Global Probiotic Premixes Market

Market Size in USD Billion

CAGR :

%

USD

1.98 Billion

USD

3.66 Billion

2024

2032

USD

1.98 Billion

USD

3.66 Billion

2024

2032

| 2025 –2032 | |

| USD 1.98 Billion | |

| USD 3.66 Billion | |

|

|

|

|

Probiotic Premixes Market Size

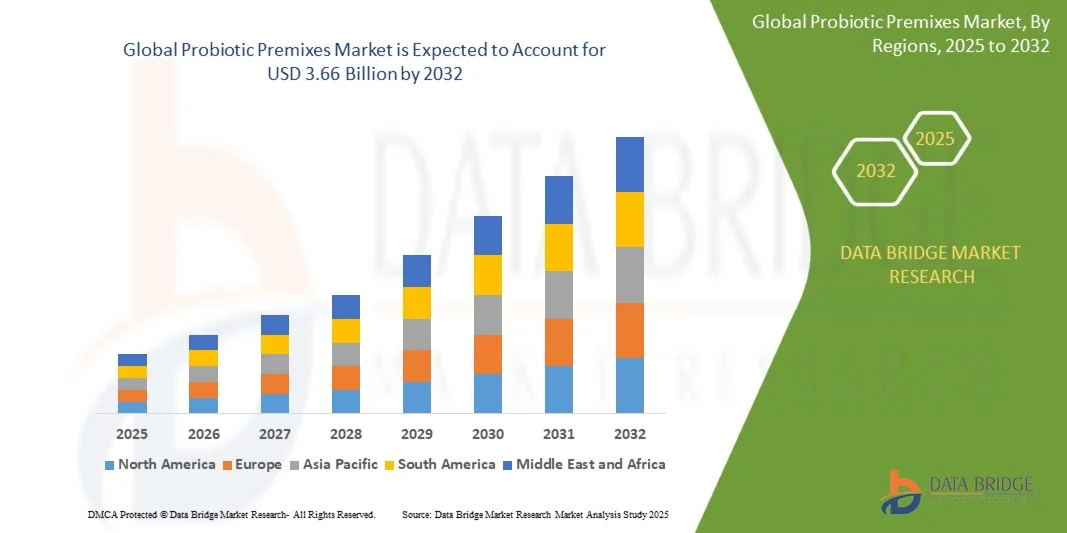

- The global probiotic premixes market size was valued at USD 1.98 billion in 2024 and is expected to reach USD 3.66 billion by 2032, at a CAGR of 8.00% during the forecast period

- The market growth is largely fueled by rising consumer awareness of gut health, immunity, and overall wellness, driving increased adoption of functional foods, dietary supplements, and feed fortified with probiotic premixes

- Furthermore, growing demand for personalized nutrition solutions and innovative probiotic formulations is encouraging manufacturers to expand their product portfolios, thereby significantly boosting market growth

Probiotic Premixes Market Analysis

- Probiotic premixes are ingredients containing beneficial bacteria or yeast that are incorporated into foods, beverages, dietary supplements, and animal feed to improve gut health and overall wellness. These premixes offer targeted health benefits, enhanced stability, and versatility for a range of applications

- The escalating demand for probiotic premixes is primarily fueled by increasing consumer health consciousness, the rising prevalence of digestive and metabolic disorders, and a growing preference for natural, preventive healthcare solutions

- North America dominated the probiotic premixes market with a share of 39.2% in 2024, due to rising consumer awareness about gut health, immunity, and preventive healthcare

- Asia-Pacific is expected to be the fastest growing region in the probiotic premixes market during the forecast period due to rapid urbanization, increasing disposable incomes, and rising health consciousness in countries such as China, Japan, and India

- Bacteria segment dominated the market with a market share of 65.8% in 2024, due to its established efficacy in improving gut health, immunity, and overall well-being. Common strains such as Lactobacillus and Bifidobacterium are widely studied and accepted, enhancing consumer confidence and manufacturer adoption. Bacterial probiotic premixes are highly versatile and can be incorporated into functional foods, beverages, and dietary supplements. The availability of diverse strains targeting specific health benefits further boosts demand. Manufacturers prefer bacterial premixes due to their stability, proven health claims, and compatibility with a wide range of products

Report Scope and Probiotic Premixes Market Segmentation

|

Attributes |

Probiotic Premixes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Probiotic Premixes Market Trends

“Increasing Demand for Personalized and Functional Nutrition”

- The probiotic premixes market is experiencing strong growth as consumers increasingly turn toward personalized and functional nutrition solutions that address specific health needs such as digestive wellness, immunity, and metabolic health. Probiotic premixes allow manufacturers to integrate targeted probiotic strains along with vitamins, minerals, and botanical extracts into foods, beverages, and supplements, offering customizable wellness benefits

