Global Protective Fabric Market

Market Size in USD Billion

CAGR :

%

USD

6.95 Billion

USD

9.20 Billion

2024

2032

USD

6.95 Billion

USD

9.20 Billion

2024

2032

| 2025 –2032 | |

| USD 6.95 Billion | |

| USD 9.20 Billion | |

|

|

|

|

Protective Fabric Market Size

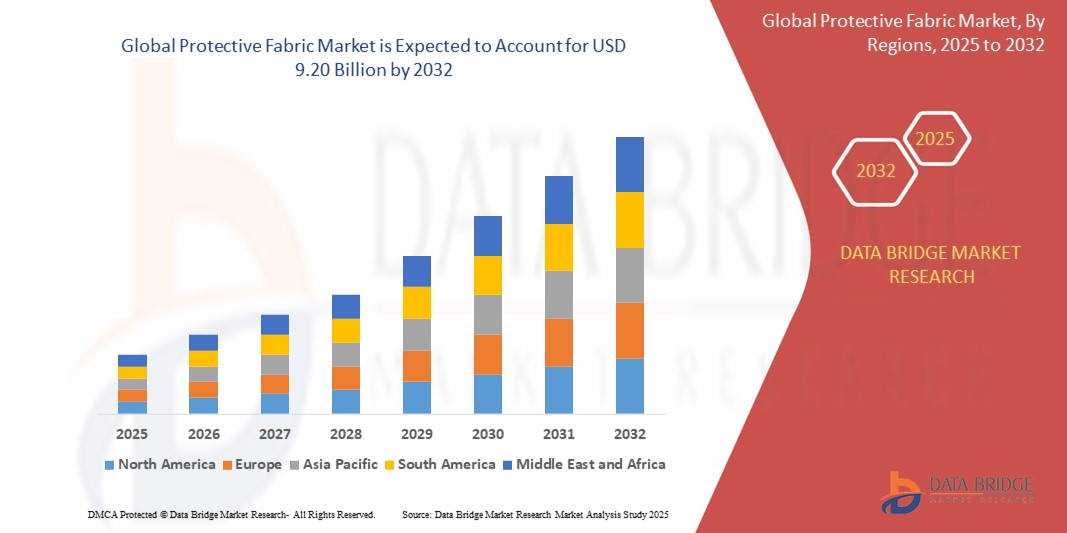

- The Global Protective Fabric Market size was valued at USD 6.95 billion in 2024 and is expected to reach USD 9.20 billion by 2032, at a CAGR of 4.50% during the forecast period

- Growth is driven by considerably due to the increasing adoption across various domains to ensure safety. also, the protective fabrics are also largely being adopted for utilities such as rainwear is also acting as a key determinant favoring the growth.

- The major factor accountable for the growth of the market is the rapidly rising industrialization and infrastructure development and rising commercialization of their products in developed countries. Besides this, the high growth in personal protection equipment and protective clothing industries across the world is also flourishing the protective fabric market's growth

Protective Fabric Market Analysis

- The increasing demand from the emerging regions and increasing demand for specialty fabrics will further offer a variety of growth opportunities for the protective fabric market.

- Also, the strict Regulations pertaining to the personnel's safety in developed economies are also highly impacting the growth of the protective fabric market in the forecast.

- Asia-Pacific is expected to dominate the global protective fabric market with a 35% share, driven by rapid industrialization, growing construction and manufacturing sectors, and increased investments in worker safety across countries like China, India, and Southeast Asia.

- North America is forecasted to be the fastest-growing region with a CAGR of 5.1%, driven by rising industrial safety standards, defense modernization programs, and technological advancements in thermal, ballistic, and chemical-resistant textiles.

- In 2024, Aramid dominates the protective fabric market due to its exceptional heat resistance, strength, and widespread use in defense and firefighting, holding over 35% market share globally. Its durability, flame resistance, and performance in extreme environments make it the preferred choice across multiple high-risk industries, sustaining its leadership.

Report Scope and Protective Fabric Market Segmentation

|

Attributes |

Protective Fabric Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Protective Fabric Market Trends

“Rising Focus on Sustainable and Eco-Friendly Protective Fabrics”

- Traditional protective fabrics, often made from synthetic fibers like aramid and polyester, face rising environmental concerns due to non-biodegradability and high carbon footprints.

