Global Processing Seals For Dairy Products Market

Market Size in USD Billion

CAGR :

%

USD

1.03 Billion

USD

1.37 Billion

2024

2032

USD

1.03 Billion

USD

1.37 Billion

2024

2032

| 2025 –2032 | |

| USD 1.03 Billion | |

| USD 1.37 Billion | |

|

|

|

|

What is the Global Processing Seals for Dairy Products Market Size and Growth Rate?

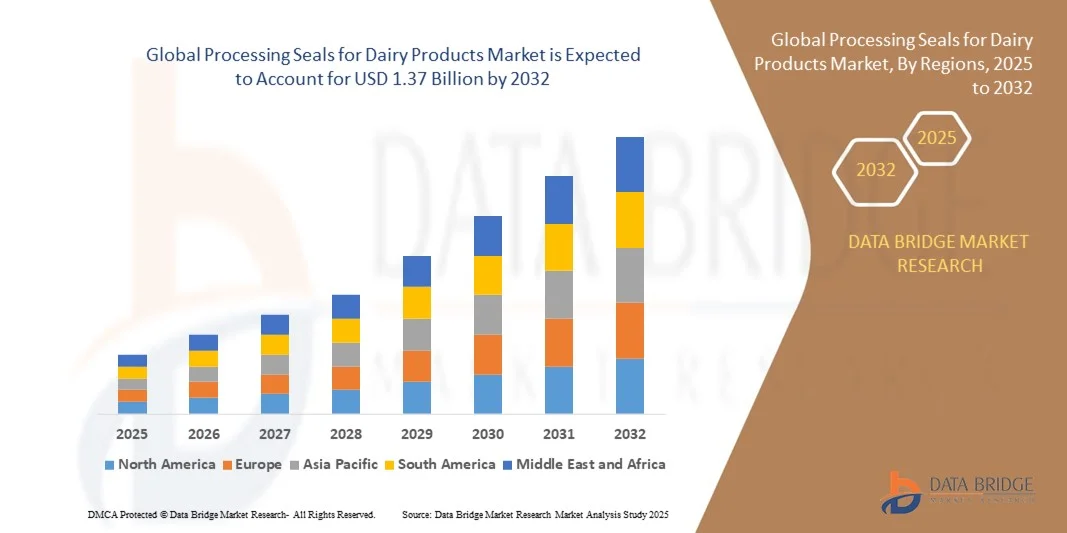

- The global processing seals for dairy products market size was valued at USD 1.03 billion in 2024 and is expected to reach USD 1.37 billion by 2032, at a CAGR of 3.60% during the forecast period

- Rising demand for qualitative packaging materials that provide preservation, protection and prolongation of the shelf life of dairy products is driving the growth in the market value. Growing demand for dairy products owing to the nutritional benefits offered by the, and growth and expansion of the food and beverages industry especially in the developing economies will further induce growth in the market value

- Stringent regulations imposed on the quality of packaging materials by the regulatory authorities and growing prevalence of compliances regarding the processing of dairy food products are some other market growth determinants

What are the Major Takeaways of Processing Seals for Dairy Products Market?

- Surging modernization and globalization are some other indirect factors that will also promote the market growth rate

- However, fluctuations in the prices of raw packaging materials will create hindrances for the market growth rate. High costs associated with innovative packaging solutions will further dampen the market growth rate. Increasing availability and utilization of seal-less products and rising environmental concerns will also derail the market growth rate

- Asia-Pacific dominated the processing seals for dairy products market with the largest revenue share of 41.31% in 2024, driven by rapid industrialization, increasing demand for dairy products, and adoption of advanced processing technologies

- The North America processing seals for dairy products market is expected to grow at the fastest CAGR of 7.98% during 2025–2032, driven by modernization of dairy plants, rising adoption of automated processing systems, and demand for high-performance sealing solutions

- The elastomers segment dominated the market with the largest revenue share of 46.5% in 2024, driven by their superior flexibility, chemical resistance, and ability to maintain tight sealing under high-pressure and high-temperature conditions

Report Scope and Processing Seals for Dairy Products Market Segmentation

|

Attributes |

Processing Seals for Dairy Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Processing Seals for Dairy Products Market?

