Global Progressive Familial Intrahepatic Cholestasis Type 2 Treatment Market

Market Size in USD Million

CAGR :

%

USD

154.80 Million

USD

248.59 Million

2025

2033

USD

154.80 Million

USD

248.59 Million

2025

2033

| 2026 –2033 | |

| USD 154.80 Million | |

| USD 248.59 Million | |

|

|

|

|

Progressive Familial Intrahepatic Cholestasis Type 2 Treatment Market Size

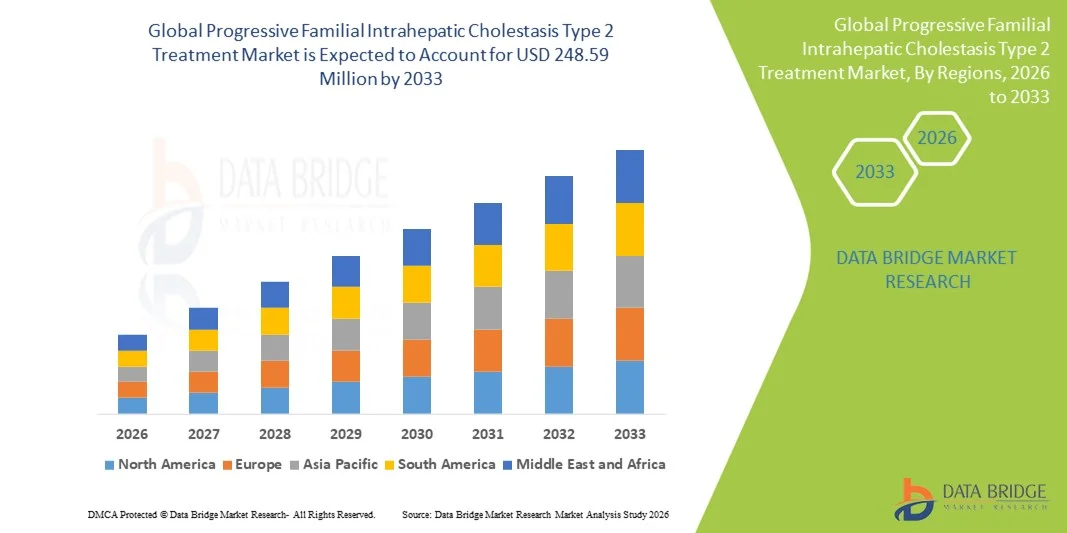

- The global progressive familial intrahepatic cholestasis type 2 treatment market size was valued at USD 154.80 million in 2025 and is expected to reach USD 248.59 million by 2033, at a CAGR of 6.10% during the forecast period

- The market growth is largely fueled by rising awareness and improved genetic diagnosis of PFIC‑2, enabling early identification and treatment of affected patients

- Furthermore, increasing investment in orphan drug development, regulatory incentives, and the emergence of targeted therapies such as IBAT inhibitors and FXR agonists are driving adoption, while specialized pediatric hepatology care is expanding patient access. These converging factors are accelerating the uptake of PFIC‑2 therapies, thereby significantly boosting the industry's growth

Progressive Familial Intrahepatic Cholestasis Type 2 Treatment Market Analysis

- PFIC‑2 treatments, including pharmacological therapies, supportive care, and liver transplantation, are increasingly vital components of rare-disease hepatology due to their role in managing a life-threatening genetic liver disorder that impairs bile acid transport, leading to progressive liver damage

- The escalating demand for PFIC‑2 therapies is primarily fueled by improved genetic screening and diagnostics, growing awareness among clinicians and patients, and increasing investment in orphan drug development for rare cholestatic liver diseases

- North America dominated the PFIC‑2 treatment market with the largest revenue share of 41.8% in 2025, characterized by advanced healthcare infrastructure, high rare-disease treatment spending, and a strong presence of key pharmaceutical and biotech players, with the U.S. experiencing substantial uptake of novel therapies and liver transplantation, supported by specialized pediatric hepatology centers and robust R&D activities

- Asia-Pacific is expected to be the fastest-growing region in the PFIC‑2 treatment market during the forecast period due to increasing healthcare access, improved diagnostic penetration, and rising investments in rare disease management in emerging markets

- Ursodeoxycholic acid (UDCA) segment dominated the PFIC‑2 treatment market with a market share of 47.8% in 2025, driven by its established clinical use, safety profile, and widespread adoption

Report Scope and Progressive Familial Intrahepatic Cholestasis Type 2 Treatment Market Segmentation

|

Attributes |

Progressive Familial Intrahepatic Cholestasis Type 2 Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Progressive Familial Intrahepatic Cholestasis Type 2 Treatment Market Trends

Advancements in Targeted Therapies and Orphan Drugs

- A significant and accelerating trend in the global PFIC‑2 treatment market is the development of targeted therapies, such as IBAT inhibitors and FXR agonists, which aim to address the underlying genetic causes of PFIC‑2

