Global Process Chemicals For Water Treatment Market

Market Size in USD Billion

CAGR :

%

USD

236.44 Billion

USD

375.42 Billion

2024

2032

USD

236.44 Billion

USD

375.42 Billion

2024

2032

| 2025 –2032 | |

| USD 236.44 Billion | |

| USD 375.42 Billion | |

|

|

|

|

Process Chemicals for Water Treatment Market Size

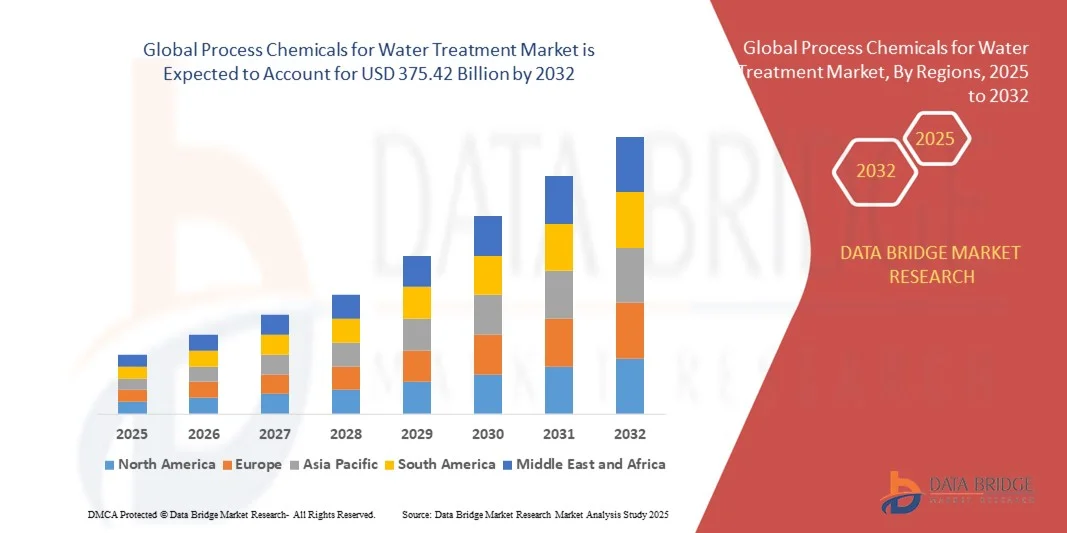

- The global process chemicals for water treatment market size was valued at USD 236.44 billion in 2024 and is expected to reach USD 375.42 billion by 2032, at a CAGR of 5.95% during the forecast period

- The market growth is largely fuelled by increasing demand for safe and clean water across municipal and industrial sectors, along with stringent government regulations on water quality and treatment standards

- Rising industrialization, urbanization, and the expansion of water infrastructure in emerging economies are further supporting market growth

Process Chemicals for Water Treatment Market Analysis

- Increasing investments in municipal and industrial water treatment facilities are propelling demand for process chemicals that ensure safe, reliable, and efficient water purification

- The rise in water scarcity, pollution, and contamination issues globally is boosting the requirement for specialized chemical solutions such as coagulants, disinfectants, and pH adjusters

- North America dominated the process chemicals for water treatment market with the largest revenue share of 38.5% in 2024, driven by stringent regulations, increasing industrialization, and growing investments in water treatment infrastructure

- Asia-Pacific region is expected to witness the highest growth rate in the global process chemicals for water treatment market, driven by large-scale infrastructure projects, modernization of water treatment facilities, and increasing adoption of advanced and sustainable chemical solutions across municipal and industrial sectors

- The coagulant segment held the largest market revenue share in 2024, driven by its widespread use in municipal and industrial water treatment for removing suspended solids and impurities. Coagulants are highly effective in enhancing water clarity, reducing turbidity, and ensuring compliance with regulatory standards, making them a preferred choice among water utilities and industrial facilities

Report Scope and Process Chemicals for Water Treatment Market Segmentation

|

Attributes |

Process Chemicals for Water Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Process Chemicals for Water Treatment Market Trends

