Global Procedure Trays Market

Market Size in USD Billion

CAGR :

%

USD

13.35 Billion

USD

27.72 Billion

2024

2032

USD

13.35 Billion

USD

27.72 Billion

2024

2032

| 2025 –2032 | |

| USD 13.35 Billion | |

| USD 27.72 Billion | |

|

|

|

|

Procedure Trays Market Size

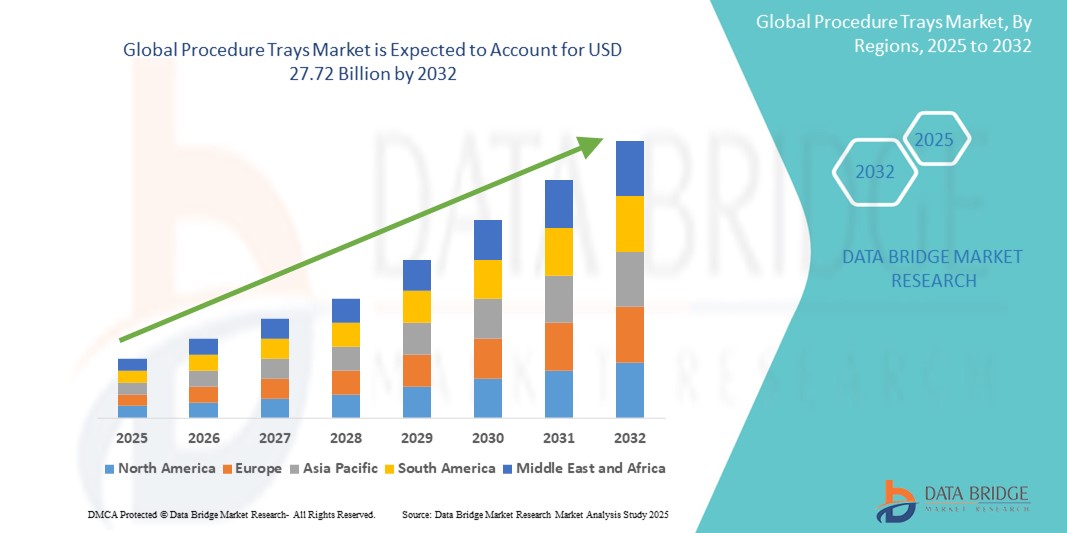

- The global procedure trays market size was valued at USD 13.35 billion in 2024 and is expected to reach USD 27.72 billion by 2032, at a CAGR of 9.56% during the forecast period

- The market growth is primarily driven by the increasing demand for customized and pre-packaged surgical kits across hospitals and ambulatory surgical centers, aiming to improve procedural efficiency and reduce preparation time

- In addition, rising surgical volumes, growing emphasis on infection control, and cost-effectiveness in healthcare delivery are prompting broader adoption of procedure trays. These factors collectively contribute to the market's expansion by streamlining operations and enhancing clinical outcomes

Procedure Trays Market Analysis

- Procedure trays, which are pre-packaged sets of surgical instruments and supplies tailored for specific procedures, play a crucial role in improving workflow efficiency and maintaining sterility in various clinical environments including hospitals, specialty clinics, and ambulatory surgical centers

- The rising demand for streamlined surgical processes, coupled with the growing need to reduce setup time and surgical site infections, is driving the adoption of customized procedure trays across healthcare settings globally

- North America dominated the procedure trays market with the largest revenue share of 39.2% in 2024, supported by high surgical volumes, stringent infection control regulations, and increased adoption of cost-effective, ready-to-use kits by healthcare providers

- Asia-Pacific is projected to be the fastest growing region during the forecast period, fueled by expanding healthcare infrastructure, increasing number of surgeries, and a rising focus on patient safety and operational efficiency

- Operating room procedure tray segment dominated the procedure trays market with a market share of 39.4% in 2024, driven by its frequent use in a wide range of surgical procedures and the need for efficient, sterile, and time-saving instrument preparation

