Global Process Mining Market

Market Size in USD Million

CAGR :

%

USD

470.77 Million

USD

9,352.66 Million

2024

2032

USD

470.77 Million

USD

9,352.66 Million

2024

2032

| 2025 –2032 | |

| USD 470.77 Million | |

| USD 9,352.66 Million | |

|

|

|

|

Process Mining Market Size

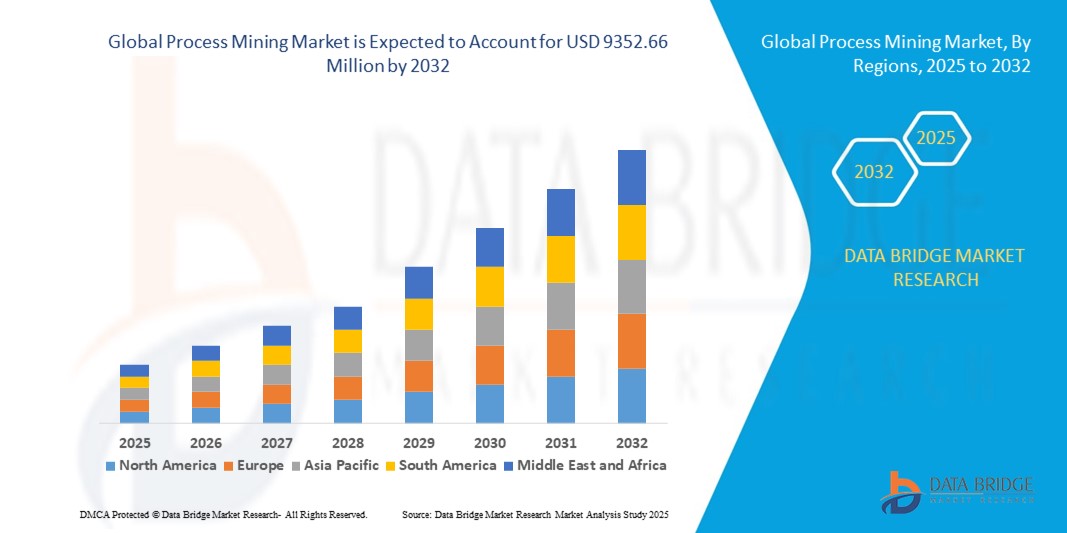

- The global process mining market size was valued at USD 470.77 million in 2024 and is expected to reach USD 9352.66 million by 2032, at a CAGR of 45.30% during the forecast period

- The market growth is largely fueled by the accelerating adoption of digital transformation initiatives across industries, leading to increased demand for data-driven operational insights and workflow optimization

- Furthermore, growing enterprise reliance on ERP and CRM systems is generating vast volumes of event logs, which serve as the foundation for process mining. These factors are enabling organizations to visualize, analyze, and enhance business processes in real time, significantly boosting market expansion

Process Mining Market Analysis

- Process mining solutions leverage event logs from enterprise systems to reconstruct, monitor, and improve actual business processes. These tools offer visibility into deviations, inefficiencies, and bottlenecks, helping organizations optimize workflows, reduce costs, and ensure regulatory compliance

- The rising demand for process transparency, improved decision-making, and automation readiness is propelling the adoption of process mining tools across sectors such as BFSI, manufacturing, healthcare, and telecommunications

- North America dominated the process mining market with a share of 33.43% in 2024, due to widespread digital transformation across enterprises and early adoption of automation and advanced analytics tools

- Asia-Pacific is expected to be the fastest growing region in the process mining market during the forecast period due to the region’s rapid digitalization, growing enterprise IT investments, and the expanding use of ERP and CRM systems in emerging economies

- Software segment dominated the market with a market share of 69% in 2024, due to the widespread deployment of advanced analytical software that enables enterprises to visualize and optimize end-to-end business workflows. Process discovery tools help in mapping actual processes from event logs, while conformance checking ensures alignment with intended process models, thus improving operational transparency and compliance

Report Scope and Process Mining Market Segmentation

|

Attributes |

Process Mining Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Process Mining Market Trends