Increasing Adoption of Advanced and Eco-Friendly Water Treatment Chemicals

- The growing adoption of advanced process chemicals is transforming the water treatment landscape by enabling efficient removal of contaminants, microbial control, and corrosion prevention. These chemicals allow municipalities and industries to maintain water quality, comply with regulations, and ensure operational efficiency. In addition, integration with smart dosing systems is improving precision and reducing chemical waste, further enhancing treatment performance

- Rising demand for eco-friendly and biodegradable chemicals is accelerating the replacement of traditional, hazardous additives with sustainable alternatives. These solutions are particularly favored in regions with stringent environmental regulations and increasing public awareness of water safety. Manufacturers are also developing multifunctional chemicals that combine disinfection, scale inhibition, and corrosion control, simplifying water treatment processes

- The affordability, versatility, and ease of application of modern process chemicals are making them attractive for both municipal and industrial water treatment. Frequent monitoring and chemical dosing improve system performance while reducing operational costs and downtime. Moreover, advanced formulations are compatible with a variety of water sources, including brackish, recycled, and industrial effluents, expanding their applicability across sectors

- For instance, in 2023, several European water utilities reported a reduction in scaling and microbial contamination after implementing advanced coagulants and disinfectants, enhancing water safety and lowering maintenance costs. The adoption of automated chemical dosing systems further reduced human error, improved compliance with water quality standards, and optimized chemical consumption

- While advanced chemicals are enhancing treatment efficacy, their impact depends on continuous innovation, regulatory compliance, and user education. Manufacturers must focus on developing safe, cost-effective, and high-performance solutions to fully capitalize on market growth. Strategic partnerships with technology providers and research institutions are also critical to driving new product development

Process Chemicals for Water Treatment Market Dynamics

Driver

Rising Water Scarcity and Increasing Industrialization

- Growing water scarcity and urbanization are pushing governments and industries to optimize water treatment processes, boosting the demand for high-performance chemicals. Efficient chemical solutions are essential to ensure safe drinking water and industrial process water quality. Adoption of smart monitoring systems also enhances the ability to detect and correct inefficiencies in real-time, supporting sustainable water management

- Industrial expansion, particularly in manufacturing, energy, and pharmaceuticals, is increasing the need for precise chemical treatment to prevent scaling, corrosion, and microbial contamination in complex water systems. Industries are investing in tailored chemical solutions that extend equipment life, improve operational efficiency, and reduce downtime, thereby lowering operational costs

- The growing focus on sustainability and regulatory compliance is encouraging the adoption of eco-friendly and low-impact chemicals that reduce environmental burden while maintaining water quality standards. Innovative formulations are being developed to minimize hazardous by-products, enabling industries to meet both environmental and economic objectives

- For instance, in 2022, several North American and Asian industrial plants upgraded to advanced anti-scalant and coagulant solutions, significantly improving process efficiency and reducing environmental impact. These upgrades also improved compliance with increasingly stringent discharge regulations, reducing penalties and supporting corporate sustainability goals

- While rising industrialization and water demand drive the market, long-term adoption depends on cost-effectiveness, consistent supply, and ongoing research into innovative chemical formulations. Strategic collaborations, government incentives, and process optimization programs further reinforce growth opportunities

Restraint/Challenge

High Cost of Advanced Chemicals and Regulatory Compliance Barriers

- The premium pricing of high-performance and environmentally friendly chemicals limits adoption among small-scale industrial users and developing regions. Cost remains a key constraint in transitioning from conventional chemical treatments. Bulk purchasing programs, while partially mitigating cost, still require significant capital investment that many smaller operators cannot afford

- Compliance with evolving local and international regulations for chemical safety and environmental impact can slow the introduction of new formulations, adding administrative and operational challenges. Companies must invest in rigorous testing, documentation, and certification processes, which increase time-to-market and overall project costs

- Supply chain disruptions, including raw material availability and logistics, may delay the delivery of critical chemicals, affecting continuous water treatment operations in both municipal and industrial sectors. Global shortages of specialty raw materials and shipping constraints can force utilities and industries to revert to suboptimal chemicals temporarily, reducing overall system efficiency

- For instance, in 2023, several South American utilities reported delayed implementation of advanced coagulants and biocides due to regulatory approvals and shipping constraints, limiting system optimization. Delays in training personnel to handle new chemicals also contributed to slower adoption and inefficiencies in treatment operations

- While process chemicals continue to evolve with innovations in performance and sustainability, addressing cost, compliance, and accessibility challenges is critical to ensure broader market penetration and long-term growth. Continued research, collaborative partnerships, and the introduction of modular chemical dosing solutions are essential to overcoming these barriers and supporting global water management initiatives

Process Chemicals for Water Treatment Market Scope

The market is segmented on the basis of type, application, and end-use.

