Global Product Analytics Market

Market Size in USD Billion

CAGR :

%

USD

9.05 Billion

USD

34.24 Billion

2024

2032

USD

9.05 Billion

USD

34.24 Billion

2024

2032

| 2025 –2032 | |

| USD 9.05 Billion | |

| USD 34.24 Billion | |

|

|

|

|

Product Analytics Market Size

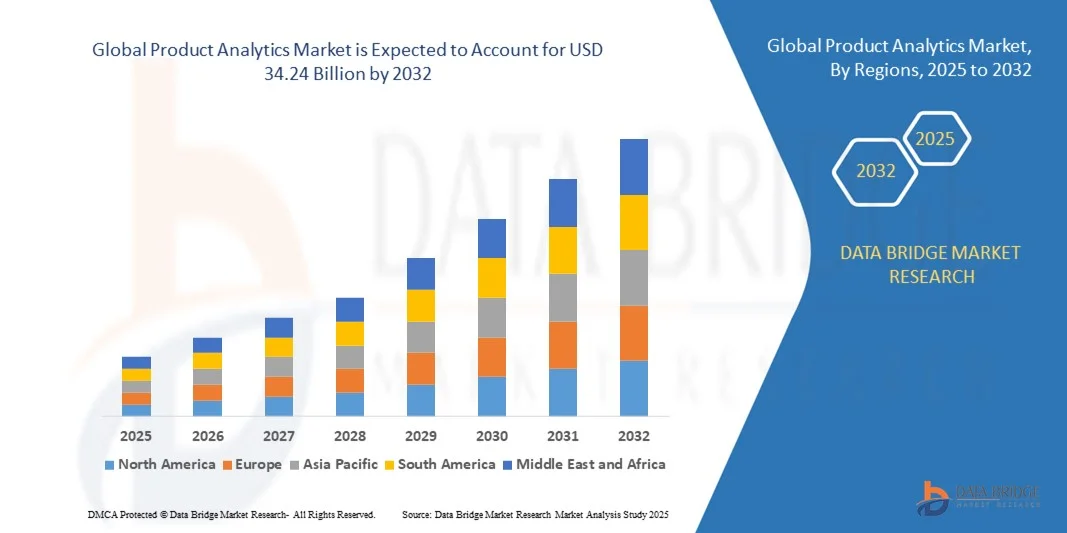

- The global product analytics market size was valued at USD 9.05 billion in 2024 and is expected to reach USD 34.24 billion by 2032, at a CAGR of 18.1% during the forecast period

- The market growth is largely fuelled by the increasing adoption of data-driven decision-making across industries, the rising need to enhance customer experience, and the growing reliance on advanced analytics tools to optimize product performance

- The integration of artificial intelligence (AI) and machine learning (ML) in product analytics platforms is enabling organizations to gain deeper insights into product usage, predict trends, and drive innovation

Product Analytics Market Analysis

- Organizations are increasingly leveraging product analytics to understand user behavior, optimize product features, and improve overall product lifecycle management

- Businesses are focusing on actionable insights derived from data to enhance product design, reduce churn, and increase customer engagement, thereby driving growth in the analytics market

- North America dominated the global product analytics market with the largest revenue share of 38.5% in 2024, driven by widespread adoption of data-driven strategies, advanced analytics tools, and growing demand for actionable insights across industries

- Asia-Pacific region is expected to witness the highest growth rate in the global product analytics market, driven by increasing IoT adoption, expanding middle-class consumer base, government initiatives supporting smart manufacturing, and growing demand for cloud-based analytics solutions across multiple sectors

- The Analyzing Data segment held the largest market revenue share in 2024, driven by the growing need for actionable insights to optimize product performance, improve customer experience, and support strategic decision-making. Analyzing Data solutions allow organizations to detect usage patterns, forecast trends, and enhance product lifecycle management, making them a preferred choice for enterprises across industries

Report Scope and Product Analytics Market Segmentation

|

Attributes |

Product Analytics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Product Analytics Market Trends

Rise of AI-Driven and Cloud-Based Product Analytics

- The growing adoption of AI-driven product analytics is transforming the market by enabling real-time insights into product performance and customer behavior. Organizations can quickly identify usage patterns, optimize features, and enhance user experience, resulting in improved product adoption and reduced churn. Companies are also leveraging predictive analytics to forecast product demand, detect anomalies early, and drive innovation in feature development

- The increasing demand for cloud-based analytics platforms is accelerating deployment, particularly for companies managing multiple products across distributed markets. Cloud solutions allow centralized data collection, real-time reporting, and seamless integration with other business intelligence tools, supporting faster decision-making. This also enables collaboration across global teams and reduces dependency on on-premise infrastructure, leading to operational efficiency

