Global Process Mining Software Market

Market Size in USD Billion

CAGR :

%

USD

1.51 Billion

USD

59.54 Billion

2024

2032

USD

1.51 Billion

USD

59.54 Billion

2024

2032

| 2025 –2032 | |

| USD 1.51 Billion | |

| USD 59.54 Billion | |

|

|

|

|

Process Mining Software Market Size

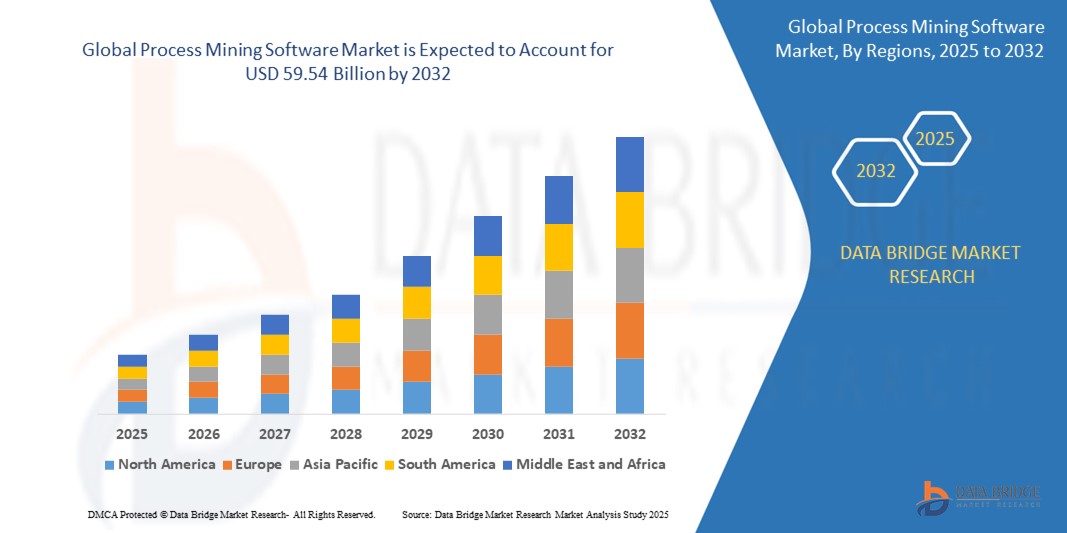

- The global ophthalmic operational microscope market was valued at USD 1.51 billion in 2024 and is expected to reach USD 59.54 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.7%, primarily driven by the increasing demand for operational efficiency and the rising adoption of cloud-based solutions

- This growth is driven by factors such as the integration of artificial intelligence (AI) and machine learning (ML), advancements in process automation, and the increasing need for real-time business process optimization

Process Mining Software Market Analysis

- Process mining software is a critical tool used in business process management, providing real-time insights into operational workflows by analyzing event logs from enterprise systems. It is essential for identifying inefficiencies, compliance deviations, and automation opportunities

- The demand for process mining software is significantly driven by the increasing need for digital transformation, workflow optimization, and data-driven decision-making. Over half of the global demand comes from industries such as banking, financial services, and insurance (BFSI), manufacturing, and healthcare, where process efficiency and regulatory compliance are top priorities

- The North America region stands out as one of the dominant markets for process mining software, driven by its high adoption of cloud computing, AI-driven analytics, and strong investments in business process automation

- For instance, major enterprises in the U.S. are increasingly integrating process mining into their operational frameworks to enhance productivity and reduce costs. Large corporations and government entities are leading the adoption of AI-powered process mining solutions to drive digital transformation

- Globally, process mining software ranks as one of the most crucial technologies in enterprise workflow optimization, following robotic process automation (RPA). It plays a pivotal role in enabling businesses to achieve operational excellence, reduce inefficiencies, and enhance compliance across various industries

Report Scope and Process Mining Software Market Segmentation

|

Attributes |

Process Mining Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Process Mining Software Market Trends

“Rising Integration of AI and Cloud-Based Solutions”

- One prominent trend in the global process mining software market is the increasing integration of artificial intelligence (AI) and cloud-based solutions

- These advanced technologies enhance the accuracy and efficiency of process mining by enabling real-time data analysis, predictive insights, and automated workflow optimization