- For instance, companies such as Kerry Group and Glanbia Nutritionals are developing probiotic premix solutions tailored for functional beverages, sports nutrition, and dietary supplements. Their efforts reflect the market trend of delivering precision nutrition through blends that support gut health and overall wellbeing

- The rising focus on functional nutrition aligns with consumer expectations for tailored solutions rather than generic supplementation. Probiotic premixes enable food and beverage companies to innovate with fortified yogurts, smoothies, nutritional powders, and even bakery products, expanding their reach across demographic segments from athletes to elderly consumers

- Personalized nutrition platforms powered by digital health tools and microbiome testing are helping consumers identify the most beneficial strains for their bodies. This has increased demand for premixes that can be flexibly formulated to match individualized needs and dietary trends such as plant-based or low-sugar nutrition

- The increasing demand for personalized and functional nutrition is positioning probiotic premixes as an essential ingredient in the future of dietary solutions. Their ability to combine multifunctional health benefits with convenience ensures strong long-term market expansion

Probiotic Premixes Market Dynamics

Driver

“Growing Consumer Awareness of Gut Health and Immunity”

- The growing awareness of gut health’s role in overall wellness, particularly in supporting immunity, is a key driver for the probiotic premixes market. Consumers are increasingly educated about the link between the gut microbiome, digestion, and immune defense, driving demand for everyday food and beverage fortification with probiotics

- For instance, Chr. Hansen and DuPont Nutrition & Biosciences (now part of IFF) have been supplying probiotic strains for incorporation into premixes targeting improved gut function and immunity. Their R&D-backed formulations highlight how companies are supporting consumer demand with clinically validated solutions

- Demand has especially surged after the pandemic, as consumers prioritize immune support through dietary interventions. Probiotic premixes provide a convenient means for brands to integrate beneficial bacteria into consumables, addressing health-conscious purchasing decisions worldwide

- This heightened consumer focus has led to rapid growth in categories such as dairy alternatives, functional drinks, and nutritional supplements, where premixes deliver consistency, scalability, and scientifically supported efficacy in new product development

- The long-term emphasis on digestive health and immunity positions probiotic premixes as a critical enabler of preventive and functional nutrition strategies globally

Restraint/Challenge

“Maintaining Stability and Shelf Life of Probiotic Formulations”

- Maintaining the stability and shelf life of probiotic formulations is a significant challenge for the probiotic premixes market. Live probiotic strains are highly sensitive to environmental conditions such as temperature, moisture, and pH, which can reduce their viability and limit product efficacy over time

- For instance, probiotic fortified beverages and snacks often face formulation hurdles because heat processing, storage, and distribution can compromise bacterial survival. Companies such as Kerry and IFF are investing in microencapsulation and protective carrier technologies to address this fundamental challenge

- The limited stability of probiotics complicates large-scale distribution, particularly in regions with inadequate cold-chain infrastructure. This creates barriers to market penetration in emerging economies despite rising consumer demand for gut health solutions

- Short shelf life also raises costs for manufacturers, who must invest in advanced stabilization technologies, specialized packaging, and rigorous quality control. This increases product pricing, potentially slowing broader adoption in mass consumer categories

- Innovations in encapsulation, freeze-drying, and strain-specific stabilization are essential to overcoming these challenges. Addressing stability and shelf life concerns will be critical to unlocking the full market potential of probiotic premixes and ensuring consistent efficacy for consumers globally

Probiotic Premixes Market Scope

The market is segmented on the basis of application, ingredients, and form.

• By Application

On the basis of application, the probiotic premixes market is segmented into functional food and beverages, dietary supplements, and feed. The functional food and beverages segment dominated the largest market revenue share in 2024, driven by growing consumer awareness about gut health and immunity. Rising demand for fortified yogurts, drinks, and other functional products has fueled adoption, as manufacturers increasingly integrate probiotic premixes to enhance product value. The segment benefits from extensive marketing campaigns emphasizing digestive health benefits and compatibility with various food matrices. Moreover, regulatory approvals for probiotics in food products across key markets have reinforced consumer trust. The segment also sees high traction due to the rising trend of clean-label and health-oriented food products.

The dietary supplements segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing consumer inclination toward preventive healthcare and self-directed nutrition. Supplements offer precise probiotic dosages and targeted health benefits, making them popular among health-conscious adults and aging populations. The growing popularity of capsules, powders, and sachets for personalized nutrition also contributes to rapid adoption. Market expansion is further supported by online retail channels and direct-to-consumer sales, providing easy accessibility. The segment is particularly driven by awareness campaigns highlighting immunity and gut microbiome health, which continue to influence purchasing decisions globally.

