Global Probiotic Yeast For Animal Feed Market

Market Size in USD Billion

CAGR :

%

USD

5.18 Billion

USD

7.82 Billion

2024

2032

USD

5.18 Billion

USD

7.82 Billion

2024

2032

| 2025 –2032 | |

| USD 5.18 Billion | |

| USD 7.82 Billion | |

|

|

|

|

Probiotic Yeast for Animal Feed Market Size

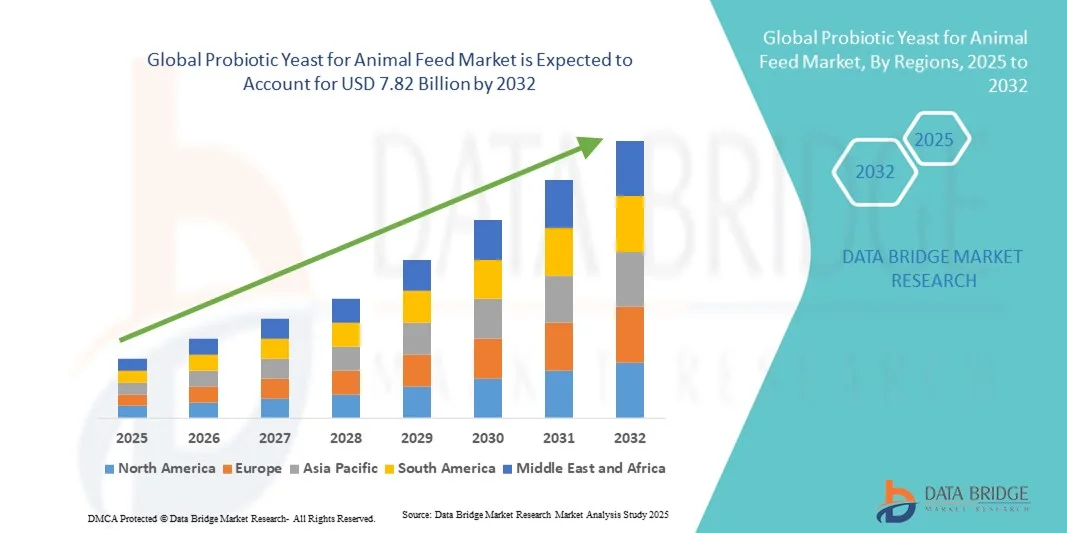

- The global probiotic yeast for animal feed market size was valued at USD 5.18 billion in 2024 and is expected to reach USD 7.82 billion by 2032, at a CAGR of 5.30% during the forecast period

- The market growth is largely fuelled by rising demand for natural growth promoters and antibiotic alternatives in livestock such as poultry, swine, and ruminants

- In addition, increasing awareness of animal gut health and productivity, technological advances in strain development and delivery, and growing adoption in intensive farming systems are supporting market expansion

Probiotic Yeast for Animal Feed Market Analysis

- Market dynamics are driven by a shift toward non-antibiotic feed solutions and a focus on improving feed conversion and animal welfare

- Key opportunities exist in product innovation such as strain optimization, encapsulation for improved stability, and tailored formulations for specific animal classes

- Europe dominated the probiotic yeast for animal feed market with the largest revenue share of 37.84% in 2024, driven by strict regulations on antibiotic use, a strong focus on animal welfare, and the widespread adoption of sustainable feed solutions across livestock sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global probiotic yeast for animal feed market, driven by expanding livestock populations, increasing investment in feed quality improvement, and supportive government initiatives promoting sustainable animal nutrition

- The Saccharomyces spp. segment held the largest market revenue share in 2024, driven by its proven efficacy in enhancing gut health, improving nutrient absorption, and promoting overall animal performance. Its robust tolerance to feed processing conditions and stability under various environmental factors make it the preferred choice across poultry, swine, and ruminant feed formulations

Report Scope and Probiotic Yeast for Animal Feed Market Segmentation

|

Attributes |

Probiotic Yeast for Animal Feed Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Associated British Foods plc (U.K.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Probiotic Yeast for Animal Feed Market Trends