Report Scope and Procedure Trays Market Segmentation

|

Attributes |

Procedure Trays Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Procedure Trays Market Trends

“Rising Demand for Customization and Sterility Compliance”

- A significant and accelerating trend in the global procedure trays market is the increasing demand for customized, pre-configured trays tailored to specific surgical procedures and healthcare settings. This trend is enhancing procedural efficiency, reducing setup time, and improving infection control outcomes

- For instance, companies such as Cardinal Health and Medline offer advanced customization platforms allowing hospitals to build procedure trays with exact surgical tools, dressings, and disposables required for specialties such as cardiovascular, orthopedic, and ophthalmic procedures

- Customization also supports compliance with stringent sterility standards set by regulatory bodies such as the FDA and EMA, helping reduce surgical site infections and improve patient outcomes

- In addition, digital solutions are being adopted to streamline inventory tracking and tray configuration processes, enabling real-time updates and enhanced supply chain management

- The integration of automation and predictive analytics in tray production is facilitating greater precision and cost control, benefiting both manufacturers and end users

- This trend toward more tailored, sterile, and regulation-compliant tray solutions is reshaping expectations in surgical settings. Consequently, companies are innovating with modular tray formats and user-specific configurations to meet the growing demand for efficient, high-quality care delivery in hospitals and ambulatory surgical centers

- The demand for procedure trays that provide greater operational flexibility, sterility assurance, and clinical efficiency is growing rapidly across both developed and emerging markets, as healthcare providers prioritize workflow optimization and infection prevention

Procedure Trays Market Dynamics

Driver

“Increased Surgical Volume and Focus on Operational Efficiency”

- The growing number of surgeries globally, driven by rising chronic diseases, aging populations, and expanding healthcare access, is significantly boosting demand for procedure trays

- For instance, hospitals and ambulatory surgical centers are adopting pre-packaged trays to reduce instrument preparation time, standardize surgical protocols, and improve turnaround efficiency in operating rooms

- Procedure trays streamline resource use, support staff productivity, and enhance surgical safety by ensuring that all necessary instruments are sterile and ready, which is especially critical in high-volume procedures such as orthopedic or cardiovascular surgeries

- Furthermore, the shift toward outpatient care and minimally invasive procedures increases demand for compact and specialty-specific trays, which improve convenience and reduce costs

- These efficiency-focused benefits are making procedure trays essential components in modern healthcare systems, aligning with broader trends toward value-based care and improved clinical outcomes

Restraint/Challenge

“Regulatory Hurdles and High Initial Customization Costs”

- Stringent regulatory requirements and high upfront costs for tray customization present significant challenges in the global procedure trays market

- Each custom tray configuration must meet detailed regulatory standards related to sterility, labeling, and quality assurance, which can delay product approval and limit flexibility for rapid deployment

- For instance, variations in regulatory protocols across regions create complexity for manufacturers, increasing compliance costs and slowing market expansion

- In addition, the initial investment required for tray design, testing, and production may deter smaller clinics or facilities with limited budgets, particularly in price-sensitive regions

- Inventory management difficulties, such as obsolescence due to protocol changes or misaligned demand forecasts, can also lead to resource inefficiencies and increased operational costs

- To overcome these hurdles, leading manufacturers are developing modular tray solutions, investing in automation, and providing digital configuration tools that enhance customization while reducing regulatory delays and overall production costs

Procedure Trays Market Scope

The market is segmented on the basis of product, packaging, and end user.

- By Product

On the basis of product, the global procedure trays market is segmented into angiography procedure tray, ophthalmic procedure tray, operating room procedure tray, anaesthesia room procedure tray, and others. The operating room procedure tray segment dominated the market with the largest revenue share of 39.4% in 2024, driven by its widespread use in high-volume surgical procedures such as orthopedic, cardiovascular, and general surgeries. The demand for standardized, pre-configured trays in operating rooms is rising due to the need for reduced setup times, enhanced sterility, and improved procedural efficiency.