- The scalability and affordability of modern product analytics solutions are making them attractive for businesses of all sizes. Companies benefit from advanced insights without large upfront investments, enabling frequent monitoring of product performance and iterative improvements. Subscription-based models and flexible pricing further support adoption, particularly among mid-sized and emerging enterprises

- For instance, in 2023, several SaaS companies implemented AI-powered product analytics platforms to monitor feature usage and customer engagement. These implementations helped identify underutilized features, optimize product roadmaps, and improve overall user satisfaction. The insights also enabled better prioritization of product updates, reducing development costs and enhancing customer retention strategies

- While AI-driven and cloud-based product analytics are enabling smarter product strategies, their impact depends on continuous innovation, data quality, and proper training. Vendors must focus on customizable solutions and deployment strategies to fully capitalize on the growing demand. In addition, integrating analytics into existing workflows and ensuring cross-team adoption is critical to realizing maximum ROI

Product Analytics Market Dynamics

Driver

Increasing Adoption of Data-Driven Product Strategies Across Industries

- Organizations worldwide are increasingly prioritizing data-driven insights to optimize product design, improve customer engagement, and drive innovation. The need to enhance product lifecycle management is accelerating investment in advanced analytics solutions. Companies are also leveraging these insights to identify market gaps, launch targeted campaigns, and refine go-to-market strategies, boosting competitive advantage

- Businesses recognize the operational and financial risks associated with underperforming products, including customer churn, lost revenue, and competitive disadvantage. This awareness is prompting adoption of real-time monitoring and predictive analytics tools. Firms are integrating these platforms with CRM and ERP systems to enhance decision-making and align product strategies with broader business objectives

- Industry initiatives and consultancy frameworks promoting digital transformation and analytics-driven product strategies are boosting demand for advanced analytics platforms. Companies are leveraging these frameworks to improve decision-making and streamline product development cycles. Collaborative innovation programs and benchmarking initiatives further encourage adoption by showcasing successful outcomes and best practices across sectors

- For instance, in 2022, several global software companies integrated AI-powered product analytics to better understand user behavior and feature adoption, enabling them to prioritize high-impact enhancements and optimize customer experience. These insights also helped align product offerings with customer expectations, reduce time-to-market for updates, and enhance overall product competitiveness

- While growing awareness and institutional support are key drivers, challenges remain in integrating analytics platforms with legacy systems and ensuring teams have sufficient analytical expertise to maximize value. Organizations must invest in change management, cross-functional training, and adoption frameworks to fully leverage analytics-driven decision-making

Restraint/Challenge

High Cost of Advanced Product Analytics Solutions and Limited Skilled Workforce

- The high investment required for advanced AI-powered product analytics platforms limits adoption among small and mid-sized enterprises. These solutions are often adopted primarily by large organizations with sufficient budgets, making cost a major barrier to broader usage. In addition, ongoing subscription fees, cloud storage costs, and integration expenses add to the financial burden for smaller businesses

- A shortage of skilled data analysts and product managers capable of interpreting insights and managing complex analytics systems remains a concern, reducing operational efficiency and slowing adoption. Companies must often invest in training or external expertise, which can extend deployment timelines and increase operational costs. Talent gaps in emerging analytics technologies further complicate adoption and limit the ability to leverage advanced capabilities effectively

- Infrastructure and data integration challenges further restrict adoption, especially for organizations with fragmented data sources or legacy systems. Ensuring accurate, real-time data across platforms is critical to deriving actionable insights. Organizations often face difficulties in harmonizing data formats, migrating historical datasets, and maintaining data quality standards to support advanced analytics

- For instance, in 2023, multiple mid-sized technology firms reported that over 60% of their product teams were unable to fully utilize advanced analytics platforms due to high costs and lack of trained personnel. This resulted in underutilization of analytics capabilities, delayed product improvements, and missed opportunities for optimizing user experience and retention

- While technology continues to advance, addressing affordability, workforce training, and integration challenges is essential. Vendors must focus on scalable, cost-effective solutions and skill-building initiatives to bridge gaps and support long-term market growth in the global product analytics market. Strategic partnerships, modular platforms, and managed service options are emerging as key approaches to overcoming these barriers and driving wider adoption

Product Analytics Market Scope

The market is segmented on the basis of mode, end user, component, enterprise size, deployment, and vertical.

