Global Project Logistics Market

Market Size in USD Billion

CAGR :

%

USD

466.38 Billion

USD

734.96 Billion

2024

2032

USD

466.38 Billion

USD

734.96 Billion

2024

2032

| 2025 –2032 | |

| USD 466.38 Billion | |

| USD 734.96 Billion | |

|

|

|

|

Project Logistics Market Size

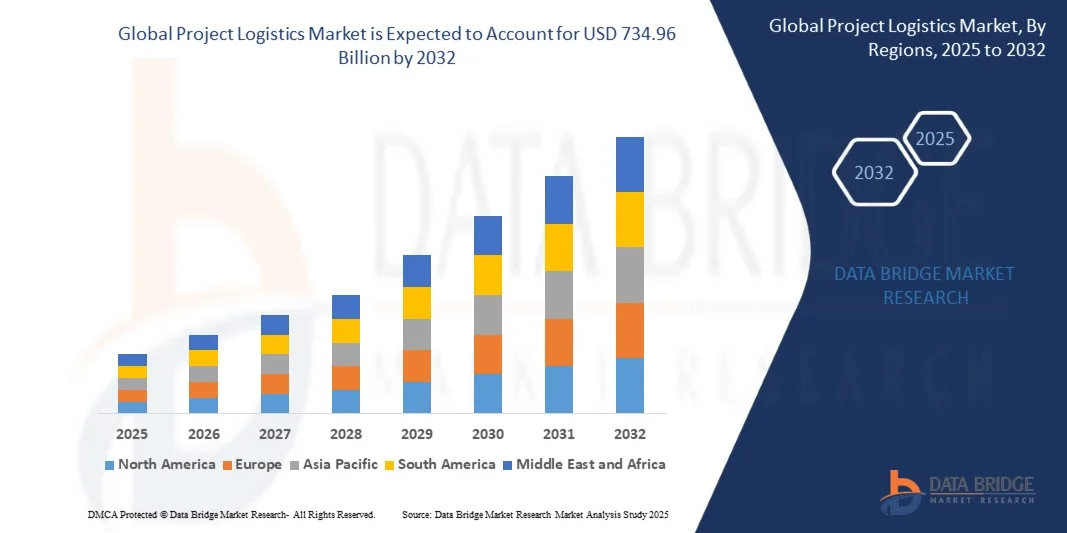

- The Project Logistics Market size was valued at USD 466.38 billion in 2024 and is projected to reach USD 734.96 billion by 2032, growing at a CAGR of 5.85% during the forecast period

- Market expansion is primarily driven by increasing large-scale infrastructure projects, industrialization, and the rising need for efficient transport of oversized and high-value cargo across international borders

- In addition, advancements in route optimization, multimodal transportation, and digital supply chain technologies are streamlining operations, making project logistics a critical component in global trade and infrastructure development

Project Logistics Market Analysis

- Project logistics, which involves the planning, execution, and management of complex transportation tasks for large, heavy, or high-value equipment, plays a crucial role in supporting infrastructure, energy, mining, and construction projects across global markets due to its ability to ensure timely and cost-effective delivery of critical components

- The rising demand for project logistics is primarily driven by global infrastructure development, increasing energy and industrial projects, and the growing need for specialized logistics services tailored to oversized and high-value cargo

- North America dominated the Project Logistics Market with the largest revenue share of 35.3% in 2024, supported by strong investments in renewable energy, oil and gas projects, and a well-established logistics infrastructure, with the U.S. leading due to its advanced transportation networks and presence of major logistics providers

- Asia-Pacific is expected to be the fastest growing region in the Project Logistics Market during the forecast period due to rapid industrialization, expanding construction activities, and government-led infrastructure initiatives in countries such as China and India

- The cross-border segment dominated the market with the largest revenue share of 58.3% in 2024, driven by the rise in international infrastructure projects, particularly in renewable energy, mining, and oil & gas.

Report Scope and Project Logistics Market Segmentation

|

Attributes |

Project Logistics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Project Logistics Market Trends

“Enhanced Efficiency Through AI and Digital Integration”

- A significant and accelerating trend in the Project Logistics Market is the deepening integration of artificial intelligence (AI), Internet of Things (IoT), and advanced analytics to improve operational efficiency, real-time visibility, and decision-making across complex supply chains. These digital innovations are transforming traditional logistics processes, particularly in the movement of oversized and high-value cargo.

- For instance, leading logistics providers such as Maersk and DHL are deploying AI-powered platforms to optimize route planning, predict delivery delays, and reduce fuel consumption. Similarly, GEODIS uses IoT sensors to provide real-time cargo monitoring, enhancing security and operational transparency for project-critical shipments.

