Global Probiotic Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

3.03 Billion

USD

5.04 Billion

2024

2032

USD

3.03 Billion

USD

5.04 Billion

2024

2032

| 2025 –2032 | |

| USD 3.03 Billion | |

| USD 5.04 Billion | |

|

|

|

|

Probiotic Ingredients Market Size

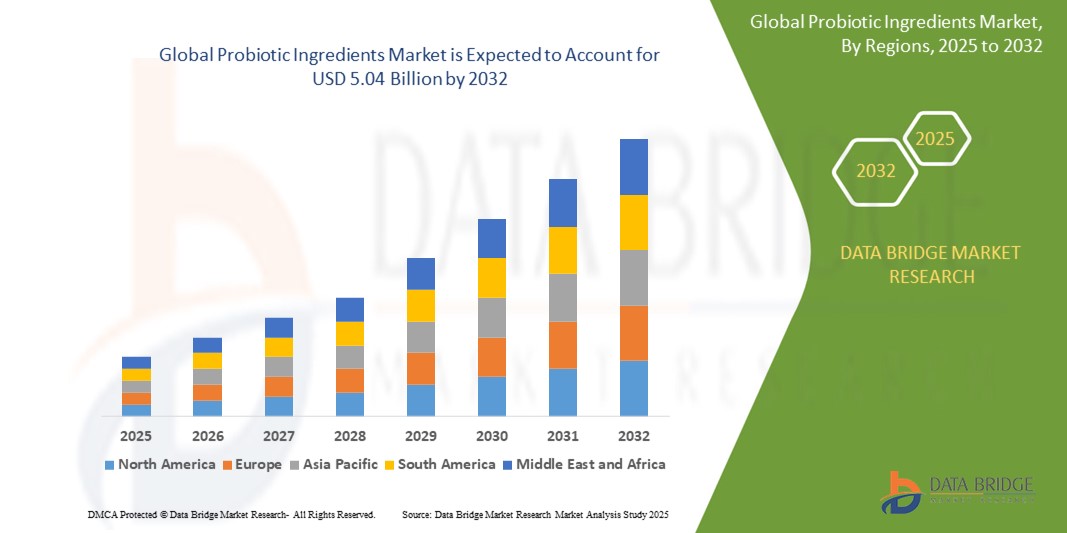

- The global probiotic ingredients market size was valued at USD 3.03 billion in 2024 and is expected to reach USD 5.04 billion by 2032, at a CAGR of 6.59% during the forecast period

- The market growth is primarily driven by increasing consumer awareness of gut health, rising demand for functional foods and beverages, and advancements in probiotic formulation technologies, enhancing their application in various industries

- Growing health consciousness and preference for natural and preventive healthcare solutions are positioning probiotic ingredients as a preferred choice for both human and animal nutrition, significantly contributing to market expansion

Probiotic Ingredients Market Analysis

- Probiotic ingredients, comprising live microorganisms such as bacteria and yeast, are increasingly integral to functional foods, pharmaceuticals, and animal nutrition due to their health benefits, including improved digestion, immunity, and overall wellness

- The surge in demand is fueled by growing consumer interest in health and wellness, the rising popularity of fortified foods, and the expanding use of probiotics in animal feed to enhance livestock health and productivity

- Europe dominated the probiotic ingredients market with the largest revenue share of 42.5% in 2024, driven by high consumer awareness, a strong tradition of dairy-based probiotic products, and the presence of leading industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by increasing urbanization, rising disposable incomes, and growing awareness of probiotic benefits in countries such as China, India, and Japan

- The functional food and beverages segment dominated the largest market revenue share of 45% in 2024, driven by increasing consumer demand for health-focused products such as probiotic-enriched yogurt, beverages, and snacks. Growing awareness of gut health and immunity benefits fuels this segment's dominance

Report Scope and Probiotic Ingredients Market Segmentation

|

Attributes |

Probiotic Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Probiotic Ingredients Market Trends