- By Mode

On the basis of mode, the global product analytics market is segmented into Tracking Data and Analyzing Data. The Analyzing Data segment held the largest market revenue share in 2024, driven by the growing need for actionable insights to optimize product performance, improve customer experience, and support strategic decision-making. Analyzing Data solutions allow organizations to detect usage patterns, forecast trends, and enhance product lifecycle management, making them a preferred choice for enterprises across industries.

The Tracking Data segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing adoption of IoT-enabled devices, wearable technology, and connected products. Tracking Data solutions enable real-time collection of product usage information, support predictive analytics, and facilitate rapid decision-making, making them highly attractive for companies looking to gain immediate visibility into customer interactions and product performance.

- By End User

On the basis of end user, the market is segmented into Designers, Manufacturers, Sales and Marketing Professionals, Consumer Engagement, Finance and Risk Professionals, and Others. The Sales and Marketing Professionals segment held the largest market revenue share in 2024, driven by the rising need to enhance customer engagement, optimize marketing campaigns, and improve product positioning across competitive markets. These solutions allow marketing teams to analyze user behavior, segment audiences, and deliver personalized product experiences effectively.

The Consumer Engagement segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing focus on customer-centric strategies and the demand for real-time feedback on product usage. Consumer Engagement solutions enable organizations to monitor user interactions, track satisfaction metrics, and tailor offerings to meet evolving expectations, thereby driving higher retention and brand loyalty.

- By Component

On the basis of component, the market is segmented into Software, Solutions, and Services. The Software segment held the largest market revenue share in 2024, driven by the increasing adoption of advanced analytics platforms, AI-powered tools, and visualization software that support data-driven product strategies. Software solutions allow organizations to automate analytics processes, generate actionable insights, and improve product lifecycle management efficiently.

The Services segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising demand for consulting, implementation, and support services related to product analytics solutions. Services help organizations customize platforms, integrate analytics with existing systems, and ensure effective adoption of tools, thereby enhancing overall operational efficiency.

- By Enterprise Size

On the basis of enterprise size, the market is segmented into SMEs and Large Enterprises. The Large Enterprises segment held the largest market revenue share in 2024, driven by significant investments in product analytics to optimize operations, improve customer satisfaction, and support diverse product portfolios. Large enterprises benefit from scalable solutions, advanced insights, and integrated platforms to manage complex analytics requirements effectively.

The SMEs segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing availability of affordable and scalable analytics solutions tailored for smaller organizations. SMEs are leveraging cloud-based and AI-powered platforms to gain actionable insights, improve product performance, and compete effectively with larger players.

- By Deployment

On the basis of deployment, the market is segmented into Cloud and On-Premises. The Cloud segment held the largest market revenue share in 2024, driven by its flexibility, scalability, and cost-effectiveness. Cloud-based platforms allow organizations to access real-time insights, integrate with other enterprise tools, and simplify deployment across distributed teams.

The On-Premises segment is expected to witness the fastest growth rate from 2025 to 2032, driven by organizations prioritizing data security, compliance, and control over sensitive product data. On-Premises solutions allow companies to manage analytics internally, maintain data integrity, and ensure adherence to regulatory standards.

- By Vertical

On the basis of vertical, the market is segmented into BFSI, Automotive, Retail and Consumer Goods, F&B Manufacturing, Machinery and Industrial Equipment Manufacturing, Media and Entertainment, Healthcare and Pharmaceuticals, Energy and Utilities, Government, and Others. The Retail and Consumer Goods segment held the largest market revenue share in 2024, driven by the growing need to monitor product usage patterns, enhance customer engagement, and optimize marketing strategies. Analytics platforms allow retailers to analyze consumer behavior, forecast trends, and improve product offerings.

The Healthcare and Pharmaceuticals segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption of data-driven insights for drug development, patient engagement, and product lifecycle optimization. Analytics solutions enable healthcare organizations to track product performance, ensure regulatory compliance, and enhance treatment outcomes effectively.

Product Analytics Market Regional Analysis

- North America dominated the global product analytics market with the largest revenue share of 38.5% in 2024, driven by widespread adoption of data-driven strategies, advanced analytics tools, and growing demand for actionable insights across industries

- Organizations in the region increasingly leverage product analytics to optimize product performance, enhance customer experience, and make strategic business decisions

- This adoption is further supported by high digital maturity, strong IT infrastructure, and robust investment in AI and cloud-based analytics platforms, establishing product analytics as a critical component of enterprise operations

U.S. Product Analytics Market Insight

The U.S. product analytics market captured the largest revenue share in 2024 within North America, fueled by rapid adoption of AI-powered platforms and cloud solutions. Enterprises are increasingly relying on real-time insights to monitor product performance, identify usage patterns, and optimize product portfolios. The growing preference for predictive analytics, coupled with integration across CRM, ERP, and marketing platforms, is further propelling market growth. Moreover, the U.S. market benefits from a strong ecosystem of analytics solution providers, technological innovation, and a digitally advanced workforce.