- By Type

On the basis of type, the process chemicals for water treatment market is segmented into corrosion inhibitor, dispersant, scale inhibitor, fungicide, coagulant, flocculant, cleaner, pre-treatment filming agents, anti-foaming agents, decolouring agents, and others. The coagulant segment held the largest market revenue share in 2024, driven by its widespread use in municipal and industrial water treatment for removing suspended solids and impurities. Coagulants are highly effective in enhancing water clarity, reducing turbidity, and ensuring compliance with regulatory standards, making them a preferred choice among water utilities and industrial facilities.

The corrosion inhibitor segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its critical role in protecting pipelines, boilers, and process equipment from scaling and corrosion. These inhibitors are increasingly adopted in industrial applications such as petrochemical plants, power generation, and oil & gas operations to extend equipment life, reduce maintenance costs, and prevent unplanned downtime. Their compatibility with modern water treatment systems and ease of application further supports rapid adoption.

- By Application

On the basis of application, the process chemicals for water treatment market is segmented into sugar & ethanol, fertilizers, geothermal power generation, petrochemical & chemicals manufacturing, refining, oil & gas, power generation, and others. The petrochemical & chemicals manufacturing segment held the largest market revenue share in 2024, driven by high water consumption and the need for precise chemical treatment to prevent scaling, corrosion, and microbial contamination. These chemicals ensure operational efficiency, regulatory compliance, and equipment longevity, making them essential for industrial processes.

The oil & gas segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing exploration and production activities worldwide. Water treatment chemicals are crucial in preventing fouling, corrosion, and scale formation in pipelines, refineries, and offshore facilities. Their application helps optimize operational costs, enhance process safety, and reduce environmental impact, supporting rapid adoption across the sector.

- By End-Use

On the basis of end-use, the market is segmented into food & beverages, petrochemicals, steel, and others. The petrochemicals segment held the largest market revenue share in 2024, driven by extensive water treatment requirements to maintain process efficiency and prevent equipment damage. Advanced chemicals are essential in ensuring product quality, reducing downtime, and meeting strict environmental and safety regulations in large-scale industrial operations.

The steel segment is expected to witness the fastest growth rate from 2025 to 2032, due to rising demand for high-quality treated water in steel manufacturing processes. Chemicals such as scale inhibitors, corrosion inhibitors, and biocides help maintain operational efficiency, prevent material degradation, and reduce energy consumption, promoting increased adoption of process chemicals in the sector.

Process Chemicals for Water Treatment Market Regional Analysis

- North America dominated the process chemicals for water treatment market with the largest revenue share of 38.5% in 2024, driven by stringent regulations, increasing industrialization, and growing investments in water treatment infrastructure

- Industrial and municipal users in the region highly value the efficiency, reliability, and regulatory compliance offered by advanced chemical solutions for water purification, corrosion prevention, and scaling control

- This widespread adoption is further supported by technological advancements, high awareness of water quality standards, and the emphasis on sustainable and eco-friendly treatment practices, establishing advanced chemicals as a preferred choice across industries and municipalities

U.S. Process Chemicals for Water Treatment Market Insight

The U.S. process chemicals for water treatment market captured the largest revenue share in 2024 within North America, fueled by rapid industrial growth, infrastructure modernization, and rising demand for high-quality drinking water. Industries and municipalities are increasingly prioritizing chemical solutions that improve operational efficiency, reduce corrosion and scaling, and ensure compliance with environmental regulations. The adoption of advanced and eco-friendly chemicals, along with ongoing government initiatives for water safety and quality, is significantly propelling the market growth.

