Global Proprietary Hmi Human Machine Interface Software Market

Market Size in USD Billion

CAGR :

%

USD

6.57 Billion

USD

13.00 Billion

2025

2033

USD

6.57 Billion

USD

13.00 Billion

2025

2033

| 2026 –2033 | |

| USD 6.57 Billion | |

| USD 13.00 Billion | |

|

|

|

|

Proprietary HMI (Human Machine Interface) Software Market Size

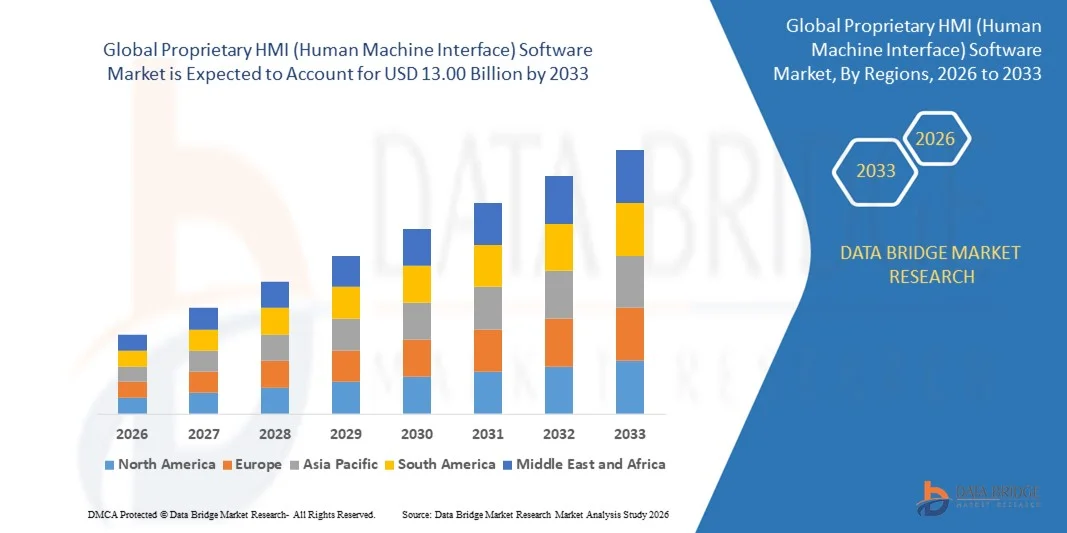

- The global proprietary HMI (Human Machine Interface) software market size was valued at USD 6.57 billion in 2025 and is expected to reach USD 13.00 billion by 2033, at a CAGR of 8.90% during the forecast period

- The market growth is largely fuelled by the rising adoption of automation technologies across industries such as manufacturing, energy, automotive, and process industries

- Increasing demand for intuitive operator interfaces and real-time monitoring capabilities is further accelerating the use of proprietary HMI platforms

Proprietary HMI (Human Machine Interface) Software Market Analysis

- The market is experiencing steady growth due to the increasing need for enhanced operational control, data visualization, and seamless interaction between humans and industrial systems

- In addition, the shift toward smart factories, closed-loop automation, and higher safety standards is boosting the adoption of proprietary HMI solutions designed to ensure reliability, compliance, and high performance

- North America dominated the proprietary HMI software market with the largest revenue share in 2025, driven by strong adoption of industrial automation and growing investments in digital transformation across manufacturing and process industries

- Asia-Pacific region is expected to witness the highest growth rate in the global proprietary HMI (Human Machine Interface) software market, driven by accelerating industrialization, rising adoption of smart factory solutions, and expanding manufacturing capabilities across emerging economies

- The Stand-Alone HMI segment held the largest market revenue share in 2025, driven by its flexibility, ease of integration with diverse industrial systems, and ability to support multiple machines and processes. Stand-Alone HMI solutions are widely adopted across manufacturing facilities for centralized monitoring and control, offering improved operational efficiency and real-time visualization

Report Scope and Proprietary HMI (Human Machine Interface) Software Market Segmentation

|

Attributes |

Proprietary HMI (Human Machine Interface) Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Proprietary HMI (Human Machine Interface) Software Market Trends

Rise of Advanced Visualization and Real-Time Control Capabilities

- The growing shift toward advanced HMI visualization tools is transforming industrial operations by enabling real-time monitoring, faster decision-making, and improved operator efficiency. The enhanced clarity, graphical interfaces, and intuitive layouts allow users to respond quickly to system changes, reducing downtime and improving overall productivity