- For instance, maralixibat (Livmarli) integrates into treatment protocols to reduce bile acid accumulation, improving patient outcomes and reducing the need for liver transplantation

- These targeted therapies enable symptom management and improved liver function, while reducing side effects compared with conventional treatments such as ursodeoxycholic acid (UDCA)

- The introduction of novel therapies is also enhancing early intervention, allowing pediatric hepatologists to manage disease progression more effectively and reduce long-term complications

- This trend towards precision medicine and patient-specific therapies is reshaping clinician and patient expectations, driving demand for innovative PFIC‑2 solutions

- The adoption of these orphan drugs is growing rapidly across both developed and emerging markets, as regulatory incentives, clinical trial outcomes, and patient advocacy programs increase treatment accessibility

- Increasing collaborations between biotech companies and academic research centers are accelerating the discovery of next-generation PFIC‑2 therapies

- Digital health tools and telemedicine platforms are enabling remote monitoring of patients, improving adherence to treatment and real-time management of disease complications

Progressive Familial Intrahepatic Cholestasis Type 2 Treatment Market Dynamics

Driver

Rising Awareness and Improved Genetic Diagnostics

- The increasing awareness of PFIC‑2 among healthcare professionals and families, combined with advancements in genetic testing, is a significant driver for market growth

- For instance, the integration of next-generation sequencing panels enables earlier and more accurate diagnosis, allowing timely intervention with appropriate therapies

- As clinicians identify more PFIC‑2 cases, demand for both pharmacological and transplant-based treatments rises, expanding the market size

- Furthermore, growing investment in orphan drug development by pharmaceutical companies is creating more treatment options for previously unmet needs

- Improved healthcare infrastructure and specialized pediatric hepatology centers are making these therapies more accessible, encouraging adoption across regions

- The combination of early diagnosis, treatment availability, and increased clinician awareness is propelling the uptake of PFIC‑2 therapies globally

- Increasing government and NGO initiatives supporting rare disease treatment awareness are encouraging families to seek timely medical intervention

- Expansion of patient advocacy programs is empowering caregivers and improving patient enrollment in clinical trials, supporting market growth

Restraint/Challenge

High Treatment Costs and Limited Patient Pool

- The high cost of PFIC‑2 therapies, particularly orphan drugs and liver transplantation, poses a major challenge to widespread adoption in both developed and developing countries

- For instance, the price of maralixibat and specialized transplantation procedures can be prohibitive for healthcare systems or patients without insurance coverage

- Limited prevalence of PFIC‑2 results in a small patient population, making clinical trial recruitment and commercial scaling difficult for pharmaceutical companies

- Regulatory hurdles, including stringent orphan drug approval requirements and country-specific pricing regulations, further slow market expansion

- Although some support programs exist to improve affordability, the overall high cost remains a barrier to adoption, particularly in emerging markets

- Overcoming these challenges through patient assistance programs, expanded insurance coverage, and cost-effective therapies is crucial for sustained market growth

- Lack of standardized treatment guidelines and limited long-term clinical data hinder broader adoption and prescriber confidence

- Variability in healthcare infrastructure across regions can restrict patient access to specialized treatment centers and transplantation facilities, slowing market penetration

Progressive Familial Intrahepatic Cholestasis Type 2 Treatment Market Scope

The market is segmented on the basis of drug type and distribution channel.

- By Drug

On the basis of drug type, the PFIC‑2 treatment market is segmented into ursodeoxycholic acid (UDCA), cholestyramine, rifampicin, late-stage pipeline drugs, and others. The ursodeoxycholic acid (UDCA) segment dominated the market with the largest revenue share of 47.8% in 2025, driven by its established clinical use, well-documented safety profile, and widespread adoption among pediatric and adult PFIC‑2 patients. UDCA is often prescribed as a first-line therapy to reduce bile acid levels, alleviate pruritus, and improve liver function. The segment benefits from strong prescriber confidence, ease of administration, and compatibility with adjunct therapies, making it the preferred choice in both developed and emerging markets. In addition, UDCA’s role in delaying disease progression reduces the immediate need for transplantation, further solidifying its market dominance. High awareness among hepatologists and long-term clinical data supporting its efficacy contribute to sustained demand. Patient adherence programs and inclusion in national rare-disease treatment guidelines also reinforce market penetration for UDCA.

The late-stage pipeline drugs segment is anticipated to witness the fastest growth rate of 38.5% from 2026 to 2033, fueled by the development of novel targeted therapies such as IBAT inhibitors and FXR agonists. These drugs are designed to address the underlying genetic defects of PFIC‑2, offering improved symptom management, reduction of bile acid accumulation, and potentially delaying or avoiding liver transplantation. Clinical trial successes and regulatory incentives for orphan drugs are attracting significant investment, accelerating the pipeline’s market entry. The growing emphasis on precision medicine and personalized treatment strategies is creating strong demand for these advanced therapies. Adoption is further supported by patient advocacy programs and increasing access through specialized pediatric hepatology centers. The segment is also benefiting from heightened awareness among clinicians about novel treatment options and their long-term benefits over conventional therapies.