Europe Process Chemicals for Water Treatment Market Insight

The Europe process chemicals for water treatment market is expected to witness the fastest growth rate from 2025 to 2032, driven by strict water quality regulations, increasing industrial applications, and heightened awareness of environmental sustainability. The region is witnessing widespread adoption of advanced coagulants, flocculants, corrosion inhibitors, and disinfectants to meet water safety standards in municipal and industrial sectors. Growing urbanization, coupled with the shift toward eco-friendly solutions, is fostering market expansion across countries such as Germany, France, and the U.K.

U.K. Process Chemicals for Water Treatment Market Insight

The U.K. process chemicals for water treatment market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising industrial water treatment requirements and government regulations on water quality. The increasing focus on sustainable treatment practices and the replacement of traditional chemicals with biodegradable and environmentally friendly alternatives is fueling market growth. In addition, industries such as food & beverages, petrochemicals, and power generation are actively adopting advanced water treatment chemicals to enhance process efficiency and reduce operational costs.

Germany Process Chemicals for Water Treatment Market Insight

The Germany process chemicals for water treatment market is expected to witness the fastest growth rate from 2025 to 2032 fueled by industrial growth, stringent environmental regulations, and rising demand for high-purity water. Advanced chemical solutions are increasingly implemented in power generation, chemical manufacturing, and municipal water treatment for corrosion control, scaling prevention, and microbial disinfection. Germany’s emphasis on sustainability, innovation, and compliance promotes widespread adoption of eco-friendly, high-performance chemicals.

Asia-Pacific Process Chemicals for Water Treatment Market Insight

The Asia-Pacific process chemicals for water treatment market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization, urbanization, and rising demand for safe and reliable water treatment solutions in countries such as China, India, and Japan. The region’s growing focus on infrastructure development, government water safety initiatives, and adoption of advanced chemical technologies is supporting market expansion. Furthermore, the affordability of local chemical solutions and increasing awareness of sustainable practices are driving adoption across municipal and industrial sectors.

Japan Process Chemicals for Water Treatment Market Insight

The Japan market is expected to witness the fastest growth rate from 2025 to 2032 due to high industrial standards, technological adoption, and government initiatives promoting water quality and sustainability. Industries and municipal authorities are increasingly adopting advanced corrosion inhibitors, coagulants, and disinfectants to maintain water safety and operational efficiency. Moreover, Japan’s focus on smart water treatment systems and eco-friendly chemical formulations is further boosting demand.

China Process Chemicals for Water Treatment Market Insight

The China process chemicals for water treatment market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, industrial expansion, and the rising middle class demanding safe and reliable water supply. The adoption of advanced and sustainable water treatment chemicals, along with government support for water quality management and smart city initiatives, is driving growth. China’s local manufacturing capabilities also make advanced chemical solutions more accessible and cost-effective, further propelling market expansion.

Process Chemicals for Water Treatment Market Share

The Process Chemicals for Water Treatment industry is primarily led by well-established companies, including:

- Lenntech B.V. (Netherlands)

- Water Treatment Products Ltd (U.K.)

- ChemTreat, Inc. (U.S.)

- Kemira Oyj (Finland)

- Thermax Ltd (India)

- Baker Hughes (U.S.)

- Solenis (U.S.)

- Akzo Nobel N.V. (Netherlands)

- Kurita Water Industries Ltd. (Japan)

- AECI (South Africa)

- Tramfloc, Inc. (U.S.)

- SNF Group (France)

- COVENTYA International (France)

- Arkema (France)

- NIPPON SHOKUBAI CO., LTD. (Japan)

- LANXESS (Germany)

- Industrial Specialty Chemicals, Inc. (U.S.)

- Sabo Industrial (Italy)

- The Lubrizol Corporation (U.S.)

- Aquatic BioScience, LLC (U.S.)

- AQUAMARK, INC (U.S.)