- The demand for modern HMI platforms is rising across industries where real-time data access and on-site responsiveness are critical. These solutions are particularly valuable in manufacturing, energy, and process industries, helping reduce operational delays and enhance workforce performance. The trend is further supported by increasing digitalization initiatives across global industrial sectors

- The affordability and ease of deployment of proprietary HMI software are driving its adoption for routine operational control, enabling standardization across industrial facilities. Enterprises benefit from improved system stability and reliable performance, enhancing long-term equipment efficiency

- For instance, in 2024, several automotive manufacturers in Europe reported reductions in production errors after deploying advanced HMI dashboards integrated with real-time equipment health indicators. These solutions enabled early fault identification and streamlined workflow execution

- While modern HMI platforms enhance operational visibility and support automation, their long-term impact depends on continuous software updates, user training, and compatibility improvements. Vendors must prioritize flexible and scalable development strategies to capture rising demand

Proprietary HMI (Human Machine Interface) Software Market Dynamics

Driver

Growing Industrial Automation and Rising Need for Enhanced Operational Control

- The increasing adoption of automation technologies is prompting manufacturers and industrial operators to prioritize HMI software as a central component of process control, ensuring smoother coordination between machines and human operators. As industries move toward high-precision and data-driven workflows, the need for reliable interfaces that support informed decision-making continues to rise. This shift is strengthening demand for advanced visualization tools that enhance situational awareness and minimize downtime

- Enterprises are increasingly aware of the efficiency gains associated with deploying proprietary HMI solutions, including reduced manual errors, enhanced safety, and improved productivity across operational environments. With industrial environments becoming more complex, businesses rely on HMI platforms to maintain real-time visibility and improve process consistency. This awareness has led to routine usage of HMI systems across both large and mid-sized industrial facilities

- Global digital transformation initiatives and government-backed modernization programs have further strengthened HMI deployment by encouraging industries to upgrade their automation ecosystems. From smart manufacturing incentives to automation grants, supportive frameworks are enabling organizations to integrate high-performance visualization and control tools. These initiatives are accelerating the adoption of modern HMI systems built for scalability and future-ready automation

- For instance, in 2023, industrial authorities in the U.S. expanded automation funding programs to accelerate digital adoption across manufacturing units, increasing the demand for advanced HMI software significantly. This expansion supported a wider rollout of industrial control upgrades and stimulated interest in intuitive and secure HMI interfaces. The strengthened funding ecosystem contributed to faster modernization across both established and emerging manufacturing hubs

- While awareness and institutional support are driving market adoption, there remains a need to improve interoperability, enhance user training, and modernize legacy systems to achieve full operational efficiency. Many facilities still rely on outdated infrastructure that creates barriers to seamless automation integration. Closing these gaps will be crucial for unlocking the full benefits of next-generation HMI technologies

Restraint/Challenge

High Integration Costs and Limited Skilled Workforce for Advanced HMI Deployment

- The high cost associated with integrating proprietary HMI software with complex automation systems remains a major barrier for small and mid-scale industrial users, limiting market accessibility. Upgrades to compatible hardware, licensing fees, and customization requirements further increase financial burdens for cost-constrained businesses. These expenses often delay modernization plans and slow down the transition toward digital manufacturing

- Many industries face shortages of skilled operators and technicians trained to manage advanced HMI platforms, creating operational inefficiencies. The lack of expertise in configuration, troubleshooting, and continuous optimization restricts effective utilization, especially in facilities transitioning from legacy control systems. As a result, industries struggle to fully leverage the capabilities of modern HMI solutions, reducing overall return on investment

- Market growth is also constrained by infrastructure limitations such as outdated machinery, inconsistent connectivity, and inadequate data management frameworks that hinder performance. These issues reduce software responsiveness, limit real-time monitoring accuracy, and affect seamless integration into automated workflows. Overcoming such infrastructural barriers requires long-term investments and technical upgrades across industrial environments

- For instance, in 2024, industrial surveys across Southeast Asia revealed that over 55% of small manufacturers faced HMI implementation delays due to lack of technical expertise and high integration complexity. These challenges prolonged project timelines and increased operational risks for many businesses undergoing automation transitions. The findings highlighted the urgent need for capacity-building and simplified deployment solutions

- While HMI technologies continue to advance, addressing skill gaps, reducing integration costs, and improving compatibility with diverse industrial systems remain essential for sustainable growth. Industry stakeholders must focus on simplified software architectures, modular installation options, and accessible training programs. These measures will help industries adopt scalable HMI models and accelerate long-term automation maturity

Proprietary HMI (Human Machine Interface) Software Market Scope

The market is segmented on the basis of configuration type, type, deployment, application, end user, and technology

- By Configuration Type

On the basis of configuration type, the proprietary HMI software market is segmented into Stand-Alone HMI and Embedded HMI. The Stand-Alone HMI segment held the largest market revenue share in 2025, driven by its flexibility, ease of integration with diverse industrial systems, and ability to support multiple machines and processes. Stand-Alone HMI solutions are widely adopted across manufacturing facilities for centralized monitoring and control, offering improved operational efficiency and real-time visualization.