- AI-driven systems in project logistics enable predictive maintenance of transport equipment, intelligent demand forecasting, and dynamic scheduling adjustments. For example, DSV leverages machine learning algorithms to evaluate cargo risks and recommend safer and more efficient multimodal transport combinations.

- The seamless integration of digital tools into project logistics networks allows for centralized control and coordination of global operations. From one platform, stakeholders can track project milestones, monitor cargo status, and automate documentation and compliance checks, significantly improving speed and accuracy in execution.

- This trend toward smarter, tech-enabled logistics solutions is reshaping client expectations across energy, construction, and infrastructure sectors. Companies like C.H. Robinson are investing heavily in digital freight platforms and AI-enhanced visibility tools to meet growing demands for responsiveness and transparency.

- The adoption of AI and digital integration in project logistics is accelerating across both developed and emerging markets, as companies seek scalable, resilient, and data-driven logistics solutions to manage increasingly complex supply chain needs.

Project Logistics Market Dynamics

Driver

“Growing Demand Driven by Global Infrastructure Expansion and Industrialization”

- The increasing volume of infrastructure development projects, energy sector investments, and industrialization—particularly in emerging economies—is a major driver fueling the demand for project logistics services globally. As governments and private entities undertake large-scale projects, there is a growing need for specialized logistics to transport oversized, high-value, and time-sensitive cargo efficiently and securely.

- For instance, in March 2024, Kuehne + Nagel announced its involvement in a major renewable energy project in Southeast Asia, managing end-to-end logistics for the transport of wind turbine components. This project highlights the growing role of logistics providers in supporting global sustainability and infrastructure initiatives.

- Project logistics offers essential services such as route surveys, freight consolidation, customs clearance, and multimodal transport coordination, which are critical for sectors like oil & gas, power generation, construction, and mining. These services ensure timely execution and cost control in projects where logistics delays can have significant financial implications.

- The expansion of cross-border trade agreements and the rise of industrial hubs in regions like Asia-Pacific, the Middle East, and Latin America further underscore the need for robust project logistics solutions that can handle complex and large-scale movements.

- Additionally, the trend toward modular construction and prefabricated infrastructure components—requiring careful transport of large modules—has created further opportunities for project logistics providers to offer tailored, end-to-end transport strategies. As companies seek partners who can deliver reliable, on-time, and cost-effective logistics support, the market is expected to witness sustained growth across both developed and developing regions.

Restraint/Challenge

“Infrastructure Limitations and Complex Regulatory Environments”

- Despite its growth potential, the Project Logistics Market faces key challenges, including inadequate transport infrastructure in certain regions and complex international regulatory environments. Many developing countries lack the road, port, or rail capacity to support the movement of heavy or oversized cargo, which can lead to costly delays and project disruptions.

- For instance, remote construction sites or energy projects in parts of Africa or Southeast Asia often require extensive planning and investment in temporary infrastructure—such as reinforced roads or custom-built docks—just to facilitate delivery, adding time and cost to project logistics execution.

- Additionally, navigating the diverse and often inconsistent customs regulations, permitting processes, and compliance requirements across countries can complicate cross-border shipments. Delays in obtaining permits or unexpected regulatory changes can significantly impact timelines, especially for large-scale projects with fixed delivery windows.

- Companies like Maersk and DSV are investing in local partnerships, regulatory expertise, and digital platforms to mitigate these risks, but these issues remain a challenge, especially for smaller logistics providers.

- Moreover, project logistics services often involve high upfront costs for planning, specialized equipment, and coordination among multiple stakeholders. For clients with limited budgets or short timelines, these costs can deter adoption or push them toward less efficient transport solutions.

- Overcoming these challenges will require continued investment in infrastructure development, harmonization of international trade policies, and greater collaboration between logistics providers, governments, and industry stakeholders.

Project Logistics Market Scope

The market is segmented on the basis of scope, end user, mode of transport, and value of shipment.

• By Scope

On the basis of scope, the Project Logistics Market is segmented into domestic and cross-border logistics services. The cross-border segment dominated the market with the largest revenue share of 58.3% in 2024, driven by the rise in international infrastructure projects, particularly in renewable energy, mining, and oil & gas. Cross-border logistics services are crucial for transporting oversized equipment and materials across different countries, requiring expertise in customs clearance, regulatory compliance, and multimodal transport solutions.

The domestic segment is expected to witness the fastest CAGR of 21.4% from 2025 to 2032, fueled by increasing investment in national infrastructure development, smart city projects, and local energy generation. Countries such as India, Brazil, and Indonesia are witnessing a surge in domestic industrial activity, boosting demand for project logistics within national borders. Service providers are expanding domestic networks to offer end-to-end solutions for timely, efficient cargo movement.