“Increasing Integration of Advanced Microbial Strains and Personalized Nutrition”

- The global probiotic ingredients market is experiencing a notable trend toward the integration of advanced microbial strains and personalized nutrition solutions

- Advanced microbial strains, such as next-generation probiotics (NGPs) such as Bacteroides and Akkermansia, enable targeted health benefits, including improved digestion, immune function, and mental wellness

- Personalized nutrition, driven by consumer demand for tailored health solutions, leverages microbiome research to develop probiotics that address individual health needs, such as managing specific gastrointestinal disorders or enhancing immunity

- For instance, companies are developing probiotic formulations that cater to unique consumer profiles, such as vegan-friendly or lactose-free options, and incorporating probiotics into innovative delivery formats such as gummies and beverages

- This trend enhances the appeal of probiotic ingredients, making them more relevant to health-conscious consumers and expanding their applications in functional foods and supplements

- Advanced analytics and research into microbial ecosystems are enabling the development of probiotic products that offer precise health benefits, such as reducing inflammation or supporting metabolic health

Probiotic Ingredients Market Dynamics

Driver

“Rising Demand for Functional Foods and Preventive Healthcare”

- Increasing consumer awareness of gut health and its role in overall well-being is a major driver for the global probiotic ingredients market

- Probiotic ingredients enhance health by supporting gut microbiome balance, improving digestion, boosting immunity, and potentially alleviating conditions such as irritable bowel syndrome (IBS) and lactose intolerance

- Government initiatives and health organizations, particularly in Europe with programs such as the Nutrition Society of Malaysia’s Probiotics Education Program (PEP), are promoting the adoption of probiotics for preventive healthcare

- The proliferation of e-commerce and direct-to-consumer (D2C) brands is enabling greater access to probiotic products, offering convenient purchasing options and rapid delivery

- Manufacturers are increasingly incorporating probiotics into functional foods and beverages, such as yogurt, kefir, and kombucha, to meet consumer demand for nutrient-dense, health-focused products

Restraint/Challenge

“High Production Costs and Regulatory Complexities”

- The high cost of developing and producing probiotic ingredients, including research, strain development, and advanced delivery systems such as encapsulation, poses a significant barrier to market growth, particularly in cost-sensitive emerging markets

- Integrating probiotics into food and beverage products requires sophisticated technologies to ensure stability and efficacy, which can increase production costs

- Data security and regulatory compliance are major challenges, as probiotic products must adhere to stringent health claim regulations and quality standards that vary across regions

- The fragmented regulatory landscape, particularly regarding health claims and product labeling, complicates operations for manufacturers and service providers operating internationally

- Lack of standardization in probiotic strains and dosages, combined with consumer skepticism about health benefits in some regions, can hinder market expansion, especially where awareness of probiotics is still developing

Probiotic Ingredients market Scope

The market is segmented on the basis of application, source, form, and end user.

- By Application

On the basis of application, the global probiotic ingredients market is segmented into functional food and beverages, pharmaceuticals, animal nutrition, and others. The functional food and beverages segment dominated the largest market revenue share of 45% in 2024, driven by increasing consumer demand for health-focused products such as probiotic-enriched yogurt, beverages, and snacks. Growing awareness of gut health and immunity benefits fuels this segment's dominance.

The pharmaceuticals segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by rising research into probiotic-based supplements and therapeutics for digestive and immune health. Advancements in targeted delivery systems and clinical validation of probiotic efficacy are accelerating adoption.

- By Source

On the basis of source, the global probiotic ingredients market is segmented into bacteria and yeast. The bacteria segment accounted for the largest market revenue share of 68% in 2024, attributed to the widespread use of bacterial strains such as Lactobacillus and Bifidobacterium in probiotic formulations. These strains are well-researched and widely accepted for their health benefits across food, supplements, and animal feed.

