Global Printing Services Market

Market Size in USD Billion

CAGR :

%

USD

21.67 Billion

USD

46.11 Billion

2024

2032

USD

21.67 Billion

USD

46.11 Billion

2024

2032

| 2025 –2032 | |

| USD 21.67 Billion | |

| USD 46.11 Billion | |

|

|

|

|

Printing Services Market Size

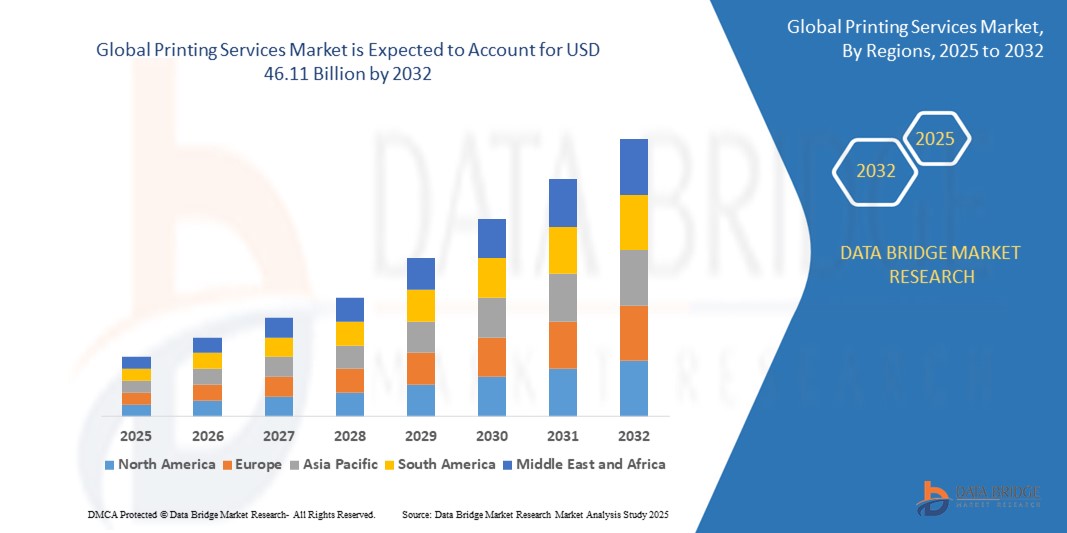

- The global printing services market size was valued at USD 21.67 billion in 2024 and is expected to reach USD 46.11 billion by 2032, at a CAGR of 9.90% during the forecast period

- The market growth is largely fueled by the increasing digital transformation across industries and the widespread adoption of cloud-based and managed print services, leading to streamlined workflows and reduced operational costs for organizations of all sizes

- Furthermore, rising enterprise demand for secure, scalable, and automated document handling solutions is establishing printing services as a critical component of modern business infrastructure. These converging factors are accelerating the shift from traditional printing to intelligent, service-based models, thereby significantly boosting the industry's growth

Printing Services Market Analysis

- Printing services encompass a broad range of solutions including managed print services, cloud printing, workflow automation, and print security software designed to optimize document output and reduce inefficiencies in corporate environments

- The escalating demand for these services is primarily driven by the need to improve document security, enhance productivity, and reduce print-related costs. Businesses are increasingly adopting hybrid deployment models and analytics-driven solutions to support remote workforces, ensure regulatory compliance, and advance sustainability goals

- North America dominated the printing services market with a share of 49.26% in 2024, due to high enterprise IT spending, early adoption of digital printing solutions, and widespread demand for managed print services

- Asia-Pacific is expected to be the fastest growing region in the printing services market during the forecast period due to increasing digitalization, rising business formation, and expanding IT infrastructure in countries such as China, India, and Japan

- On-premises segment dominated the market with a market share of 48.3% in 2024, due to its prevalence in highly regulated industries such as government and finance, where organizations require full control over sensitive data and infrastructure. The stability, data residency assurance, and customization flexibility of on-premises systems make them the preferred choice for enterprises with stringent IT governance