Europe Product Analytics Market Insight

The Europe product analytics market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising digital transformation initiatives and growing adoption of AI-based analytics platforms. Stringent regulatory frameworks, increasing focus on data-driven product strategies, and the need to enhance product lifecycle management are encouraging enterprises to adopt product analytics. Countries such as Germany, France, and the U.K. are witnessing significant investments in analytics solutions across retail, BFSI, and manufacturing sectors.

U.K. Product Analytics Market Insight

The U.K. product analytics market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for personalized customer experiences and optimized product strategies. Businesses are investing in advanced analytics tools to monitor product performance, improve operational efficiency, and enhance competitive advantage. The presence of a strong analytics ecosystem, high digital adoption, and support for AI and cloud-based platforms is further boosting growth.

Germany Product Analytics Market Insight

The Germany product analytics market is expected to witness the fastest growth rate from 2025 to 2032, fueled by growing emphasis on innovation, smart manufacturing, and data-driven product development. Enterprises across automotive, industrial equipment, and consumer goods sectors are adopting analytics platforms to optimize product design, forecast demand, and enhance customer satisfaction. The country’s focus on Industry 4.0 initiatives and advanced IT infrastructure is also supporting market growth.

Asia-Pacific Product Analytics Market Insight

The Asia-Pacific product analytics market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid digitalization, growing adoption of cloud-based platforms, and increasing focus on customer-centric product strategies in countries such as China, Japan, and India. The rise of IoT-enabled products, growing middle-class consumer base, and government initiatives supporting smart manufacturing are accelerating adoption.

Japan Product Analytics Market Insight

The Japan product analytics market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s advanced technological ecosystem, high IoT penetration, and emphasis on product innovation. Companies are increasingly adopting analytics platforms to monitor product usage, optimize features, and enhance customer engagement. The integration of analytics with smart manufacturing and connected devices is also fueling growth.

China Product Analytics Market Insight

The China product analytics market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, expanding e-commerce sector, and adoption of AI-enabled analytics solutions. Enterprises are leveraging product analytics to gain insights into customer behavior, enhance product development, and improve operational efficiency. The availability of domestic analytics solution providers and cost-effective platforms is further propelling market growth in China.

Product Analytics Market Share

The Product Analytics industry is primarily led by well-established companies, including:

- Google LLC (U.S.)

- IBM (U.S.)

- Oracle Corporation (U.S.)

- Adobe Inc. (U.S.)

- Salesforce, Inc. (U.S.)

- Mixpanel, Inc. (U.S.)

- Piwik PRO (Poland)

- Amplitude Analytics, Inc. (U.S.)

- Heap Inc. (U.S.)

- Plytix.com ApS (Denmark)

- Pendo.io (U.S.)

- LatentView Analytics (U.S.)

- Kissmetrics (U.S.)

- SAP SE (Germany)

- Atlassian Corporation Plc (U.K.)

- SAS Institute Inc. (U.S.)

- Teradata Corporation (U.S.)

- Sisense Inc. (U.S.)

- Woopra, Inc. (U.S.)

Latest Developments in Global Product Analytics Market

- In March 2024, Accenture launched IBM Sterling Intelligent, a supply chain cost optimization solution designed to enhance consumer transparency throughout the shopping journey. The tool leverages real-time systems, data analytics, and machine learning to streamline operations from product discovery to delivery, enabling companies to reduce costs, improve efficiency, and support digital transformation initiatives. Its adoption is expected to strengthen supply chain visibility and positively impact market competitiveness

- In March 2024, Oracle introduced Oracle Analytics Server (OAS) with over a hundred new features aimed at enhancing the analytics experience across organizations. The update allows users to derive deeper insights from data, make informed decisions, and improve overall business outcomes. The solution is poised to drive broader adoption of advanced analytics tools, fostering data-driven decision-making and operational efficiency in the market

- In February 2024, Medallia Inc. launched four new solutions—Ask Athena, Intelligent Summaries, Smart Response, and Themes—focused on personalizing customer and employee experiences. Available via the Medallia Experience Cloud, these AI-powered and automation-enabled tools help organizations engage employees, spread actionable insights, and deliver customized experiences. The launch is expected to advance market capabilities in experience management and drive adoption of scalable, ethical AI solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.