The yeast segment is anticipated to experience significant growth from 2025 to 2032, driven by increasing applications of yeast-based probiotics, such as Saccharomyces boulardii, in pharmaceuticals and animal nutrition. Their resilience in harsh environments and growing recognition in gut health solutions contribute to this growth.

- By Form

On the basis of form, the global probiotic ingredients market is segmented into dry and liquid forms. The dry form segment dominated with a market revenue share of 60% in 2024, owing to its longer shelf life, ease of storage, and widespread use in functional foods, supplements, and animal feed. Dry probiotics are cost-effective and suitable for large-scale production.

The liquid form segment is projected to witness the fastest growth rate of 18.5% from 2025 to 2032, fueled by rising consumer preference for ready-to-drink probiotic beverages and liquid supplements. Innovations in stabilization technologies are enhancing the viability of liquid probiotics, driving market expansion.

- By End User

On the basis of end user, the global probiotic ingredients market is segmented into human and animal. The human segment held the largest market revenue share of 78% in 2024, driven by high consumer demand for probiotic products to support digestive health, immunity, and overall wellness. The proliferation of probiotic-enriched foods and supplements in retail channels supports this dominance.

The animal segment is expected to exhibit rapid growth of 20.1% from 2025 to 2032, propelled by increasing adoption of probiotics in animal nutrition to enhance livestock health, improve feed efficiency, and reduce antibiotic use. Growing focus on sustainable animal husbandry practices further boosts this segment.

Probiotic Ingredients Market Regional Analysis

- Europe dominated the probiotic ingredients market with the largest revenue share of 42.5% in 2024, driven by high consumer awareness, a strong tradition of dairy-based probiotic products, and the presence of leading industry players

- Consumers prioritize probiotic ingredients for their benefits in gut health, immunity, and overall wellness, particularly in regions with high health consciousness and diverse dietary preferences

- Growth is supported by advancements in probiotic strains, such as bacteria and yeast-based formulations, alongside rising adoption in functional foods, pharmaceuticals, and animal nutrition

U.K. Probiotic Ingredients Market Insight

The U.K. market is expected to witness rapid growth, driven by rising consumer demand for functional foods and beverages that promote gut health and wellness. Increased awareness of probiotic benefits, coupled with a focus on preventive healthcare, encourages adoption. Evolving regulations on health claims and product labeling influence consumer preferences, balancing efficacy with compliance.

Germany Probiotic Ingredients Market Insight

Germany is anticipated to experience significant growth in the probiotic ingredients market, attributed to its advanced food and beverage sector and strong consumer focus on health and wellness. German consumers prefer scientifically backed probiotic products that enhance digestion and contribute to overall health. The integration of probiotics in premium functional foods and pharmaceutical applications supports sustained market growth.

U.S. Probiotic Ingredients Market Insight

The U.S. probiotic ingredients market is expected to witness significant growth, fueled strong demand for functional foods and dietary supplements. Growing consumer awareness of gut health and immunity benefits drives market expansion. The trend towards preventive healthcare and increasing incorporation of probiotics in beverages and snacks further boosts both OEM and aftermarket segments.

Asia-Pacific Probiotic Ingredients Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rising health awareness, increasing disposable incomes, and expanding food and beverage industries in countries such as China, India, and Japan. Growing demand for functional foods, dietary supplements, and animal nutrition products boosts market penetration. Government initiatives promoting health and wellness further encourage the adoption of probiotic ingredients.

Japan Probiotic Ingredients Market Insight

Japan’s probiotic ingredients market is expected to grow rapidly due to strong consumer preference for high-quality, scientifically validated probiotic products that enhance gut health and immunity. The presence of major food and beverage manufacturers and the integration of probiotics in functional foods and beverages accelerate market growth. Rising interest in personalized nutrition also contributes to market expansion.