The ophthalmic procedure tray segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by the increasing number of eye surgeries globally, particularly cataract and LASIK procedures. These trays offer tailored configurations suited to delicate ophthalmic instruments and contribute to better infection control and time savings in outpatient surgical settings.

- By Packaging

On the basis of packaging, the global procedure trays market is segmented into box, mold, and wrap. The Box packaging segment held the largest revenue share of 45.2% in 2024, owing to its robust protection during transport and storage, stackability, and ease of access during surgical preparation. Box packaging is widely adopted across hospitals and surgical centers for high-volume tray usage.

The wrap segment is expected to experience the fastest growth during the forecast period, driven by its lightweight, cost-effective nature and widespread usage in sterile barrier systems. Wrap packaging is especially favored in developing regions and in facilities focusing on cost containment without compromising sterility.

- By End User

On the basis of end user, the global procedure trays market is segmented into hospitals and clinics, ambulatory surgical centers, and other healthcare facilities. The hospitals and clinics segment dominated the market with the largest revenue share of 61.3% in 2024, primarily due to the high volume of surgeries performed, availability of advanced infrastructure, and increasing emphasis on surgical workflow optimization. These facilities benefit significantly from customized trays that reduce operating room turnaround times and improve procedural consistency.

The ambulatory surgical centers segment is projected to grow at the highest CAGR from 2025 to 2032, driven by the global shift toward minimally invasive, outpatient surgeries. ASCs are increasingly adopting procedure trays to enhance efficiency, maintain sterility, and reduce costs while delivering high-quality surgical care in a time-sensitive environment.

Procedure Trays Market Regional Analysis

- North America dominated the procedure trays market with the largest revenue share of 39.2% in 2024, supported by high surgical volumes, stringent infection control regulations, and increased adoption of cost-effective, ready-to-use kits by healthcare providers

- Healthcare providers in the region prioritize efficiency, cost-effectiveness, and safety, making customized procedure trays an essential solution for streamlining surgical workflows and reducing preparation time

- This widespread adoption is further supported by the presence of major industry players, increased demand for minimally invasive procedures, and a growing focus on patient-centric care, solidifying procedure trays as a critical component in hospital and ambulatory care environments

U.S. Procedure Trays Market Insight

The U.S. procedure trays market captured the largest revenue share of 79.6% in 2024 within North America, driven by the country’s high surgical volumes, advanced healthcare infrastructure, and growing preference for customized sterile solutions. Hospitals and ambulatory surgical centers are increasingly adopting pre-packaged trays to enhance procedural efficiency and meet strict infection control regulations. The presence of major manufacturers and growing investments in outpatient care further support the expansion of the market across multiple specialties.

Europe Procedure Trays Market Insight

The Europe procedure trays market is projected to expand at a substantial CAGR throughout the forecast period, fueled by rising demand for standardized surgical practices and growing awareness about infection prevention. Stringent regulatory requirements around sterilization and reusable instruments are prompting a shift towards single-use, procedure-specific trays. Adoption is particularly strong in surgical centers and specialized clinics, with increasing use in orthopedic, cardiovascular, and ophthalmic procedures.

U.K. Procedure Trays Market Insight

The U.K. procedure trays market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the country’s strong public and private healthcare systems. Rising surgical procedures, especially in ophthalmology and day-case surgeries, are driving the demand for efficient, ready-to-use tray solutions. In addition, emphasis on reducing hospital-acquired infections and surgical delays is encouraging hospitals to invest in customizable, sterile procedure trays.

Germany Procedure Trays Market Insight

The Germany procedure trays market is expected to expand at a considerable CAGR, propelled by its technologically advanced healthcare facilities and focus on operational efficiency. The demand for high-quality, customized surgical trays is rising across hospitals and specialty clinics, with growing preference for sustainable packaging and compliance with EU sterility standards. Digital tracking and automated tray configuration solutions are also gaining traction among German healthcare providers.