- For instance, AI-powered process mining solutions can detect inefficiencies, predict bottlenecks, and recommend data-driven improvements, allowing businesses to enhance operational efficiency and compliance

- Cloud-based deployment allows organizations to seamlessly store, access, and analyze large volumes of event log data without requiring extensive on-premise infrastructure, increasing scalability and cost-effectiveness

- This trend is revolutionizing business process management, enabling enterprises to achieve greater agility, reduce inefficiencies, and accelerate digital transformation through AI-driven automation

Process Mining Software Market Dynamics

Driver

“Growing Demand for Business Process Optimization”

- The increasing need for business process optimization and operational efficiency is significantly driving the demand for process mining software

- As industries undergo digital transformation, organizations are seeking data-driven solutions to identify inefficiencies, enhance productivity, and ensure regulatory compliance. Process mining software enables companies to gain real-time insights into their workflows, allowing them to make informed decisions for continuous improvement

- The rising adoption of automation technologies, including robotic process automation (RPA) and AI-driven analytics, further emphasizes the need for process mining solutions that can analyze, monitor, and refine business operations.

- As more businesses strive to reduce operational costs and increase agility, process mining software plays a crucial role in identifying bottlenecks, detecting deviations, and streamlining workflows across various sectors, including banking, healthcare, manufacturing, and IT services.

For instance,

- In May 2023, Pegasystems Inc. introduced the AI-powered Pega Process Mining system, designed to help businesses analyze event log data, optimize workflows, and enhance process efficiency through AI and generative AI-ready APIs. This innovation highlights the growing need for advanced process mining tools in business operations

- In February 2023, Celonis partnered with IBM to expand process mining capabilities, allowing enterprises to integrate AI-powered insights into their automation and digital transformation strategies. This collaboration underscores the rising demand for process mining solutions in enterprise resource planning (ERP) and customer relationship management (CRM) systems

- As organizations increasingly prioritize workflow automation, cost reduction, and compliance, the demand for process mining software continues to grow, making it a critical driver for digital transformation across industries

Opportunity

“Expanding Applications of Bio-Based and Sustainable Crosslinking Agents”

- The growing emphasis on sustainability and environmental regulations is driving the adoption of bio-based and eco-friendly crosslinking agents across various industries, including coatings, adhesives, textiles, and composites

- Renewable raw materials, such as plant-derived resins, lignin, and natural oils, are being increasingly utilized to develop low-VOC, non-toxic, and biodegradable crosslinking solutions

- Stringent environmental regulations, particularly in regions like Europe and North America, are encouraging manufacturers to shift toward greener alternatives, reducing dependency on petroleum-based crosslinking agents

For instance,

- In February 2024, according to a report by the European Chemicals Agency (ECHA), regulatory policies such as REACH and the Green Deal are driving innovation in bio-based crosslinking solutions, leading to increased R&D investments in sustainable polymer chemistry

- In November 2023 a study published by the American Chemical Society (ACS) highlighted that bio-based crosslinking agents derived from vegetable oils and lignin-based polymers are showing comparable or superior performance to traditional petroleum-based alternatives, making them a viable option for large-scale commercial applications

- The integration of AI in process mining software can lead to enhanced business agility, reduced operational costs, and improved customer experiences. By leveraging AI-powered analytics, organizations can identify potential inefficiencies early and implement proactive process improvements, driving digital transformation and long-term success

Restraint/Challenge

“High Implementation Costs Hindering Market Adoption”

- The high cost of implementing process mining software poses a significant challenge for the market, particularly affecting the adoption rate among small and medium-sized enterprises (SMEs)

- Process mining solutions, which are essential for identifying inefficiencies, optimizing workflows, and ensuring compliance, often require substantial investment in software licenses, cloud infrastructure, and integration with existing enterprise systems

- This significant financial barrier can deter smaller businesses with limited IT budgets from adopting process mining technology, leading to continued reliance on manual process analysis or traditional business intelligence tools

For instance,

- In October 2024, according to a report by the European Coatings Journal, manufacturers in emerging economies face difficulties adopting high-performance, eco-friendly crosslinking agents due to the higher cost of sustainable raw materials and regulatory compliance requirements