China Probiotic Ingredients Market Insight

China holds the largest share of the Asia-Pacific probiotic ingredients market, propelled by rapid urbanization, increasing health consciousness, and rising demand for functional foods and dietary supplements. The country’s growing middle class and focus on preventive healthcare support the adoption of advanced probiotic ingredients. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Probiotic Ingredients Market Share

The probiotic ingredients industry is primarily led by well-established companies, including:

- DSM (Netherlands)

- DuPont (U.S.)

- Kerry (Ireland)

- Lallemand Inc. (Canada)

- Chr. Hansen Holding A/S (Denmark)

- Yakult Honsha Co., Ltd (Japan)

- Nestlé (Switzerland)

- MORINAGA & CO., LTD. (Japan)

- BioGaia AB (Sweden)

- Protexin (U.K.)

- DANONE (France)

- Deerland Enzymes, Inc. (U.S.)

- UAS Laboratories (U.S.)

- Probi (Sweden)

- glacbiotech Co., Ltd. (South Korea)

- Biena Snacks (U.S.)

- Advanced Enzyme Technologies (India)

- Orffa (Netherlands)

- Associated British Foods plc (U.K.)

What are the Recent Developments in Global Probiotic Ingredients Market?

- In April 2024, Swedish biotech leader Probi AB introduced a new line of clinically supported probiotic strains focused on improving digestive health. These strains were developed to address specific gastrointestinal conditions such as bloating, irregularity, and gut inflammation. Backed by rigorous scientific research and human clinical trials, the launch reinforces Probi’s commitment to advancing microbiome science and expanding its footprint in the global gut health segment. The new formulations are tailored for supplement brands seeking targeted digestive solutions, aligning with growing consumer demand for personalized wellness products

- In March 2024, Nestlé Health Science finalized its acquisition of Atrium Innovations, a leading manufacturer of dietary supplements and probiotics. This strategic move strengthens Nestlé’s position in the fast-growing nutritional health and wellness market, particularly in the areas of gut health, healthy aging, and metabolic support. Atrium’s portfolio—featuring brands such as Garden of Life and Pure Encapsulations—complements Nestlé’s existing offerings and expands its reach across consumer and practitioner channels. The acquisition reflects Nestlé’s commitment to science-backed solutions and its ambition to lead in personalized nutrition and supplement innovation

- In February 2024, Danone expanded its plant-based probiotic product line under its flagship yogurt brands, reinforcing its commitment to health-focused innovation and sustainability. This move responds to growing consumer demand for dairy-free and vegan-friendly options that still deliver the digestive and immune benefits of probiotics. The new offerings include plant-based yogurts and beverages enriched with clinically supported probiotic strains, designed to support gut health while aligning with flexitarian and lactose-intolerant lifestyles. Danone’s expansion reflects its broader strategy to lead in functional nutrition and adapt to evolving dietary trends across global markets

- In October 2023, Probi AB (Sweden) and Clasado Biosciences (UK) announced a groundbreaking collaboration at SupplySide West, unveiling two advanced synbiotic solutions. These formulations combine Bimuno GOS, a highly researched galactooligosaccharide prebiotic, with either Probi Defendum or Probi Digestis probiotic strains. The pairing of Bimuno GOS and Defendum demonstrates a synergistic effect, enhancing immune and digestive health, while the Digestis combination offers complementary mechanisms for gastrointestinal support. With over 340 scientific publications backing these ingredients, the launch marks a major step in making clinically supported synbiotics more accessible to formulators and consumers

- In March 2023, India-based startup Nutrazee expanded its vegan supplement portfolio with the launch of Probiotic Gummies for Digestive & Immune Health. Designed for both children and adults, these gummies feature a clinically validated strain of Bacillus Coagulans and prebiotic fiber to support gut microbiome balance, improve stool consistency, and enhance immune function. The formulation is shelf-stable, sugar-free, and crafted with plant-based ingredients, offering a convenient and tasty alternative to traditional probiotic formats. This launch highlights Nutrazee’s commitment to innovation in functional nutrition and accessible wellness solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Probiotic Ingredients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Probiotic Ingredients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Probiotic Ingredients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.