- In response, global sustainability regulations and corporate ESG commitments are driving demand for recyclable, bio-based, and low-impact protective materials.

For instance,

- The European Union’s Green Deal and REACH regulations emphasize sustainable textile production and reduced environmental impact.

- Manufacturers are investing in protective fabrics made from recycled PET, organic cotton, bio-polyesters, and plant-based aramids, aligning with green certifications.

- These sustainable materials are increasingly used in healthcare, military uniforms, and industrial PPE, where both safety and sustainability are key requirements.

- Growing consumer and industry demand for eco-conscious PPE is pushing brands to prioritize circular design, biodegradable options, and lower-emission production methods.

Protective Fabric Market Dynamics

Driver

“Rising Workplace Safety Regulations and Industrial Expansion”

- Stringent worker safety regulations in sectors such as oil & gas, construction, firefighting, and manufacturing are driving the demand for advanced protective fabrics that offer heat, chemical, and mechanical resistance.

- Regulatory bodies such as OSHA (U.S.), EU-OSHA, and ISO are mandating the use of certified personal protective equipment (PPE), including flame-retardant and arc-resistant fabrics.

- Rapid industrialization in emerging economies like India, China, and Brazil is expanding the scope of protective fabric use across new infrastructure, energy, and production facilities.

- Employers are increasingly investing in protective workwear to reduce injuries, boost worker confidence, and comply with insurance and labor laws.

For instance,

- The Indian Ministry of Labour launched new safety codes, pushing industries to adopt protective clothing compliant with national and global safety standards.

Restraint/Challenge

“High Cost and Complex Manufacturing of Advanced Protective Fabrics”

- High-performance protective fabrics like aramid, PBI, and carbon fiber blends require complex and costly production processes involving specialty chemicals and precision engineering.

- The high initial investment in R&D, machinery, and certification testing acts as a barrier for new entrants and limits affordability for SMEs.

- Price sensitivity in developing regions reduces adoption, especially where safety awareness and enforcement remain weak.

- Volatility in raw material prices, particularly for petroleum-based fibers, impacts overall cost predictability and profit margins.

Protective Fabric Market Scope

The market is segmented on the basis of raw material, product type and end user.

- By raw material

On the basis of raw material, the protective fabric market is segmented into aramid, PBI, polyamide, cotton fibers, polyolefin, polyesters and others. In 2024, Aramid dominates the protective fabric market due to its exceptional heat resistance, strength, and widespread use in defense and firefighting, holding over 35% market share globally. Its durability, flame resistance, and performance in extreme environments make it the preferred choice across multiple high-risk industries, sustaining its leadership.

In 2024, Polyolefin is the fastest growing segment with a CAGR of over 8%, driven by rising demand for lightweight, chemical-resistant, and cost-effective fabrics in industrial and medical applications. Increased use in cleanrooms, protective clothing, and packaging enhances its growth, especially in emerging economies focused on worker safety and hygiene.

- By product type

On the basis of product type, the protective fabric market is segmented into fire and heat-resistant, chemical resistant, UV resistant, ballistic and mechanical resistant and cold resistant. The fire and heat-resistant segment dominates the protective fabric market due to stringent safety regulations and high demand from firefighting, military, and industrial sectors. Its critical role in thermal protection drives widespread adoption and consistent market leadership.

The chemical resistant segment is the fastest growing, driven by rising industrialization and demand from chemical, pharmaceutical, and oil & gas sectors. Growing worker safety concerns and stricter regulations are accelerating its adoption across both developed and developing regions.

- By end user

On the basis of end user, the protective fabric market is segmented into building and construction, firefighting, oil and gas, healthcare, law enforcement and military and others. The firefighting segment leads the market due to the essential use of protective fabrics to ensure thermal insulation, flame resistance, and durability. Strict safety standards and continuous investments in protective gear boost consistent demand in this sector.

The healthcare segment is the fastest growing, propelled by increased focus on hygiene, infection control, and safety post-COVID-19. Rising use of protective fabrics in gowns, drapes, and other medical textiles is fueling rapid market expansion globally.

Protective Fabric Market Regional Analysis

- Asia-Pacific is expected to dominate the global protective fabric market with a 35% share, driven by rapid industrialization, growing construction and manufacturing sectors, and increased investments in worker safety across countries like China, India, and Southeast Asia.

