high-performance printed tapes globally.

- By Technology

On the basis of technology, the Printed Tape market is segmented in to flexography, lithography, digital printing, screen printing, gravure, others. The flexography segment drives the Printed Tape market due to its cost-effective, high-speed printing capabilities, ability to produce vibrant colors and detailed designs, suitability for large-volume runs, compatibility with various substrates, and widespread adoption in packaging industries seeking efficient, high-quality, and customizable printed tape solutions.

The flexography segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its efficient printing process, low production costs, ability to handle diverse materials, increasing demand for high-quality packaging, and advancements in printing technology enhancing print resolution and speed across industries.

- By Printing Ink

On the basis of printing ink, the Printed Tape market is segmented in to water-based, solvent-based, uv curable. The water-based segment drives the Printed Tape market due to its environmentally friendly nature, low volatile organic compound (VOC) emissions, strong adhesion properties, cost-effectiveness, and growing consumer demand for sustainable packaging solutions, making it a preferred choice among manufacturers focused on green and safe production processes.

The water-based segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing environmental regulations, rising consumer preference for eco-friendly products, advancements in water-based adhesive technologies, growing demand for sustainable packaging, and expanding awareness of health and safety benefits in manufacturing processes.

- By Application

On the basis of application, the Printed Tape market is segmented in to food and beverage, consumer durables, transportation and logistics, others. The food and beverage segment drives the Printed Tape market due to stringent packaging standards, growing demand for tamper-evident and hygienic sealing solutions, increased product traceability needs, rising consumer preference for branded packaging, and expanding food delivery services requiring secure and visually appealing tape applications.

The food and beverage segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing demand for safe, tamper-evident packaging, rising food delivery services, stringent hygiene regulations, growing consumer focus on product authenticity, and advancements in printed tape technologies enhancing brand visibility.

Printed Tape Market Regional Analysis

- Asia-Pacific (APAC) dominates the Printed Tape market with a 35.67% revenue share in 2025, driven by rapid industrialization, booming e-commerce growth, rising demand for customized and secure packaging, expanding manufacturing sectors, and increasing investments in advanced printing technologies across key countries like China and India.

- The region’s expanding manufacturing sectors and growing investments in advanced printing technologies contribute to market growth. Enhanced production capabilities and technological adoption enable high-quality, cost-effective printed tapes, meeting diverse industry needs and solidifying Asia-Pacific’s leadership in the global printed tape market.

- Additionally, rising consumer awareness about brand differentiation and package safety in Asia-Pacific encourages manufacturers to adopt printed tapes with vibrant designs and tamper-evident features. This trend, combined with government support for smart packaging initiatives, further accelerates market growth across emerging economies like China and India.

China Printed Tape Market Insight

The China Printed Tape market captured the largest revenue share of approximately 42% within Asia-Pacific (APAC) in 2025, manufacturers to use printed tapes with vibrant designs and tamper-evident features. Coupled with government support for smart packaging initiatives, this trend accelerates market growth in emerging economies such as China and India.

North America Printed Tape Market Insight

The North America market is projected to expand at a substantial CAGR due to rising e-commerce growth, increasing demand for secure and customized packaging solutions, advancements in printing technology, growing awareness about brand identity, and strong investments by key players to enhance product quality and sustainability.

U.S. Printed Tape Market Insight

The U.S. market is driven by robust industrial infrastructure, high demand from automotive and aerospace sectors, advancements in coating technologies, stringent environmental regulations promoting low-friction solutions, and increased investment in R&D. These factors collectively support the growing adoption of Printed Tape across various applications.

Printed Tape Market Share

The Printed Tape industry is primarily led by well-established companies, including:

- The Chemours Company (United States)

- Solvay S.A. (Belgium)

- PPG Industries, Inc. (United States)

- BASF SE (Germany)

- Mankiewicz Gebr. & Co. GmbH (Germany)

- Henkel AG & Co. KGaA (Germany)

- RPM International Inc. (United States)

- Saint-Gobain (France)

- CIE Automotive (Spain)

- Zhejiang Jiashan Coating Co., Ltd. (China)

- Jiangsu Yoke Industrial Co., Ltd. (China)

- Coventya GmbH (Germany)

- NanoTech Coatings (United Kingdom)

- Süd-Chemie AG (Germany)

- Arkema S.A. (France)

Latest Developments in Global Printed Tape Market

- In March 2024, 3M Company introduced a new line of tamper-proof security tapes. These tapes are designed to enhance package security and brand integrity, catering to industries requiring high levels of protection against unauthorized access. The launch underscores 3M's commitment to innovation in packaging solutions.

- In April 2024, Intertape Polymer Group launched a new series of compostable, water-based printed tapes. These eco-friendly tapes aim to meet the growing demand for sustainable packaging solutions, offering an alternative to traditional plastic-based tapes. The development aligns with global sustainability trends in packaging.

- In May 2024, Tesa SE expanded its product line to include UV-resistant heavy-duty printed tape solutions. These tapes are designed for applications requiring durability under exposure to sunlight and harsh environmental conditions, catering to industries such as construction and outdoor logistics.

- In June 2024, Berry Global introduced a new range of digitally printed, high-strength branding tapes. These tapes offer enhanced durability and customization options, allowing businesses to effectively promote their brand identity through packaging. The release reflects the increasing importance of branding in packaging solutions.

- In July 2024, Scapa Group enhanced its portfolio by introducing new sustainable tape products. These tapes are made from recyclable materials and are designed to meet the growing consumer demand for eco-friendly packaging solutions. The move aligns with the industry's shift towards sustainability.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Printed Tape Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Printed Tape Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Printed Tape Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.