Rising Focus On Gut Health And Feed Efficiency In Livestock

- The increasing emphasis on animal gut health and nutrient absorption efficiency is transforming the probiotic yeast market for animal feed. Livestock producers are adopting yeast-based probiotics to improve digestion, enhance feed utilization, and promote growth without relying on antibiotics. This shift aligns with global efforts to ensure sustainable livestock production and animal welfare, with growing government and private investments supporting advanced feed technologies

- The growing recognition of yeast’s ability to modulate the gut microbiota and boost immunity is driving its inclusion in feed formulations for poultry, swine, and ruminants. These functional benefits lead to better performance outcomes, higher feed conversion ratios, and reduced disease incidence in herds and flocks. Furthermore, the inclusion of yeast aids in stabilizing rumen pH and improving fiber digestion, which enhances overall productivity in ruminant livestock

- Rising consumer demand for antibiotic-free meat and dairy products is further strengthening the case for probiotic yeast adoption. Producers are turning toward yeast strains such as Saccharomyces cerevisiae to achieve consistent performance while maintaining compliance with food safety and residue-free standards. As consumer awareness of animal welfare and food transparency grows, yeast-based additives are becoming integral to sustainable animal nutrition programs

- For instance, in 2023, several European poultry producers reported up to a 6% improvement in feed conversion efficiency after incorporating yeast-based probiotics into their feed formulations. The move was also linked to reduced antibiotic usage and improved flock uniformity, enhancing both productivity and profitability. Similar adoption trends are observed in the U.S. and Asia-Pacific, where integrated farms are transitioning to yeast-based solutions for long-term health and performance gains

- While the adoption of probiotic yeast is accelerating, success depends on continued research into strain optimization, improved delivery mechanisms, and farmer education. Companies focusing on localized production and cost-effective formulations will be best positioned to capture this expanding market. Future innovation will also rely on integrating digital monitoring tools to track feed efficiency and animal response in real time

Probiotic Yeast for Animal Feed Market Dynamics

Driver

Increasing Shift Toward Antibiotic Alternatives In Livestock Nutrition

- The global movement to reduce antibiotic usage in animal production due to antimicrobial resistance concerns is driving the adoption of probiotic yeast as a natural alternative. Governments, regulatory bodies, and industry associations are promoting yeast-based feed additives for improving animal health and productivity without contributing to resistance issues. This aligns with policies aimed at sustainable farming and export compliance, creating strong momentum for biological feed ingredients

- Livestock producers are realizing the benefits of probiotic yeast in maintaining gut health, stimulating the immune system, and enhancing feed digestibility. This growing acceptance is evident across poultry, dairy, and swine sectors, where producers seek safe, sustainable, and high-performing solutions. The natural ability of yeast to enhance microbial balance and nutrient uptake further strengthens its appeal as a multifunctional feed additive

- In addition, global initiatives to promote residue-free animal products are accelerating yeast probiotic adoption. The inclusion of yeast-based feed additives ensures compliance with export regulations and enhances consumer confidence in meat, milk, and egg quality. Many international certification programs now encourage probiotic use, supporting traceability and premium positioning in global food markets

- For instance, in 2023, the U.S. Food and Drug Administration reinforced antibiotic usage restrictions in feed, resulting in a significant rise in the utilization of probiotic yeast among poultry integrators and dairy cooperatives across North America. Similar regulatory actions in the EU and Asia are further encouraging the shift toward yeast-based alternatives in commercial livestock operations

- While regulatory support and health awareness are propelling demand, the market’s long-term growth will rely on demonstrating consistent performance benefits and ensuring cost-effectiveness for widespread adoption among small and mid-sized producers. Continued collaborations between feed manufacturers, research institutions, and government agencies will be essential to sustain this growth trajectory

Restraint/Challenge

High Product Cost And Lack Of Awareness Among Small-Scale Farmers

- Despite its proven benefits, the higher cost of probiotic yeast compared to conventional feed additives remains a major restraint, particularly in developing regions. Smallholder farmers often perceive these products as expensive, limiting their inclusion in daily feed programs despite long-term benefits. The limited availability of cost-efficient formulations further exacerbates the price gap between traditional and probiotic-based additives