The Embedded HMI segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its compact design, direct integration with control devices, and suitability for specialized machinery. Embedded HMIs are increasingly preferred for applications requiring dedicated control interfaces with minimal footprint and low latency.

- By Type

On the basis of type, the market is segmented into Machine-Level and Supervisory. The Machine-Level segment held the largest market revenue share in 2025, driven by its extensive use in automated machinery for real-time monitoring and precise equipment control. Machine-Level HMIs help improve operational efficiency, reduce downtime, and provide detailed feedback for individual equipment performance.

The Supervisory segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for centralized control of multiple machines or processes. Supervisory HMIs enable plant-wide visualization, data aggregation, and analytics, supporting better decision-making and operational optimization.

- By Deployment

On the basis of deployment, the market is segmented into On-Premises and Cloud-Based. The On-Premises segment held the largest market revenue share in 2025, driven by industries’ preference for secure, low-latency systems and direct control over operational data. These solutions are widely implemented in manufacturing plants requiring reliable, high-performance HMI platforms.

The Cloud-Based segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by adoption of Industry 4.0 initiatives, remote monitoring needs, and scalable software-as-a-service (SaaS) models. Cloud HMIs provide flexibility, real-time analytics, and reduced infrastructure costs, making them attractive for modern industrial operations.

- By Application

On the basis of application, the market is segmented into Oil and Gas, Energy and Power, Food and Beverages, Metals and Mining, Aerospace and Defence, and Others. The Oil and Gas segment held the largest market revenue share in 2025, driven by high demand for robust monitoring, control, and safety systems across upstream, midstream, and downstream operations.

The Food and Beverages segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by automation trends, stringent quality control requirements, and the rising need for process optimization. HMI solutions in this sector enhance productivity, ensure compliance, and reduce operational errors.

- By End User

On the basis of end user, the market is segmented into Process Industries and Discrete Industries. The Process Industries segment held the largest market revenue share in 2025, driven by extensive deployment in chemical, petrochemical, and power generation sectors where continuous monitoring and precise control are critical.

The Discrete Industries segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing automation in automotive, electronics, and machinery manufacturing. HMIs in discrete industries support assembly line efficiency, equipment monitoring, and data-driven process improvements.

- By Technology

On the basis of technology, the market is segmented into Optical, Acoustic, Bionic, Tactile, and Motion. The Optical segment held the largest market revenue share in 2025, driven by adoption in precision control, machine vision, and quality inspection applications across industries.

The Motion segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for gesture-based interfaces, touchless operation, and interactive industrial applications. Motion HMIs enhance safety, reduce physical contact, and provide intuitive user experiences in modern manufacturing environments.

Proprietary HMI (Human Machine Interface) Software Market Regional Analysis

- North America dominated the proprietary HMI software market with the largest revenue share in 2025, driven by strong adoption of industrial automation and growing investments in digital transformation across manufacturing and process industries

- Enterprises in the region prioritize advanced visualization tools, seamless control interfaces, and secure connectivity, increasing demand for proprietary HMI platforms integrated with automation and control systems

- This widespread uptake is further supported by high technological readiness, mature industrial infrastructure, and the rising need for real-time monitoring and operational efficiency, establishing the region as a key market for proprietary HMI software

U.S. Proprietary HMI (Human Machine Interface) Software Market Insight

The U.S. proprietary HMI software market captured the largest revenue share in 2025 within North America, fuelled by accelerated adoption of intelligent automation solutions and the shift toward smart factories. Industries are increasingly prioritizing enhanced operator control, data visualization, and predictive analytics to strengthen production workflows. The widespread deployment of connected devices, along with strong demand for integrated platforms supporting SCADA, PLCs, and edge systems, continues to propel market growth. Moreover, the integration of proprietary HMI software with advanced technologies such as AI-driven analytics and cloud-based monitoring is significantly contributing to the market’s expansion.