Increasing Complexity of Business Processes

- Business processes across industries are becoming increasingly complex due to digital transformation, multi-cloud environments, and hybrid workflows, spurring demand for process mining solutions that provide clear and actionable insights into actual operational flows

- For instance, Celonis, a global leader in process mining, supports enterprises in manufacturing, banking, and healthcare to uncover hidden inefficiencies and compliance issues by analyzing event logs from ERP, CRM, and other enterprise systems, enabling end-to-end visibility and process transparency

- The rise of remote work and distributed teams adds layers of process variation that companies seek to monitor and optimize using process mining tools combined with AI and machine learning

- Regulatory compliance requirements are growing, requiring precise process audits and real-time monitoring, driving organizations to embed process mining within their governance and risk management frameworks

- Integration of robotic process automation (RPA) with process mining allows continuous process optimization and automated remediation, creating a self-healing and adaptive business ecosystem

- Increasing adoption of cloud-based process mining solutions facilitates scalable, accessible analytics at lower cost and with faster implementation cycles

Process Mining Market Dynamics

Driver

Increasing Operational Efficiency

- Organizations increasingly adopt process mining to boost operational performance by identifying bottlenecks, reducing process variances, and improving resource utilization in critical workflows such as order-to-cash, procure-to-pay, and customer onboarding

- For instance, IBM’s process mining solutions enable enterprises in telecom, insurance, and manufacturing to translate data into measurable efficiency improvements and cost savings, reinforcing agile decision-making and competitive advantage

- Rising pressure to reduce operational costs amidst economic uncertainties accelerates process transparency and continuous improvement initiatives supported by process mining insights

- Enhanced reporting and visualization tools empower executives and frontline managers to monitor real-time process health and compliance metrics across diverse departments and geographies

- Process mining helps pinpoint sources of manual rework, delays, and compliance violations, supporting lean transformation and Six Sigma initiatives in process-intensive organizations

Restraint/Challenge

Technological Data Privacy Concerns

- The collection and analysis of detailed process data raise significant privacy and data protection challenges, leading to cautious adoption in highly regulated industries such as healthcare, banking, and government sectors

- For instance, concerns around GDPR, HIPAA, and other data sovereignty laws require process mining vendors and users to implement stringent data anonymization, encryption, and access controls before deploying widespread analytics

- Integrating process mining platforms with legacy IT systems often exposes sensitive organizational data, heightening security risks and compliance burdens that slow down enterprise-scale adoption

- Data governance gaps and limited organizational readiness to manage process data ethically and securely can compromise trust in process mining initiatives

- Balancing the benefits of operational transparency with the imperative to protect personally identifiable and proprietary information necessitates ongoing innovation in secure analytics frameworks and regulatory alignment

Process Mining Market Scope

The market is segmented on the basis of offering, mining algorithm, and data source.

- By Offering

On the basis of offering, the process mining market is segmented into software and services. The software segment, which includes process discovery tools and conformance checking tools, accounted for the largest market revenue share of 69% in 2024. This dominance is primarily due to the widespread deployment of advanced analytical software that enables enterprises to visualize and optimize end-to-end business workflows. Process discovery tools help in mapping actual processes from event logs, while conformance checking ensures alignment with intended process models, thus improving operational transparency and compliance.

The services segment is projected to witness the fastest growth rate from 2025 to 2032, driven by the increasing demand for consulting, integration, and training services that ensure smooth implementation and scalability of process mining solutions. As businesses move toward process automation and digital transformation, specialized service providers are helping organizations interpret mined data, identify bottlenecks, and redesign processes for higher efficiency. This service-based support becomes critical, especially for industries lacking in-house expertise or facing complex legacy system integrations.

- By Mining Algorithm

On the basis of mining algorithm, the market is segmented into deep learning and sequence analysis. The sequence analysis segment held the largest market share in 2024, owing to its mature application in traditional process mining tasks such as activity tracking, anomaly detection, and pattern identification. Organizations leverage sequence-based algorithms to reconstruct process flows from system event logs, allowing for granular insights into recurring inefficiencies and compliance deviations. Its structured logic and lower computational complexity make it highly reliable for rule-based process evaluations.