Advanced Material Innovation and Automation Integration

- A major trend in the global processing seals for dairy products market is the adoption of advanced sealing materials and automation technologies that improve operational efficiency, hygiene, and shelf life of dairy products. This trend is driving innovations in seal durability, chemical resistance, and precision fitting for high-speed dairy processing equipment

- For instance, new silicone and fluoropolymer seals are being incorporated into automated filling and packaging lines, reducing downtime and contamination risks. Companies are also integrating sensors to monitor seal wear and performance in real time, optimizing production efficiency

- Advanced Processing Seals enable features such as extended lifespan, resistance to high temperatures and cleaning agents, and compatibility with various dairy processing equipment, reducing maintenance costs and improving operational reliability

- The trend toward automation, smart monitoring, and hygienic sealing solutions is reshaping processing line standards, with companies such as Freudenberg Sealing Technologies developing intelligent, high-performance seals that enhance efficiency and ensure compliance with food safety regulations

- The demand for durable, high-performance, and automation-ready Processing Seals for Dairy Products is increasing globally, driven by the dairy industry’s need for consistent product quality, efficiency, and regulatory compliance

What are the Key Drivers of Processing Seals for Dairy Products Market?

- The rising demand for packaged dairy products, coupled with stringent hygiene and food safety regulations, is a major driver for Processing Seals in dairy manufacturing

- For instance, in 2024, Trelleborg Seals & Profiles introduced seals specifically engineered for aseptic and ultra-high temperature (UHT) processing lines, supporting global compliance and improving operational safety. Such innovations are expected to drive market growth

- Dairy producers increasingly require seals that can withstand chemical cleaning, high pressures, and repeated thermal cycles while preventing contamination. Advanced materials such as silicone, PTFE, and fluoropolymers provide this resilience, boosting adoption

- The increasing automation of dairy processing lines and the adoption of smart monitoring systems for predictive maintenance are also driving market expansion. Automated systems reduce downtime and enhance production efficiency, creating higher demand for compatible, high-precision seals

- Moreover, the growth in global dairy consumption, expansion of dairy plants, and need for reduced production losses are key factors propelling the market. Companies offering durable, maintenance-friendly, and hygienically certified seals are gaining traction across both developed and emerging markets

Which Factor is Challenging the Growth of the Processing Seals for Dairy Products Market?

- High costs of advanced, automation-compatible sealing materials pose a challenge, particularly for small- and medium-sized dairy processors. These premium seals are often more expensive than traditional rubber alternatives

- For instance, reports indicate that the adoption of PTFE or fluoropolymer seals is limited in developing regions due to initial investment costs

- In addition, improper installation or lack of expertise in handling advanced seals can lead to leaks, contamination, or line stoppages, affecting adoption rates. Companies such as Novotema/IDEX emphasize technical support and training to alleviate such issues

- While prices are gradually decreasing, perceived complexity and premium costs can slow adoption in cost-sensitive regions. Balancing performance benefits with affordability remains critical

- Overcoming these challenges through material innovations, training programs, and cost-effective solutions will be vital for sustained growth in the processing seals for dairy products market

How is the Processing Seals for Dairy Products Market Segmented?

The market is segmented on the basis of material type and distribution channel.

- By Material Type

On the basis of material type, the processing seals for dairy products market is segmented into metals, face materials, elastomers, and others. The elastomers segment dominated the market with the largest revenue share of 46.5% in 2024, driven by their superior flexibility, chemical resistance, and ability to maintain tight sealing under high-pressure and high-temperature conditions. Elastomer seals, such as silicone and EPDM, are widely preferred in dairy processing for their durability during repeated cleaning cycles and resistance to dairy acids, ensuring product safety and minimizing contamination risks. Their versatility across various processing equipment such as pumps, valves, and homogenizers further supports adoption.

The metals segment is expected to witness the fastest CAGR of 20.8% from 2025 to 2032, fueled by growing demand for hybrid seals and reinforced metal-elastomer combinations in advanced dairy processing lines. Metal-based seals enhance structural integrity and extend service life, particularly in high-pressure or high-temperature applications.