- By Distribution Channel

On the basis of distribution channel, the PFIC‑2 treatment market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment dominated the market with the largest revenue share of 55% in 2025, driven by the requirement for specialized handling, patient monitoring, and administration of treatments under clinical supervision. Hospital pharmacies are critical for dispensing orphan drugs and supporting liver transplantation protocols, particularly in pediatric hepatology centers. They offer direct access to healthcare professionals for guidance on dosing, side effect management, and therapy adjustments. The dominance is also supported by insurance reimbursement frameworks and government-sponsored rare-disease programs, which facilitate access to hospital-dispensed therapies. Hospital pharmacies play a key role in ensuring treatment adherence and providing integrated care for complex PFIC‑2 patients. In addition, their established networks and partnerships with pharmaceutical companies enhance the reliability of drug supply and accessibility.

The online pharmacies segment is expected to witness the fastest growth rate of 27.8% from 2026 to 2033, fueled by increasing digital health adoption, telemedicine consultations, and rising patient preference for home delivery of medications. Online channels provide convenience for caregivers managing pediatric PFIC‑2 patients, especially in regions with limited specialized hospital access. Integration with digital prescriptions and patient support programs ensures secure and timely delivery of both conventional and novel therapies. The growth of e-pharmacy platforms is further supported by awareness campaigns, ease of price comparison, and the availability of rare-disease medications through verified online portals. Increasing smartphone penetration and healthcare app adoption are also driving convenience-focused uptake. Furthermore, online pharmacies are becoming critical for maintaining continuity of care during travel restrictions or for patients in remote areas.

Progressive Familial Intrahepatic Cholestasis Type 2 Treatment Market Regional Analysis

- North America dominated the PFIC‑2 treatment market with the largest revenue share of 41.8% in 2025, characterized by advanced healthcare infrastructure, high rare-disease treatment spending, and a strong presence of key pharmaceutical and biotech players

- Patients and caregivers in the region highly value the availability of specialized therapies, comprehensive disease management programs, and access to novel treatments such as IBAT inhibitors and FXR agonists

- This widespread adoption is further supported by government and insurance coverage for rare-disease therapies, high awareness among clinicians and patients, and active participation in clinical trials, establishing North America as the leading market for PFIC‑2 treatment

U.S. Progressive Familial Intrahepatic Cholestasis Type 2 Treatment Market Insight

The U.S. PFIC‑2 treatment market captured the largest revenue share of 45% in 2025 within North America, fueled by advanced healthcare infrastructure and the widespread availability of orphan drugs. Patients and caregivers are increasingly prioritizing access to specialized therapies, including ursodeoxycholic acid (UDCA) and novel pipeline drugs, to manage disease progression and improve quality of life. The growing presence of pediatric hepatology centers, clinical trial participation, and telemedicine services further propels market adoption. Moreover, supportive insurance coverage and government initiatives for rare diseases are significantly contributing to the market’s expansion.

Europe Progressive Familial Intrahepatic Cholestasis Type 2 Treatment Market Insight

The Europe PFIC‑2 treatment market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by well-established healthcare systems and regulatory support for rare-disease treatments. Increasing awareness among clinicians and caregivers, coupled with investments in specialized pediatric hepatology centers, is fostering the adoption of both conventional and novel therapies. European patients are drawn to the availability of comprehensive treatment programs and access to clinical trials. The market is experiencing significant growth across major countries, with PFIC‑2 treatments being incorporated into national rare-disease frameworks and hospital protocols.

U.K Progressive Familial Intrahepatic Cholestasis Type 2 Treatment Market Insight

The U.K. PFIC‑2 treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness of rare liver disorders and the increasing availability of orphan drugs. Concerns regarding early diagnosis and disease progression are encouraging caregivers and clinicians to adopt timely treatment options. The U.K.’s robust healthcare infrastructure, alongside active participation in international clinical trials, is expected to continue stimulating market growth. Moreover, patient support programs and government incentives are helping improve access to advanced PFIC‑2 therapies.

Germany Progressive Familial Intrahepatic Cholestasis Type 2 Treatment Market Insight

The Germany PFIC‑2 treatment market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of rare liver diseases and advanced pediatric care infrastructure. Germany’s strong focus on medical innovation, clinical research, and rare-disease management promotes the adoption of novel therapies, including IBAT inhibitors and FXR agonists. Integration of PFIC‑2 treatment protocols within specialized hospital networks is becoming increasingly prevalent, with a strong preference for evidence-based care and multidisciplinary management. The availability of patient support programs and reimbursement policies further enhances market growth.