• By End User

On the basis of End User, The Project Logistics Market is segmented by end user into oil and gas, construction, mining, aerospace, power generation, and pharmaceuticals. The oil and gas segment held the largest revenue share of 31.6% in 2024, due to the sector’s reliance on timely delivery of heavy, sensitive, and high-value equipment to remote and offshore locations. The complexity of upstream and downstream projects drives demand for specialized logistics planning and execution.

The power generation segment is expected to be the fastest growing, registering a CAGR of 22.1% from 2025 to 2032, spurred by global investments in renewable energy, especially wind and solar projects, which require coordinated transport of turbines, blades, and other large components. The push for clean energy and infrastructure upgrades in emerging markets like Southeast Asia and Africa is expected to further drive this segment.

• By Mode of Transport

on the basis of mode of transport, the Project Logistics Market is segmented into road, air, sea, and rail transportation. The road transportation segment dominated the market with a revenue share of 37.9% in 2024, supported by its flexibility, last-mile connectivity, and ability to reach remote project sites. Road transport is commonly used in combination with sea and rail for multimodal solutions, especially in construction and mining logistics.

The air transportation segment is expected to witness the fastest growth during the forecast period, with a projected CAGR of 23.5% from 2025 to 2032, owing to the rising need for time-critical deliveries in sectors such as aerospace, pharmaceuticals, and oil & gas. Though air freight is costlier, it ensures speed and reliability, which is critical for high-value, urgent project components.

• By Value of Shipment

On the basis of value, the Project Logistics Market is segmented into low-value, medium-value, and high-value shipments. The high-value segment accounted for the largest revenue share of 44.7% in 2024, driven by the complex requirements of sectors such as aerospace, oil & gas, and power generation. These shipments typically involve specialized handling, insurance, and security measures to ensure safe and timely delivery.

The medium-value segment is projected to experience the fastest CAGR of 20.9% from 2025 to 2032, as mid-sized industrial projects and modular construction increase globally. These shipments strike a balance between cost sensitivity and the need for reliability, making them ideal for new entrants and expanding industries in developing markets. Service providers are tailoring logistics strategies to optimize costs while maintaining performance and safety standards for this growing shipment category.

Project Logistics Market Regional Analysis

- North America dominated the Project Logistics Market with the largest revenue share of 35.3% in 2024, driven by extensive infrastructure development, energy projects, and industrial expansion across the region.

- The U.S. and Canada, in particular, exhibit strong demand for specialized logistics services that can handle oversized and complex cargo, supported by advanced transport infrastructure and well-established regulatory frameworks.

- The region benefits from high investments in renewable energy, construction, and manufacturing sectors, alongside a mature logistics industry with leading service providers offering integrated, technology-enabled solutions. This combination positions North America as a key market for project logistics in both domestic and cross-border operations.

U.S. Project Logistics Market Insight

The U.S. project logistics market captured the largest revenue share of 38% in 2024 within North America, driven by the rapid expansion of energy infrastructure, industrial construction, and defense projects. The country’s strong emphasis on technological innovation and advanced supply chain management supports widespread integration of specialized logistics services for oversized and high-value cargo. Additionally, significant investments in renewable energy projects, such as wind and solar farms, and ongoing infrastructure modernization initiatives are propelling demand for efficient project logistics solutions with superior reliability and precision.

Europe Project Logistics Market Insight

The Europe market for project logistics is projected to expand at a steady CAGR during the forecast period, primarily fueled by growing adoption in energy, automotive, and construction sectors. Stringent regulations on emissions, safety, and sustainability, coupled with increasing investments in cross-border transportation networks, contribute to demand across industrial, commercial, and governmental applications. Countries such as Germany and France lead in logistics innovation and digitalization, with a focus on efficiency and carbon reduction. The region’s emphasis on green logistics and smart mobility is fostering stronger demand for project logistics services in large-scale infrastructure and renewable energy developments.

U.K. Project Logistics Market Insight

The U.K. project logistics market is expected to grow at a significant CAGR owing to heightened investments in renewable energy and infrastructure modernization projects. The rise in smart city initiatives and government support for sustainable logistics solutions are key growth drivers. Additionally, the U.K.’s strong presence of global logistics providers and specialized service companies is fostering advanced project management for applications such as offshore wind farms, defense systems, and large industrial installations.