- ANGUS Chemical Company (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PROCESS CHEMICALS FOR WATER TREATMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PROCESS CHEMICALS FOR WATER TREATMENT MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 IMPORT AND EXPORT DATA

2.16 GLOBAL PROCESS CHEMICALS FOR WATER TREATMENT MARKET MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

6 IMPACT OF COVID-19 PANDEMIC ON THE GLOBAL PROCESS CHEMICALS FOR WATER TREATMENT MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTUERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 GLOBAL PROCESS CHEMICALS FOR WATER TREATMENT MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 CORROSION INHIBITOR

7.3 DISPERSANT

7.4 SCALE INHIBITOR

7.5 FUNGICIDE

7.6 COAGULANT

7.7 FLOCCULANT

7.8 CLEANERS

7.9 PRE-TREATMENT FILMING AGENTS

7.1 ANTI-FOAMING AGENT

7.11 DECOLOURING AGENTS

7.12 OTHERS

8 GLOBAL PROCESS CHEMICALS FOR WATER TREATMENT MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 SUGAR & ETHANOL

8.2.1 CORROSION INHIBITOR

8.2.2 DISPERSANT

8.2.3 SCALE INHIBITOR

8.2.4 FUNGICIDE

8.2.5 COAGULANT

8.2.6 FLOCCULANT

8.2.7 CLEANERS

8.2.8 PRE-TREATMENT FILMING AGENTS

8.2.9 ANTI-FOAMING AGENT

8.2.10 DECOLOURING AGENTS

8.2.11 OTHERS

8.3 FERTILIZERS

8.3.1 CORROSION INHIBITOR

8.3.2 DISPERSANT

8.3.3 SCALE INHIBITOR

8.3.4 FUNGICIDE

8.3.5 COAGULANT

8.3.6 FLOCCULANT

8.3.7 CLEANERS

8.3.8 PRE-TREATMENT FILMING AGENTS

8.3.9 ANTI-FOAMING AGENT

8.3.10 DECOLOURING AGENTS

8.3.11 OTHERS

8.4 GEOTHERMAL POWER GENERATION

8.4.1 CORROSION INHIBITOR

8.4.2 DISPERSANT

8.4.3 SCALE INHIBITOR

8.4.4 FUNGICIDE

8.4.5 COAGULANT

8.4.6 FLOCCULANT

8.4.7 CLEANERS

8.4.8 PRE-TREATMENT FILMING AGENTS

8.4.9 ANTI-FOAMING AGENT

8.4.10 DECOLOURING AGENTS

8.4.11 OTHERS

8.5 PETROCHEMICAL & CHEMICALS MANUFACTURING

8.5.1 CORROSION INHIBITOR

8.5.2 DISPERSANT

8.5.3 SCALE INHIBITOR

8.5.4 FUNGICIDE

8.5.5 COAGULANT

8.5.6 FLOCCULANT

8.5.7 CLEANERS

8.5.8 PRE-TREATMENT FILMING AGENTS

8.5.9 ANTI-FOAMING AGENT

8.5.10 DECOLOURING AGENTS

8.5.11 OTHERS

8.6 REFINING

8.6.1 CORROSION INHIBITOR

8.6.2 DISPERSANT

8.6.3 SCALE INHIBITOR

8.6.4 FUNGICIDE

8.6.5 COAGULANT

8.6.6 FLOCCULANT

8.6.7 CLEANERS

8.6.8 PRE-TREATMENT FILMING AGENTS

8.6.9 ANTI-FOAMING AGENT

8.6.10 DECOLOURING AGENTS

8.6.11 OTHERS

8.7 OIL & GAS

8.7.1 CORROSION INHIBITOR

8.7.2 DISPERSANT

8.7.3 SCALE INHIBITOR

8.7.4 FUNGICIDE

8.7.5 COAGULANT

8.7.6 FLOCCULANT

8.7.7 CLEANERS

8.7.8 PRE-TREATMENT FILMING AGENTS

8.7.9 ANTI-FOAMING AGENT

8.7.10 DECOLOURING AGENTS

8.7.11 OTHERS

8.8 POWER GENERATION

8.8.1 CORROSION INHIBITOR

8.8.2 DISPERSANT

8.8.3 SCALE INHIBITOR

8.8.4 FUNGICIDE

8.8.5 COAGULANT

8.8.6 FLOCCULANT

8.8.7 CLEANERS

8.8.8 PRE-TREATMENT FILMING AGENTS

8.8.9 ANTI-FOAMING AGENT

8.8.10 DECOLOURING AGENTS

8.8.11 OTHERS

8.9 OTHERS

9 GLOBAL PROCESS CHEMICALS FOR WATER TREATMENT MARKET, BY GEOGRAPHY

9.1 GLOBAL PROCESS CHEMICALS FOR WATER TREATMENT MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

9.2 OVERVIEW