Asia-Pacific Procedure Trays Market Insight

The Asia-Pacific procedure trays market is poised to grow at the fastest CAGR of 23.1% during the forecast period of 2025 to 2032, driven by rapid healthcare infrastructure development, increasing surgical volumes, and rising adoption of cost-efficient, pre-packed tray solutions. Countries such as China, India, and Japan are leading the trend, supported by expanding medical tourism, improved healthcare access, and a growing focus on patient safety.

Japan Procedure Trays Market Insight

The Japan procedure trays market is gaining momentum due to a well-established healthcare system and a cultural emphasis on hygiene and precision. With rising demand for ophthalmic and cardiovascular surgeries, the need for high-accuracy, sterilized tray configurations is increasing. The integration of procedure trays with hospital information systems and supply chain optimization tools is also contributing to market growth.

India Procedure Trays Market Insight

The India procedure trays market accounted for the largest revenue share in Asia Pacific in 2024, supported by rising surgical procedure volumes, rapid urbanization, and growing demand for infection control in both public and private hospitals. Increased investments in ambulatory surgical centers and a shift toward disposable, sterile surgical kits are key factors driving the market. In addition, domestic manufacturers offering cost-effective tray options are making procedure trays more accessible across a wide range of healthcare facilities.

Procedure Trays Market Share

The procedure trays industry is primarily led by well-established companies, including:

- Owens & Minor, Inc. (U.S.)

- Cardinal Health (U.S.)

- 3M (U.S.)

- Teleflex Incorporated (U.S.)

- B. Braun SE (Germany)

- Merit Medical Systems (U.S.)

- Biometrix (U.S.)

- Medline Industries, LP (U.S.)

- Mölnlycke Health Care AB (U.K.)

- Nelipak (U.S.)

- Baxter International Inc. (U.S.)

- Boston Scientific Corporation (U.S.)

- Ecolab (U.S.)

- Medtronic (Ireland)

- Hogy Medical (Japan)

- Smith + Nephew (U.K.)

- Thermo Fisher Scientific Inc. (U.S.)

- Ansell Limited (Australia)

- PAUL HARTMANN AG (Germany)

What are the Recent Developments in Global Procedure Trays Market?

- In May 2024, Medline Industries, LP, a leading healthcare manufacturer and distributor, announced the expansion of its customized procedure tray (CPT) production facility in Florida. The initiative aims to meet rising demand for sterile, procedure-specific surgical kits in North America. By enhancing local production capabilities, Medline is positioned to provide faster delivery times, reduced logistical costs, and improved supply chain resilience for hospitals and ambulatory surgical centers

- In March 2024, B. Braun Melsungen AG launched its next-generation modular surgical procedure trays designed for cardiovascular and orthopedic applications. These trays offer improved flexibility in configuration and incorporate eco-friendly packaging materials. This development reflects B. Braun’s focus on sustainability and precision in surgical care, enabling healthcare providers to tailor kits based on procedural complexity while minimizing environmental impact

- In February 2024, 3M Health Care introduced a new line of customizable procedure trays integrated with RFID tracking technology. This innovation enhances inventory management, reduces waste, and streamlines tray replenishment processes across hospital networks. The smart tray solution is part of 3M’s broader initiative to advance digital healthcare solutions that improve operational efficiency and patient safety

- In January 2024, Teleflex Incorporated entered into a strategic collaboration with a major UK-based NHS Trust to supply tailored procedure trays for urology and critical care units. The partnership emphasizes Teleflex’s commitment to expanding its footprint in the European market by offering high-quality, procedure-specific kits that align with hospital protocols and infection control standards

- In December 2023, Cardinal Health launched a digital customization platform that allows hospitals to design and order surgical procedure trays online with real-time feedback on cost and regulatory compliance. This platform enhances procurement efficiency and allows for rapid response to changing clinical needs, reflecting Cardinal Health’s dedication to innovation and customer-centric service in the healthcare supply chain

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.