- The region’s dominance is reinforced by a large labor-intensive workforce exposed to occupational hazards, boosting demand for protective clothing in oil & gas, mining, and chemical industries.

- Additionally, government mandates and foreign investments in industrial safety equipment are accelerating adoption of high-performance protective fabrics in PPE applications.

China Protective Fabric Market Insight

China leads Asia-Pacific with a 38% revenue share in 2025, supported by expansive construction, automotive, and industrial sectors, coupled with strict enforcement of workplace safety regulations and rising export-oriented PPE manufacturing.

India Protective Fabric Market Insight

India is projected to record the highest CAGR of 6.9%, fueled by urban infrastructure growth, increasing safety compliance in oil & gas, and government initiatives under programs like "Make in India" promoting domestic PPE production.

Europe Protective Fabric Market Insight

Europe's market is shaped by strict safety standards, high awareness of worker protection, and widespread use in chemical, military, and manufacturing sectors—especially in Germany, France, and the Netherlands.

U.K. Protective Fabric Market Insight

The U.K. market is driven by demand for sustainable, flame-retardant fabrics, innovation in lightweight military textiles, and domestic production aligned with the nation’s focus on defense and high-tech textile advancements.

Germany Protective Fabric Market Insight

Germany leads Europe in technical textile innovation, with a strong base in automotive, defense, and industrial manufacturing. R&D in high-strength, multifunctional fabrics supports continued market growth in premium protective wear.

North America Protective Fabric Market Insight

North America is forecasted to be the fastest-growing region with a CAGR of 5.1%, driven by rising industrial safety standards, defense modernization programs, and technological advancements in thermal, ballistic, and chemical-resistant textiles.

U.S. Protective Fabric Market Insight

In 2025, The U.S., holding 35% of the North American market in 2025, benefits from a strong defense sector, high PPE usage in oil & gas and construction, and continuous innovation in aramid and PBI-based protective fabric technologies.

Protective Fabric Market Share

The Protective Fabric industry is primarily led by well-established companies, including:

- TEIJIN LIMITED (Japan)

- W. L. Gore & Associates Inc. (U.S.)

- DowDuPont (U.S.)

- 3M (U.S.)

- Milliken & Company (U.S.)

- Lakeland Inc. (U.S.)

- Cetriko S.L. (Spain)

- Glen Raven Inc. (U.S.)

- Klopman International (Italy)

- DUNHAM Rubber & Belting Corporation (U.S.)

- Kolon Industries, Inc. (South Korea)

- Shawmut Corporation LLC (U.S.)

- CS Hyde Company (U.S.)

- Tex Tech Industries (U.S.)

- FABRI-TECH COMPONENTS Inc. (U.S.)

- William J. Dixon, Inc. (U.S.)

- Burlington Safety Laboratory Inc. (U.S.)

- APEX MILLS (U.S.)

- Jason Mills, LLC (U.S.)

- Swift Textile Metalizing LLC (U.S.)

Latest Developments in Global Protective Fabric Market

- In May 2025, DuPont announced a major investment to expand its Nomex® aramid fiber production in Spain, aimed at meeting the rising global demand for flame-resistant protective fabrics in firefighting, military, and industrial sectors, reinforcing its position as a global leader in high-performance textiles.

- In April 2025, Teijin Limited launched a bio-based aramid fabric under its Teijinconex® brand. Derived from renewable raw materials, the fabric maintains high heat and flame resistance while reducing carbon footprint, aligning with global sustainability goals in protective clothing and PPE markets.

- In March 2025, Milliken & Company acquired the PPE business of Fire-Dex, strengthening its position in the North American firefighting protective gear segment. The acquisition expands Milliken’s technical textile portfolio and enhances its access to fire-resistant fabric technology and distribution channels.

- In February 2025, W. L. Gore & Associates introduced a new lightweight Gore-Tex protective fabric with enhanced breathability and abrasion resistance for industrial and tactical uniforms. The innovation supports extended wear comfort in hot environments without compromising safety or durability.

- In January 2025, Kolon Industries collaborated with Hyundai Rotem to develop smart protective military fabrics integrated with sensors for real-time monitoring of soldier health and environment. This innovation marks a step forward in merging protective textiles with wearable tech for defense applications.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Protective Fabric Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Protective Fabric Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Protective Fabric Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.