- Consequently, such limitations can result in disparities in process optimization and automation adoption, making it difficult for certain industries and businesses to fully realize the benefits of digital transformation, ultimately hindering the overall growth of the market

Process Mining Software Market Scope

The market is segmented on the basis of deployment, enterprise type, application, end-user, and component.

|

Segmentation |

Sub-Segmentation |

|

By Deployment |

|

|

By Enterprise Type |

|

|

By Application |

|

|

By End-user |

|

|

By Component |

|

Process Mining Software Market Regional Analysis

“North America is the Dominant Region in the Process Mining Software Market”

- North America is expected to dominate the ophthalmic operational microscope market, driven by advanced healthcare infrastructure, high adoption of cutting-edge medical technologies, and strong presence of key market players

- The U.S. holds a significant share due to increased demand for high-precision ophthalmic procedures, rising prevalence of eye disorders such as cataracts and glaucoma, and continuous advancements in surgical techniques

- The availability of well-established reimbursement policies and growing investments in research & development by leading medical device companies further strengthen the market.

- In addition, the increasing number of ophthalmic surgeries, including cataract and refractive procedures, along with a high rate of adoption of minimally invasive techniques, is fueling market expansion across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the process mining software market, driven by rapid digital transformation, increasing adoption of AI-driven analytics, and the expansion of automation initiatives across industries

- Countries such as China, India, and Japan are emerging as key markets due to the growing demand for enterprise process optimization, increasing investments in AI and cloud computing, and the rise of data-driven business strategies

- Japan, with its technologically advanced enterprises and strong presence of automation-driven industries, remains a crucial market for process mining software. The country continues to lead in the integration of AI-powered analytics to enhance efficiency in manufacturing, finance, and IT sectors

- China and India, with their large enterprise base and expanding digital economy, are witnessing increased government and private sector investments in business process automation. The expanding presence of global process mining software providers and the rising adoption of cloud-based enterprise solutions further contribute to the market’s rapid growth

Process Mining Software Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Celonis GmbH (Germany)

- Datapolis (Poland)

- Exeura (Italy)

- Fluxicon BV (Netherlands)

- FUJITSU (Japan)

- Hyland Software, Inc. (U.S.)

- Everflow (U.S.)

- Kofax (U.S.)

- Minit (Slovakia)

- Cognitive (myInvenio) (Italy)

- QPR Software Plc (Finland)

- Signavio (Germany)

- Software AG (Germany)

- UiPath (Romania)

- ABBYY (U.S.)

- FortressIQ (U.S.)

- SKAN (U.S.)

Latest Developments in Global Process Mining Software Market

- In May 2023, Pegasystems Inc. launched an AI-powered Pega Process Mining system within the Pega Platform to enhance business operations. This system examines event log data to detect inefficiencies, improve workflows, and address issues seamlessly. Designed for accessibility, it offers intuitive tools for non-technical users and includes generative AI-ready APIs for integration with models like OpenAI’s ChatGPT, fostering autonomous enterprise capabilities

- In April 2023, UiPath and Snowflake collaborated to launch a business automation platform by integrating UiPath's data capabilities with the Snowflake Manufacturing Data Cloud. This platform leverages UiPath's process mining software to streamline workflows and align data left in systems, enabling manufacturers to optimize operations and accelerate digital transformation

- In November 2022, Pegasystems Inc. acquired Everflow, a Brazil-based process mining company, to enhance its ability to address inefficiencies in organizational operations. This acquisition integrated Everflow's intuitive process mining tools with Pega's AI-powered solutions, creating a more robust offering for workflow optimization and hyperautomation

- In September 2022, Celonis GmbH formed a platinum partnership with Roboyo Group, a leading German hyper-automation professional service provider. This collaboration integrates Celonis's process mining and execution management capabilities with Roboyo's hyper-automation expertise, offering a 360-degree view of processes. The partnership aims to accelerate digital transformation and optimize operational performance for clients

- In May 2022, Celonis GmbH launched two innovative process mining platforms: Celonis Business Miner and Celonis Process Sphere. These platforms provide clients with a fresh business perspective by offering multi-dimensional insights into processes. They also explore additional solutions to uncover opportunities for operational improvements, enhancing efficiency and decision-making

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.