Asia-Pacific Progressive Familial Intrahepatic Cholestasis Type 2 Treatment Market Insight

The Asia-Pacific PFIC‑2 treatment market is poised to grow at the fastest CAGR of ~23% during the forecast period of 2026 to 2033, driven by increasing healthcare access, rising awareness of rare liver diseases, and improving diagnostic capabilities in countries such as China, Japan, and India. The region's growing adoption of pediatric hepatology care and orphan drugs is supporting market expansion. Furthermore, government initiatives promoting rare-disease treatment, telemedicine services, and enhanced access to specialty hospitals are facilitating adoption across emerging markets.

Japan Progressive Familial Intrahepatic Cholestasis Type 2 Treatment Market Insight

The Japan PFIC‑2 treatment market is gaining momentum due to the country’s advanced healthcare system, high awareness of rare diseases, and emphasis on pediatric liver care. Adoption is driven by increasing availability of orphan drugs, specialized hepatology centers, and clinical trial participation. Integration of novel therapies into standard treatment protocols, along with strong patient support programs, is fueling growth. In addition, the aging population and focus on quality of life in pediatric patients are expected to further increase treatment uptake in residential and hospital settings.

India Progressive Familial Intrahepatic Cholestasis Type 2 Treatment Market Insight

The India PFIC‑2 treatment market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rising awareness among healthcare providers and caregivers, increasing pediatric healthcare infrastructure, and improved access to orphan drugs. India stands as a key emerging market for rare-disease therapies, with PFIC‑2 treatments becoming increasingly available in major hospitals and specialty centers. Government rare-disease initiatives, growing telemedicine adoption, and supportive patient assistance programs are key factors propelling market growth.

Progressive Familial Intrahepatic Cholestasis Type 2 Treatment Market Share

The Progressive Familial Intrahepatic Cholestasis Type 2 Treatment industry is primarily led by well-established companies, including:

- Mirum Pharmaceuticals, Inc. (U.S.)

- Ipsen Pharma (France)

- Vivet Therapeutics (France)

- Takeda Pharmaceutical Company Limited (Japan)

- Travere Therapeutics, Inc. (U.S.)

- Calliditas Therapeutics AB (Sweden)

- Jadeite Medicines Inc. (Japan)

- Albireo Pharma, Inc. (U.S.)

- Genkyotex SA (Switzerland)

- Eiger BioPharmaceuticals, Inc. (U.S.)

- Ligand Pharmaceuticals, Inc. (U.S.)

- GSK plc (U.K.)

- Gilead Sciences, Inc. (U.S.)

- Novartis AG (Switzerland)

- Vertex Pharmaceuticals, Inc. (U.S.)

- Zydus Lifesciences (India)

- Ohara Pharmaceutical Co., Ltd. (Japan)

- Hepagene Therapeutics, Inc. (U.S.)

- Ascletis Pharma, Inc. (China)

- COUR Pharmaceuticals (U.S.)

What are the Recent Developments in Global Progressive Familial Intrahepatic Cholestasis Type 2 Treatment Market?

- In March 2025, LIVMARLI (maralixibat) was approved in Japan for the treatment of cholestatic pruritus associated with both Alagille syndrome and PFIC. This marks the first approved treatment for PFIC in Japan, significantly expanding geographic access and offering a much-needed therapy for Japanese pediatric patients

- In March 2024, the FDA further expanded the Livmarli label to include PFIC patients 12 months and older with a higher-concentration formulation. This label expansion broadens access to younger patients and provides a more flexible dosing option, strengthening Livmarli’s role in long-term management of PFIC‑2

- In April 2023, CANbridge Pharmaceuticals (Greater China) confirmed its exclusive license with Mirum for Livmarli in PFIC, ALGS, and biliary atresia, and reported that it had filed a New Drug Application (NDA) in China for PFIC. canbridgepharma.com This is a key step toward making Livmarli available in China, potentially opening up treatment access for a large, underserved patient population in Greater China

- In September 2021, the U.S. Food and Drug Administration (FDA) approved Livmarli (maralixibat) for treatment of cholestatic pruritus in PFIC patients aged 12 months and older. This was a landmark approval, because Livmarli is an ileal bile acid transporter (IBAT) inhibitor that reduces bile acid buildup, offering a non-transplant medical therapy for PFIC‑2 and improving patient quality of life

- In July 2021, the FDA approved Bylvay (odevixibat) for pruritus in PFIC (types 1 & 2) patients aged 3 months and older. This approval was based on a randomized, double‑blind, placebo‑controlled trial in pediatric PFIC subjects, showing significant reduction in scratching behavior and bilirubin, thereby bringing the first non-surgical, targeted therapy for PFIC-related itching

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.