9.3 NORTH AMERICA

9.3.1 U.S.

9.3.2 CANADA

9.3.3 MEXICO

9.4 EUROPE

9.4.1 GERMANY

9.4.2 U.K.

9.4.3 ITALY

9.4.4 FRANCE

9.4.5 SPAIN

9.4.6 SWITZERLAND

9.4.7 RUSSIA

9.4.8 TURKEY

9.4.9 BELGIUM

9.4.10 NETHERLANDS

9.4.11 REST OF EUROPE

9.5 ASIA-PACIFIC

9.5.1 JAPAN

9.5.2 CHINA

9.5.3 SOUTH KOREA

9.5.4 INDIA

9.5.5 AUSTRALIA & NEW ZEALAND

9.5.6 HONG KONG

9.5.7 TAIWAN

9.5.8 SINGAPORE

9.5.9 THAILAND

9.5.10 INDONESIA

9.5.11 MALAYSIA

9.5.12 PHILIPPINES

9.5.13 REST OF ASIA-PACIFIC

9.6 SOUTH AMERICA

9.6.1 BRAZIL

9.6.2 ARGENTINA

9.6.3 REST OF SOUTH AMERICA

9.7 MIDDLE EAST AND AFRICA

9.7.1 SOUTH AFRICA

9.7.2 EGYPT

9.7.3 SAUDI ARABIA

9.7.4 UNITED ARAB EMIRATES

9.7.5 ISRAEL

9.7.6 REST OF MIDDLE EAST AND AFRICA

10 GLOBAL PROCESS CHEMICALS FOR WATER TREATMENT MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

10.4 COMPANY SHARE ANALYSIS: EUROPE

10.5 MERGERS & ACQUISITIONS

10.6 NEW PRODUCT DEVELOPMENT & APPROVALS

10.7 EXPANSIONS

10.8 REGULATORY CHANGES

10.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

11 SWOT ANALYSIS

12 GLOBAL PROCESS CHEMICALS FOR WATER TREATMENT MARKET – COMPANY PROFILE

12.1 KEMIRA OYJ

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT UPDATES

12.2 BASF SE

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT UPDATES

12.3 THERMAX LTD.

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT UPDATES

12.4 LENNTECH WATER TREATMENT SOLUTIONS

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT UPDATES

12.5 CHEMTREAT

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT UPDATES

12.6 BAKER HUGHES COMPANY

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT UPDATES

12.7 SOLENIS

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT UPDATES

12.8 TRAMFLOC, INC.

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT UPDATES

12.9 SNF GROUP

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT UPDATES

12.1 COVENTYA INTERNATIONAL

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT UPDATES

12.11 ARKEMA

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT UPDATES

12.12 NIPPON SHOKUBAI CO., LTD.

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT UPDATES

12.13 LANXESS

12.13.1 COMPANY SNAPSHOT

12.13.2 REVENUE ANALYSIS

12.13.3 PRODUCT PORTFOLIO

12.13.4 RECENT UPDATES

12.14 THE LUBRIZOL CORPORATION

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 PRODUCT PORTFOLIO

12.14.4 RECENT UPDATES

12.15 ANGUS CHEMICAL COMPANY

12.15.1 COMPANY SNAPSHOT

12.15.2 REVENUE ANALYSIS

12.15.3 PRODUCT PORTFOLIO

12.15.4 RECENT UPDATES

12.16 KURITA WATER INDUSTRIES LTD.

12.16.1 COMPANY SNAPSHOT

12.16.2 REVENUE ANALYSIS

12.16.3 PRODUCT PORTFOLIO

12.16.4 RECENT UPDATES

13 QUESTIONNAIRE

14 RELATED REPORTS

15 ABOUT DATA BRIDGE MARKET RESEARCH

Global Process Chemicals For Water Treatment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Process Chemicals For Water Treatment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Process Chemicals For Water Treatment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.