Report Scope and Printing Services Market Segmentation

|

Attributes |

Printing Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Printing Services Market Trends

“Rising Technological Advancements”

- The printing services market is rapidly evolving with the integration of advanced technologies such as artificial intelligence, automation, and IoT, transforming workflows and boosting efficiency

- For instance, companies such as Kodak, HP, and Canon are launching high-speed digital presses and AI-powered print management tools, enabling faster turnaround, predictive maintenance, and enhanced print quality

- Print-on-demand and web-to-print solutions are gaining traction, allowing businesses to minimize waste, reduce inventory, and offer more flexible, customized print runs

- Sustainability is becoming a core focus, with leading players investing in eco-friendly inks, recycled substrates, and green printing practices to meet regulatory and consumer expectations

- Product personalization is surging, as brands leverage data-driven insights to deliver tailored marketing materials and packaging, responding to the growing demand for unique customer experiences

- In conclusion, the convergence of digital transformation, sustainability, and customization is positioning the printing services market for steady growth and ongoing innovation through 2025 and beyond

Printing Services Market Dynamics

Driver

“Growing Demand for Customization”

- The increasing need for customized marketing materials, packaging, and promotional items is a primary driver for the printing services market

- For instance, companies such as Vistaprint, Shutterfly, and FedEx Office are expanding their offerings to include variable data printing, personalized photo products, and bespoke packaging solutions, catering to diverse client requirements

- The rise of e-commerce and direct-to-consumer brands is fueling demand for short-run, highly tailored print jobs that support brand differentiation and customer engagement

- Technological advancements in digital printing and workflow automation are making it easier and more cost-effective for print service providers to deliver on-demand customization at scale

- The trend toward experiential marketing and unique brand experiences is prompting businesses to invest in creative, personalized print collateral to stand out in a crowded marketplace

Restraint/Challenge

“Changing Consumer Preferences”

- Shifting consumer habits, including the move toward digital media and paperless workflows, are reducing demand for traditional print products and impacting overall print volumes

- For instance, companies such as Xerox and Ricoh are adapting by diversifying into digital services and managed print solutions, but face challenges in offsetting declines in core print revenues

- Environmental concerns and the push for sustainability are prompting some customers to reduce print consumption or seek digital alternatives, challenging print service providers to innovate and remain relevant

- The rapid pace of technological change requires ongoing investment in new equipment, software, and staff training, which can strain resources for smaller print businesses

- Intense competition and price sensitivity in the market are pressuring margins, making it difficult for providers to balance quality, customization, and cost-effectiveness

Printing Services Market Scope

The market is segmented on the basis of type, deployment mode, organization size, industry vertical, and channel type.

- By Type

On the basis of type, the printing services market is segmented into Print Management, Device Management, Discovery and Design, and Document Imaging. The Print Management segment accounted for the largest market revenue share in 2024, owing to its ability to centralize control over print infrastructure, optimize usage, reduce waste, and enhance document security. Organizations increasingly rely on print management solutions to reduce costs associated with hardware, consumables, and energy, especially within large office environments. The demand is also strengthened by the rising need for compliance with data protection standards and secure printing protocols.

The Discovery and Design segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by the increasing need for customized document workflows and integration with enterprise applications. Businesses across industries are leveraging design-centric solutions to create tailored print environments that align with evolving operational goals and branding standards, especially in marketing, education, and industrial documentation workflows.

- By Deployment Mode

On the basis of deployment mode, the market is segmented into Hybrid, Cloud, and On-Premises. The On-Premises segment held the largest share of 48.3% in 2024, primarily due to its prevalence in highly regulated industries such as government and finance, where organizations require full control over sensitive data and infrastructure. The stability, data residency assurance, and customization flexibility of on-premises systems make them the preferred choice for enterprises with stringent IT governance.

The Cloud segment is expected to witness the fastest growth through 2032, fueled by increasing demand for scalability, reduced IT overheads, and remote accessibility. Cloud-based printing services are particularly appealing to SMEs and geographically dispersed businesses, offering seamless updates, centralized control, and integration with digital workflows, thus supporting hybrid work models and sustainability goals.