The deep learning segment is expected to grow at the fastest pace from 2025 to 2032, supported by its ability to handle unstructured, high-volume, and complex event data. Deep learning models, especially recurrent neural networks (RNNs) and transformers, offer predictive insights by recognizing non-linear dependencies and temporal relationships in process sequences. These capabilities empower enterprises to move beyond traditional process analytics into intelligent forecasting and dynamic decision-making, especially in fast-changing or customer-facing workflows.

- By Data Source

On the basis of data source, the market is categorized into ERP systems and CRM systems. The ERP systems segment dominated the market in 2024, as enterprise resource planning systems serve as the backbone of operational data across manufacturing, finance, procurement, and supply chains. ERP-generated event logs provide comprehensive visibility into business processes, making them an ideal foundation for deploying process mining tools. Organizations prioritize ERP integration to enhance transactional accuracy, compliance reporting, and workflow standardization.

The CRM systems segment is projected to experience the highest CAGR from 2025 to 2032, fueled by the rising importance of customer experience optimization and sales process automation. Process mining in CRM systems helps businesses analyze customer journey data, identify delays or drop-offs in service pipelines, and align marketing strategies with behavioral trends. The growing shift toward omnichannel engagement and real-time customer interaction has amplified the value of CRM-derived insights, driving deeper adoption across service-oriented sectors.

Process Mining Market Regional Analysis

- North America dominated the process mining market with the largest revenue share of 33.43% in 2024, driven by widespread digital transformation across enterprises and early adoption of automation and advanced analytics tools

- The region’s robust presence of technology firms and cloud infrastructure providers supports the integration of process mining into business intelligence systems

- High enterprise spending on process optimization, strong regulatory compliance frameworks, and a growing demand for operational transparency contribute to the dominance of North America in this market

U.S. Process Mining Market Insight

The U.S. process mining market captured the largest revenue share in 2024 within North America, fueled by increasing adoption of cloud-based ERP systems and AI-powered analytics tools across industries. Enterprises in the U.S. are leveraging process mining to improve efficiency, compliance, and cost-effectiveness. The presence of major software vendors, along with heightened demand from sectors such as BFSI, healthcare, and manufacturing, accelerates market growth. Growing interest in digital twin technologies and real-time process visibility further strengthens the U.S. position in the global market.

Europe Process Mining Market Insight

The Europe process mining market is projected to expand at a notable CAGR during the forecast period, driven by the region’s strong emphasis on operational governance, digital transformation mandates, and stringent compliance regulations. Countries across the EU are actively embracing process mining tools to meet GDPR and ESG reporting requirements. The demand is particularly strong in automotive, public administration, and financial services sectors. Mature IT infrastructure, combined with rising awareness of business process intelligence, is expected to sustain growth across both Western and Central Europe.

U.K. Process Mining Market Insight

The U.K. process mining market is expected to grow at a steady CAGR through the forecast period, driven by the increasing demand for process visibility in financial services, government, and healthcare. As U.K. enterprises focus on post-Brexit digital competitiveness, there is a surge in investment toward automation, compliance tracking, and data-driven decision-making. Process mining is being used to streamline legacy systems, enhance customer journeys, and ensure agility in operations—making it an integral part of the U.K.’s digital strategy.

Germany Process Mining Market Insight

The Germany process mining market is set to grow significantly, fueled by the country’s strong industrial base and emphasis on Industrie 4.0 initiatives. German firms, particularly in manufacturing and logistics, are adopting process mining to optimize supply chains and production efficiency. The market is further driven by collaborations between academic institutions and enterprise software vendors. Germany’s focus on precision, data privacy, and energy-efficient operations aligns well with the core value propositions of process mining technologies.