Germany Project Logistics Market Insight

Germany holds a substantial share in the project logistics market in Europe, supported by its well-developed manufacturing ecosystem and focus on export-oriented industries. The country’s growing demand for heavy machinery transport, automotive production, and industrial automation solutions is accelerating the uptake of advanced logistics capabilities. Germany’s robust R&D investments and collaborations between logistics providers and technology firms are enabling innovations in digital tracking, autonomous transport, and energy-efficient operations suitable for a range of project-based applications.

Asia-Pacific Project Logistics Market Insight

The Asia-Pacific market for project logistics is poised to register the fastest CAGR of 22% from 2025 to 2032, driven by rapid industrialization, urbanization, and increasing infrastructure development in countries such as China, Japan, South Korea, and India. The region’s expanding manufacturing base, growing energy projects, and large-scale construction activities are key factors fueling demand. Additionally, APAC’s emergence as a global logistics hub for heavy and specialized cargo is enhancing service availability and cost competitiveness, broadening adoption across commercial and industrial sectors.

Japan Project Logistics Market Insight

Japan’s project logistics market is witnessing steady growth, supported by the country’s advanced industrial infrastructure and extensive adoption of automation technologies. Japan places strong emphasis on precision, safety, and efficiency in logistics operations, encouraging widespread use of specialized transport and handling solutions for sectors such as energy, construction, and manufacturing. The aging population and emphasis on infrastructure resilience also drive demand for innovative logistics systems that integrate digital monitoring and automation for improved reliability and sustainability.

China Project Logistics Market Insight

China accounted for the largest market revenue share in the Asia-Pacific region in 2024, propelled by rapid industrialization, expansive infrastructure development, and increasing government support for logistics modernization. The country is a key player in global supply chain operations, with domestic companies advancing heavy-lift and multimodal logistics capabilities to serve growing demand in energy, construction, and manufacturing sectors. Affordable and scalable logistics solutions are accelerating penetration in both domestic and international project markets, strengthening China’s position as a global leader in project logistics services.

Project Logistics Market Share

The Project Logistics industry is primarily led by well-established companies, including:

- Amazon.com, Inc. (U.S.)

- United Parcel Service, Inc. (U.S.)

- FedEx Corporation (U.S.)

- Deutsche Post AG (DHL Group) (Germany)

- DSV A/S (Denmark)

- Kuehne + Nagel International AG (Switzerland)

- A.P. Moller – Maersk A/S (Denmark)

- C.H. Robinson Worldwide, Inc. (U.S.)

- J.B. Hunt Transport Services, Inc. (U.S.)

- XPO Logistics, Inc. (U.S.)

- GEODIS (France)

- Nippon Express (Japan)

- CEVA Logistics (CMA CGM Group) (France)

- Toll Group (Australia)

- Expeditors International (U.S.)

What are the Recent Developments in Project Logistics Market?

- In April 2023, DHL Global Forwarding, a division of Deutsche Post DHL Group, launched a dedicated project logistics hub in Singapore to enhance its capabilities in handling oversized and complex shipments across the Asia-Pacific region. This initiative aims to strengthen DHL’s position as a leading global project logistics provider by offering tailored solutions for sectors such as energy, construction, and manufacturing, supported by advanced tracking and cargo management technologies.

- In March 2023, Kuehne + Nagel International AG expanded its project logistics services in North America by opening a new specialized facility in Houston, Texas. Designed to support the oil and gas and aerospace industries, the facility offers comprehensive end-to-end logistics solutions, including heavy-lift transport and customs expertise. This development reflects Kuehne + Nagel’s commitment to meeting the growing demand for complex logistics management in key industrial sectors.

- In March 2023, A.P. Moller – Maersk A/S announced the launch of a digital platform aimed at improving visibility and efficiency in project logistics shipments worldwide. The platform leverages AI and IoT technologies to provide real-time tracking, predictive analytics, and automated documentation, enhancing operational transparency and reducing delays. This innovation reinforces Maersk’s focus on integrating technology to optimize global supply chain and project cargo management.

- In February 2023, XPO Logistics, Inc. entered into a strategic partnership with a leading European wind energy company to provide end-to-end logistics solutions for the installation of offshore wind farms. The collaboration involves multimodal transport, specialized handling of oversized components, and dedicated project management teams. This partnership highlights XPO’s expertise in supporting renewable energy projects and complex logistics requirements.

- In January 2023, FedEx Corporation unveiled its FedEx Custom Critical Heavyweight Division, focused on providing expedited and specialized transport solutions for oversized and high-value project cargo across the U.S. The new division is equipped with advanced tracking and security technologies to ensure safe and timely delivery of critical shipments. This launch demonstrates FedEx’s commitment to addressing the unique challenges of project logistics and expanding its footprint in this high-growth market segment.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.