- Limited awareness about probiotic yeast’s functional advantages, dosage optimization, and compatibility with existing feed formulations restricts adoption in rural and low-income farming communities. Many producers continue to rely on traditional feed practices due to insufficient education and technical support. This lack of knowledge leads to underutilization of yeast products, even in regions where they are readily available

- In several emerging markets, inadequate distribution channels and storage infrastructure hinder timely access to high-quality yeast-based products. Variations in product stability and lack of local supply chains further reduce market penetration. Seasonal storage challenges and poor cold-chain logistics can also impact product quality, reducing farmer trust in consistent results

- For instance, in 2023, livestock cooperatives in Southeast Asia reported that less than 25% of small-scale dairy farmers regularly used probiotic yeast due to cost sensitivity and lack of technical assistance from feed suppliers. The gap between innovation and field-level awareness remains a key challenge for expanding market reach across developing regions

- While innovations in fermentation technology and economies of scale are expected to reduce costs, addressing awareness gaps and improving product accessibility will be critical to unlocking the full potential of probiotic yeast in animal feed applications. Manufacturers must prioritize training programs, micro-distribution networks, and localized technical support to ensure long-term adoption

Probiotic Yeast for Animal Feed Market Scope

The market is segmented on the basis of genus and livestock.

- By Genus

On the basis of genus, the probiotic yeast for animal feed market is segmented into Saccharomyces spp., Kluyveromyces spp., and Others. The Saccharomyces spp. segment held the largest market revenue share in 2024, driven by its proven efficacy in enhancing gut health, improving nutrient absorption, and promoting overall animal performance. Its robust tolerance to feed processing conditions and stability under various environmental factors make it the preferred choice across poultry, swine, and ruminant feed formulations.

The Kluyveromyces spp. segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to its unique ability to produce beneficial enzymes and bioactive compounds that support digestion and immune modulation. Increasing research on strain-specific benefits and its integration into specialized feed blends for improved productivity are expected to fuel segment expansion over the forecast period.

- By Livestock

On the basis of livestock, the probiotic yeast for animal feed market is segmented into Ruminants, Swine, Poultry, Aquatic Animals, Pets, and Equine. The Ruminants segment accounted for the largest market share in 2024, driven by the extensive use of yeast-based feed additives to enhance rumen fermentation, improve fiber digestion, and stabilize rumen pH. The demand for high-quality dairy and beef products further supports the adoption of yeast probiotics in cattle nutrition.

The Poultry segment is projected to record the fastest growth during 2025–2032, owing to increasing adoption of probiotic yeast as a natural growth promoter and immune enhancer. Rising concerns over antibiotic residues in poultry products and the growing preference for sustainable, antibiotic-free production systems are driving rapid uptake of yeast-based feed supplements in the global poultry industry.

Probiotic Yeast for Animal Feed Market Regional Analysis

- Europe dominated the probiotic yeast for animal feed market with the largest revenue share of 37.84% in 2024, driven by strict regulations on antibiotic use, a strong focus on animal welfare, and the widespread adoption of sustainable feed solutions across livestock sectors

- Livestock producers across the region are increasingly incorporating yeast-based probiotics to enhance nutrient absorption, improve gut health, and support optimal growth in poultry, ruminants, and swine

- The demand for probiotic yeast is further supported by consumer preference for antibiotic-free animal products, rising feed innovation, and growing collaborations between biotechnology companies and feed manufacturers to develop region-specific formulations

Germany Probiotic Yeast for Animal Feed Market Insight

The Germany probiotic yeast for animal feed market captured the largest revenue share in 2024 within Europe, supported by the country’s advanced livestock management systems and high awareness of animal nutrition quality. German feed producers are increasingly investing in yeast-based formulations to reduce antibiotic dependency while maintaining animal productivity and health. The country’s strong regulatory framework, focus on sustainable agriculture, and innovation-driven feed industry are major factors accelerating market expansion.