• By Ingredients

On the basis of ingredients, the probiotic premixes market is segmented into bacteria and yeast. The bacteria segment dominated the largest market revenue share of 65.8% in 2024, primarily due to its established efficacy in improving gut health, immunity, and overall well-being. Common strains such as Lactobacillus and Bifidobacterium are widely studied and accepted, enhancing consumer confidence and manufacturer adoption. Bacterial probiotic premixes are highly versatile and can be incorporated into functional foods, beverages, and dietary supplements. The availability of diverse strains targeting specific health benefits further boosts demand. Manufacturers prefer bacterial premixes due to their stability, proven health claims, and compatibility with a wide range of products.

The yeast segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by its rising use in specialized dietary supplements and animal feed applications. Yeast-based probiotics, such as Saccharomyces boulardii, are recognized for their digestive health benefits, including protection against gastrointestinal disorders. The segment is also gaining traction due to growing research highlighting yeast’s efficacy in enhancing nutrient absorption and immune support. Increasing interest in non-bacterial probiotic alternatives and their suitability for specific formulations further accelerates growth.

• By Form

On the basis of form, the probiotic premixes market is segmented into dry and liquid. The dry form segment dominated the largest market revenue share in 2024, owing to its long shelf life, stability under various storage conditions, and ease of handling in industrial applications. Dry premixes can be easily incorporated into powders, capsules, and fortified foods without compromising probiotic viability. The segment also benefits from simplified transportation and reduced cold chain dependency, making it favorable for both domestic and export markets. Manufacturers prefer dry forms for cost-effective production and consistent dosing. Consumer trust in the effectiveness of dry probiotic products further supports market dominance.

The liquid form segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing incorporation into beverages and functional drinks. Liquid probiotic premixes offer rapid solubility, better dispersion, and targeted delivery in beverages, making them highly appealing for health-conscious consumers. The segment also benefits from rising trends in ready-to-drink formulations and innovative product launches. Liquid forms are particularly advantageous for applications requiring immediate consumption and rapid action. Growing demand from the nutraceutical and functional drink industries continues to drive adoption and expansion.

Probiotic Premixes Market Regional Analysis

- North America dominated the probiotic premixes market with the largest revenue share of 39.2% in 2024, driven by rising consumer awareness about gut health, immunity, and preventive healthcare

- The region witnesses strong adoption of functional foods, beverages, and dietary supplements fortified with probiotic premixes due to high disposable incomes, advanced manufacturing infrastructure, and robust distribution networks

- Health-conscious consumers and the growing trend of personalized nutrition are further supporting market expansion, establishing probiotic premixes as a key ingredient across food, supplement, and feed applications

U.S. Probiotic Premixes Market Insight

The U.S. probiotic premixes market captured the largest revenue share in 2024 within North America, fueled by increasing demand for functional foods and dietary supplements. Rising consumer preference for digestive health products, immunity boosters, and personalized nutrition solutions is driving adoption. Online retail channels and the expansion of health-focused food chains are facilitating wider accessibility. Moreover, continuous innovation in product formulations and strain-specific probiotic premixes is encouraging manufacturers to introduce differentiated offerings, further propelling market growth.

Europe Probiotic Premixes Market Insight

The Europe probiotic premixes market is projected to expand at a significant CAGR during the forecast period, driven by growing health awareness, stringent food safety regulations, and increasing demand for fortified functional foods and supplements. Rising urbanization and higher consumer spending on health and wellness products are supporting adoption. The market is also witnessing growth across feed applications for livestock, driven by the need for improved animal health and productivity.

U.K. Probiotic Premixes Market Insight

The U.K. probiotic premixes market is anticipated to grow at a noteworthy CAGR, propelled by rising consumer interest in digestive health, immunity enhancement, and wellness trends. Increasing demand for functional beverages, dietary supplements, and fortified foods is driving growth. The availability of diverse probiotic strains and formulations, coupled with strong retail and e-commerce infrastructure, supports widespread market adoption.

Germany Probiotic Premixes Market Insight

The Germany probiotic premixes market is expected to expand at a considerable CAGR during the forecast period, fueled by high health awareness, regulatory support for functional foods, and the growing popularity of dietary supplements. Germany’s advanced food processing industry and focus on innovation encourage the incorporation of probiotic premixes in food and feed applications. The adoption of sustainable and clean-label products further promotes market growth.