Europe Proprietary HMI (Human Machine Interface) Software Market Insight

The Europe proprietary HMI software market is expected to witness the fastest growth rate from 2026 to 2033, driven by stringent operational standards, industrial modernization, and a rising focus on workplace safety. Increasing adoption of connected automation systems and digital control infrastructures across manufacturing, energy, automotive, and food processing sectors is supporting market growth. European industries are also embracing advanced HMI platforms for improved process visibility, energy efficiency, and compliance, leading to their integration across new facilities and retrofitting projects. The rising demand for sustainable, efficient, and intelligent automation systems continues to accelerate expansion in the region.

U.K. Proprietary HMI (Human Machine Interface) Software Market Insight

The U.K. proprietary HMI software market is expected to witness the fastest growth rate from 2026 to 2033, supported by the rapid adoption of industrial automation and rising focus on enhancing safety, productivity, and digital control. Growing concerns around operational reliability and the need for efficient plant management are prompting industries to invest in advanced HMI platforms. The country’s increasing penetration of connected devices and expanding smart manufacturing initiatives further stimulate demand for high-performance HMI software. In addition, the U.K.’s robust technology ecosystem and industrial digitalization programs continue to accelerate automation adoption.

Germany Proprietary HMI (Human Machine Interface) Software Market Insight

The Germany proprietary HMI software market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing emphasis on advanced automation, digital engineering, and secure industrial operations. Germany’s strong industrial base and commitment to innovation promote the adoption of feature-rich HMI platforms across manufacturing, automotive, and energy sectors. The demand for intuitive interfaces, enhanced visualization capabilities, and integrated control solutions is rising as industries transition to smarter production environments. Furthermore, the alignment of HMI technologies with Germany’s Industry 4.0 initiatives strengthens long-term market growth.

Asia-Pacific Proprietary HMI (Human Machine Interface) Software Market Insight

The Asia-Pacific proprietary HMI software market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid industrial expansion, increasing automation adoption, and rising investments in advanced manufacturing across China, Japan, India, and Southeast Asia. Growing urbanization and government-led digitalization programs are accelerating demand for intelligent control and monitoring systems. As APAC continues to emerge as a global manufacturing and automation hub, the availability of cost-effective systems and expanding industrial applications are enabling broader adoption of proprietary HMI platforms. The region’s strong push toward smart factories and technological modernization further supports market expansion.

Japan Proprietary HMI (Human Machine Interface) Software Market Insight

The Japan proprietary HMI software market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s strong digital ecosystem, rapid industrial automation, and demand for precision-oriented control systems. Japan places significant emphasis on efficiency, quality, and safety, driving accelerated adoption of advanced HMI solutions. The integration of HMI platforms with robotics, IoT devices, and smart production technologies continues to fuel market growth. In addition, Japan’s aging workforce is likely to increase reliance on intelligent automation and user-friendly interfaces across factories, logistics, and commercial facilities.

China Proprietary HMI (Human Machine Interface) Software Market Insight

The China proprietary HMI software market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid industrial automation, expanding manufacturing capabilities, and strong adoption of smart control technologies. China is one of the world’s leading markets for industrial automation, with proprietary HMI platforms becoming increasingly standard across production floors, commercial buildings, and process industries. The country’s push toward smart factories, alongside the presence of large domestic automation vendors, continues to strengthen market growth. Growing investments in digital industrialization and modern control systems further accelerate the adoption of proprietary HMI software across the region.

Proprietary HMI (Human Machine Interface) Software Market Share

The Proprietary HMI (Human Machine Interface) Software industry is primarily led by well-established companies, including:

- General Electric (U.S.)

- Rockwell Automation, Inc. (U.S.)

- Schneider Electric (France)

- Siemens (Germany)

- Adroit Technologies (U.K.)

- Beijer Electronics (Sweden)

- BrainChild Electronic Co., Ltd. (China)

- Ing. Punzenberger COPA-DATA GmbH (Austria)

- Elipse Software (Brazil)

- Inductive Automation (U.S.)

- NATIONAL INSTRUMENTS CORP. (U.S.)

- ABB (Switzerland)

- Advantech Co., Ltd. (Taiwan)

- Emerson Electric Co. (U.S.)

- Honeywell (U.S.)

- Mitsubishi Electric Corporation (Japan)

- Yokogawa Electric Corporation (Japan)

- VALEO (France)

- Spectris (U.K.)

- Kontron (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.