Asia-Pacific Process Mining Market Insight

The Asia-Pacific process mining market is poised to grow at the fastest CAGR from 2025 to 2032, driven by the region’s rapid digitalization, growing enterprise IT investments, and the expanding use of ERP and CRM systems in emerging economies. Businesses across India, China, and Southeast Asia are increasingly focusing on automation and transparency to stay competitive. Government-led digital initiatives and rising awareness of AI-based solutions are accelerating the adoption of process mining tools across industries.

Japan Process Mining Market Insight

The Japan process mining market is witnessing steady growth, supported by the country’s advanced IT infrastructure and focus on efficiency in manufacturing and services. Japanese enterprises are increasingly deploying process mining tools to modernize traditional workflows, reduce process redundancies, and enhance regulatory compliance. The convergence of robotics, AI, and process mining in industrial applications is opening new avenues for optimization. In addition, Japan’s aging workforce is prompting greater interest in automation and digital oversight.

China Process Mining Market Insight

The China process mining market accounted for the largest revenue share in Asia Pacific in 2024, driven by the country’s fast-paced industrial transformation and massive enterprise data generation. Chinese companies, particularly in retail, banking, and telecom, are adopting process mining to gain deeper insights into operations and consumer behavior. The government’s push toward smart manufacturing and digital governance, alongside strong domestic software development, is propelling the growth of this market. Cloud adoption and real-time analytics integration are further supporting the rise of process mining solutions in China.

Process Mining Market Share

The process mining industry is primarily led by well-established companies, including:

- Celonis (Germany)

- Software AG (Germany)

- Minit (Slovakia)

- QPR ProcessAnalyzer (Finland)

- Signavio (Germany)

- OpsOne (Japan)

- Datapolis (Hungary)

- Disco (Netherlands)

- Fujitsu (Japan)

- Icaro (Brazil)

- Kofax (U.S.)

Latest Developments in Global Process Mining Market

- In July 2023, Microsoft launched Power Automate Process Mining, a next-generation AI-infused solution designed to help organizations gain deep visibility into business operations. This strategic move strengthens Microsoft’s presence in the process mining market by seamlessly integrating process intelligence, automation, and low-code applications into a unified platform. The launch is expected to significantly enhance enterprise agility by enabling users to uncover inefficiencies, act on AI-driven recommendations, and implement continuous process improvement—all within Microsoft’s existing ecosystem. This positions Microsoft as a strong contender for businesses seeking end-to-end digital optimization

- In May 2023, Pegasystems introduced Pega Process Mining, aimed at simplifying the identification and resolution of inefficiencies within business workflows. By enabling users of all skill levels to uncover performance gaps and improvement opportunities, this development enhances Pega’s intelligent automation capabilities. It also reinforces Pega’s competitive edge by tightly integrating process mining with its core CRM and case management tools, allowing organizations to drive smarter decision-making and operational refinement directly within the Pega ecosystem

- In May 2023, QPR Software entered a strategic partnership with Paris-based Solution BI, a firm recognized for its end-to-end business intelligence services. This collaboration expands QPR’s reach in the European market, particularly in French-speaking regions, and enhances its delivery capabilities by leveraging Solution BI’s expertise in data integration and performance analytics. The partnership is expected to accelerate the deployment of process mining solutions across diverse industries, promoting deeper penetration into mid-sized enterprises seeking scalable BI-driven process insights

- In January 2022, Celonis GmbH and Accenture announced a collaboration focused on accelerating digital transformation through enhanced process bottleneck detection. By combining Celonis’ execution management technology with Accenture’s consulting and implementation expertise, the partnership empowers organizations to quickly identify operational inefficiencies and optimize workflows. This collaboration has broadened Celonis’ enterprise footprint, especially among large global clients, and reinforced its leadership position in the process mining landscape through value-added service integration

- In February 2021, Software AG entered into a partnership with Automation Anywhere to enhance end-to-end automation capabilities by integrating Automation Anywhere’s RPA process mining and management tools within the ARIS platform. This collaboration enables businesses to streamline their automation strategies by combining robust process modeling with intelligent automation. The integration supports organizations in improving operational efficiency, managing workflows more effectively, and accelerating their digital transformation journeys through unified process governance and execution

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Process Mining Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Process Mining Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Process Mining Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.