Asia-Pacific Probiotic Premixes Market Insight

The Asia-Pacific probiotic premixes market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid urbanization, increasing disposable incomes, and rising health consciousness in countries such as China, Japan, and India. Growing demand for functional foods, dietary supplements, and fortified animal feed is contributing to market expansion. Government initiatives promoting nutrition and health, combined with expanding manufacturing capacities and increasing availability of probiotic products, are driving adoption across residential, commercial, and livestock applications

Japan Probiotic Premixes Market Insight

The Japan probiotic premixes market is gaining momentum due to high consumer awareness about digestive health, a strong preference for functional foods, and an aging population seeking immunity and wellness solutions. The country’s advanced food technology infrastructure and focus on R&D encourage innovation in probiotic formulations. Demand is also fueled by convenience-focused product formats and integration into beverages and dietary supplements.

China Probiotic Premixes Market Insight

The China probiotic premixes market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to a rapidly growing middle class, increasing health consciousness, and rising demand for functional foods and dietary supplements. Urbanization, expanding retail channels, and government initiatives promoting nutrition awareness are key growth drivers. Domestic manufacturers and competitive pricing further support widespread adoption in both human and animal health applications.

Probiotic Premixes Market Share

The probiotic premixes industry is primarily led by well-established companies, including:

- Tate & Lyle (U.K.)

- Cargill, Incorporated (U.S.)

- Archer Daniels Midland Company (U.S.)

- Ingredion Incorporated (U.S.)

- Roquette Frères (France)

- The Nutra Sweet Company (U.S.)

- Ajinomoto Co., Inc. (Japan)

- JK Sucralose Inc. (China)

- Dow (U.S.)

- DuPont (U.S.)

- Pure Circle Limited (U.S.)

- Glanbia plc (Ireland)

- Buddy Nutrition (U.S.)

- SternVitamin GmbH & Co. KG (Germany)

- Wright Enrichment Inc. (U.S.)

- Fenchem (China)

- Royal Agrifirm Group (Netherlands)

- Pristinepremixes (India)

- Jubilant life sciences Pvt Ltd (India)

Latest Developments in Probiotic Premixes Market

- In June 2024, Israeli agrifoodtech startup Wonder Veggies announced plans to introduce the “world’s first probiotic fresh produce” in collaboration with partners next year. This innovation leverages technology that allows probiotic bacteria to penetrate plant tissue and function as endophytes, providing live beneficial microbes directly through fresh produce. This development could significantly transform the functional food and agriculture sectors by expanding probiotic delivery beyond supplements and fortified foods, potentially creating a new market segment for microbiome-enhanced fresh produce and influencing consumer adoption of everyday gut health solutions

- In June 2024, Bengaluru-based gut health startup MicrobioTx launched two innovative offerings on World Microbiome Day: Personal Probiotics, India’s first personalized prebiotic and probiotic blend based on individual gut profiles, and GutChat, a free gut health-focused chatbot. These initiatives advance the personalization and digitalization of microbiome wellness, enabling consumers to access tailored gut health solutions and information. By merging technology with probiotic science, MicrobioTx is fostering increased awareness, adoption, and engagement in the gut health market, particularly within the fast-growing Indian nutraceutical and wellness sector

- In May 2024, DSM-Firmenich and Lallemand Health Solutions announced a strategic partnership to introduce synergistic synbiotic solutions for early life nutrition. By combining probiotics and prebiotics in complementary formulations, this collaboration addresses growing demand for targeted gut health interventions for infants and young children. This initiative is expected to strengthen the early life nutrition segment within the probiotic market, offering enhanced functional benefits, increasing product differentiation, and driving market growth in both dietary supplements and specialized nutritional products

- In May 2023, Roquette launched its new excipient, PEARLITOL ProTec, a plant-based co-processed blend of mannitol and maize starch, designed to protect and stabilize moisture-sensitive probiotics. By enhancing shelf life, consistency, and compatibility with consumer-friendly dosage formats, this innovation supports broader adoption of probiotic supplements across nutraceuticals and functional foods. The development reinforces Roquette’s role as a key enabler of more stable, versatile, and consumer-oriented probiotic products, potentially expanding the market for high-quality, shelf-stable probiotic formulations globally

- In February 2023, Evonik introduced PhytriCare IM, a plant-based product containing selected flavonoid-rich extracts aimed at promoting health in sows, laying hens, and dairy cows. With anti-inflammatory properties, the product targets the livestock and animal feed sector, supporting animal wellness and productivity. By integrating plant-based bioactive ingredients into animal nutrition, this launch addresses growing market demand for natural, functional solutions in livestock management, enhancing the appeal of probiotic and plant extract-based premixes in the agricultural market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Probiotic Premixes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Probiotic Premixes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Probiotic Premixes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.