- By Distribution Channel

On the basis of distribution channel, the Processing Seals for Dairy Products market is segmented into online, retail, wholesale, and others. The wholesale segment accounted for the largest market revenue share of 42.7% in 2024, owing to its ability to supply bulk quantities to large-scale dairy manufacturers and processing plants. Wholesalers offer competitive pricing, logistical support, and access to a wide range of specialized seals, making them a preferred choice for industrial buyers.

The online segment is anticipated to witness the fastest CAGR of 22.3% from 2025 to 2032, driven by the increasing adoption of e-commerce platforms for industrial and commercial procurement. Online channels provide manufacturers with easy access to technical specifications, customer reviews, and rapid delivery options. The convenience, transparency, and growing penetration of digital marketplaces are enabling online sales to expand rapidly, especially in emerging markets where distributors may have limited local presence.

Which Region Holds the Largest Share of the Processing Seals for Dairy Products Market?

- Asia-Pacific dominated the processing seals for dairy products market with the largest revenue share of 41.31% in 2024, driven by rapid industrialization, increasing demand for dairy products, and adoption of advanced processing technologies

- Consumers and manufacturers in the region highly value the efficiency, durability, and hygiene offered by Processing Seals for Dairy Products, which help maintain product safety and comply with stringent regulatory standards

- This widespread adoption is further supported by expanding dairy production, rising disposable incomes, and government initiatives promoting food safety and modernization, establishing Processing Seals for Dairy Products as a preferred solution across the region

China Processing Seals for Dairy Products Market Insight

The China processing seals for dairy products market captured the largest revenue share of 38% in 2024 within APAC, fueled by increasing dairy consumption, urbanization, and modernization of processing plants. Manufacturers are prioritizing high-performance seals to improve efficiency, reduce product loss, and meet strict hygiene standards. The availability of cost-effective components from domestic suppliers further boosts adoption across the country.

Japan Processing Seals for Dairy Products Market Insight

The Japan processing seals for dairy products market is growing steadily due to technological advancements, focus on quality control, and demand for high-efficiency dairy processing systems. Integration of advanced sealing solutions in automated production lines ensures safety, durability, and minimal downtime, supporting the adoption of processing seals for dairy products in commercial dairy operations.

Which Region is the Fastest Growing Region in the Processing Seals for Dairy Products Market?

The North America processing seals for dairy products market is expected to grow at the fastest CAGR of 7.98% during 2025–2032, driven by modernization of dairy plants, rising adoption of automated processing systems, and demand for high-performance sealing solutions. The growing trend toward sustainable and hygienic dairy processing, along with technological upgrades in equipment, is fueling market growth.

U.S. Processing Seals for Dairy Products Market Insight

The U.S. processing seals for dairy products market is witnessing rapid growth due to stringent food safety regulations, the integration of smart processing systems, and a strong focus on quality and efficiency in dairy manufacturing. Manufacturers increasingly rely on advanced seals to reduce downtime, improve product safety, and support sustainable operations, establishing the U.S. as a key growth market in North America.

Canada Processing Seals for Dairy Products Market Insight

The Canada processing seals for dairy products market is also expanding, supported by growing dairy production, demand for processed dairy items, and adoption of high-efficiency sealing solutions. Modern dairy plants and stringent hygiene standards are driving manufacturers to invest in durable, high-performance Processing Seals for Dairy Products, further boosting regional growth.

Which are the Top Companies in Processing Seals for Dairy Products Market?

The processing seals for dairy products industry is primarily led by well-established companies, including:

- Novotema/IDEX (Italy)

- Minor Rubber Products (U.S.)

- Freudenberg Sealing Technologies (Germany)

- American Rubber Corp (U.S.)

- Sealing Solutions Pty Ltd (Australia)

- SKF (Sweden)

- Northern Engineering (Sheffield) Ltd (U.K.)

- AESSEAL plc (U.K.)

- Trelleborg Seals & Profiles (Sweden)

- PARKER HANNIFIN CORP (U.S.)

- James Walker (U.K.)

- Precision Associates, Inc. (U.S.)

- Kismet Rubber Products (U.S.)

- Spareage Sealing Solutions (India)

- CinchSeal (U.S.)

- GARLOCK (U.S.)

- Enpro Industries (U.S.)

- Flowserve Corporation (U.S.)

- A.W. Chesterton Company (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Processing Seals For Dairy Products Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Processing Seals For Dairy Products Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Processing Seals For Dairy Products Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.