- By Organization Size

On the basis of organization size, the market is divided into Large Enterprises, Medium Enterprises, and Small Enterprises. The Large Enterprises segment captured the largest market share in 2024, driven by complex operational requirements, higher document volumes, and established infrastructure budgets. These enterprises prioritize comprehensive print solutions that enhance productivity, ensure compliance, and support multivendor environments.

The Small Enterprises segment is expected to grow at the fastest pace from 2025 to 2032, as smaller organizations increasingly adopt managed print services to optimize resources, reduce operational costs, and access advanced document management capabilities without heavy capital investments. Cloud-based offerings and subscription models have made enterprise-grade solutions more accessible to this segment.

- By Industry Vertical

On the basis of vertical, the printing services market is segmented into BFSI, Government, Healthcare, Education, Industrial Manufacturing, Retail, Food and Beverages, IT and Telecom, and Others. The BFSI sector dominated the market in 2024 due to its heavy reliance on secure documentation, customer communication, compliance records, and financial reporting. The sector’s need for high-volume, accurate, and secure printing continues to drive demand for advanced print services.

The Healthcare sector is expected to grow at the highest CAGR from 2025 to 2032, propelled by the increasing digitization of patient records, compliance with health information regulations, and the demand for secure, high-speed print environments in hospitals, clinics, and laboratories. The critical role of printed documents in prescriptions, reports, and patient communication underlines the need for reliable, integrated printing services.

- By Channel Type

On the basis of channel type, the market is segmented into Printer/Copier Manufacturers, System Integrators/Resellers, and Independent Software Vendors (ISVs). The Printer/Copier Manufacturers segment led the market share in 2024, as OEMs increasingly bundle hardware with software and managed print services to provide end-to-end solutions. Their established customer base and global reach position them strongly to offer value-added services across industries.

The Independent Software Vendors (ISVs) segment is projected to grow at the fastest rate through 2032, driven by the surge in demand for customizable, platform-agnostic solutions that integrate with diverse IT environments. ISVs are addressing niche requirements such as analytics, mobile printing, and workflow automation, helping organizations modernize their print infrastructure while ensuring compatibility and flexibility.

Printing Services Market Regional Analysis

- North America dominated the printing services market with the largest revenue share of 49.26% in 2024, driven by high enterprise IT spending, early adoption of digital printing solutions, and widespread demand for managed print services

- Organizations across sectors such as BFSI, healthcare, and government are embracing cloud-based print infrastructure and workflow automation to reduce operational costs and improve efficiency

- The region’s strong ecosystem of solution providers, advanced digital infrastructure, and rising emphasis on document security and compliance contribute significantly to the market’s leadership position

U.S. Printing Services Market Insight

The U.S. printing services market captured the largest revenue share in 2024 within North America, fueled by the high demand for managed print services and document workflow optimization in large enterprises. The country’s strong presence of tech-savvy SMEs, coupled with growing interest in cloud deployment, is further driving adoption. Industries are increasingly investing in software-based solutions for real-time monitoring, secure printing, and analytics. Moreover, regulatory requirements related to document handling in finance and healthcare sectors continue to stimulate demand for secure and efficient printing services.

Europe Printing Services Market Insight

The Europe printing services market is projected to expand at a substantial CAGR during the forecast period, supported by the region’s strong emphasis on sustainability, data privacy, and automation. Regulatory frameworks such as GDPR are prompting businesses to adopt secure and traceable print environments. Countries across Western Europe are transitioning toward hybrid and cloud-based solutions to support remote and distributed workforces. The growing digital transformation in verticals such as manufacturing, education, and retail is further accelerating market adoption across the region.

U.K. Printing Services Market Insight

The U.K. printing services market is anticipated to grow at a noteworthy CAGR, driven by increased investment in digital printing technology and cloud-based document management systems. The country's focus on IT modernization across public and private sectors is fueling demand for scalable and secure print solutions. SMEs in particular are embracing subscription-based models that offer cost control and operational efficiency. The continued shift to hybrid work arrangements is also expanding the need for remote-access printing services and digital workflow integration.