U.K. Probiotic Yeast for Animal Feed Market Insight

The U.K. probiotic yeast for animal feed market is projected to grow steadily from 2025 to 2032, propelled by the growing trend of sustainable livestock farming and increasing investments in animal health innovation. The rising consumer preference for traceable and residue-free animal products is prompting feed producers to integrate probiotic yeast into feed formulations. Furthermore, the U.K.’s expanding research initiatives and policy support for environmentally responsible farming practices are creating a favorable landscape for market development.

Asia-Pacific Probiotic Yeast for Animal Feed Market Insight

The Asia-Pacific probiotic yeast for animal feed market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by rising livestock production, growing awareness of feed efficiency, and a shift toward natural feed additives. Expanding feed manufacturing capacity in countries such as China, India, and Japan, combined with increasing government focus on reducing antibiotic usage, is supporting rapid market adoption. The region’s growing middle-class population and rising consumption of animal-derived products are further driving probiotic yeast demand.

China Probiotic Yeast for Animal Feed Market Insight

The China probiotic yeast for animal feed market accounted for the largest revenue share in 2024 within Asia-Pacific, owing to the country’s massive livestock base and ongoing efforts to modernize feed production. Government restrictions on antibiotic growth promoters and the expansion of domestic feed manufacturing are accelerating the adoption of yeast-based probiotics. The increasing availability of affordable yeast products and strong R&D investments by local companies are also reinforcing market growth across the country.

Japan Probiotic Yeast for Animal Feed Market Insight

The Japan probiotic yeast for animal feed market is expected to witness steady growth from 2025 to 2032, driven by the country’s advanced livestock management systems, focus on animal welfare, and high preference for premium-quality animal products. Japanese livestock producers are increasingly adopting yeast-based probiotics to enhance feed conversion efficiency, improve gut health, and reduce antibiotic dependence. In addition, strong collaboration between research institutions and feed manufacturers is fostering innovation in developing precision probiotic formulations suited to Japan’s specialized livestock sectors, including dairy and poultry.

North America Probiotic Yeast for Animal Feed Market Insight

The North America probiotic yeast for animal feed market is expected to witness steady growth from 2025 to 2032, driven by the region’s well-established animal feed industry and growing awareness of natural growth-promoting additives. The U.S. and Canada are at the forefront of probiotic yeast adoption, encouraged by stringent food safety standards and technological innovation in feed formulation. Rising investments in livestock productivity and the development of specialized yeast strains tailored to different animal categories are expected to boost regional market expansion.

U.S. Probiotic Yeast for Animal Feed Market Insight

The U.S. probiotic yeast for animal feed market is expected to witness steady growth from 2025 to 2032, supported by widespread adoption of sustainable and antibiotic-free feed practices. The market is driven by increasing awareness among producers of the benefits of yeast probiotics in improving animal performance, immunity, and nutrient utilization. Moreover, strong regulatory frameworks encouraging the use of natural additives, coupled with rising investments by feed manufacturers and biotechnology firms in product development, are further propelling market growth. The expanding demand for high-quality meat and dairy products continues to solidify the U.S. as a leading market for probiotic yeast applications.

Probiotic Yeast for Animal Feed Market Share

The Probiotic Yeast for Animal Feed industry is primarily led by well-established companies, including:

• Associated British Foods plc (U.K.)

• Alltech (U.S.)

• Cargill, Incorporated (U.S.)

• Lesaffre (France)

• Lallemand Inc. (Canada)

• Novus International, Inc. (U.S.)

• AngelYeast Co., Ltd. (China)

• Chr. Hansen Holding A/S (Denmark)

• Kerry Inc. (Ireland)

• Kemin Industries, Inc. (U.S.)

• Titan Biotech (India)

• BioFeed (Denmark)

• Prosol S.p.A. (Italy)

• BIOMIN (Austria)

• Leiber GmbH (Germany)

• Shanghai Genon Biotech Co., Ltd. (China)

• Ohly (U.K.)

• Rajvi Enterprise (India)

• Hexon Laboratories Private Limited (India)

• Prions Bio Tech (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.