Germany Printing Services Market Insight

The Germany printing services market is expected to expand at a considerable CAGR during the forecast period, propelled by the country's advanced industrial base and commitment to innovation. German enterprises prioritize automation, data security, and sustainable operations, making managed print services a strategic investment. The strong presence of manufacturers and ISVs enhances solution availability tailored to local needs. In addition, the integration of print services with ERP and enterprise content management (ECM) systems is becoming a key driver of market growth.

Asia-Pacific Printing Services Market Insight

The Asia-Pacific printing services market is poised to grow at the fastest CAGR from 2025 to 2032, driven by increasing digitalization, rising business formation, and expanding IT infrastructure in countries such as China, India, and Japan. Organizations in the region are rapidly transitioning from traditional printing to managed and cloud-based print services to support growing document demands. The cost-effectiveness, scalability, and automation of modern printing services are particularly appealing to SMEs and public institutions in APAC.

Japan Printing Services Market Insight

The Japan printing services market is gaining momentum due to its focus on operational efficiency, digital transformation, and aging workforce automation. Japanese enterprises are integrating printing services with digital workflows and adopting eco-friendly solutions to meet sustainability goals. The demand for secure, efficient, and remotely accessible printing capabilities is rising in sectors such as finance, education, and healthcare. Moreover, the country's strong technology landscape is facilitating innovation in print software and device management.

China Printing Services Market Insight

The China printing services market accounted for the largest revenue share in Asia Pacific in 2024, driven by rapid industrial growth, urbanization, and the proliferation of digitally enabled enterprises. The growing number of SMEs and their adoption of affordable, scalable print solutions are major contributors. Domestic solution providers are rapidly advancing managed print offerings tailored to local business needs. In addition, government-led digitalization initiatives and investments in education and healthcare infrastructure are boosting demand across verticals.

Printing Services Market Share

The printing services industry is primarily led by well-established companies, including:

- Xerox Corporation (U.S.)

- Ricoh (Japan)

- H.P. Development Company, L.P. (U.S.)

- Konica Minolta Business Solutions Australia Pty Ltd (Australia)

- Canon Inc. (Japan)

- Lexmark International, Inc. (U.S.)

- KYOCERA Document Solutions Inc. (Japan)

- SHARP CORPORATION (Japan)

- Toshiba America Business Solutions, Inc. (U.S.)

- ARC Document Solutions, LLC (U.A.E)

- Wipro (India)

- TOPPAN Inc. (Japan)

- Dai Nippon Printing Co., Ltd. (Japan)

- Bertelsmann SE & Co. KGaA (Germany)

- R.R. Donnelley & Sons Company (U.S.)

Latest Developments in Global Printing Services Market

- In June 2023, TC Transcontinental Printing, a division of Transcontinental Inc., invested USD 15 million in its book printing platform at the Transcontinental Beauceville (Interglobe) facility in Quebec. This move aims to meet the growing demand in the North American market, doubling hardcover binding capacity, and increasing overall production by approximately 15%

- In December 2022, Canva partnered with Creatively Holdings Inc. to support creative professionals by offering resources and opportunities. The collaboration combined Canva's design tools with Creatively's community and events, empowering creatives with essential resources to enhance their skills and careers

- In October 2022, Printful, Inc. collaborated with Pietra, an e-commerce platform, to provide over 60,000 creators with customizable branded products. This partnership enabled creators to access a global made-to-order market, utilize on-demand production, and bolster their e-commerce businesses, especially during the holiday shopping season, including Black Friday and Cyber Monday

- In June 2022, Toppan developed a responsive hologram capable of displaying text and images in bright light conditions. This innovation simplifies verification processes, particularly for individuals lacking specialized hardware or QR code scanners

- In May 2022, Siegwerk introduced SICURA Litho Pack ECO, a UV offset ink with over 40% renewable and vegetable-based components for non-food paper and board applications. This eco-friendly ink series offers a higher bio-renewable content than average UV inks, aligning with sustainability goals in the printing industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.